Berkshire was the stock to own years ago – But not now

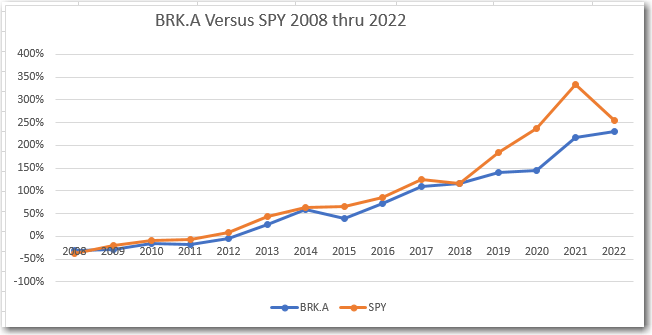

The Law of Large Numbers says that as companies get bigger and mature their performance drops to the mean average of all large companies. This has certainly happened to Berkshire Hathaway (BRK.A and BRK.B). In its early days, 1981 thru 2007, it was a monster stock performer. Easily outperforming indexes such as the SPY. But during the period of 2008 thru 2022, one can see from the graph above, Berkshire has underperformed the SPY.

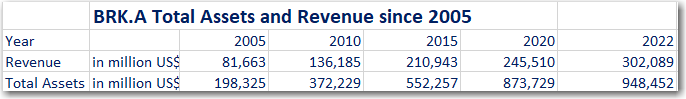

The graph below shows the steady increase in the size of Berkshire over the last 18 years.

The Glory days – When Berkshire Hathaway was much smaller than it is today, it outperformed the SPY by a wide margin, to everyone’s amazement. See graph below.

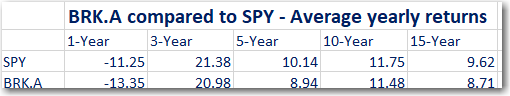

The comparison by average yearly returns over the last 15 years thru 2022 is below.

A fun video to walk you thru the history of the Berkshire Hathaway performance is below.

Conclusion: Berkshire Hathaway stock was great when it was smaller, but today it cannot even keep up with the SP500. There is no point in owning Berkshire Hathaway stock. If in the future, the company announces that they will start breaking the company up by spinning off multiple companies within it, then it would become much more interesting since spinoffs frequently provide some alpha. In the meantime, you have the key person risk of both Warren Buffett and Charlie Munger nearing the end of their stewardship of the company. No one can fill their shoes.

All data used to create the graphics came from Wikipedia, Morningstar and SlickCharts.com .

SwingTrader.Trading is dedicated to bringing you three Model portfolios to demonstrate that Swing Trading can be profitable. Please visit my site. Have yourself added to my email mailing list to be signaled when I make a new blog post, HERE.

Model Portfolio Compounded Percentage

| Mid Cap Flyers | 2072% |

| Small Cap Discoveries | 22273% |

| CANSLIM Growth | 5776% |

| MDY – Mid Cap | 322% |

| IJR – Small Cap | 422% |

All content on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalised advice before you make any trading or investing decisions. Disclaimer

You must be logged in to post a comment.