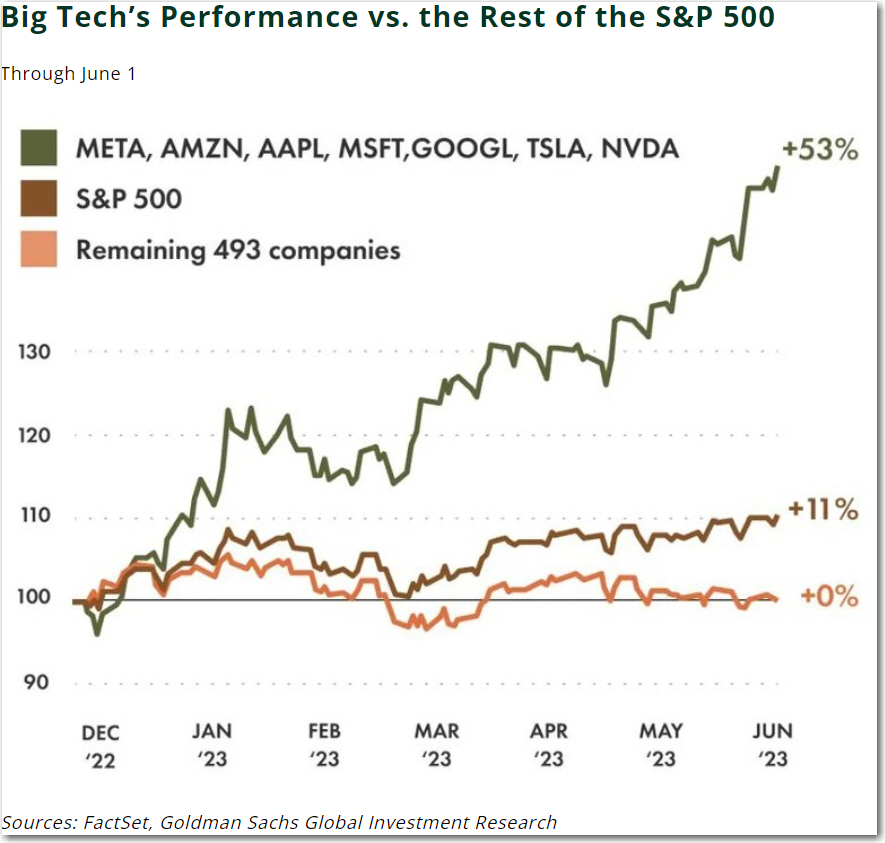

The chart above demonstrates how the largest mega cap stocks skew the results of the S&P 500. This year the skew is to the upside but this works the other way when the mega caps take a tumble because of gross overvaluation. What goes up always comes down.

This week in the stock market was a largely flat week for the indexes. The SPY was -0.5% with RSP 0.0% with MDY -0.5% and IJR +0.2%, for the week.

CANSLIM Growth Portfolio continues to be up over 17% for the year and easily outperforms its benchmark IJR by over 14%. Leading the way are CLS, NOA and ACEL up 84%, 54% and 23% respectively.

See the CANSLIM Growth Portfolio Detail Here

Small Cap Discoveries Portfolio remains up over 14% for the year well ahead of its benchmark, IJR.

Mid-cap Flyers remains 4% ahead of its benchmark MDY, for the year.

Large Cap Stalwarts lags its benchmark RSP.

Large Cap Stalwarts made some updates to its Model Portfolio last weekend. The detail can be seen at Large Cap Stalwarts Monthly Update.

In the four Model Portfolios, Mid Cap Flyers, Small Cap Discoveries, CANSLIM Growth and Large Cap Stalwarts, the end-of-week stats are below.

2023 Performance as of 09/15/2023

| Small Cap Discoveries | +14.3% |

| IJR – Small Cap ETF Benchmark | +3.1% |

| CANSLIM Growth | +17.6% |

| IJR – Small Cap ETF Benchmark | +3.1% |

| Mid Cap Flyers | +10.2% |

| MDY – Mid Cap ETF Benchmark | +5.8% |

| Large Cap Stalwarts | -1.0% |

| RSP – S&P 500 Equal Weight ETF | +4.5% |

Backtests for the Four Model Portfolios

All content on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalised advice before you make any trading or investing decisions. Disclaimer

Copyright 2023 SwingTrader.Trading. All Rights Reserved.

You must be logged in to post a comment.