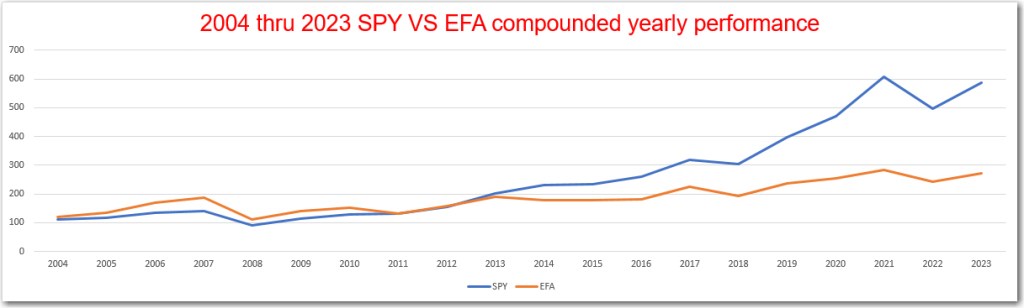

Over the years, I have read many articles by investment professionals that urge investors to set aside a portion of their Portfolios for International stocks. I believe in general, it is bad idea to do this. In the long run it will hurt your investment performance. Full disclosure, I do not have any International mutual funds or ETF’s in my portfolio and haven’t for a very long time. Why is that? They don’t perform well when compared to US stocks. Sure, they have their moments, such as the period 2004 thru 2007 where the International stocks were the place to be. But their moment in the sun is brief. No one knows ahead of time when their brief moment to shine, will be.

The ETF’s used for this comparison:

- Representing the USA is SPY (SPDR S&P 500 ETF Trust) . This is a well know cap weighted ETF of the S&P 500 index.

- Representing the International Stocks is EFA (iShares MSCI EAFE ETF) It is a cap weighted ETF of the MSCI EAFE Index. It has publicly traded securities in the European, Australasian and Far Eastern markets. China is excluded. The three regions most represented in the index are 1). Europe Developed 2). Japan 3). United Kingdom.

Let me break it down:

- SPY – outperformed EFA in years 2008, 2010, 2011, 2013, 2014, 2015, 2016, 2018, 2019, 2020, 2021, 2023. It was mostly even in 2009

- EFA – outperformed SPY in years 2004, 2005, 2006, 2007, 2012, 2017, 2022.

- The outperformance years of SPY far exceeded the outperformance years of EFA. Starting at $100, beginning 12/30/2003 and ending on August 14, 2023, SPY had returned $586 compared to EFA which returned only $270, A wide outperformance over 19 1/2 years.

Conclusion – Adding International mutual funds or ETF’s to your portfolio will negatively impact your long term investment results. It does not add diversification, it just adds underperformance. One can get plenty of diversification by sticking to USA broad based mutual funds or ETF’s.

All data for this article came from the Yahoo Finance or Morningstar website.

All content on this website is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalized advice before you make any trading or investing decisions. Disclaimer

Copyright 2023 SwingTrader.Trading. All Rights Reserved.

You must be logged in to post a comment.