This month in the stock market was a strong up month. The SPY was +9.1% with RSP (Invesco S&P 500 Equal Weight ETF) +9.2% with MDY +8.4% and IJR +8.3%.

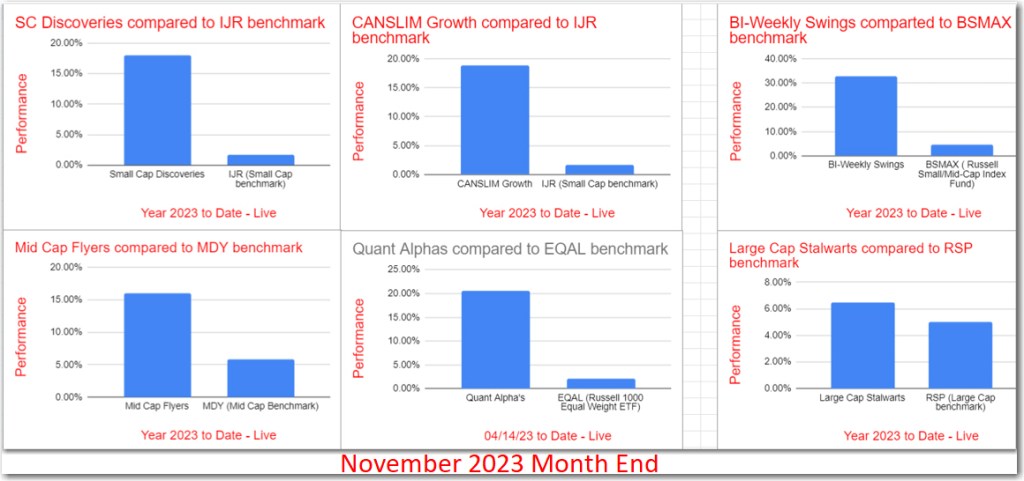

This month saw big gains in the USA stock market. The Small Cap, Mid Cap and Equal weight Large Cap indexes had 8 or 9% gains. The Swing Trader portfolios have performed even better increasing their performance lead ahead of the benchmarks. Small Cap Discoveries, Mid Cap Flyers, Canslim Growth, Large Cap Stalwarts, BI-Weekly Swings and Quant Alpha’s are all ahead of their respective benchmarks for the year and are positive for the year.

This November, I decided to convert the two Probationary Portfolios, BI-Weekly Swings and Quant Alpha’s, to be Model Portfolios. I will add these two to the four I already have and now I total six Model Portfolios. They span the range of micro-cap, small cap, mid cap, large cap stocks. The frequency is Monthly for some, BI-Weekly and twice a month updates also.

CANSLIM Growth is now up over 18% for the year and easily beats its benchmark IJR by over 17%. Active outperformers are CLS and NSSC They are up +119% and +50% since added.

The Small Cap Discoveries is now up over 18% for the year and continues to outperform its benchmark IJR by over 16%. Active outperformers TAST, WLDN, ORN and HRTG account for much of this Alpha. They are up +110%, +39%, +46% and +58% respectively.

The Mid-cap Flyers is now up over 16% for the year and is now outpacing its benchmark MDY by over 10% for the year. Active outperformers are OSCR and GPS. They are up +48% and +42% respectively.

The Large Cap Stalwarts is now up over 6% for the year and is now outpacing its benchmark RSP by 1%. Active outperformers are DVA, PODD and LW. They are up +22%, +21% and +20% respectively.

The BI-Weekly Swings is now up over 32% for the year and crushing its benchmark BSMAX by 28%. Active outperformers are AMAL and CHWY. They are up +27% and +20% respectively.

The Quant Alpha’s is now up over 20% for the year and continues to outpace its benchmark EQAL by 18%. Active outperformers SMCI, POWL and ANF account for much of this Alpha. They are up +150%, +56% and +51% respectively.

In the six Model Portfolios, Mid Cap Flyers, Small Cap Discoveries, CANSLIM Growth, Large Cap Stalwarts, BI-Weekly Swings and Quant Alpha’s, the end-of-month stats are below.

Performance 2023 to 11/30/2023

All content on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalized advice before you make any trading or investing decisions. Disclaimer

Copyright 2023 SwingTrader.Trading. All Rights Reserved.

You must be logged in to post a comment.