This month in the stock market was a very positive result month. The SPY was +5.2% with RSP (Invesco S&P 500 Equal Weight ETF) +4.0% with MDY +5.8%, IJR +3.3% and BSMAX (iShares Russell Small/Mid-Cap Index) +4.7%.

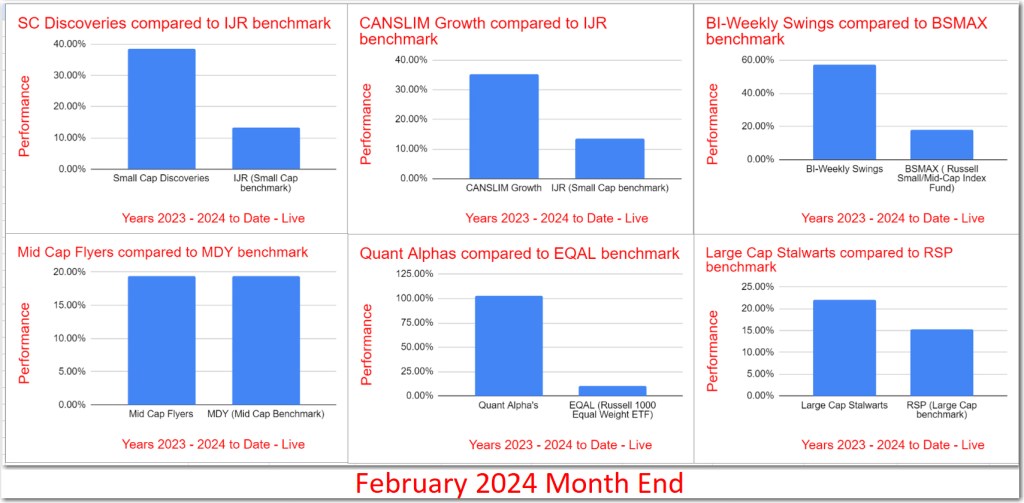

Small Cap Discoveries, Canslim Growth, Large Cap Stalwarts, BI-Weekly Swings and Quant Alpha’s are all ahead of their respective benchmarks for the 2023-2024 period.

CANSLIM Growth is now up over 35% for 2023-2024 and easily beats its benchmark IJR by over 21%. Active outperformers are NSSC and AMAL. They are up +134% and +43% since added.

The Small Cap Discoveries is now up over 38% for 2023-2024 and continues to outperform its benchmark IJR by over 25%. Active outperformers ROOT and VIRC account for some of this Alpha. They are up +260% and +64% respectively.

The Mid Cap Flyers is now up over 19% for 2023-2024 and is keeping pace with its benchmark MDY. Active outperformers are PTVE and GPS. They are up +38% and 34% respectively.

The Large Cap Stalwarts is now up over 22% for 2023-2024 and is now outpacing its benchmark RSP by 6%. Active outperformers are META and AMZN. They are up +32% and +17% respectively.

The BI-Weekly Swings is now up over 57% for 2023-2024 and crushing its benchmark BSMAX by 39%. Active outperformers are AMAL, NSSC and VIRC. They are up +41%, +128% and +42% respectively. Outperformer ROOT was Removed in February for a +196% gain.

The Quant Alpha’s is now up over 102% for 2023-2024 and continues to destroy its benchmark EQAL by 92%. Active outperformers SMCI, POWL and ANF account for some of this Alpha. They are up +693%, +247% and +154% respectively.

In the six Model Portfolios, Mid Cap Flyers, Small Cap Discoveries, CANSLIM Growth, Large Cap Stalwarts, BI-Weekly Swings and Quant Alpha’s, the end-of-month stats are below.

Performance 01/01/23 to 02/29/2024

| Small Cap Discoveries | 38.74% |

| IJR (Small Cap benchmark) | 13.43% |

| CANSLIM Growth | 35.16% |

| IJR (Small Cap benchmark) | 13.43% |

| Mid Cap Flyers | 19.23% |

| MDY (Mid Cap Benchmark) | 19.24% |

| Large Cap Stalwarts | 22.03% |

| RSP (Large Cap benchmark) | 15.25% |

| BI-Weekly Swings | 57.24% |

| BSMAX ( Russell Small/Mid-Cap Index Fund) | 17.74% |

| Quant Alpha’s | 102.38% |

| EQAL (Russell 1000 Equal Weight ETF) | 10.13% |

The end-of the-month results shows continuing dramatic outperformance of the Model Portfolios compared to their respective benchmarks into 2024. Powered by the outsized performances of the BI-Weekly Swings and Quant Alpha’s Model Portfolio’s, the Model Portfolios continue to validate the backtests of the criteria used to generate the selections.

All content on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalized advice before you make any trading or investing decisions. Disclaimer

Copyright 2023-2024 SwingTrader.Trading. All Rights Reserved.

You must be logged in to post a comment.