The Model Portfolio Quant Alpha’s was updated this morning. A new Add was made and one Removal was made. All prices are as of 04/17/2024. A total of 24 stocks are in the Portfolio now.

This Portfolio uses Quant scores as the chief factor in adding and removing stocks. Other criteria is used to limit the scope of the stocks to be considered. The criteria is shown below.

- No Micro-Cap stocks.

- High liquidity.

- USA or Canada headquartered only stocks.

- Twice a month I will add to the Portfolio.

- I will not use subjective criteria for Stock selection.

- When a Remove signal is received, I will remove 100% of that stock, not a portion.

- I will not add any stocks that are Airlines, crypto related, BioTech or Mega Cap..

- You can expect that eventually 30 to 35 stocks will be in the Portfolio.

- The holding period is expected to range from 9 months to 2 years.

Add – RCL (Royal Caribbean Cruises)

Remove – VLO (Valero Energy Corporation)

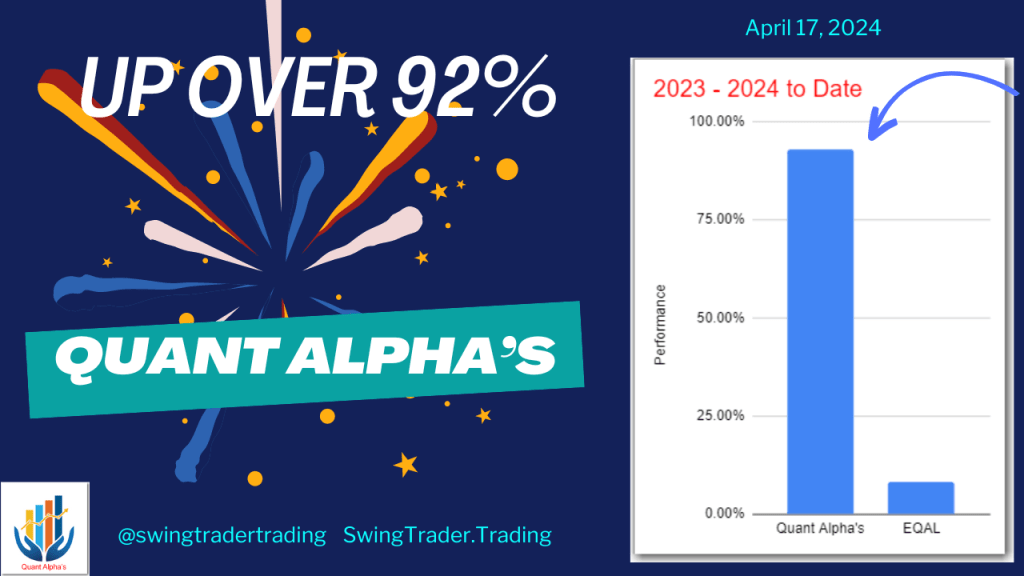

Since the last update several weeks ago, this Portfolio has maintained its wide outperformance against the ETF benchmark, EQAL. The Portfolio is up over 92% for 2023-2024 and beats its benchmark by 84%.

Standout performers in the Portfolio include SMCI up +779% since its addition on 4/14/23, POWL up +132% since its addition on 5/12/23 and ANF up +125% since its addition on 10/18/23. VLO was Removed. VLO was Added on 4/14/23 and was up 31% when it was Removed.

Quant Alpha’s Portfolio details here

YOUTUBE Swing Trader Trading Channel

Model Portfolio Performance 12-31-2022 to 04-17-2024

| Quant Alpha’s * | 92.74% |

| EQAL (Russell 1000 Equal Weight ETF) * | 8.34% |

| BI-Weekly Swings | 59.63% |

| BSMAX ( Russell Small/Mid-Cap Index Fund) | 14.57% |

| Small Cap Discoveries | 48.28% |

| IJR (Small Cap benchmark) | 7.91% |

| CANSLIM Growth | 33.66% |

| IJR (Small Cap benchmark) | 7.91% |

| Mid Cap Flyers | 17.55% |

| MDY (Mid Cap Benchmark) | 16.82% |

| Large Cap Stalwarts | 22.15% |

| RSP (Large Cap benchmark) | 12.82% |

Backtests for the Five Model Portfolios

The Quant Alpha’s Model Portfolio Added RCL a company in the Travel Services Industry. The Portfolio continues its huge outperformance since it went live in April, 2023 by being up 92% since then. The Quant rating system continues to show its Alpha.

All content on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalized advice before you make any trading or investing decisions. Disclaimer

You must be logged in to post a comment.