The Model Portfolio BI-Weekly Swings was updated this morning. New Adds of 6 stocks were made and Removals of 6 stocks were made. All prices are as of 05/22/2024. A total of 21 stocks are in the Portfolio.

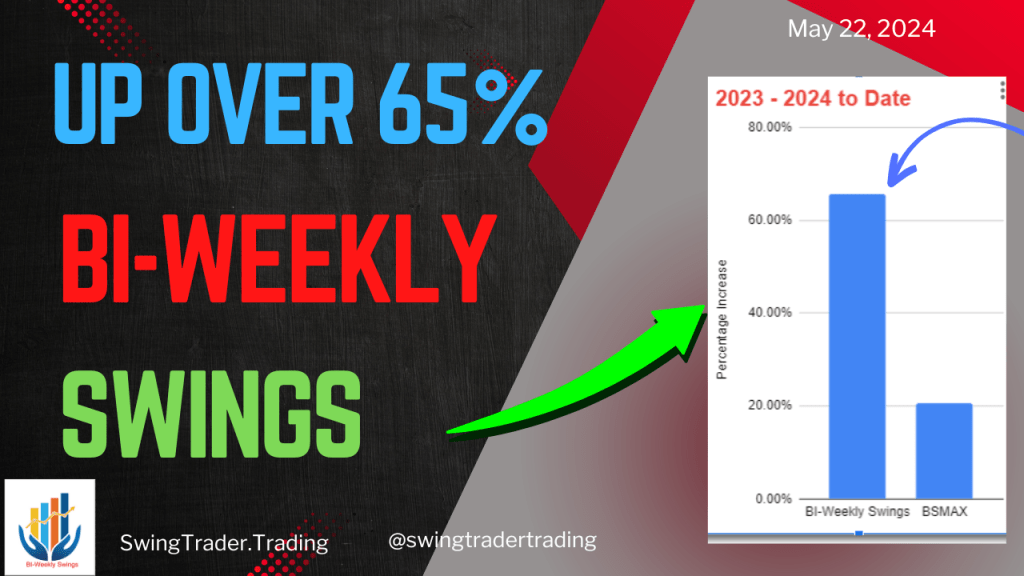

The BI-Weekly Swings Portfolio is up 65% 2023-2024 and is 45% ahead of its benchmark BSMAX.

The BI-Weekly Swings Portfolio is made up of 15 to 21 stocks. It is updated every two weeks. It consists of three separate strategies used together to get a good cross section of Mid Cap, Small Cap and Micro Cap stocks. Two of the strategies are also used in the monthly Model Portfolio area and are being used here because they perform especially well with the two week update cycle. The third strategy is new to this website. The criteria used is Earnings per share (EPS) and related data concerning EPS to identify positive trends such as upside, surprises, magnitude, and consensus metrics. In addition, Return on Equity (ROE), change in EPS, change in Sales, Relative Strength and Price to Sales are used.

Add – HNST, IAG, INTR, IONQ, KGC, PAYO

Remove – AMTX, ARIS, COTY, DH, OSW, PAYS

Noteworthy outperformers in the Active section are HRTG up 29%, VIRC up 65% and APEI up 33%.

See the BI-Weekly Portfolio Detail Here.

YOUTUBE Swing Trader Trading Channel

2023-2024 Performance as of 05/22/2024

| Quant Alpha’s * | 104.71% |

| EQAL (Russell 1000 Equal Weight ETF) * | 14.18% |

| BI-Weekly Swings | 65.69% |

| BSMAX ( Russell Small/Mid-Cap Index Fund) | 20.60% |

| Small Cap Discoveries | 53.33% |

| IJR (Small Cap benchmark) | 15.59% |

| CANSLIM Growth | 45.64% |

| BSMAX ( Russell Small/Mid-Cap Index Fund) | 20.60% |

| Mid Cap Flyers | 26.99% |

| MDY (Mid Cap Benchmark) | 23.50% |

| Large Cap Stalwarts | 26.00% |

| RSP (Large Cap benchmark) | 18.36% |

Backtests for the Five Model Portfolios

The BI-Weekly Swings Model Portfolio, continued its strong outperformance since it went live at the beginning of 2023. The Portfolio is now up 65% percent. Six new Adds were made to the Portfolio in this update and six Removals were made. The Portfolio continues to maintain its outperformance over its benchmark index BSMAX. The Portfolio goes thru three phases. The Outperform, sideways and Underperform. Currently, we are in the sideways phase.

All content on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalized advice before you make any trading or investing decisions. Disclaimer

Copyright 2023-2024 SwingTrader.Trading. All Rights Reserved.

You must be logged in to post a comment.