This month in the stock market was a positive result month for the indexes. The SPY was +5.1% with RSP (S&P 500 Equal Weight ETF) +2.8% with MDY +4.5%, IJR +5.0%, EQAL (Russell 1000 Equal Weight ETF) +3.6% and BSMAX (Russell Small/Mid-Cap Index) +3.3%.

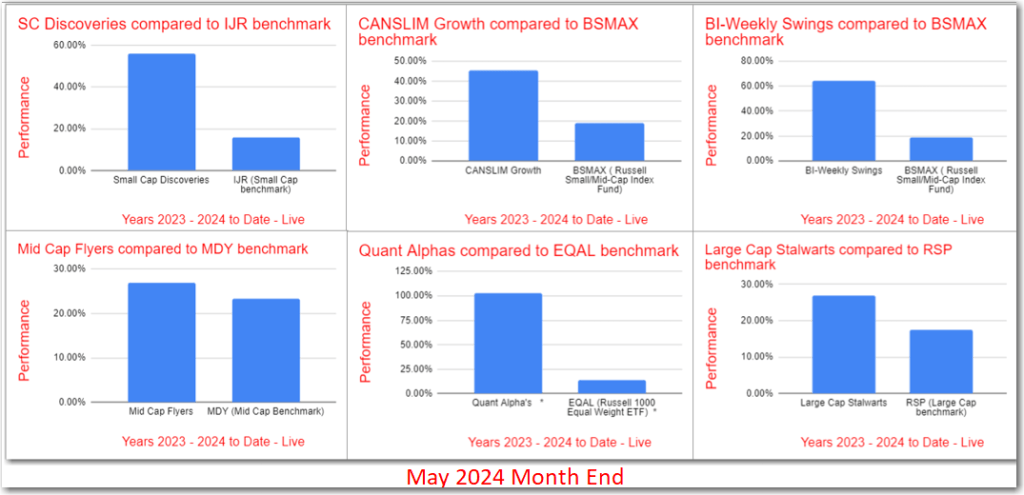

All Model Portfolios are now all ahead of their respective benchmarks for the 2023-2024 period.

The Quant Alpha’s is now up over 102% for 2023-2024 and continues to destroy its benchmark EQAL by 89%. The outperformance increased dramatically in May. Active outperformers SMCI, POWL and ANF account for some of this Alpha. They are up +618%, +237% and +244% respectively.

The BI-Weekly Swings is now up over 64% for 2023-2024 and crushing its benchmark BSMAX by 45%. Active outperformers are HRTG and VIRC. They are up +29% and +60% respectively.

The Small Cap Discoveries is now up over 55% for 2023-2024 and continues to outperform its benchmark IJR by over 39%. This outperformance increased slightly in May. Active outperformers HRTG and AMCX account for some of this Alpha. They are up +59% and 41% respectively.

CANSLIM Growth is now up over 45% for 2023-2024 and easily beats its benchmark BSMAX by over 25%. The outperformance increased in May. Active outperformer CSWC was up 38%. Outperformer GSL was removed in May. It was up 58% when removed.

The Large Cap Stalwarts is now up over 26% for 2023-2024 and is now outpacing its benchmark RSP by 9%. The outperformance increased in May. Outperformer NTAP leads the way up with a 16% gain since it was added.

The Mid Cap Flyers is now up over 26% for 2023-2024 and is edging out its benchmark MDY by 4%. The outperformance increased in May. Active outperformers are FSM and CMRE. They are up +35% and 28% respectively. Outperformer GPS was removed in May. It was up 53% since added.

YOUTUBE Swing Trader Trading Channel

Performance 01/01/23 to 05/31/2024

| Quant Alpha’s * | 102.85% |

| EQAL (Russell 1000 Equal Weight ETF) * | 13.67% |

| BI-Weekly Swings | 64.25% |

| BSMAX ( Russell Small/Mid-Cap Index Fund) | 19.70% |

| Small Cap Discoveries | 55.76% |

| IJR (Small Cap benchmark) | 15.86% |

| CANSLIM Growth | 45.38% |

| BSMAX ( Russell Small/Mid-Cap Index Fund) | 19.70% |

| Mid Cap Flyers | 26.93% |

| MDY (Mid Cap Benchmark) | 23.35% |

| Large Cap Stalwarts | 26.88% |

| RSP (Large Cap benchmark) | 17.37% |

Backtests for the Model Portfolios

The end-of the-month results shows continuing dramatic outperformance of the Model Portfolios. Led by Quant Alpha’s Portfolio up +102%. Five of the six Model Portfolios increased their outperformance in May over their benchmarks. Making a solid month of improvements.

All content on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalized advice before you make any trading or investing decisions. Disclaimer

Copyright 2023-2024 SwingTrader.Trading. All Rights Reserved.

You must be logged in to post a comment.