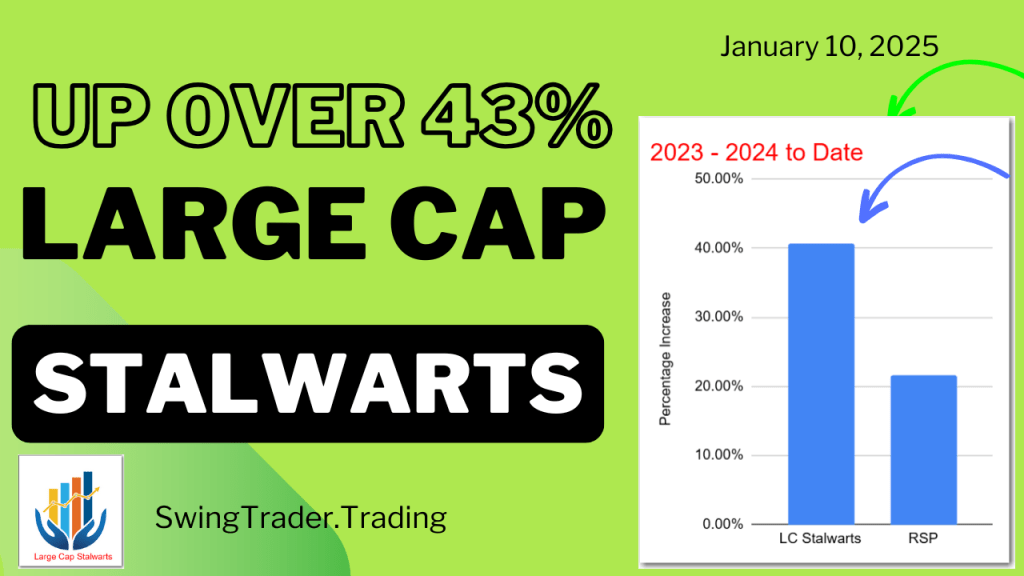

The Model Portfolio Large Cap Stalwarts continues its outperformance over its benchmark RSP ( S&P 500 Equal Weight ETF). It is now up 43% since it went live in 2023. This is 22% ahead of its benchmark RSP. This is an increase in the outperformance since the last update in November.

The Model Portfolio Large Cap Stalwarts was updated this weekend. New Adds of 7 stocks were made and 8 Removals of stocks were made. All prices are as of 01/10/2025. A total of 18 stocks are in the Portfolio now.

The Model Portfolio is made up of 10 to 20 stocks. First, the software checks if the large cap stocks are listed in the S&P 500 index. Then, it analyzes the most recent earnings data to identify positive trends such as upside, surprises, magnitude, and consensus metrics.

BackTest – The Backtest for this Portfolio outperformed the RSP benchmark in 12 out of the 19 years tested. It underperformed in years 2008, 2009, 2011, 2013, 2018 and 2020. It was largely even with the benchmark in 2010. When the Portfolio outperformed, it was usually by a significant margin. The best year was 2017 when it was up by 44%

Add – AMZN, CTRA, DVA, SCHW, TPR, TRV, TSN, WY

Remove – APH, CF, MCK, NTRS, SYF, WAB, ZBRA

Noteworthy active portfolio stocks are RCL and NCLH are up 33% and 60% respectively since added.

Large Cap Stalwarts Portfolio Detail Here

Performance 01/01/2023 to 01/10/2025

| Quant Alpha’s * | 154.89% |

| EQAL (Russell 1000 Equal Weight ETF) * | 20.33% |

| BI-Weekly Swings | 66.95% |

| BSMAX ( Russell Small/Mid-Cap Index Fund) | 24.08% |

| Small Cap Discoveries | 67.72% |

| IJR (Small Cap benchmark) | 18.96% |

| CANSLIM Growth | 48.00% |

| BSMAX ( Russell Small/Mid-Cap Index Fund) | 24.08% |

| Mid Cap Flyers | 41.05% |

| MDY (Mid Cap Benchmark) | 26.14% |

| Large Cap Stalwarts | 43.53% |

| RSP (Large Cap benchmark) | 21.63% |

Click here for the Live Scorecard

Backtests for the Five Model Portfolios

The Large Cap Stalwarts Model Portfolio continues to outperform its RSP benchmark by a healthy amount. The Portfolio is now up 43% since the beginning of 2023. It increased its outperformance against the RSP benchmark since the last update.

All content on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalized advice before you make any trading or investing decisions. Disclaimer

Copyright 2023-2025 SwingTrader.Trading. All Rights Reserved.

You must be logged in to post a comment.