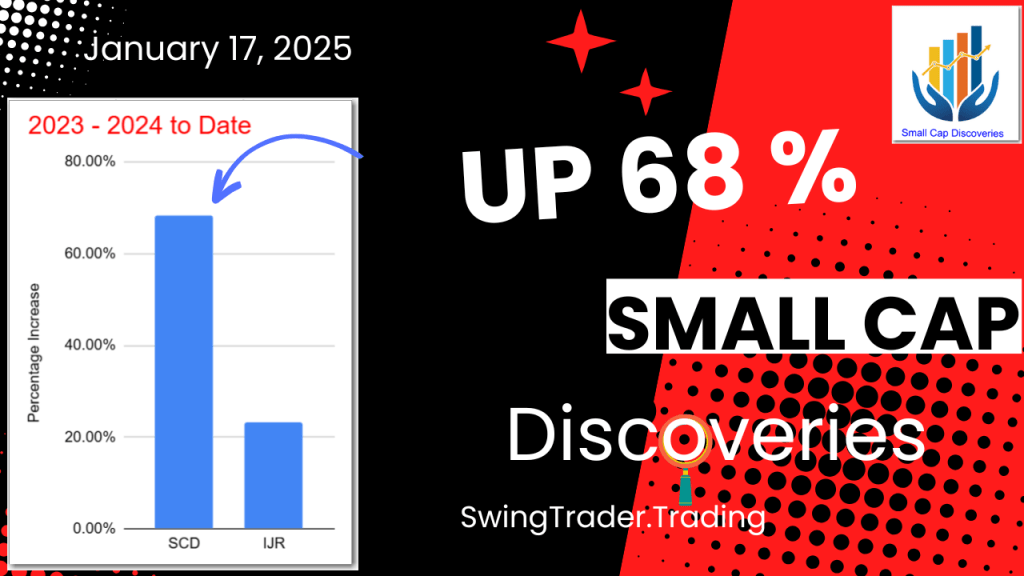

The Portfolio continues to outpace its benchmark, IJR, by a wide margin. The Portfolio is up over 68% for 2023-2024 and 45% ahead of its benchmark.

The Model Portfolio Small Cap Discoveries was updated this weekend. New Adds of 1 stock were made and Removals of 3 stocks were made. All prices are as of 01/17/2025. A total of 14 stocks are in the Portfolio now.

The Small Cap Discoveries portfolio is made up of 14 to 30 stocks. It consists of three separate strategies used together to get a good cross section of Small and Micro Cap stocks. The criteria used is Earnings per share (EPS) and related data concerning EPS to identify positive trends such as upside, surprises, magnitude, and consensus metrics. In addition Relative Strength, Price/Sales and Price/Book are examined.

BackTest – The Backtest for this Portfolio outperformed the IJR benchmark in 15 out of the 19 years tested. It underperformed in years 2008, 2015, 2017 and 2019. When the Portfolio outperformed, it was usually by a wide margin. The best year was 2009 when it was up by 127%.

Add – EHTH

Remove – CCLD, MHH, RGS

Noteworthy active transactions are AENT (added on 9/20/24) and FLXS (Added 6/21/24). They are up 77%, and 58% respectively.

See the Small Cap Discoveries Portfolio Detail Here

Performance 12/31/2022 to 01/17/2025

| Quant Alpha’s * | 165.37% |

| EQAL (Russell 1000 Equal Weight ETF) * | 24.45% |

| BI-Weekly Swings | 73.43% |

| BSMAX ( Russell Small/Mid-Cap Index Fund) | 28.30% |

| Small Cap Discoveries | 68.37% |

| IJR (Small Cap benchmark) | 23.22% |

| CANSLIM Growth | 50.95% |

| BSMAX ( Russell Small/Mid-Cap Index Fund) | 28.30% |

| Mid Cap Flyers | 43.84% |

| MDY (Mid Cap Benchmark) | 30.62% |

| Large Cap Stalwarts | 48.82% |

| RSP (Large Cap benchmark) | 25.50% |

Click here for Live Portfolio results

Backtests for the Model Portfolios

This update of the Small Cap Discoveries Model Portfolio is highlighted by its continuing outperformance over its benchmark. The Portfolio is up 68% since it went live at the beginning of 2023. The outperformance increased over its benchmark IJR from 32% to 45% since the November update.

All content on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalised advice before you make any trading or investing decisions. Disclaimer

Copyright 2023-2025 SwingTrader.Trading. All Rights Reserved.

You must be logged in to post a comment.