This is the final update for the Model Portfolios.

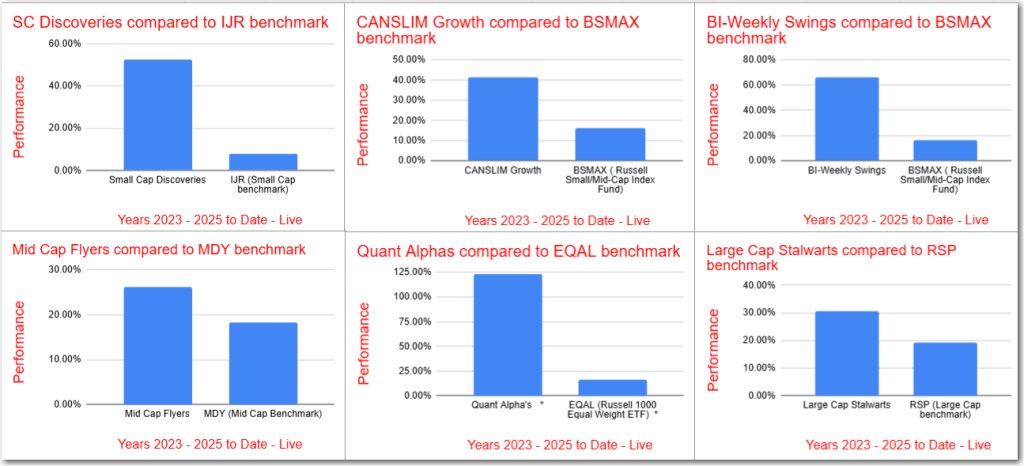

All Model Portfolios are ahead of their respective benchmarks for the 2023-2025 period.

The Quant Alpha’s is now up over 122% for 2023-2025 and continues to destroy its benchmark EQAL by 106%. Noteable outperformers WGS +301%, POWL +249%, APP +877% and CLS +272%

The BI-Weekly Swings is now up over 66% for 2023-2025 and crushing its benchmark BSMAX by 50%. Noteable outperformers Root +196%, NSSC + 104% and CLS +89%.

The Small Cap Discoveries is now up over 52% for 2023-2025 and continues to outperform its benchmark IJR by over 44%. Noteable outperformers ROOT +493%, TAST +130% and ZIMV +128%.

CANSLIM Growth is now up over 41% for 2023-2025 and easily beats its benchmark BSMAX by over 25%. Noteable outperformers CLS +226%, NSSC + 128% and XP +81%.

The Large Cap Stalwarts is now up over 30% for 2023-2025 and is now outpacing its benchmark RSP by 11%. Noteable outperformers PYPL +51%, IRM +42% and META +38%.

The Mid Cap Flyers is now up over 26% for 2023-2025 and is now outpacing its benchmark MDY by 8%. Noteable outperformers VRT +165%, GEO +92% and APLD +65%.

Performance 01/01/23 to 04/30/2025

Click here for the Live scorecard

Backtests for the Model Portfolios

How I did I do it? I used the Zacks Research Wizard for all backtesting. I found that it was reasonably accurate and easy to use. For the four monthly and one bi-weekly model portfolio, I used the Zacks Research Wizard to generate new selections based on the criteria I used for each Portfolio. As a starting point for the Portfolio criteria, I used the Tiny Titans and Estimated Revenue Up 5% screen criteria provided by AAII. I also used some of the screen criteria provided by Zacks Research Wizard for some of their better screens. I tested everything they provided to come up a few that were good. Once a screen generated new selections for a model Portfolio, I always used them without change after doing some due diligence for mergers, bad company news etc. If a current selection was not in the new list I did not delete it automatically. If it showed a profit since selection, I compared its stats to the screen criteria. If the only reason the current selection no longer showed up in the new selection list was because it went up in price, I kept it for another cycle. I was letting my winners run and cutting losers short. The backtester and screens used the range technique. If say one of the criteria was Price/Sales <= 1.0 and the Price/Sales was above that, it did not show on the list of new selections. Some backtesters use the weighted factor technique where each factor is weighted and not confined to a range. This might give better results but the one I know about that uses this technique, Portfolio123, I found too hard to use.

The Quant Alpha Model Portfolio used a premium Quantitative research platform that provides a daily list of top-ranked stocks to buy or sell, based on a comprehensive Quant Score. This score incorporates multiple factors, including valuation, growth, profitability, momentum, and earnings estimate revisions.

All content on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalized advice before you make any trading or investing decisions. Disclaimer

Copyright 2023-2025 SwingTrader.Trading. All Rights Reserved.

2 responses to “April 2025 – Model Stock Portfolios Update – Final Update”

Sorry to see you go – but big thanks for the contributions and updates up to this point, this has definitely sparked an interest for me – do you contribute any where else? would like to continue to follow if so.

LikeLike

It’s been good

LikeLike