- Quant Weekly – Additional new Add

- Quant 30 – Five Removals and five new Adds

- Legacy – continues to be up over 200%. One Removal this update.

After the summary of The Richest Man in Babylon book by George Clason are the Portfolio updates. Click here to skip straight to the updates.

The Richest Man in Babylon is a collection of parables set in ancient Babylon that teach timeless principles of personal finance, wealth-building, and financial independence. Written in simple, story-driven language, it emphasizes discipline, wisdom, and consistent habits as the foundation for prosperity.

Key Lessons

- Pay Yourself First

Save at least 10% of your income before spending on anything else. This is the cornerstone of wealth accumulation. - Live Below Your Means

Control expenses and avoid lifestyle inflation. Differentiate between wants and needs. - Make Your Money Work for You

Invest wisely so that savings generate returns. Let your money create more money. - Protect Your Wealth

Guard against risky investments and scams. Seek advice from knowledgeable, trustworthy people before committing your money. - Own Your Home

Building equity provides long-term financial security. - Ensure a Future Income

Plan for retirement and unforeseen circumstances by securing stable, ongoing income streams. - Increase Your Ability to Earn

Continuously improve your skills, knowledge, and expertise to increase earning potential.

Wealth isn’t about sudden windfalls—it’s built gradually through discipline, saving, investing, and protecting your capital. By following these principles, anyone, regardless of income level, can grow rich over time.

Website Investment Educational Blog Posts – Related video

Model Portfolio Quant Alpha Weekly

The newly Added stock is below. Ten stocks are now in the Portfolio. This Portfolio continues to beat its benchmark by a wide margin.

Add: KGC (Kinross Gold)

Outperformer: COMM (CommScope) +100%

Click here for the Quant Alpha Weekly details

What folks like about Kinross Gold

- Stock’s still cheap even though it’s been doing real well — could be a good time to jump in.

- Strong cash flow and solid assets make it look like a company bigger players might want to buy.

- Shares are up about 48% this year, thanks to high gold prices, cash flow doubling, and a $500 million buyback in the works.

- Brought in record free cash flow of about $1.42 billion for 2024 — shows the company’s running strong.

What’s got folks worried:

- Growth looks flat — production’s stuck at 2 million ounces a year through 2027.

- If gold prices don’t move much higher, stock gains might hit a ceiling.

- Mines are spread across places that can bring political or regulatory trouble, which could hurt profits.

- Costs are climbing — by 2026, it might cost over $1,600 an ounce to produce, squeezing margins.

Model Portfolio Quant 30

This week’s update includes five new Additions and five Removals from the portfolio.

This Portfolio is now beating its benchmark.

Add: LPL (LG Display), MU (Micron Technology), TIGR (UP Fintech Holding), VEON (VEON Ltd), TSM (Taiwan Semiconductor)

Remove: CMCL, ISSC, FINV, LX, LASR

Outperformers: GFI (Gold Fields) and WLDN (Willdan Group) up over 30% and PGY (Pagaya Technologies) up at least 70%.

Click here for the Quant 30 details

Model Portfolio Quant Alpha’s – Legacy

The portfolio now has 22 stocks in it. It is up over +200% since it began in 2023. This update removes one stock that has received a hard Sell signal from the Quant system. OPFi was added to the portfolio on 10/29/24 and was up +93% when removed.

Remove: OPFI (OppFi)

Outperformers: EAT (Brinker International) and LMB (Limbach Holdings) are up over 100%, AGX (Argan) is up over 200%, WGS (GeneDx Holdings), PSIX (Power Solutions ) and STRL (Sterling Infrastructure) are up over 300%, POWL (Powell Industries) is up over +400% and CLS (Celestica) is up over 800%

Click here for the Quant Alpha’s – Legacy details

OPFI problem areas

- Margin Pressure: JPMorgan’s new data fees may weigh on OppFi’s margins, creating potential headwinds for profitability and long-term growth.

- Macroeconomic Exposure: The business remains sensitive to economic downturns, which could drive higher delinquencies and defaults among its core customer base.

- Subprime Risk Profile: Heavy reliance on subprime borrowers heightens risk, particularly amid inflationary pressures and broader economic uncertainty, positioning OppFi as a speculative investment.

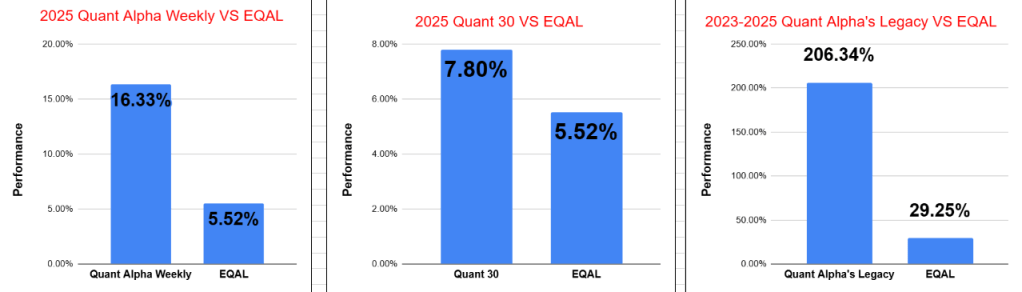

Performance to 08-28-2025

| Portfolio start date 6/27/25 | |

| Quant Alpha Weekly | 16.33% |

| EQAL (Russell 1000 Equal Weight ETF) | 5.52% |

| Portfolio start date 6/27/25 | |

| Quant 30 | 7.80% |

| EQAL (Russell 1000 Equal Weight ETF) | 5.52% |

| Portfolio start date 4/14/23 | |

| Quant Alpha’s – Legacy | 206.34% |

| EQAL (Russell 1000 Equal Weight ETF) | 29.25% |

Click here for the Live Quant scorecard

The Quant Alpha Weekly Portfolio continues it’s steady increase in new members and remains substantially ahead of its benchmark.

The Quant 30 Portfolio now is starting to see some significant rotation among the 30 members. It managed to close ahead of the benchmark

The Quant Alpha’s – Legacy Portfolio maintained its over 200% return.

All content on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalized advice before you make any trading or investing decisions. Disclaimer

Copyright 2023-2025 SwingTrader.Trading. All Rights Reserved.

You must be logged in to post a comment.