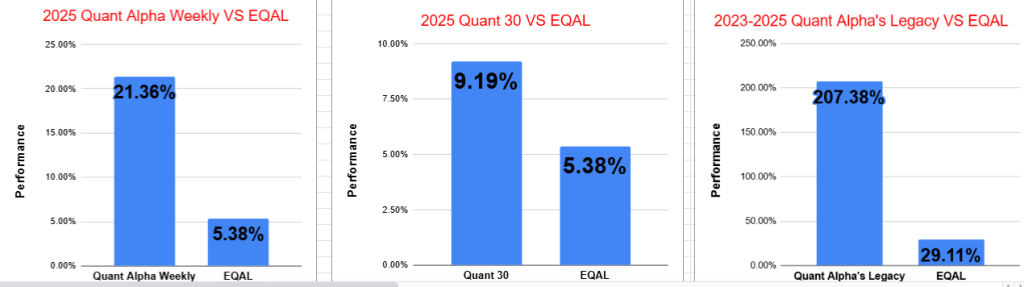

- Quant Weekly – Up over 20% in two months

- Quant 30 – Well ahead of its benchmark

- Legacy – continues to be up over 200%

After the summary of the YouTube video “The Emotional Traps That Destroy Traders – Jesse Livermore” are the Portfolio updates.

Summary: The Emotional Traps of Speculation

The greatest danger for speculators is not the market itself but their own emotions. Even the most brilliant analysis or strategy is useless if fear, hope, greed, or ego take control. Success in speculation requires mastering these internal battles through discipline and rules.

Key Emotional Traps

- Fear of Taking a Loss (Loss Aversion)

- Traders avoid small losses because they’re painful, leading to larger, destructive losses.

- Prison of Hope

- Refusal to accept mistakes causes traders to hold losers, hoping they recover, instead of acting rationally.

- Averaging Down

- Adding to losing positions to “prove” oneself right, reinforcing failure instead of success.

- Chasing Winners (FOMO)

- Buying into overextended stocks out of greed or envy, usually near tops.

- Cutting Winners Short / Holding Losers Long

- A reversal of rational behavior: fear makes traders sell winners too early, while hope makes them cling to losers.

- Mental Exhaustion

- Emotional stress from bad trades and constant worry destroys judgment and decision-making.

- Belief That Emotions Can’t Be Controlled

- Amateurs accept emotional reactions as inevitable. Professionals impose rules—like stop-losses, entry/exit plans, and position sizing—to cage emotions.

- Short-Term Focus

- Amateurs see each trade as a battle to win, while professionals see the long game where small, controlled losses are simply “business expenses.”

- Illusion of Willpower Alone

- Willpower isn’t enough—journaling and reviewing decisions are vital to spot emotional patterns and recondition behavior.

Core Principles for Success

- Your real enemy in the stock market is your own psychology.

- Discipline comes from predefined rules and systems, not raw willpower.

- Treat losses as normal and small—never as personal defeats.

- Success is achieved not by conquering the market, but by conquering yourself.

Big Takeaway:

The ultimate victory in trading is not beating the market, but beating your own destructive instincts.

Website Investment Educational Blog Posts – Related video

Model Portfolio Quant Alpha Weekly

The newly Added stock is below. Eleven stocks are now in the Portfolio. This Portfolio continues to beat its benchmark by a wide margin.

Add: CDE (Coeur Mining)

Outperformer: Outperformer: COMM (CommScope) +100%

Click here for the Quant Alpha Weekly details

Positives for Coeur Mining

- Coeur Mining is on track for a record production year in 2025, fueled by stronger output and the Las Chispas acquisition.

- The company has delivered positive free cash flow in consecutive quarters, supported by the Rochester Expansion and Las Chispas’ low-cost ounces.

- Balance sheet momentum is building — with growing free cash flow expected to accelerate debt paydown and possibly shift the company into a net cash position.

Concerns for Coeur Mining:

- Heavy share dilution over the last decade has muted per-share growth, despite rising production.

- Profitability still trails sector peers, leaving valuation metrics looking less compelling at current prices.

- Acquisitions have come at steep costs — Las Chispas in particular demands sustained exploration success to justify the price tag.

Model Portfolio Quant 30

This week’s update includes one new Addition and one Removal from the portfolio.

This Portfolio continues to beat its benchmark.

Add: DB (Deutsche Bank)

Remove: WLDN

Outperformers: GFI (Gold Fields) and PSIX (Power Solutions ) up over 30% and PGY (Pagaya Technologies) up at least 70%.

Click here for the Quant 30 details

Model Portfolio Quant Alpha’s – Legacy

The portfolio now has 22 stocks in it. It is up +200% since it began in 2023.

Remove: None

Outperformers: EAT (Brinker International) and LMB (Limbach Holdings) are up over 100%, AGX (Argan) is up over 200%, WGS (GeneDx Holdings), PSIX (Power Solutions ) and STRL (Sterling Infrastructure) are up over 300%, POWL (Powell Industries) is up over +400% and CLS (Celestica) is up over 800%

Click here for the Quant Alpha’s – Legacy details

Performance to 09-04-2025

| Portfolio start date 6/27/25 | |

| Quant Alpha Weekly | 21.35% |

| EQAL (Russell 1000 Equal Weight ETF) | 5.38% |

| Portfolio start date 6/27/25 | |

| Quant 30 | 9.19% |

| EQAL (Russell 1000 Equal Weight ETF) | 5.38% |

| Portfolio start date 4/14/23 | |

| Quant Alpha’s – Legacy | 207.38% |

| EQAL (Russell 1000 Equal Weight ETF) | 29.11% |

Click here for the Live Quant scorecard

The Quant Alpha Weekly Portfolio continues it’s steady increase in new members and remains substantially ahead of its benchmark. Up over 20% since it began on June 27. 2025.

The Quant 30 Portfolio only had one change this update. It managed to close ahead of the benchmark once again.

The Quant Alpha’s – Legacy Portfolio maintained its over 200% return in a classic Position Trading Portfolio implementation.

All content on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalized advice before you make any trading or investing decisions. Disclaimer

Copyright 2023-2025 SwingTrader.Trading. All Rights Reserved.

You must be logged in to post a comment.