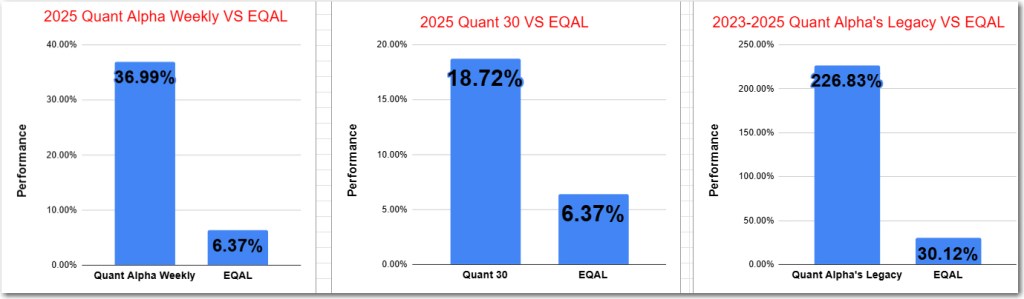

- Quant Weekly – Up over 30% in 2 1/2 months

- Quant 30 – Up over 18% in 2 1/2 months

- Legacy – continues to be up over 200%

After the summary of “Why Stocks React to Fed Rate Cuts” are the Portfolio updates.

Why Stocks React to Fed Rate Cuts

Positive Drivers

- Lower borrowing costs – Cheaper credit fuels business expansion and consumer spending.

- Investor confidence – Cuts signal proactive Fed management, boosting sentiment.

- Higher valuations – Reduced discount rates make future earnings look more attractive.

When Cuts Backfire

- Recession backdrop – In downturns (e.g., 2000s, 2008), lower rates couldn’t stop market losses.

- Already priced in – If cuts meet or miss expectations, markets may sell off.

Key Considerations

- Economic context – Preemptive cuts in stable times help; crisis-driven cuts often don’t.

- Investor expectations – The element of surprise (or lack thereof) drives reactions.

- Fed messaging – A dovish tone can lift markets even without a cut.

Website Investment Educational Blog Posts –

Model Portfolio Quant Alpha Weekly

The newly Added stock is below. Thirteen stocks are now in the Portfolio. This Portfolio continues to beat its benchmark by a wide margin.

Add: SEZL (Sezzle)

Outperformers: SSRM (SSR Mining) and PSIX (Power Solutions) up over 30%, COMM (CommScope) up over +100%

Click here for the Quant Alpha Weekly details

Positives for Sezzle

- Sezzle Inc. is recognized for its rapid revenue and GMV growth, with merchant adoption of BNPL driving a 74% GMV and 76% revenue growth, making it an attractive opportunity for investors despite increased leverage.

- The company’s Rule of 40 score exceeds 130, highlighting its efficiency in balancing revenue growth and profit margin, positioning it as a strong growth story in the fintech space.

- Sezzle’s unique consumer-driven strategy differentiates it from competitors like Affirm and Klarna, focusing on embedding solutions directly into the consumer financial ecosystem, thereby enhancing user engagement and lifetime value.

Concerns about Sezzle

- Sezzle faces potential risks from macroeconomic and regulatory changes, with concerns about its reliance on subprime borrowers and the impact of increasing state-level BNPL regulations.

- Valuation concerns arise as Sezzle’s premium multiple is deemed unsustainable amidst rising compliance costs and macroeconomic headwinds, leaving little room for error.

- The rapid approval of new consumers could lead to increased delinquencies, with management guiding for higher credit loss provisions, posing a risk to asset quality.

Model Portfolio Quant 30

This week’s update includes one new Addition and one Removal from the portfolio.

This Portfolio continues to beat its benchmark by a wide margin.

Add: VFF (Village Farms)

Remove: EAT (Brinker International)

Outperformers: KGC (Kinross Gold) , GFI (Gold Fields), SSRM (SSR Mining) and PSIX (Power Solutions) up over 40%, PGY (Pagaya Technologies) is up over 100%.

Click here for the Quant 30 details

Model Portfolio Quant Alpha’s – Legacy

The portfolio now has 21 stocks in it. It is up over +200% since it began in 2023.

Remove: None

Outperformers: EAT (Brinker International) and RSI (Rush Street Interactive) are up over 100%, AGX (Argan) is up over 200%, WGS (GeneDx Holdings) is up over 300%, PSIX (Power Solutions ), STRL (Sterling Infrastructure) and POWL (Powell Industries) are up over +400% and CLS (Celestica) is up over 900%

Click here for the Quant Alpha’s – Legacy details

Performance to 09-18-2025

| Portfolio start date 6/27/25 | |

| Quant Alpha Weekly | 36.99% |

| EQAL (Russell 1000 Equal Weight ETF) | 6.37% |

| Portfolio start date 6/27/25 | |

| Quant 30 | 18.72% |

| EQAL (Russell 1000 Equal Weight ETF) | 6.37% |

| Portfolio start date 4/14/23 | |

| Quant Alpha’s – Legacy | 226.83% |

| EQAL (Russell 1000 Equal Weight ETF) | 30.12% |

Click here for the Live Quant scorecard

The Quant Alpha Weekly Portfolio continues it’s steady increase in new members and remains substantially ahead of its benchmark. Up over 30% since it began on June 27. 2025.

The Quant 30 Portfolio only had one change this update. It managed to close ahead of the benchmark once again.

The Quant Alpha’s – Legacy Portfolio maintained its over 200% return in a classic Position Trading Portfolio implementation.

All content on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalized advice before you make any trading or investing decisions. Disclaimer

Copyright 2023-2025 SwingTrader.Trading. All Rights Reserved.

You must be logged in to post a comment.