- Quant Weekly – Up over 30% in 3 months

- Quant 30 – Up over 18% in 3 months

- Legacy – continues to be up over 200%

After the summary of the Rich Dad Poor Dad book by Robert Kiyosaki, are the Portfolio updates.

Rich Dad Poor Dad – Summary

Robert Kiyosaki shares lessons he learned from his two “dads”:

- Poor Dad – his biological father, well-educated but financially insecure.

- Rich Dad – his best friend’s father, a businessman who built wealth through entrepreneurship and investing.

The contrast between their mindsets forms the core of the book.

Key Lessons

- The Rich Don’t Work for Money

- The poor and middle class work for a paycheck.

- The rich focus on acquiring assets that generate income.

- Financial Education is Essential

- Schools teach academics, not financial literacy.

- Understanding money—how it works, how to invest it, how to grow it—is critical to building wealth.

- Mindset Matters

- Poor Dad’s mindset: “Get a good job, work hard, climb the ladder.”

- Rich Dad’s mindset: “Own the ladder. Build systems. Make money work for you.”

- Assets vs. Liabilities

- Assets put money in your pocket (investments, rental properties, businesses).

- Liabilities take money out (big houses, cars bought with debt, consumer spending).

- Wealth comes from accumulating assets.

- Work to Learn, Not to Earn

- Develop skills in sales, investing, leadership, and managing money.

- Focus on learning how to run businesses and handle finances, not just earning a salary.

- Taxes and Corporations

- The rich use legal structures like corporations to reduce taxes and protect assets.

- Employees get taxed first, but businesses can deduct expenses before paying taxes.

- Overcoming Fear and Taking Risks

- Fear of losing money keeps many people from investing.

- Failure is part of the learning process. Courage and persistence are essential to wealth-building.

Core Message

Wealth is built not through a high income, but through financial intelligence, the right mindset, and consistent investment in assets. To escape the “rat race,” stop working only for money and start making money work for you.

Website Investment Educational Blog Posts – Related Video

Note: This website will next week convert to having a free and a paid option. The paid option will get all updates right away each week. The free option will still get the current content but the Portfolio updates will be at least one week delayed. Want to be a paid subscriber and get the updates with no delay? Click here.

Model Portfolio Quant Alpha Weekly

The newly Added stock is below. Fourteen stocks are now in the Portfolio. This Portfolio continues to beat its benchmark by a wide margin.

Add: MU (Micron Technology)

Outperformers: PSIX (Power Solutions) up over 40%, COMM (CommScope) up over +99%

Click here for the Quant Alpha Weekly details

Positives for Micron Technology

- Q4 revenue jumped 46%, fueled by red-hot DRAM demand for AI and data-center gear—10 straight beats on EPS and sales.

- Sitting pretty in the AI megatrend, with leadership in DRAM and HBM that commands premium pricing and keeps hyperscalers close.

- Margins expanding and future HBM supply locked in, signaling runway for more AI-driven growth as DRAM stays tight.

Concerns for Micron Technology

- Stock looks richly priced, with analysts flagging a possible 15–20% pullback and no real margin of safety.

- Free-cash-flow yield is thin compared to the lofty valuation, raising doubts about big shareholder payouts despite the AI buzz.

- Watch for falling ASPs and tougher competition—Samsung’s aggression could eat into Micron’s edge.

Model Portfolio Quant 30

This week’s update does not have any changes.

This Portfolio continues to beat its benchmark by a wide margin.

Add: None

Remove: None

Outperformers: KGC (Kinross Gold) , GFI (Gold Fields), SSRM (SSR Mining) and up over 40%, PSIX (Power Solutions) AND PGY (Pagaya Technologies) are up over 60%.

Click here for the Quant 30 details

Model Portfolio Quant Alpha’s – Legacy

The portfolio now has 21 stocks in it. It is up over +200% since it began in 2023.

Remove: None

Outperformers: AGX (Argan)and WGS (GeneDx Holdings) are up over 200%, PSIX (Power Solutions ), STRL (Sterling Infrastructure) and POWL (Powell Industries) are up over +400% and CLS (Celestica) is up over 900%

Click here for the Quant Alpha’s – Legacy details

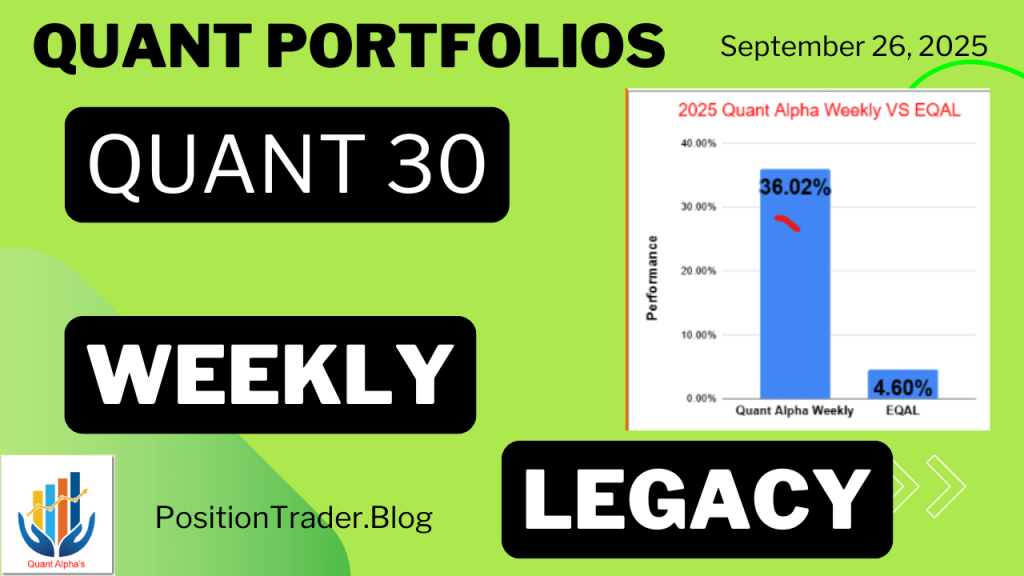

Performance to 09-25-2025

| Portfolio start date 6/27/25 | |

| Quant Alpha Weekly | 36.02% |

| EQAL (Russell 1000 Equal Weight ETF) | 4.60% |

| Portfolio start date 6/27/25 | |

| Quant 30 | 18.61% |

| EQAL (Russell 1000 Equal Weight ETF) | 4.60% |

| Portfolio start date 4/14/23 | |

| Quant Alpha’s – Legacy | 219.03% |

| EQAL (Russell 1000 Equal Weight ETF) | 28.32% |

Click here for the Live Quant scorecard

The Quant Alpha Weekly Portfolio continues it’s steady increase in new members and remains substantially ahead of its benchmark. Up over 30% since it began on June 27. 2025.

The Quant 30 Portfolio had no changes this week. It managed to close ahead of the benchmark once again.

The Quant Alpha’s – Legacy Portfolio maintained its over 200% return in a classic Position Trading Portfolio implementation.

All content on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalized advice before you make any trading or investing decisions. Disclaimer

Copyright 2023-2025 SwingTrader.Trading. All Rights Reserved.

You must be logged in to post a comment.