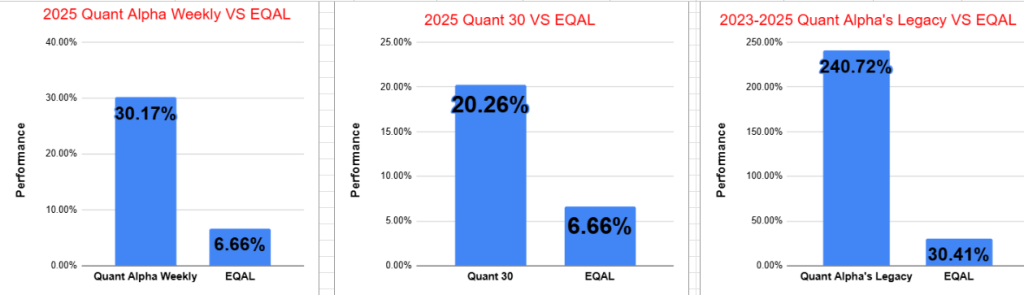

- Quant Weekly – Up over 30% in 3 months

- Quant 30 – Up over 20% in 3 months

- Legacy – continues to be up over 220%

After the summary “How does a US government shutdown effect the stock market?” are the Portfolio updates.

How does a US government shutdown effect the stock market?

Overall Market

- Shutdowns barely dent stocks—S&P 500 fell only ~2% on average during past standoffs.

- Example: 2013 shutdown (16 days)—S&P slipped ~3% during, then rallied +10% in the next 3 months.

- 2018–19 shutdown (35 days)—S&P gained +11% in the following month.

- Bottom line: short-term chop, then a rebound. Bigger drivers remain earnings and Fed policy.

Sectors & Assets

- Defense, healthcare, IT contractors risk delays in federal payments.

- Treasuries and gold usually catch a bid; bond yields slide.

- Dollar weakens as global investors side-eye U.S. dysfunction.

- Healthcare could take a hit if ACA credits lapse.

Economic Fallout

- Each week closed shaves ~0.1–0.2% off GDP, usually recouped later.

- Key data releases (jobs, inflation) get delayed, leaving the Fed and Wall Street flying blind.

- Long impasses hit confidence, chilling consumer spending and business hiring.

Website Investment Educational Blog Posts

Note: This site now offers both a free and a paid subscription. Paid subscribers receive weekly Portfolio updates as soon as they’re released. Free subscribers still get full content, but Portfolio updates will arrive with at least a one-week delay. Want instant access? Click here.

Model Portfolio Quant Alpha Weekly

The newly Added stock was released to the Paid Subscribers earlier today. Fifteen stocks are now in the Portfolio. This Portfolio continues to beat its benchmark by a wide margin.

Micron Technology added just last week to this Portfolio, is already up 17.1% since added! This shows the importance of having up-to-date Add/Remove data to work with.

Add: Free subscribers will see the new Add next week.

Outperformers: PSIX (Power Solutions) up over 40%, COMM (CommScope) up over +98%

Click here for the Quant Alpha Weekly details

Model Portfolio Quant 30

If there were any changes to this Portfolio this week the Paid Subscribers got an email with the details. The free subscribers will know about this weeks changes, next week.

This Portfolio continues to beat its benchmark by a wide margin. It is now up 20%.

Add:

Remove:

Outperformers: KGC (Kinross Gold) , GFI (Gold Fields), SSRM (SSR Mining) and up MU (Micron Technology) up over 50%,

Click here for the Quant 30 details

Model Portfolio Quant Alpha’s – Legacy

The portfolio now has 21 stocks in it. It is up over +220% since it began in 2023.

Remove: None

Outperformers: AGX (Argan) is up over 200%, WGS (GeneDx Holdings) and PSIX (Power Solutions ) are up 300%, STRL (Sterling Infrastructure) and POWL (Powell Industries) are up over +400% and CLS (Celestica) is up over 900%

Click here for the Quant Alpha’s – Legacy details

Performance to 10-02-2025

| Portfolio start date 6/27/25 | |

| Quant Alpha Weekly | 30.17% |

| EQAL (Russell 1000 Equal Weight ETF) | 6.66% |

| Portfolio start date 6/27/25 | |

| Quant 30 | 20.26% |

| EQAL (Russell 1000 Equal Weight ETF) | 6.66% |

| Portfolio start date 4/14/23 | Live |

| Quant Alpha’s – Legacy | 240.72% |

| EQAL (Russell 1000 Equal Weight ETF) | 30.41% |

Click here for the Live Quant scorecard

The Quant Alpha Weekly Portfolio continues it’s steady increase in new members and remains substantially ahead of its benchmark. Up over +30% since it began on June 27. 2025.

The Quant 30 Portfolio had no changes this week. It managed to close ahead of the benchmark once again. Up +20% since June 27, 2025

The Quant Alpha’s – Legacy Portfolio maintained its over +220% return in a classic Position Trading Portfolio implementation.

All content on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalized advice before you make any trading or investing decisions. Disclaimer

Copyright 2023-2025 SwingTrader.Trading. All Rights Reserved.

You must be logged in to post a comment.