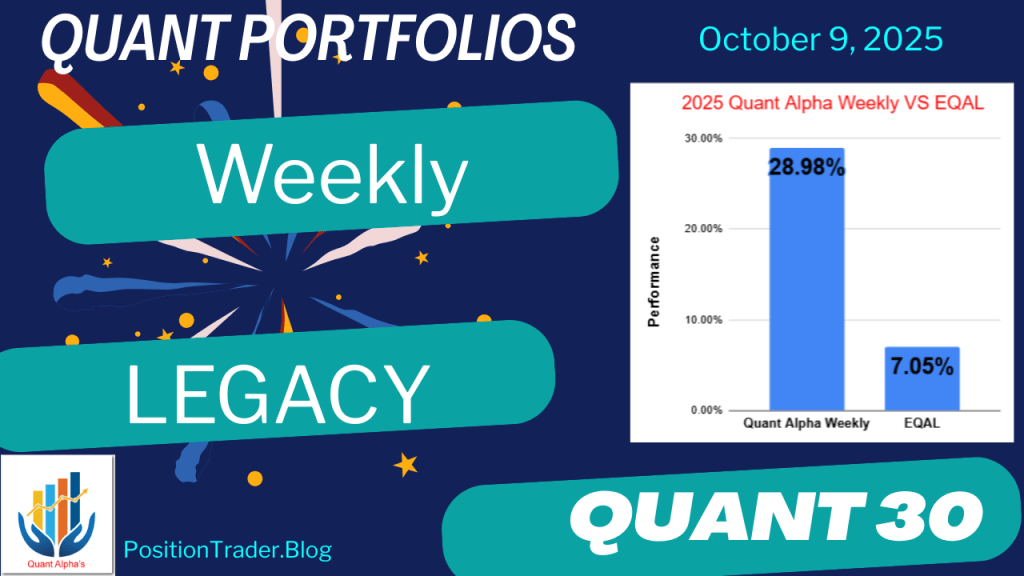

- Quant Weekly – Up over 28% in 3 months

- Quant 30 – Up over 19% in 3 months

- Legacy – continues to be up over 220%, Celestica has now become a 10 bagger.

After the summary on the outlook for minerals stocks are the Portfolio updates.

Outlook for minerals stocks

Reasons for the big rally

- Gold surge acted as the main catalyst. A sustained, year-long rally in gold prices to record highs drove up the valuations of gold-mining stocks, which historically have tended to outperform the metal itself during a bull market.

- Geopolitical tensions and ‘risk-off’ sentiment. Ongoing global instability, coupled with concerns over national debt levels and the weakening U.S. dollar, sent investors seeking the safety of gold. Central banks and retail investors both flocked to the metal.

- Monetary policy pivot. Federal Reserve interest rate cuts eased the pressure on gold, a non-interest-bearing asset. The prospect of further easing made holding bullion more attractive relative to government bonds.

- Government-backed momentum for critical minerals. Washington’s push to secure domestic rare earth and critical mineral supplies sent certain stocks, like MP Materials and Lithium Americas, soaring on news of potential government equity stakes.

- Stronger free cash flow for miners. Thanks to higher metal prices and disciplined corporate behavior—including a focus on operational efficiency instead of reckless acquisitions—many miners saw a significant boost to their free cash flow. This allowed them to return capital to shareholders through dividends and buybacks.

The outlook for these stocks

- Gold stocks: Expect volatility but a continued bull run. While some analysts anticipate a short-term correction after huge recent gains, the long-term fundamentals remain strong. Bullish drivers like geopolitical risk, high debt, and central bank buying are not going away anytime soon, though the rally may broaden to other sectors.

- Critical minerals: A bumpy, politically charged ride. Investment in some critical minerals is complicated by an oversupply in the market, with nickel and lithium experiencing price drops in 2024. However, strong long-term demand from the green energy transition and continued government policy support will remain a powerful tailwind.

- Sector consolidation is likely. A persistent lower-price environment for some metals, combined with high interest rates and geopolitical risks, will continue to drive mergers and acquisitions (M&A).

- Base metals: Divergent performance ahead. Some analysts see demand shifting more outside of China in 2025, benefiting copper producers in particular. However, base metal giants like Rio Tinto and Anglo American have faced headwinds and remain more sensitive to broader global growth concerns.

Website Investment Educational Blog Posts –

Note: This site now offers both a free and a paid subscription. Paid subscribers receive weekly Portfolio updates as soon as they’re released. Free subscribers still get full content, but Portfolio updates will arrive with at least a one-week delay. Want instant access? Click here.

Model Portfolio Quant Alpha Weekly

The newly Added stock was released to the Paid Subscribers earlier today. Shown below is the stock added last week. Sixteen stocks are now in the Portfolio. This Portfolio continues to beat its benchmark by a wide margin.

Add (10/2/25): NEM (Newmont Corporation)

Outperformers: SSRM (SSR Mining) up over 40%, COMM (CommScope) up over +90%

Click here for the Quant Alpha Weekly details

What’s Working for Newmont

- Cash flow’s booming: record EPS and disciplined portfolio management pushed shares up 85% year-to-date.

- Shedding the clutter: divesting non-core assets sharpened focus on top-tier mines and boosted efficiency.

- Strong Q2 showing: adjusted net income jumped 91% year-over-year, underscoring fat margins and steady momentum.

What’s Got Analysts Cautious

- Growth cooling off: performance likely to normalize, and the stock looks pricey vs. history, limiting upside.

- Output slipping: production per share keeps drifting lower—reserves aren’t being replaced fast enough.

- Capex catch-up ahead: deferred spending could hit in late 2025, raising costs and trimming free cash flow.

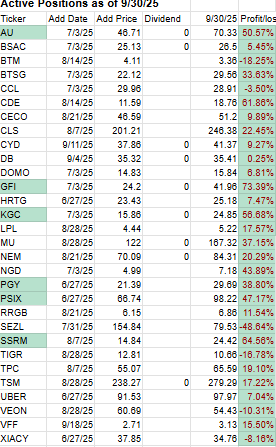

Model Portfolio Quant 30

This week’s update, if any, has been sent to the paid subscribers. Last week there were no changes. At this time of the earnings reporting cycle, the number of changes tends to be at the lowest level. When the earnings reports start rolling in, the updates should start ramping up.

This Portfolio continues to beat its benchmark by a wide margin.

VFF (Village Farms) added on 9/18/25, is already up 34%.

Add (10/2/25): None

Remove (10/2/25): None

Outperformers: KGC (Kinross Gold) and GFI (Gold Fields), MU (Micron Technology) are up over 50% and PGY (Pagaya Technologies) is up over 40%.

Click here for the Quant 30 details

Model Portfolio Quant Alpha’s – Legacy

The portfolio now has 21 stocks in it. It is up over +200% since it began in 2023. Celestica has now become a 10 bagger.

Remove: None

Outperformers: AGX (Argan) and WGS (GeneDx Holdings) are up over 200%, PSIX (Power Solutions ) up over 300%, STRL (Sterling Infrastructure) and POWL (Powell Industries) are up over +400% and CLS (Celestica) is up over 1000%

Click here for the Quant Alpha’s – Legacy details

Performance to 10-09-2025

| Portfolio start date 6/27/25 | |

| Quant Alpha Weekly | 28.98% |

| EQAL (Russell 1000 Equal Weight ETF) | 7.05% |

| Portfolio start date 6/27/25 | |

| Quant 30 | 19.72% |

| EQAL (Russell 1000 Equal Weight ETF) | 7.05% |

| Portfolio start date 4/14/23 | |

| Quant Alpha’s – Legacy | 243.45% |

| EQAL (Russell 1000 Equal Weight ETF) | 30.79% |

Click here for the Live Quant scorecard

The Quant Alpha Weekly Portfolio continues it’s steady increase in new members and remains substantially ahead of its benchmark. Up over 28% since it began on June 27. 2025.

The Quant 30 Portfolio had no changes this week. It managed to close ahead of the benchmark once again.

The Quant Alpha’s – Legacy Portfolio maintained its over 220% return in a classic Position Trading Portfolio implementation.

Quant 30 Model Portfolio as of 9/30/25

All content on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalized advice before you make any trading or investing decisions. Disclaimer

Copyright 2023-2025 SwingTrader.Trading. All Rights Reserved.

You must be logged in to post a comment.