- Quant Weekly – Up over 35% in 3 1/2 months

- Quant 30 – Up over 20% in 3 1/2 months

- Legacy – continues to be up over 220%

After the summary “Why Leveraged ETF’s are considered too risky for most investors” are the Portfolio updates.

Why Leveraged ETF’s are considered too risky for most investors

Leveraged ETFs (LETFs) are considered too risky for most average stock investors because of how they are structured and how they behave over time. Here’s a breakdown:

1. Daily Reset & Compounding Risk

- Leveraged ETFs (like 2x or 3x funds) aim to deliver 2x or 3x the DAILY return of an index, not long-term performance.

- Because they reset daily, market volatility causes compounding effects that can erode returns over weeks or months, even if the underlying index ends up flat or higher.

2. Volatility Decay

- In choppy markets, gains and losses compound against each other.

- Example: If an index goes -10% one day and +10% the next, the index is slightly down overall—but a 3x ETF will magnify those swings and lose significantly more over the same period.

3. High Expense Ratios and Trading Costs

- Leveraged ETFs typically have higher management fees and require active rebalancing, which can eat into returns.

- Frequent trading to maintain leverage makes them more expensive to hold long-term.

4. Market Timing Required

- They’re designed for short-term trades, not buy-and-hold investing.

- Success requires precise timing of entry and exit points. Missing a few key days can wipe out gains.

5. Liquidity & Tracking Errors

- Some leveraged ETFs have lower trading volume or use derivatives like swaps and futures.

- This increases tracking error, meaning performance can diverge from the stated goal.

Key takeaway: Early massive drawdowns mean most long-term holders would have been forced out before enjoying later gains, showing how daily leverage turns deep bear markets into near-zero resets.

Hypothetical TQQQ (ProShares UltraPro QQQ 3X) Example

Here’s a hypothetical illustration of how a 3× leveraged Nasdaq-100 ETF (like TQQQ) might have performed if it had existed since 2000, using historical QQQ data and applying daily 3× leverage with resets:

- Dot-com crash (2000–2002): QQQ lost about –83% from peak to trough; a 3× product would have suffered an estimated decline of –98%+, effectively wiping out nearly all capital.

- 2003–2007 bull run: QQQ roughly tripled; a 3× version could have risen more than 10×—but only if an investor somehow stayed invested after the near-total early loss.

- Global Financial Crisis (2008): QQQ dropped roughly –48%; a 3× fund would likely have plunged –90%+, again close to a total loss.

- 2009–2021 tech boom: QQQ gained over 1,500%; surviving capital in a 3× fund could have soared far more than 10,000%, but only if the investor avoided being wiped out in earlier crashes.

- 2022 Nasdaq bear market: QQQ slid roughly –33%; a 3× fund would have fallen about –75%, erasing years of gains in a single volatile year.

- Key takeaway: Early massive drawdowns mean most long-term holders would have been forced out before enjoying later gains, showing how daily leverage turns deep bear markets into near-zero resets.

Website Investment Educational Blog Posts –

Note: This site now offers both a free and a paid subscription. Paid subscribers receive weekly Portfolio updates as soon as they’re released. Free subscribers still get full content, but Portfolio updates will arrive with at least a one-week delay. Want instant access? Click here.

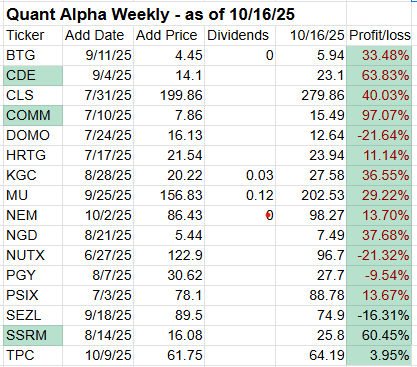

Model Portfolio Quant Alpha Weekly

The newly Added stock, if any, was released to the Paid Subscribers earlier today. Shown below is the stock added last week. This Portfolio continues to beat its benchmark by a wide margin. It is up 37%.

Newmont Company added 10/2/25 is already up 13%.

Add (10/9/25): TPC (Tutor Perini)

Outperformers: CDE (Coeur Mining) up over 60%, COMM (CommScope) up over +97%

Click here for the Quant Alpha Weekly details

What does Tudor Perini do?: California-based, this construction powerhouse runs the gamut — from general contracting to design-build and construction management — delivering major projects for both private developers and public agencies across the globe.

Positives about Tudor Perini

- Backlog’s booming: Tutor Perini’s got a record $21.1B backlog, locking in years of revenue visibility.

- High-margin focus: The company’s doubling down on complex civil and building projects, fattening margins and boosting earnings power.

- Clearing the decks: Major dispute charges are now behind them — that’s a cleaner balance sheet and stronger profitability runway.

Concerns about Tudor Perini

- Stock’s running hot: Shares look overbought, signaling a possible near-term pullback.

- Legal overhang: Ongoing lawsuits and claims could hit both cash flow and credibility if outcomes turn sour.

- Policy risk: Heavy dependence on government contracts means any slowdown in federal infrastructure spending could pinch revenue.

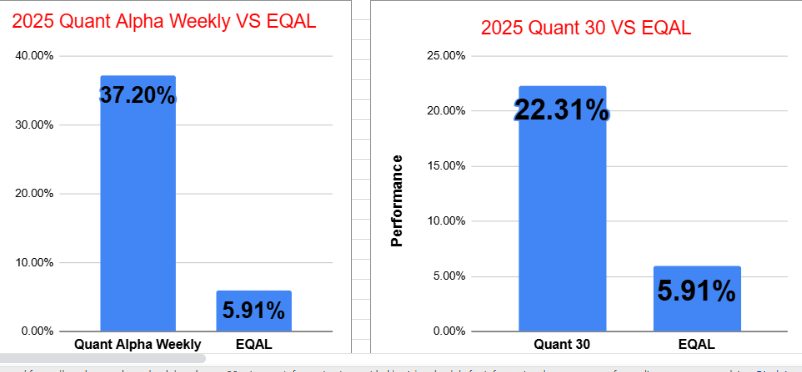

Model Portfolio Quant 30

This week’s update, if any, has been sent to the paid subscribers. Last week there were no changes. At this time of the earnings reporting cycle, the number of changes tends to be at the lowest level. When the earnings reports start rolling in, the updates should start ramping up.

This Portfolio continues to beat its benchmark by a wide margin. I is up 22%.

Add (10/9/25): None

Remove (10/9/25): None

Outperformers: KGC (Kinross Gold) , GFI (Gold Fields), SSRM (SSR Mining) and MU (Micron Technology) are up over 60%.

Click here for the Quant 30 details

Model Portfolio Quant Alpha’s – Legacy

The portfolio now has 21 stocks in it. It is up over +220% since it began in 2023. Celestica maintains its 10 bagger status.

Remove: None

Outperformers: AGX (Argan)and WGS (GeneDx Holdings) and PSIX (Power Solutions ) are up over 300%, STRL (Sterling Infrastructure) and POWL (Powell Industries) are up over +500% and CLS (Celestica) is up over 1000%

Click here for the Quant Alpha’s – Legacy details

Performance to 10-16-2025

| Portfolio start date 6/27/25 | |

| Quant Alpha Weekly | 37.20% |

| EQAL (Russell 1000 Equal Weight ETF) | 5.91% |

| Portfolio start date 6/27/25 | |

| Quant 30 | 22.31% |

| EQAL (Russell 1000 Equal Weight ETF) | 5.91% |

| Portfolio start date 4/14/23 | Live |

| Quant Alpha’s – Legacy | 251.78% |

| EQAL (Russell 1000 Equal Weight ETF) | 29.63% |

Click here for the Live Quant scorecard

The Quant Alpha Weekly Portfolio continues it’s steady increase in new members and remains substantially ahead of its benchmark. Up over 35% since it began on June 27. 2025.

The Quant 30 Portfolio had no changes this week. It managed to close ahead of the benchmark once again. It is up 22%.

The Quant Alpha’s – Legacy Portfolio maintained its over 200% return in a classic Position Trading Portfolio implementation.

All content on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalized advice before you make any trading or investing decisions. Disclaimer

Copyright 2023-2025 SwingTrader.Trading. All Rights Reserved.

You must be logged in to post a comment.