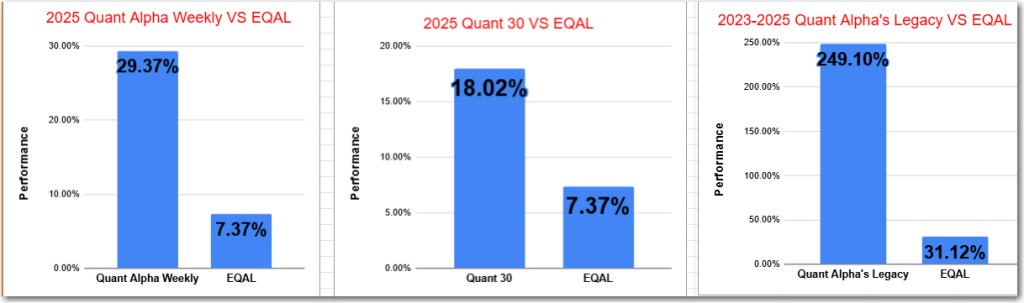

- Quant Weekly – Up over 29% in 3 1/2 months

- Quant 30 – Up over 18% in 3 1/2 months

- Legacy – continues to be up over 230%, Celestica becomes a 11 bagger.

After the summary “What are ten baggers and how to spot them” are the Portfolio updates.

What are ten baggers and how to spot them

What’s a Ten-Bagger

- A “ten-bagger” is a stock (or investment) that goes up ten times your original purchase price. If you buy a share at $10, a ten-bagger would see it hit $100.

- The term was popularized by Peter Lynch in One Up On Wall Street.

How People Try to Spot Them Before They Pop

These are not guarantees — just what tends to line up in companies that blow up:

- Early phase with room to grow — smaller or mid-cap firms, often in growth sectors where demand is expanding.

- Innovative edge or unique product/service that solves something big or disrupts existing markets. If they’re just another copy, less chance.

- Reasonable valuation early on — not overpriced. If you pay too much, even great growth is hampered. Lynch preferred stocks with P/E ratios modest compared to peers or their past.

- Strong earnings growth over years, not just hype for a quarter. Must show consistency.

- Good financial fundamentals — manageable debt, positive cash flow, ability to reinvest and scale without collapsing under costs.

- Large total addressable market (TAM) — the bigger the potential market, the more room to run. If the market is niche and saturated, upside can be limited.

- Durability / strong moat — a competitive advantage (brand, tech, regulatory, network effect) that keeps competitors from eating your lunch.

- Long‐term holding — you need patience. These ten-baggers often take many years to hit the 10x mark.

Bottom line: finding a ten-bagger ahead of time means spotting companies that are just starting to scale, doing it smart, and getting in early — with guts to hold through the shakeouts.

Website Investment Educational Blog Posts –

Note: This site now offers both a free and a paid subscription. Paid subscribers receive weekly Portfolio updates as soon as they’re released. Free subscribers still get full content, but Portfolio updates will arrive with at least a one-week delay. Want instant access? Click here.

Model Portfolio Quant Alpha Weekly

The newly Added stock, if any, was released to the Paid Subscribers earlier today. Shown below is the fact that no stock qualified to be added last week. This Portfolio continues to beat its benchmark by a wide margin. It is up 29%.

Add (10/16/25): None

Outperformers: CLS (Celestica) is up over 40%, COMM (CommScope) is up over +100%

Click here for the Quant Alpha Weekly details

Model Portfolio Quant 30

This week’s update, if any, has been sent to the paid subscribers. Last week there there was one Add and one Removal.

This Portfolio continues to beat its benchmark by a wide margin. It is up 18% in 3 1/2 months.

Since Porch Group was released to the paid subscribers last week, it is up +8% since then.

Add (10/16/25): PRCH (Porch Group)

Remove (10/16/25): BSAC (Banco Santander-Chile)

Outperformers: MU (Micron Technology), GFI (Gold Fields) and CDE (Coeur Mining) are up over 60%.

Click here for the Quant 30 details

What does Porch Group do: Seattle-based Porch Group runs a full-stack home services and insurance platform that ties together everything from home inspection and mortgage software to moving, repair, and warranty coverage. The company’s suite spans insurance, title, and contractor tools—plus marketing and financial software for home service pros.

Positives about Porch Group

- Porch Group’s pivot to a high-margin, fee-based model is paying off — revenue beat expectations, and gross profit margins jumped sharply.

- The move toward insurance service fees over underwriting risk is driving record profitability and a leaner, more predictable business.

- Q2 2025 numbers impressed: 83% gross margin and $15.6 million in adjusted EBITDA, prompting raised guidance and confidence in its long-term growth path.

Concerns about Porch Group

- After a sharp stock rally, some see it as ripe for profit-taking, with the price running ahead of fundamentals.

- $400+ million in long-term debt and ongoing cash burn could pressure liquidity unless refinancing or sustained profits kick in.

- The stock’s lofty valuation — trading at a higher EV/revenue multiple than peers like Hippo and Lemonade — might turn off investors looking for stability over pure growth.

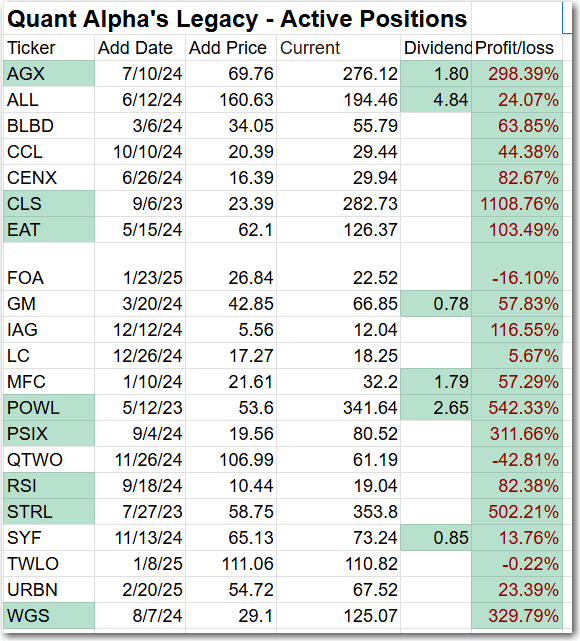

Model Portfolio Quant Alpha’s – Legacy

The portfolio now has 21 stocks in it. It is up over +230% since it began in 2023. Celestica achieved a 11 bagger status. See up-to-date Portfolio below.

Remove: None

Outperformers: AGX (Argan) is up 200%, WGS (GeneDx Holdings) and PSIX (Power Solutions ) are up over 300%, STRL (Sterling Infrastructure) and POWL (Powell Industries) are up over +500% and CLS (Celestica) is up over 1100%

Click here for the Quant Alpha’s – Legacy details

Performance to 10-23-2025

| Portfolio start date 6/27/25 | |

| Quant Alpha Weekly | 29.35% |

| EQAL (Russell 1000 Equal Weight ETF) | 7.37% |

| Portfolio start date 6/27/25 | |

| Quant 30 | 18.02% |

| EQAL (Russell 1000 Equal Weight ETF) | 7.37% |

| Portfolio start date 4/14/23 | |

| Quant Alpha’s – Legacy | 249.10% |

| EQAL (Russell 1000 Equal Weight ETF) | 31.12% |

Click here for the Live Quant scorecard

The Quant Alpha Weekly Portfolio remains substantially ahead of its benchmark. Up over 29% since it began on June 27. 2025.

The Quant 30 Portfolio had one Add and one Remove his week. It managed to close ahead of the benchmark once again. It is up 18%.

The Quant Alpha’s – Legacy Portfolio maintained its over 230% return in a classic Position Trading Portfolio implementation.

All content on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalized advice before you make any trading or investing decisions. Disclaimer

Copyright 2023-2025 SwingTrader.Trading. All Rights Reserved.

You must be logged in to post a comment.