- Quant Weekly – Up over 30%

- Quant 30 – Up over 17%

- Legacy – Up over 240%

After the summary of The Millionaire Next Door by Thomas Stanley are the Portfolio updates.

Summary of The Millionaire Next Door

1. Real wealth isn’t flashy.

Most millionaires don’t look the part. They drive used cars, wear simple clothes, and live in modest homes — they just quietly stack cash.

2. Income ≠ wealth.

Big paychecks mean nothing if you spend it all. True wealth comes from saving, investing, and compounding, not showing off.

3. Frugality is the flex.

Millionaires budget, track expenses, and think twice before every purchase. They treat money like a tool, not a trophy.

4. Live below your means — way below.

The secret sauce: spend less than you earn and invest the difference. Every dollar saved is a future soldier in your financial army.

5. Freedom over flash.

They don’t chase status symbols. They chase independence — the ability to live life on their own terms without relying on a paycheck.

6. Discipline beats luck.

Wealthy people plan, set goals, and stay consistent for decades. They build wealth brick by brick, not overnight.

7. Avoid financial parasites.

Millionaires don’t bankroll adult kids, overextend on “networking” or throw money at bad business ideas. They protect their balance sheet like a fortress.

8. Choose the right partner.

A spouse who shares the same financial mindset — frugal, grounded, goal-driven — can make or break your wealth journey.

9. Small business is a big lever.

Many self-made millionaires own small, often unglamorous businesses — think contractors, dry cleaners, or wholesalers — not tech unicorns.

10. Quiet wealth is lasting wealth.

The loudest person in the room usually isn’t the richest. Real millionaires don’t need validation — their bank accounts do the talking.

Website Investment Educational Blog Posts – Related Video

Note: This site now offers both a free and a paid subscription. Paid subscribers receive weekly Portfolio updates as soon as they’re released. Free subscribers still get full content, but Portfolio updates will be posted with at least a two-week delay. Want timely access to the new Adds/Removes? Click here.

Model Portfolio Quant Alpha Weekly

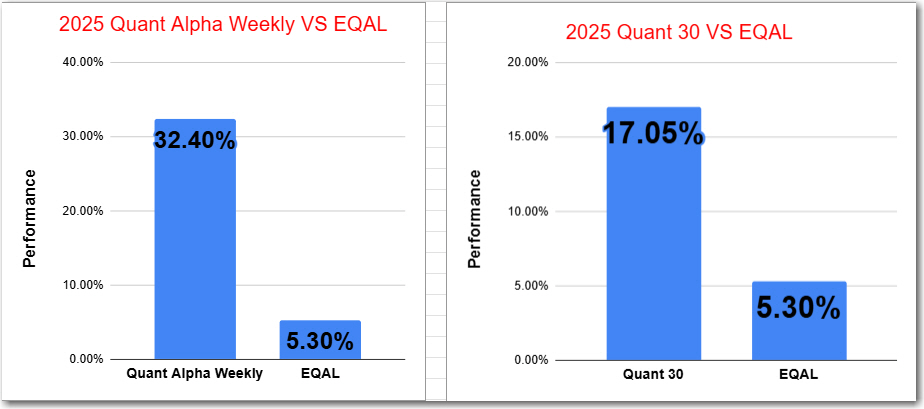

The newly Added stock, if any, was released to the Paid Subscribers earlier today. Shown below is the stock Added two weeks ago. This Portfolio continues to beat its benchmark by a wide margin, 32% to 5%.

Add (10/16/25) : None

Outperformers: CLS (Celestica) is up over 70%, COMM (CommScope) is up over +100%

Click here for the Quant Alpha Weekly details

Model Portfolio Quant 30

This week’s update, if any, has been sent to the paid subscribers. Shown below is the update made two weeks ago.

This Portfolio continues to beat its benchmark by a wide margin, 17% to 5%.

Add (10/16/25): PRCH (Porch Group)

Remove (10/16/25): BSAC (Banco Santander-Chile)

Outperformers: MU (Micron Technology), GFI (Gold Fields) and CLS (Celestica) are up over 60%.

Click here for the Quant 30 details

Model Portfolio Quant Alpha’s – Legacy

The portfolio now has 21 stocks in it. It is up over +230% since it began in 2023. Celestica is now a 13 bagger.

Remove: None

Outperformers: AGX (Argan), WGS (GeneDx Holdings) and PSIX (Power Solutions ) are up over 300%, STRL (Sterling Infrastructure) and POWL (Powell Industries) are up over +500% and CLS (Celestica) is up over 1300%

Click here for the Quant Alpha’s – Legacy details

Celestica had it’s 2025 Q3 Earnings release on 10/28/25.

Celestica – What does it do?

Celestica Inc. (CLS) is a Toronto-based global provider of supply chain and manufacturing solutions. It operates through two segments — Advanced Technology Solutions (ATS) and Connectivity & Cloud Solutions (CCS) — serving clients across tech, aerospace, industrial, and healthcare markets.

The company delivers end-to-end services, including design, engineering, component sourcing, manufacturing, system integration, logistics, and after-market support. Its hardware platform solutions and open-source software cater to OEMs, hyperscalers, and cloud providers worldwide.

Founded in 1994, Celestica has built its edge on speed, precision, and strong partnerships in high-growth industries like AI and data infrastructure.

Positives :

- Celestica’s firing on all cylinders — its CCS segment drives 68% of revenue and 79% of earnings, fueled by booming AI hardware demand.

- Margins keep climbing, with CCS hitting 8.3%, thanks to surging 800G switch sales and deep partnerships with top hyperscalers.

- The company keeps beating analyst expectations — a clear sign of strong execution and relentless data center demand.

Concerns :

- The stock’s already priced for perfection — valuation looks stretched versus peers, leaving little short-term room to run.

- Heavy dependence on a few big customers could sting if any cut back orders or shift suppliers.

- Some analysts see the stock as overheated, warning of a possible pullback if the broader market wobbles.

Performance to 10-30-2025

| Portfolio start date 6/27/25 | |

| Quant Alpha Weekly | 32.40% |

| EQAL (Russell 1000 Equal Weight ETF) | 5.30% |

| Portfolio start date 6/27/25 | |

| Quant 30 | 17.05% |

| EQAL (Russell 1000 Equal Weight ETF) | 5.30% |

| Portfolio start date 4/14/23 | |

| Quant Alpha’s – Legacy | 264.80% |

| EQAL (Russell 1000 Equal Weight ETF) | 29.00% |

Click here for the Live Quant scorecard

The Quant Alpha Weekly Portfolio remains substantially ahead of its benchmark. Up over 32% since it began on June 27, 2025.

The Quant 30 Portfolio holds its big lead over the benchmark once again. Up 17% since it began on June 27, 2025

The Quant Alpha’s – Legacy Portfolio maintained its over 240% return since it began in April 2023 in a classic Position Trading Portfolio implementation.

All content on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalized advice before you make any trading or investing decisions. This post was written with the assistance of artificial intelligence. The original ideas and final review are human-generated. Disclaimer

Copyright 2023-2025 SwingTrader.Trading. All Rights Reserved.

You must be logged in to post a comment.