- Quant 30 – UP over 13% since June

- Quant Weekly – Up over 24% since June

- Legacy – Up over 250% since April 2023

After the summary “Why Momentum is one of the most important factors” are the Portfolio updates.

Why Momentum is one of the most important factors

- Winners keep winnin’. Stocks that are already moving up tend to keep climbing — it’s the classic “money follows strength” move.

- Behavior drives it. Investors chase what’s hot and dump what’s not — momentum feeds on human nature.

- It’s data-backed. For decades, academic studies show momentum strategies beat the market — often by several percentage points a year.

- It’s everywhere. Doesn’t matter if it’s tech, energy, or defense — momentum works across sectors and market caps.

- Short-term edge. Over 3–12 months, momentum is one of the strongest predictors of future returns.

- Wall Street’s secret sauce. Quant funds, hedge funds, and ETFs build entire systems around this — it’s not just a fad, it’s an engine.

- Compounds confidence. Rising prices attract more buyers, volume spikes, and sentiment turns — momentum builds its own gravity.

- It trumps fundamentals — for a while. Even a mediocre company can ride a wave if the chart’s hot and the crowd’s in.

- Reversals can sting. When the music stops, momentum flips hard — fast money out, big drops in days.

- But net-net, it pays. Over time, momentum remains one of the few market anomalies that actually works — if you’ve got the guts to ride the swings.

Website Investment Educational Blog Posts –

Note: This site now offers both a free and a paid subscription. Paid subscribers receive weekly Portfolio updates as soon as they’re released. Free subscribers still get full content, but Portfolio updates will be posted with at least a two-week delay. Want timely access to the new Adds/Removes? Click here.

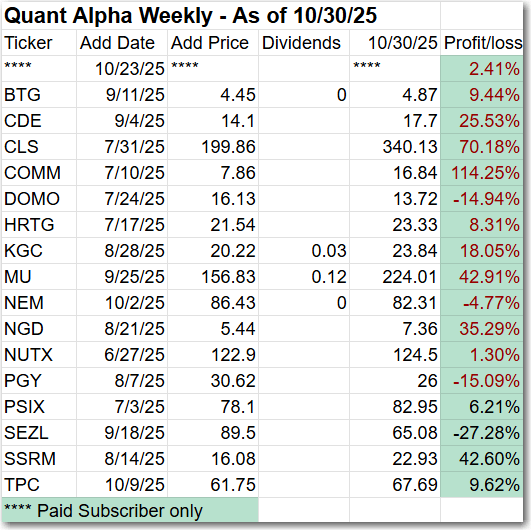

Model Portfolio Quant Alpha Weekly

The newly Added stock, if any, was released to the Paid Subscribers earlier today. Shown below is the stock Added two weeks ago. This Portfolio continues to beat its benchmark by a wide margin, 24% to 4%.

Since being released to paid subscribers a week ago, the 10/30/25

Addition is up 9% in a largely down market. Don’t want to miss the next winner? Join the paid subscribers.

Add (10/23/25): AVAH (Aveanna Healthcare)

Outperformers: CLS (Celestica) is up over 70%, COMM (CommScope) is up over +100%

What does Aveanna Healthcare do?

Aveanna Healthcare (AVAH) is an Atlanta-based home care provider offering pediatric and adult services nationwide. Its model keeps patients at home and out of costly hospital or nursing settings. The company runs three segments:

- Private Duty Services (PDS): In-home skilled nursing and therapy for medically fragile children and adults.

- Home Health & Hospice (HHH): Skilled nursing, rehab therapy, and end-of-life care.

- Medical Solutions (MS): Supplies and nutrition products like pumps, formulas, and equipment.

Founded in 2016, Aveanna’s patient-first platform focuses on cost efficiency and quality in home-based care.

Click here for the Quant Alpha Weekly details

Model Portfolio Quant 30

This week’s update, if any, has been sent to the paid subscribers. Shown below is the update made two weeks ago.

This Portfolio continues to beat its benchmark by a wide margin, 13% to 4%.

Add (10/23/25): None

Remove (10/23/25): None

Outperformers: MU (Micron Technology), GFI (Gold Fields) and CLS (Celestica) are up over 50%.

Click here for the Quant 30 details

Model Portfolio Quant Alpha’s – Legacy

The portfolio now has 21 stocks in it. It is up over +250% since it began in 2023. Celestica continues its 13 bagger performance.

Remove: None

Outperformers: AGX (Argan), WGS (GeneDx Holdings) and PSIX (Power Solutions ) are up over 300%, STRL (Sterling Infrastructure) and POWL (Powell Industries) are up over +500% and CLS (Celestica) is up over 1300%

Click here for the Quant Alpha’s – Legacy details

Performance to 11-06-2025

| Portfolio start date 6/27/25 | |

| Quant Alpha Weekly | 24.54% |

| EQAL (Russell 1000 Equal Weight ETF) | 4.46% |

| Portfolio start date 6/27/25 | |

| Quant 30 | 13.13% |

| EQAL (Russell 1000 Equal Weight ETF) | 4.46% |

| Portfolio start date 4/14/23 | |

| Quant Alpha’s – Legacy | 267.79% |

| EQAL (Russell 1000 Equal Weight ETF) | 28.16% |

Click here for the Live Quant scorecard

The Quant Alpha Weekly Portfolio continues it’s steady increase in new members and remains substantially ahead of its benchmark. Up over 24% since it began on June 27. 2025.

The Quant 30 Portfolio had no changes this week. It managed to close ahead of the benchmark once again. It is up 13% since it began on June 27. 2025.

The Quant Alpha’s – Legacy Portfolio maintained its over 250% return since April 2023, in a classic Position Trading Portfolio implementation.

All content on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalized advice before you make any trading or investing decisions. This post was written with the assistance of artificial intelligence. The original ideas and final review are human-generated. Disclaimer

Copyright 2023-2025 SwingTrader.Trading. All Rights Reserved.

You must be logged in to post a comment.