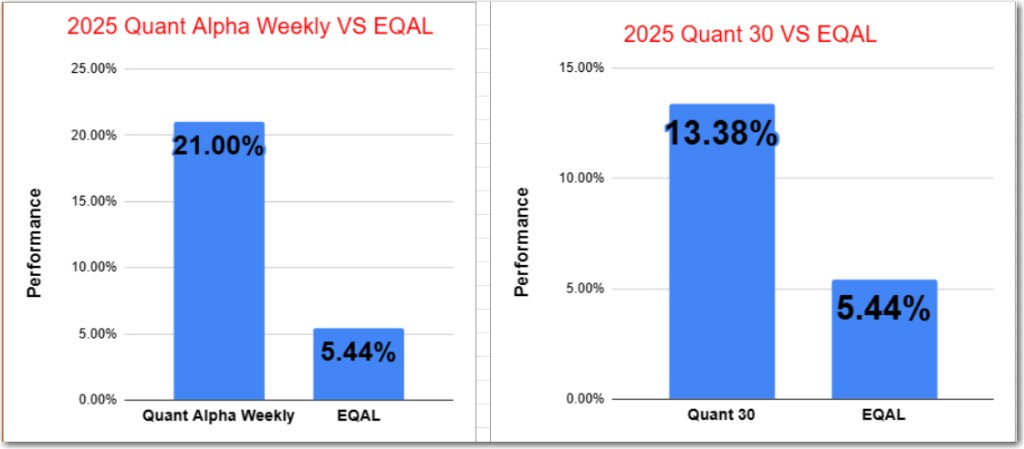

- Quant 30 – UP over 13% since June

- Quant Weekly – Up over 21% since June

- Legacy – Up over 240% since April 2023

After the summary “Who Wins if the Supreme Court Kills the IEEPA Tariffs” are the Portfolio updates.

Who Wins if the Supreme Court Kills the IEEPA Tariffs

- U.S. import-heavy industries — especially electronics, retail, and autos — could see major gains if the Court rules the IEEPA tariffs illegal.

- Two big wins: no more tariff costs going forward and possible refunds on billions already paid.

Big Potential Winners by Industry

- Retail & Consumer Goods: Lower import costs could ease inflation pressure and protect margins.

- Names to watch: Walmart, Home Depot, Target, Lowe’s, Amazon, Dollar Tree, Williams Sonoma, Ross, Dollar General.

- Electronics: One of the biggest import categories — could see an instant cash windfall from refunds.

- Names to watch: LG, Samsung, Electrolux, Best Buy.

- Automotive: Auto parts and tooling tariffs are in focus — even partial relief would be a win.

- Names to watch: GM, Ford, Stellantis.

- Manufacturing & Toys: Smaller manufacturers, including plaintiffs in the case, stand to benefit too.

- Example: Learning Resources (educational toys).

What to Watch

- Scope of the Ruling: Could apply narrowly to the plaintiffs or broadly to all importers.

- Replacement Tariffs: The administration could reimpose new tariffs under different laws — uncertainty remains.

- Refund Red Tape: Even if refunds are approved, expect a slow, complex process.

Bottom Line:

If the Court strikes the tariffs, importers get a cost break and maybe big refunds — but trade policy moves fast, and the window for gains might not stay open long.

Website Investment Educational Blog Posts –

Note: This site now offers both a free and a paid subscription. Paid subscribers receive weekly Portfolio updates as soon as they’re released. Free subscribers still get full content, but Portfolio updates will be posted with at least a two-week delay. Want timely access to the new Adds/Removes? Click here.

Model Portfolio Quant Alpha Weekly

The newly Added stock, if any, was released to the Paid Subscribers earlier today. Shown below is the stock Added two weeks ago. This Portfolio continues to beat its benchmark by a wide margin, 21% to 5%.

Add (10/30/25): TTMI (TTM Technologies)

Outperformers: CLS (Celestica) is up over 40%, COMM (CommScope) is up over +100%

Click here for the Quant Alpha Weekly details

TTM Technologies — a Santa Ana-based heavyweight — builds high-end PCBs and RF systems used across defense, aerospace, AI, and 5G.

- Runs two segments: PCB and RF & Specialty Components.

- Makes mission systems, RF/microwave assemblies, and custom circuit boards for everything from fighter jets to data centers.

- Offers design, testing, and quick-turn manufacturing — full-service from blueprint to build.

- Its tech powers radar, comms, and surveillance systems under the MOSAIC radar brand.

- Customers include OEMs, government agencies, and hyperscalers in defense, automotive, and cloud infrastructure.

- Founded in 1978, still out of California with a global footprint in the U.S. and Taiwan.

Key Strengths TTM Technologies:

- Defense muscle: Biggest PCB shop in North America, 91% tied to U.S. defense. DoD budget pushing $1T—TTMI eats well.

- Serious momentum: Q3’25 revenue up 22% to $753M; profit exploding +271%. Backlog up 14%.

- AI heat: Defense + AI now ~80% of sales. Riding the data-center wave hard.

- Smart expansion: New sites in Wisconsin and Malaysia boost capacity and keep the supply chain nimble.

- Sharper ops: Utilization up 10% YoY—better margins, cleaner execution, more cash to deploy.

Key Challenges for TTM Technologies:

- Debt weight: Medium leverage could bite if rates stay sticky.

- Rising costs: Labor, materials, freight, energy—everything’s more expensive. Margins feel it.

- Cyclical beats: Auto, aero, telecom—when they wobble, earnings wobble. Auto already dipped.

- Geo-risk: Asian sites face political and supply-chain headaches. Ramp-ups aren’t guaranteed.

- Material squeeze: Semiconductor shortages still choke some system builds.

Model Portfolio Quant 30

This week’s update, if any, has been sent to the paid subscribers. Shown below is the update made two weeks ago.

This Portfolio continues to beat its benchmark by a wide margin, 13% to 5%.

Add (10/30/25): VSAT (Viasat)

Remove (10/30/25):TSM (Taiwan Semiconductor)

Outperformers: MU (Micron Technology), GFI (Gold Fields) and CLS (Celestica) are up over 45%.

Click here for the Quant 30 details

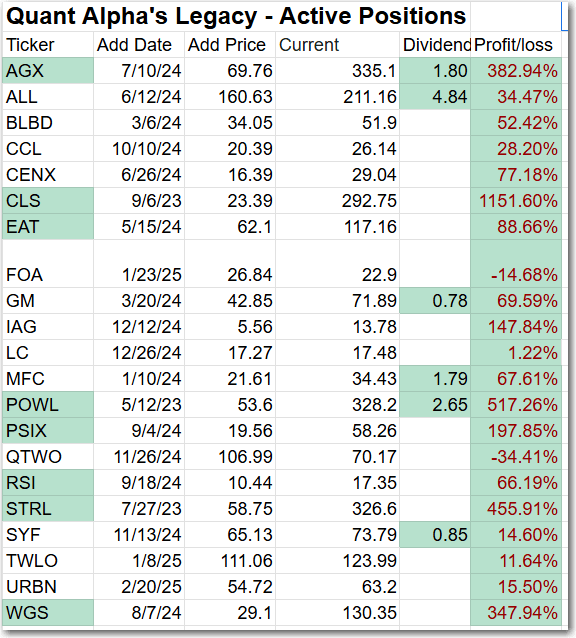

Model Portfolio Quant Alpha’s – Legacy

The portfolio now has around 20 stocks in it. It is up over +240% since it began in 2023. Celestica continues its 11 bagger performance.

Remove: None

Outperformers: AGX (Argan) and WGS (GeneDx Holdings) are up over 300%, STRL (Sterling Infrastructure) and POWL (Powell Industries) are up over +400% and CLS (Celestica) is up over 1100%

Click here for the Quant Alpha’s – Legacy details

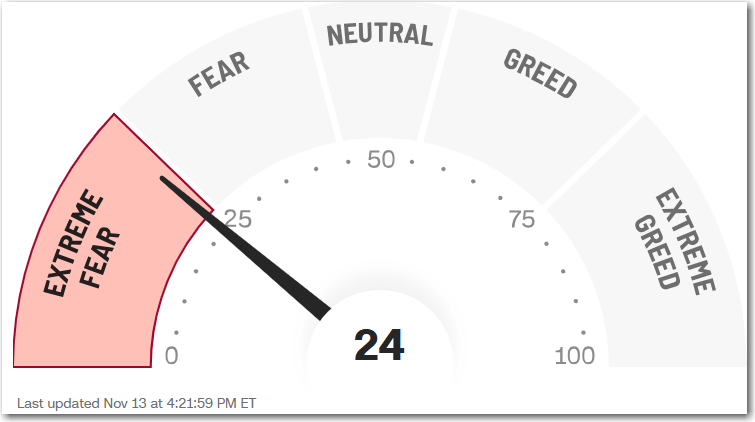

Performance to 11-13-2025

| Portfolio start date 6/27/25 | |

| Quant Alpha Weekly | 21.01% |

| EQAL (Russell 1000 Equal Weight ETF) | 5.44% |

| Portfolio start date 6/27/25 | |

| Quant 30 | 13.38% |

| EQAL (Russell 1000 Equal Weight ETF) | 5.44% |

| Portfolio start date 4/14/23 | Live |

| Quant Alpha’s – Legacy | 247.78% |

| EQAL (Russell 1000 Equal Weight ETF) | 29.15% |

Click here for the Live Quant scorecard

The Quant Alpha Weekly Portfolio remains substantially ahead of its benchmark. Up over 21% since it began on June 27. 2025.

The Quant 30 Portfolio managed to close ahead of the benchmark once again. It is up 13% since it began on June 27. 2025.

The Quant Alpha’s – Legacy Portfolio maintained its over 240% return since April 2023, in a classic Position Trading Portfolio implementation.

All content on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalized advice before you make any trading or investing decisions. This post was written with the assistance of artificial intelligence. The original ideas and final review are human-generated. Disclaimer

Copyright 2023-2025 SwingTrader.Trading. All Rights Reserved.

You must be logged in to post a comment.