- Quant 30 – Up over 21% since June

- Quant Weekly – Up over 33% since June

- Legacy – Up over 250% since April 2023

- Education – How real is the Santa Claus rally?

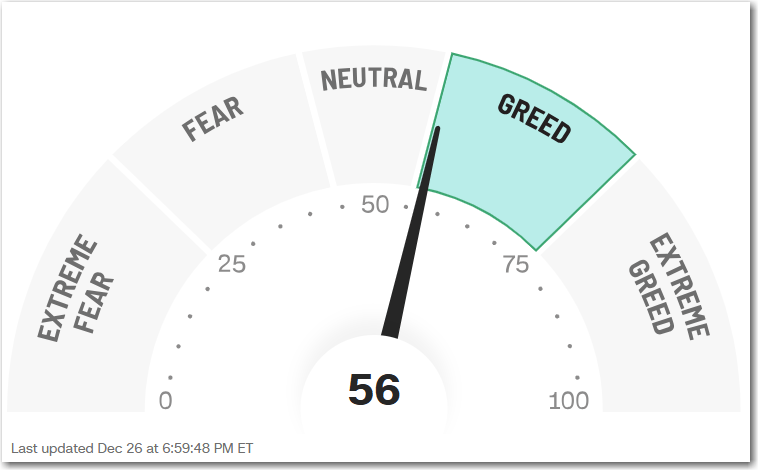

This last week ended with the CNN Fear and Greed Index edging into the Greed area. The Quant Weekly and 30 portfolios closed at all-time highs. The demand for high momentum stocks is slowly coming back to life.

Note: The introductory price of a yearly paid subscription will be increasing on January 1, 2026. Subscribing before that date will lock in the current lower price.

Note: This site now offers both a free and a paid subscription. Paid subscribers receive weekly Portfolio updates as soon as they’re released. Free subscribers still get full content, but Portfolio updates will be posted with at least a two-week delay. Want timely access to the new Adds/Removes? Click here.

Model Portfolio Quant Alpha Weekly

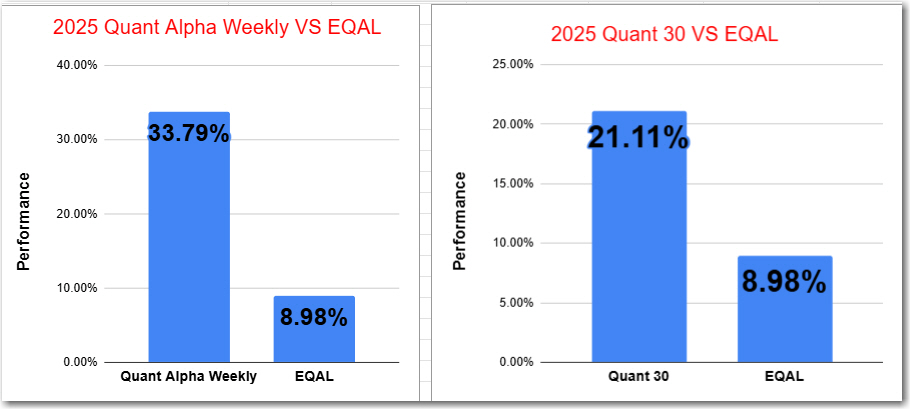

The newly Added stock, if any, is being released to the Paid Subscribers today. Shown below is the stock Added two weeks ago. This Portfolio continues to beat its benchmark by a wide margin, 33% to 8%.

No Adds were made to the Weekly portfolio for this update.

Add (12/12/25) : None

Outperformers: CLS (Celestica) up over 40%, MU (Micron Technology) up over 80%, COMM (CommScope) up over +130%

Click here for the Quant Alpha Weekly details

CommScope review:

CommScope (COMM), the Quant Weekly portfolio #1 stock has reshaped its profile after selling its $10.5B CCS unit to Amphenol.

5 things to like about CommScope:

- Debt Wipeout: CCS proceeds nearly erase net debt, flipping COMM from heavily leveraged to cash-rich.

- Margin Breakout: Q3 2025 EBITDA margins hit a record 24.7%; 2025 EBITDA guided to $350–375M, with ANS and Ruckus sales up 49% YoY.

- Secular Tailwinds: AI data center cabling, DOCSIS 4.0 upgrades, and the WiFi 7 cycle support long-term growth.

- Big Special Dividend: Management plans a sizable payout; estimates point to roughly $8.20 per share in excess cash.

- Compelling Valuation: Shares trade at ~9x forward EBITDA with ~90% EBITDA growth, a sub-1x PEG.

3 concerns about CommScope:

- Cyclicality Risk: Ruckus and ANS showed sequential declines in Q3, signaling potential earnings volatility.

- Smaller-Scale Execution: Post-sale revenue drops to ~$2B; management must prove margins and growth are sustainable at reduced scale.

- Concentration & Tech Risk: Heavy exposure to customers like Comcast, risk of cable operators favoring fiber over DOCSIS, and sensitivity to any slowdown in AI capex.

Model Portfolio Quant 30

This week’s new update, if any, is being released to the paid subscribers. Shown below is the update made two weeks ago. This Portfolio continues to beat its benchmark by a wide margin, 21% to 8%.

No new Adds for this update.

Add (12/12/25) : None

Remove (12/12/25) : None

Outperformers: MU (Micron Technology) up over 130%, GFI (Gold Fields) up over 90% and CLS (Celestica) are up over 50%.

Click here for the Quant 30 details

Micron Technology Review:

Micron Technology is our top performing stock in Quant 30 and recently has issued new earnings. Micron Technology (MU) offers strong upside, with a few real risks to watch.

5 things to like about Micron:

- Standout Profitability: MU posts a 28% net margin, 53% EBITDA margin, and 23% ROE—well above semiconductor averages.

- AI-Fueled Growth: Q1 FY2026 revenue jumped 57% YoY to $13.6B, powered by surging HBM demand. EPS rose nearly 58% sequentially, showing major operating leverage.

- HBM Leadership: HBM production is fully booked through 2026, running at a $6B+ annual pace. Micron leads with 1-gamma DRAM and an HBM4 launch expected in H1 2026.

- Margin Expansion: Gross margins climbed from 46% to 57% in Q1, with management guiding toward ~68% in Q2 2026 on tight supply and strong pricing.

- Strong Balance Sheet: An Altman Z-Score of 5.18 signals low risk, with solid ROA, modest leverage, and record free cash flow.

3 concerns about Micron:

- Capacity Bottlenecks: HBM is sold out through 2026, and new fabs in Idaho and Singapore won’t add capacity until 2027–2028, capping near-term upside.

- Cycle Timing Risk: New supply may arrive near a memory cycle peak, raising the risk of margin pressure if AI demand cools.

- Valuation Premium: MU trades at a ~38% P/B premium to peers versus a 14% historical norm, while the stock remains range-bound relative to the S&P 500.

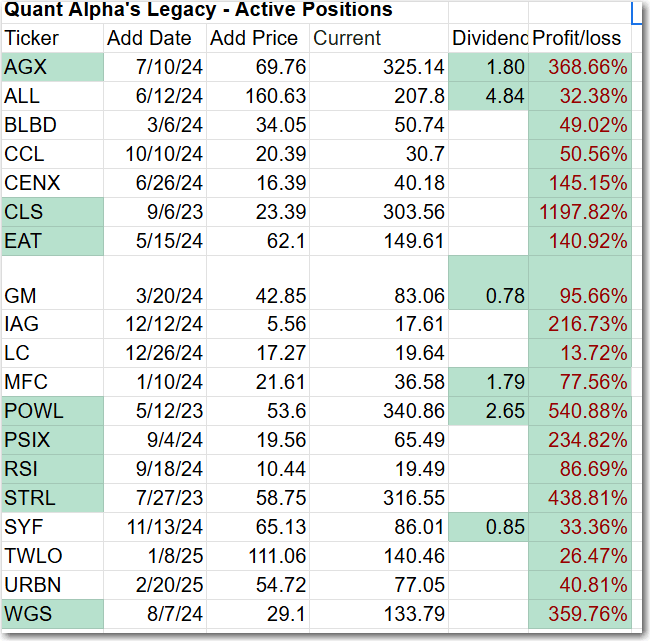

Model Portfolio Quant Alpha’s – Legacy

The portfolio now has around 19 stocks in it. It is up over +250% since it began in 2023. Celestica achieves a 11 bagger performance. FOA received a hard Sell this week from the Quant system so it is being Removed from the Portfolio.

Remove (12/12/25): FOA (Finance of America)

Outperformers: AGX (Argan) up over 300%, WGS (GeneDx Holdings) up over 300%, STRL (Sterling Infrastructure) up over 400%, POWL (Powell Industries) up over 500% and CLS (Celestica) is up over 1100%

Click here for the Quant Alpha’s – Legacy details

Performance to 12-26-2025

| Portfolio start date 6/27/25 | |

| Quant Alpha Weekly | 33.79% |

| EQAL (Russell 1000 Equal Weight ETF) | 8.98% |

| Portfolio start date 6/27/25 | |

| Quant 30 | 21.11% |

| EQAL (Russell 1000 Equal Weight ETF) | 8.98% |

| Portfolio start date 4/14/23 | |

| Quant Alpha’s – Legacy | 267.73% |

| EQAL (Russell 1000 Equal Weight ETF) | 32.75% |

Click here for the Live Quant scorecard

The Quant Alpha Weekly Portfolio remains ahead of its benchmark. Up over 33% since it began on June 27, 2025.

The Quant 30 Portfolio managed to close ahead of the benchmark once again. It is up 21% since it began on June 27, 2025.

The Quant Alpha’s – Legacy Portfolio maintained its over 250% return since April 2023, in a classic Position Trading Portfolio implementation.

How real is the Santa Claus Rally?

This covers the classic window: last 5 trading days of December + first 2 days of January (the “Santa Rally” period). According to historical S&P 500 holiday-season performance data:

- 2020–2021: +~3.03% — strong positive result.

- 2021–2022: +~1.12% — modest gain.

- 2022–2023: −~1.97% — a significant downturn.

- 2023–2024: +~0.44% — small positive.

- 2024–2025: −~0.40% — weak/negative return.

(Source: Trade-Ideas analysis of Santa Claus Rally returns over the past five periods.) Trade Ideas

What That Means

- Mixed results lately: Out of the last five Santa Rally periods, 3 were positive and 2 were negative — not a sure thing. Trade Ideas

- No guarantee: Seasonal patterns historically lean positive — the S&P 500 has risen in this period about 76–79% of years since the 1950s — but recent years show that macro conditions can override the seasonal effect

- Returns vary a lot: Even when positive, the gains in recent years have been modest compared with long-term averages — the historical average is around 1.3% over this seven-day stretch.

Bottom Line

The Santa Claus rally is a historical tendency, not a law. It’s shown up most years on average, but over the last 5 years the pattern has been patchy, with both gains and losses in the S&P 500’s holiday window. That means while Santa can show up, he doesn’t always deliver the goods.

Website Investment Educational Blog Posts –

All content on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalized advice before you make any trading or investing decisions. This post was written with the assistance of artificial intelligence. The original ideas and final review are human-generated. Disclaimer

Copyright 2023-2025 SwingTrader.Trading. All Rights Reserved.

You must be logged in to post a comment.