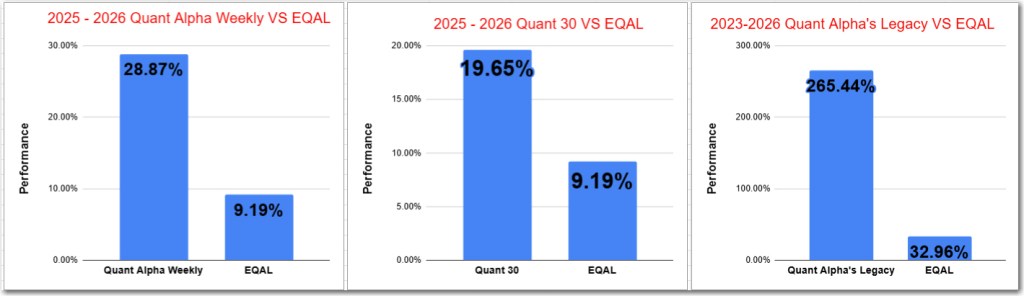

- Quant 30 – Up over 19% since June

- Quant Weekly – Up over 28% since June

- Legacy – Up over 250% since April 2023

- Education – Do Small Cap stocks outperform in January?

U.S. equities opened 2026 on solid footing, with major indexes posting gains in the first trading session of the year. The S&P 500 rose 0.6%, the Nasdaq Composite climbed 1.1%, and the Dow Jones Industrial Average added 0.2% on January 2, building on the strong momentum carried over from 2025.

Measured Technical Backdrop: Just 12 S&P 500 constituents are currently in extreme technical territory—4 overbought and 8 oversold—pointing to a relatively balanced market setup rather than stretched conditions.

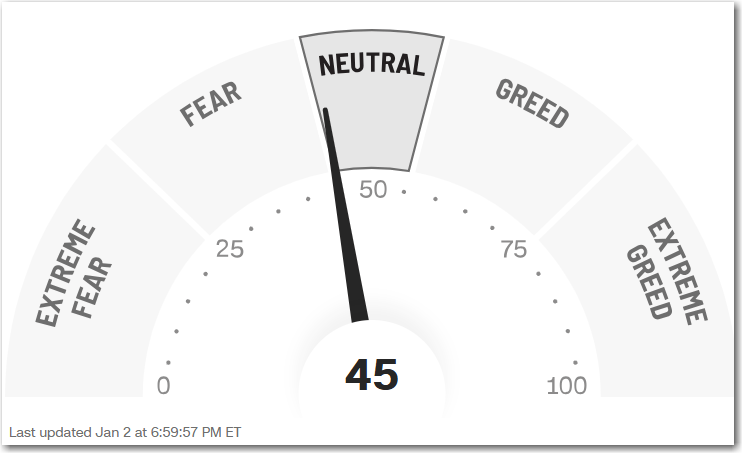

The Fear and Greed Index starts the year off in the Neutral quadrant.

Note: This site now offers both a free and a paid subscription. Paid subscribers receive weekly Portfolio updates as soon as they’re released. Free subscribers still get full content, but Portfolio updates will be posted with at least a two-week delay. Want timely access to the new Adds/Removes? Click here.

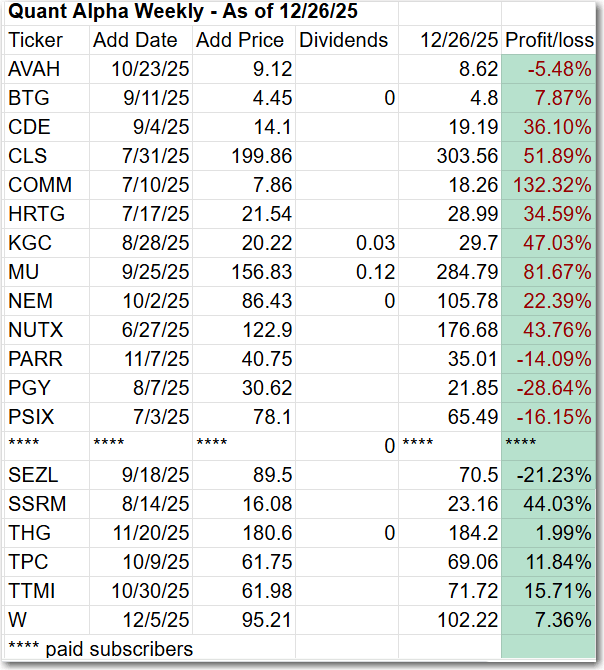

Model Portfolio Quant Alpha Weekly

The newly Added stock, if any, is being released to the Paid Subscribers today. Shown below is the stock Added two weeks ago. This Portfolio continues to beat its benchmark by a wide margin, 28% to 9%.

One Add was made to the Weekly portfolio for this update.

Add (12/19/25) : RY (Royal Bank of Canada)

Outperformers: CLS (Celestica) up over 50%, MU (Micron Technology) up over 100%, COMM (CommScope) up over +130%

Click here for the Quant Alpha Weekly details

What does Royal Bank of Canada do?

Royal Bank of Canada is a global financial heavyweight with businesses across personal and commercial banking, wealth management, insurance, and capital markets. It does everything from deposits and loans to investing, insurance, and institutional trading for individuals, companies, and governments worldwide. Founded in 1864, RBC is headquartered in Toronto.

Key Strengths

- Record numbers: RY crushed fiscal ’25—net income up 25% to $20.4B, one of the strongest years in the bank’s history.

- Capital muscle: CET1 at 13.5% gives them plenty of cushion and flexibility if the economy gets bumpy.

- High-value momentum: Wealth Management and Capital Markets are firing, driving growth beyond plain-vanilla banking.

- Shareholder-friendly: Dividend bumped 6% and management’s shooting for 17%+ ROE in FY ’26—confidence is loud and clear.

- Market leader: Canada’s biggest bank, massive scale, global footprint, and a deep client base keep the moat wide.

Key Weaknesses

- Pricey stock: Trading at a big premium—about 39% above peers—which caps upside with revenue growth only around 5%.

- Credit pressure: Rising credit costs and mortgage renewals could weigh as past tailwinds start to fade.

- Limited runway: With growth already priced in, the risk-reward looks tight at these levels.

Model Portfolio Quant 30

This week’s new update, if any, is being released to the paid subscribers. Shown below is the update made two weeks ago. This Portfolio continues to beat its benchmark by a wide margin, 19% to 9%.

No new Adds for this update.

Add (12/19/25) : STX (Seagate Technology)

Remove (12/19/25) : TPC (Tutor Perini)

Outperformers: MU (Micron Technology) up over 150%, GFI (Gold Fields) up over 80% and CLS (Celestica) are up over 50%.

Click here for the Quant 30 details

Model Portfolio Quant Alpha’s – Legacy

The portfolio now has around 19 stocks in it. It is up over +250% since it began in 2023. Celestica achieves a 11 bagger performance.

Remove (12/19/25): None

Outperformers: AGX (Argan) up over 300%, WGS (GeneDx Holdings) up over 300%, STRL (Sterling Infrastructure) up over 400%, POWL (Powell Industries) up over 500% and CLS (Celestica) is up over 1100%

Click here for the Quant Alpha’s – Legacy details

Performance to 01-02-2026

| Portfolio start date 6/27/25 | |

| Quant Alpha Weekly | 28.87% |

| EQAL (Russell 1000 Equal Weight ETF) | 9.19% |

| Portfolio start date 6/27/25 | |

| Quant 30 | 19.65% |

| EQAL (Russell 1000 Equal Weight ETF) | 9.19% |

| Portfolio start date 4/14/23 | |

| Quant Alpha’s – Legacy | 265.44% |

| EQAL (Russell 1000 Equal Weight ETF) | 32.96% |

Click here for the Live Quant scorecard

The Quant Alpha Weekly Portfolio remains ahead of its benchmark. Up over 28% since it began on June 27, 2025.

The Quant 30 Portfolio managed to close ahead of the benchmark once again. It is up 19% since it began on June 27, 2025.

The Quant Alpha’s – Legacy Portfolio maintained its over 250% return since April 2023, in a classic Position Trading Portfolio implementation.

Do Small Cap stocks outperform in January?

The idea that stocks—especially small caps—tend to outperform in January due to tax-loss selling in December and reinvestment in the new year.

How accurate it actually is

- Historically:

- Real and measurable before the 1990s, strongest in small-cap stocks.

- Modern era (last ~25 years):

- Inconsistent and weak

- January is positive about 60–65% of the time, only slightly better than a coin flip.

- Returns:

- Any excess return is usually small (often <1%)

- Easily erased by volatility, taxes, or transaction costs.

Where it still shows up (sometimes)

- Small-cap stocks more than large caps

- After down years, when tax-loss selling is heavier

- Mostly in the first 5–10 trading days, not the full month

Why it faded

- Widely known → arbitraged away

- Institutional and algorithmic trading dominate markets

- Less retail tax-driven behavior

- Global capital flows dilute calendar effects

Bottom line

- The January Effect is not reliable enough to trade on its own

- Today it’s more a curiosity than an edge

- At best, it’s a minor tailwind, useful only when it aligns with:

- Valuation

- Liquidity

- Trend

- Broader economic cycle

Website Investment Educational Blog Posts –

All content on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalized advice before you make any trading or investing decisions. This post was written with the assistance of artificial intelligence. The original ideas and final review are human-generated. Disclaimer

Copyright 2023-2026 SwingTrader.Trading. All Rights Reserved.