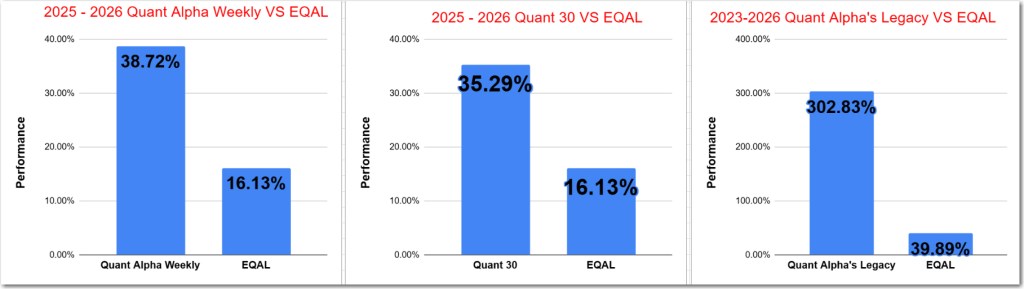

- Quant 30 – Up over 35% since June

- Quant Weekly – Up over 38% since June

- Legacy – Up over 270% since April 2023

All Quant Portfolios shine as the market drops on AI related sector rotation.

USA Stock market last week 02/13/26

- S&P 500 closed around 6,836.17, down about -1.4% on the week.

- Nasdaq fell roughly -2.1% on the week.

- Dow fell about -1.2% over the week.

- Russell 2000 was down roughly -0.9% for the week.

Takeaways

- Market trend: Mild negative performance across major indexes for the week.

- Weakest sectors: Technology, software, and AI-linked names — hit by sector rotation and disruption concerns.

- Relatively stronger areas: Financial/exchange stocks and certain defensive/value sectors showed relative resilience.

- Small caps: Russell 2000 had a smaller decline, suggesting some support for smaller names despite broader weakness.

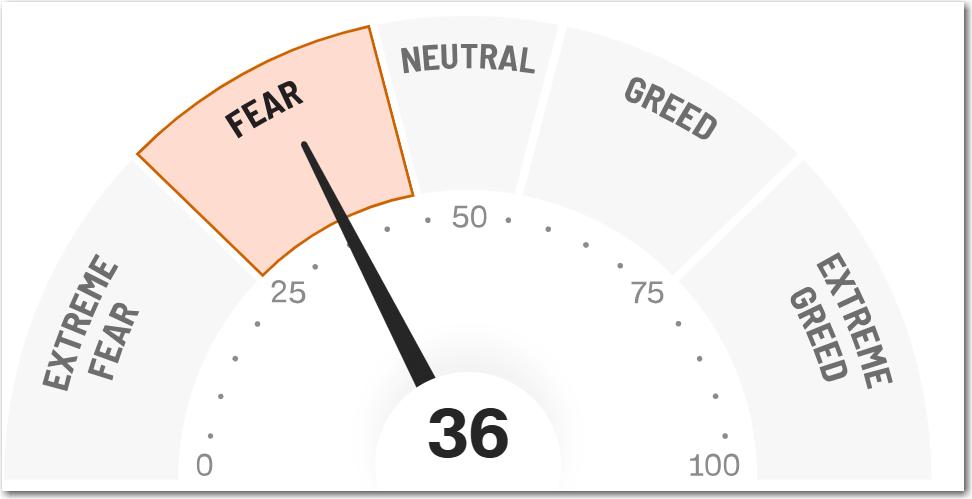

The CNN Fear and Greed Index ends the week at Fear 36.

Market Drivers This Week (02/16/26 – 02/20/26)

- Tue, Feb 17 – Retail Sales Report

- Reflects consumer spending trends; strong sales can support cyclicals and risk assets.

- Wed, Feb 18 – Industrial Production & Capacity Utilization

- Signals manufacturing strength; influences cyclical sectors and small caps.

- Thu, Feb 19 – Housing Starts / Building Permits

- Key indicator of housing demand and broader economic momentum.

- Thu, Feb 19 – Fed Officials Speaking

- Any shifts in commentary on inflation, rate expectations, or future guidance could move markets.

- Fri, Feb 20 – Leading Economic Indicators (LEI)

- A favorite for gauging near-term economic direction; impacts market sentiment and positioning.

Note: Choose between free and paid subscription levels. Paid subscribers enjoy instant access to weekly Portfolio updates upon release. Free subscribers access identical content, with Portfolio updates published after a two-week waiting period. Want timely access to the new Adds/Removes? Click here.

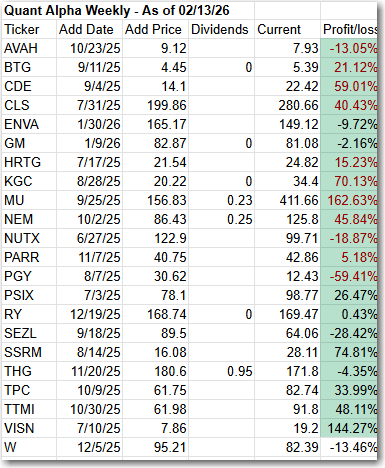

Model Portfolio Quant Alpha Weekly

Any newly added stock is being released to Paid Subscribers today. Below are the updates from two weeks ago. This Portfolio continues to significantly outperform its benchmark, 38% versus 16%.

One Add to the Portfolio this week

Add (01/30/26) : ENVA (Enova International)

Outperformers: CDE (Coeur Mining) up over 50%, MU (Micron Technology) up over 160%, VISN (Vistance Networks) up over +140%

Click here for the Quant Alpha Weekly details

Model Portfolio Quant 30

This week’s new update, if any, is being released to the paid subscribers. Shown below is the update made two weeks ago. This Portfolio continues to beat its benchmark by a wide margin, 35% to 16%.

No Adds for this update.

Add (01/30/26) : None

Remove (01/30/26) : None

Outperformers: MU (Micron Technology) up over 230%, GFI (Gold Fields) up over 120% and KGC (Kinross Gold) is up over 110%.

Click here for the Quant 30 details

Model Portfolio Quant Alpha’s – Legacy

The portfolio now has around 19 stocks in it. It is up over +270% since it began in 2023. Celestica achieves a 10 bagger performance.

Remove (01/30/26): None

Outperformers: AGX (Argan) up over 400%, PSIX (Power Solutions)up over 400%, STRL (Sterling Infrastructure) up over 600%, POWL (Powell Industries) up over 900% and CLS (Celestica) is up over 1000%

Click here for the Quant Alpha’s – Legacy details

Performance to 02-13-2026

| Portfolio start date 6/27/25 | |

| Quant Alpha Weekly | 38.72% |

| EQAL (Russell 1000 Equal Weight ETF) | 16.13% |

| Portfolio start date 6/27/25 | |

| Quant 30 | 35.29% |

| EQAL (Russell 1000 Equal Weight ETF) | 16.13% |

| Portfolio start date 4/14/23 | |

| Quant Alpha’s – Legacy | 302.83% |

| EQAL (Russell 1000 Equal Weight ETF) | 39.89% |

Click here for the Live Quant scorecard

The Quant Alpha Weekly Portfolio remains ahead of its benchmark. Up over 38% since it began on June 27, 2025.

The Quant 30 Portfolio remains ahead of its benchmark. It is up 35% since it began on June 27, 2025.

The Quant Alpha’s – Legacy Portfolio maintained its over 270% return since April 2023, in a classic Position Trading Portfolio implementation.

Website Investment Educational Blog Posts –

All content on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalized advice before you make any trading or investing decisions. This post was written with the assistance of artificial intelligence. The original ideas and final review are human-generated. Disclaimer

Copyright 2023-2026 SwingTrader.Trading. All Rights Reserved.