Category: Quant Alpha’s

-

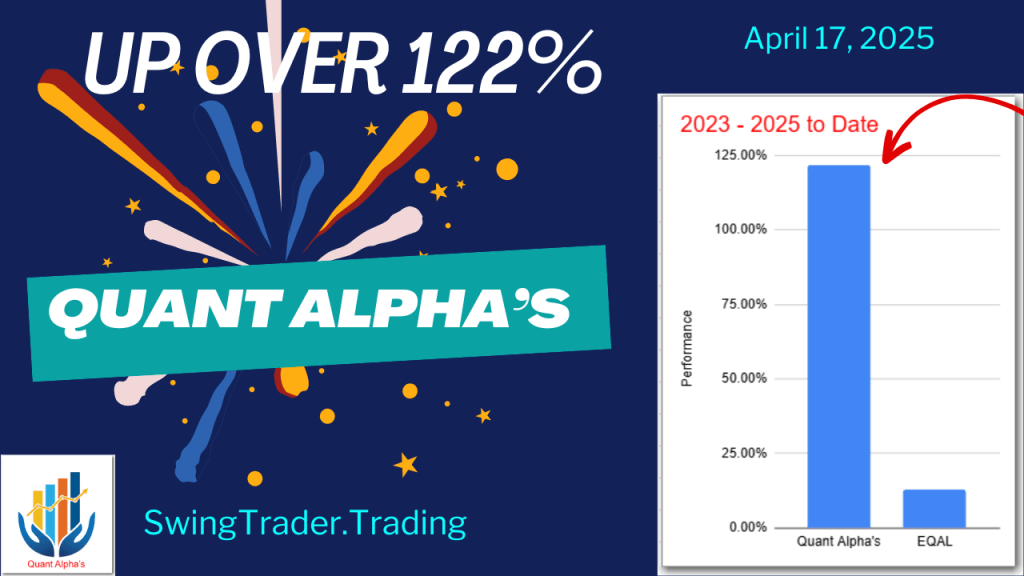

Up 122% – Quant Alpha’s Portfolio Update 04/17/2025

Since the last update two weeks ago, this Portfolio has maintained its wide outperformance against the ETF benchmark, EQAL. The Portfolio is up over 122% for 2023-2025 and beats its benchmark by 99%. The Model Portfolio Quant Alpha’s was updated today. No Removals or Adds wer made. All prices are as of 4/17/2025. A total…

-

Up 110% – Quant Alpha’s Portfolio Update 04/03/2025

Since the last update two weeks ago, this Portfolio has maintained its wide outperformance against the ETF benchmark, EQAL. The Portfolio is up over 110% for 2023-2025 and beats its benchmark by 95%. The Model Portfolio Quant Alpha’s was updated today. A Removal was made. All prices are as of 4/03/2025. A total of 24…

-

Up 131% – Quant Alpha’s Portfolio Update 03/20/2025

Since the last update two weeks ago, this Portfolio has maintained its wide outperformance against the ETF benchmark, EQAL. The Portfolio is up over 131% for 2023-2025 and beats its benchmark by 111%. The Model Portfolio Quant Alpha’s was updated today. A Removal was made. All prices are as of 3/20/2025. A total of 25…

-

Up 123% – Quant Alpha’s Portfolio Update 03/07/2025

Since the last update two weeks ago, this Portfolio has maintained its wide outperformance against the ETF benchmark, EQAL. The Portfolio is up over 123% for 2023-2025 and beats its benchmark by 103%. The Model Portfolio Quant Alpha’s was updated today. A Removal was made. All prices are as of 3/07/2025. A total of 26…

-

Up 158% – Quant Alpha’s Portfolio Update 02/20/2025

Since the last update, the Portfolio has outperformed the ETF benchmark EQAL, up over 158% for 2023-2025. It currently holds 27 stocks, with a strong selection criteria avoiding micro-cap, airlines, crypto, and biotech firms. Key performers include POWL and CLS, with future expansion expected to 30-35 stocks.

-

Up 176% – Quant Alpha’s Portfolio Update 02/06/2025

The Portfolio has significantly outperformed the ETF benchmark EQAL, rising over 176% from April 2023 to February 2025, surpassing the benchmark by 151%. Updated biweekly, it consists of 28 stocks, targeting high liquidity and excluding certain sectors. Notable performers include POWL (+359%) and CLS (+469%).

-

Up 178% – Quant Alpha’s Portfolio Update 01/23/2025

The Portfolio has outperformed its ETF benchmark EQAL, achieving a 178% gain for 2023-2025, exceeding the benchmark by 153%. An update included adding FOA and removing APP. Currently, there are 27 stocks, with a goal of 30-35. Notable performers include POWL and APP, reflecting significant returns.

-

Up 156% – Quant Alpha’s Portfolio Update 01/10/2025

The Portfolio has significantly outperformed the ETF benchmark EQAL, achieving over 156% growth for 2023-2024 and surpassing the benchmark by 135%. It now includes 27 stocks. New additions and stringent selection criteria ensure continuous performance improvement, with standout performers like APP gaining 745% since addition.

-

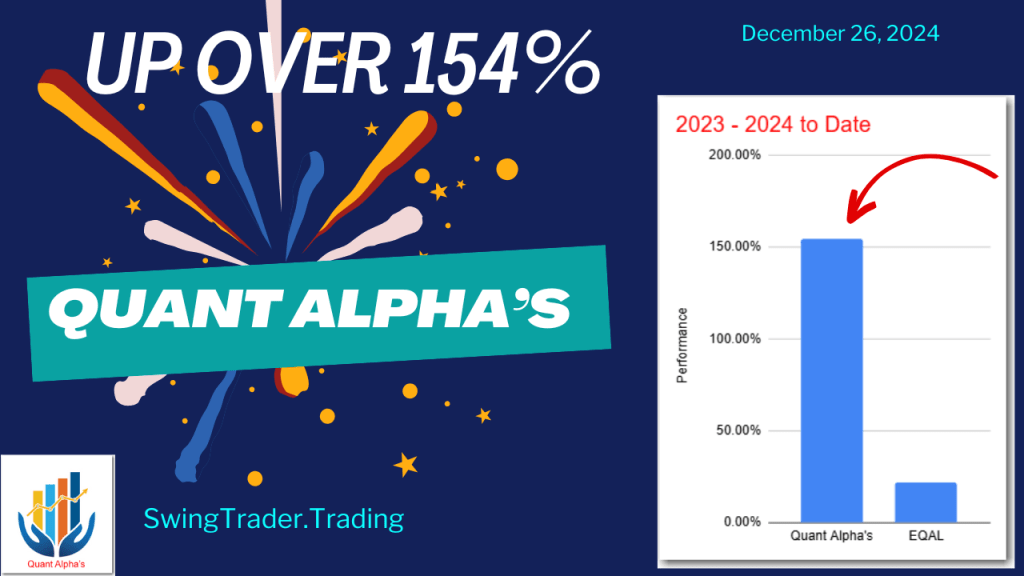

Up 154% – Quant Alpha’s Portfolio Update 12/26/2024

The Portfolio continues to outperform its ETF benchmark, EQAL, with a remarkable 154% increase in 2023-2024, surpassing EQAL by 133%. Updated to include 26 stocks, the Portfolio utilizes Quant scores for stock selection, avoiding certain sectors. Notable performers include AppLovin Corporation, up 790% since addition.

-

Up 152% – Quant Alpha’s Portfolio Update 12/12/2024

The Portfolio has achieved over 152% growth for 2023-2024, significantly outperforming its benchmark EQAL by 127%. It currently includes 25 stocks, with a focus on Quant scores for stock selection. Notable performers include APP with a 737% gain. The strategy emphasizes high liquidity and avoids specific sectors like airlines.

-

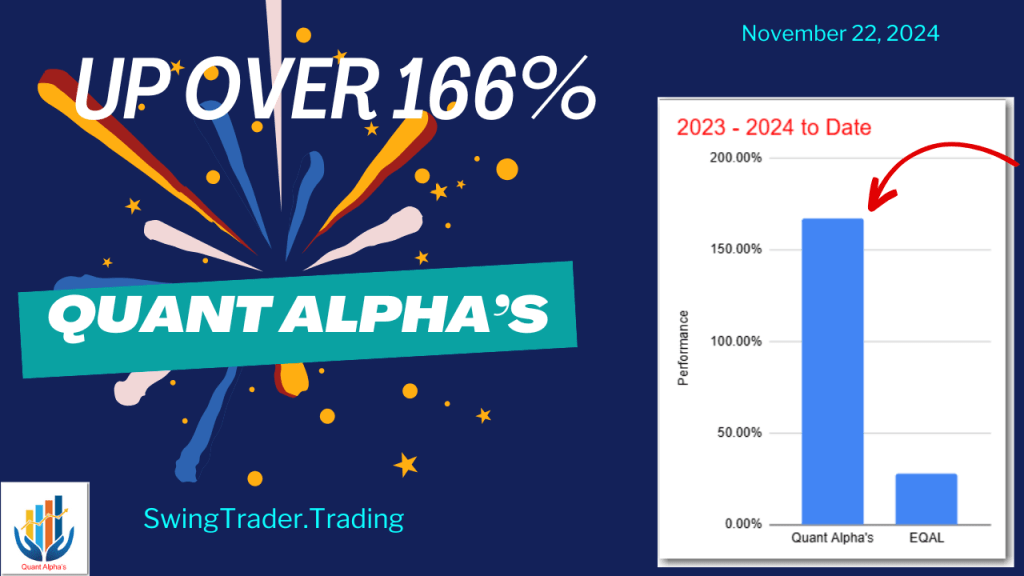

Up 166% – Quant Alpha’s Portfolio Update 11/26/2024

The Portfolio has outperformed its benchmark EQAL with a 166% gain for 2023-2024, surpassing it by 138%. It now includes 24 stocks. The strategy utilizes Quant scores for stock selection, with an expected holding period of 9 months to 2 years.

-

Up 152% – Quant Alpha’s Portfolio Update 11/13/2024

The Portfolio continues to outperform the EQAL benchmark, achieving a 152% increase for 2023-2024, surpassing the benchmark by 127%. Containing 26 stocks, it utilizes Quant scores for selection, avoiding micro-cap and specific sectors. Notable performers include POWL and APP.

-

Remove SMCI – Quant Alpha’s Portfolio Update 10/30/2024

SMCI (Super Micro Computer) released some troubling news on Wednesday. Their auditor resigned. This is very bad sign for a company. It could indicate more undisclosed problems are lurking. Since the Quant ratings are very close to a Sell signal and with this additional negative news, I am removing this stock from the active list.…

-

Up 129% – Quant Alpha’s Portfolio Update 10/29/2024

The Model Portfolio Quant Alpha was updated. The portfolio, using Quant scores for selection, is up 129% since April 2023, outperforming the EQAL benchmark significantly. Performance highlights include stocks like SMCI and POWL, with expected growth to 30-35 holdings.

-

Up 111% – Quant Alpha’s Portfolio Update 10/10/2024

The Model Portfolio Quant Alpha’s was updated on 10/10/2024, adding Carnival Corporation (CCL) and removing Core & Main (CNM), with a total of 25 stocks now included. The portfolio focuses on Quant scores, avoiding subjective criteria and eliminating micro-cap stocks, airlines, crypto, biotech, and mega caps. Performance is strong, with a 111% increase since its…

-

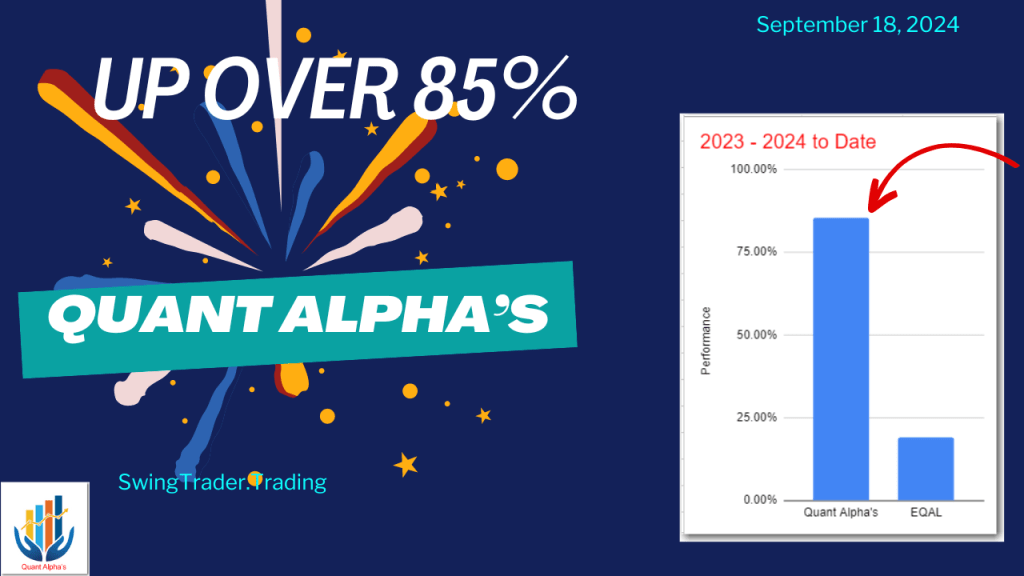

Up 85% – Quant Alpha’s Portfolio Update 09/18/2024

The Model Portfolio Quant Alpha was updated with the addition of Rush Street Interactive and the removals of Pactiv Evergreen and Caterpillar, now totaling 25 stocks. The portfolio, using Quant scores for stock selection, has outperformed its benchmark, EQAL, with an 85% increase for 2023-2024. Notable performers include Super Micro, POWL, and ANF. The strategy…

-

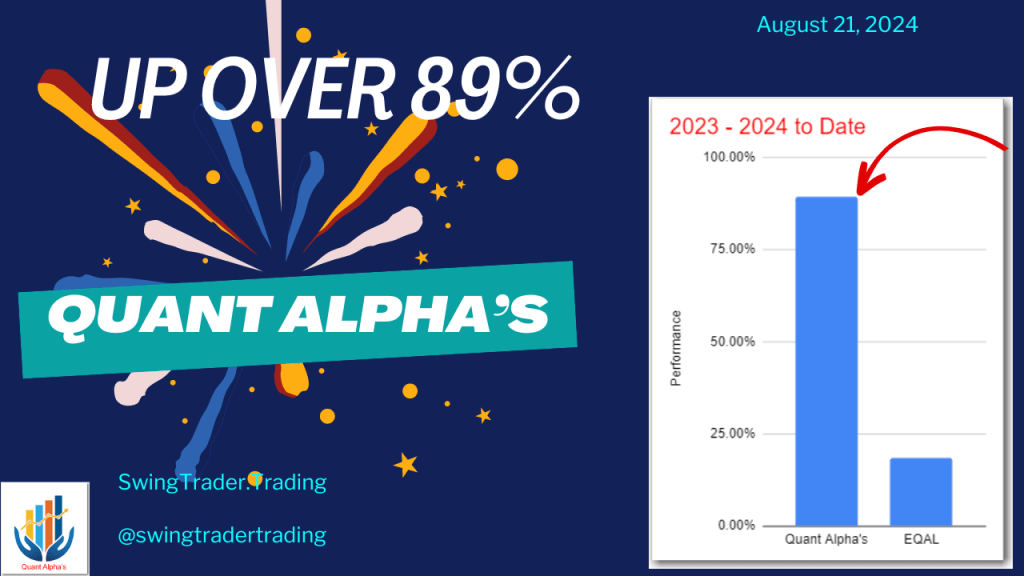

Up 89% – Quant Alpha’s Portfolio Update 08/21/2024

The Model Portfolio Quant Alpha’s was updated this morning with a new stock added and a stock removed. The portfolio now holds 26 stocks, using Quant scores for selection. It has outperformed the EQAL benchmark, achieving an 89% increase and beating the benchmark by 70% for 2023-2024.

-

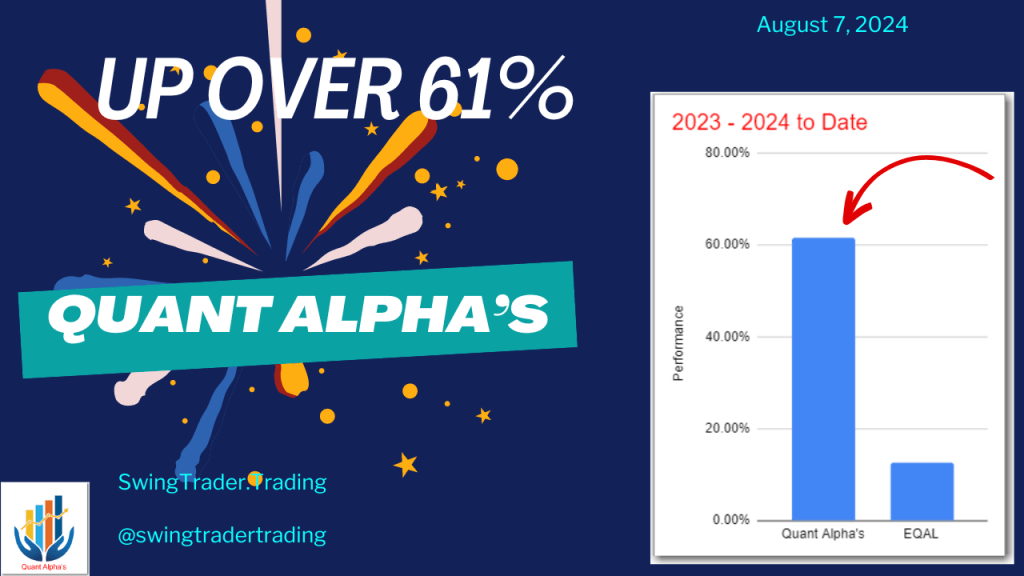

Up 61% – Quant Alpha’s Portfolio Update 08/07/2024

The updated Model Portfolio Quant Alpha’s includes 26 stocks based on Quant scores and specific criteria. It does not include micro-cap stocks, emphasizes high liquidity, and limits stocks to USA/Canada headquarters. The portfolio outperformed the EQAL benchmark by 39%, with standout performers such as SMCI, POWL, and ANF. Notable recent addition: WGS (GeneDx Holdings).

-

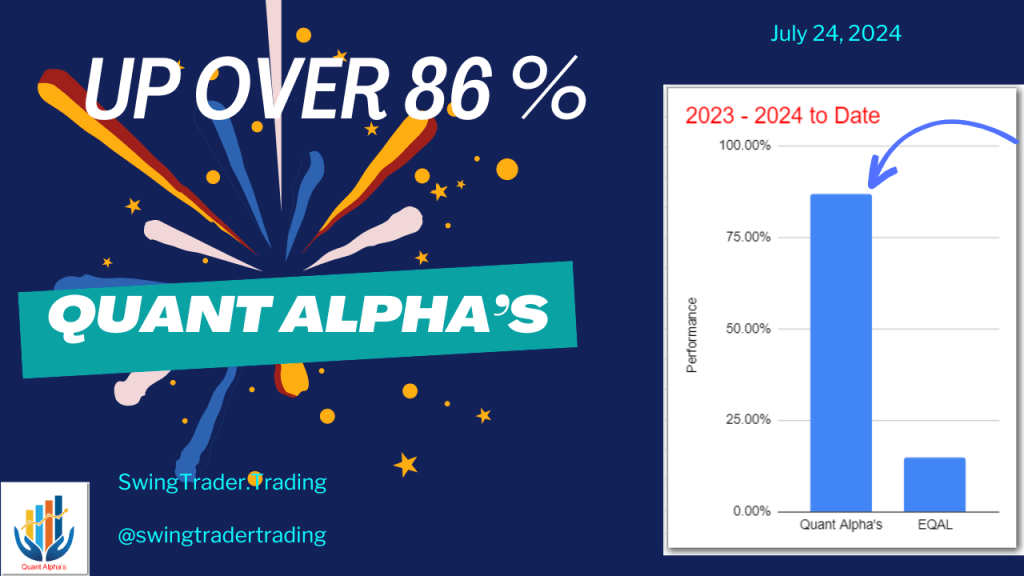

Up 86% – Quant Alpha’s Portfolio Update 07/24/2024

Quant Alpha’s Portfolio update. Outperforming in 2023. – 2024

-

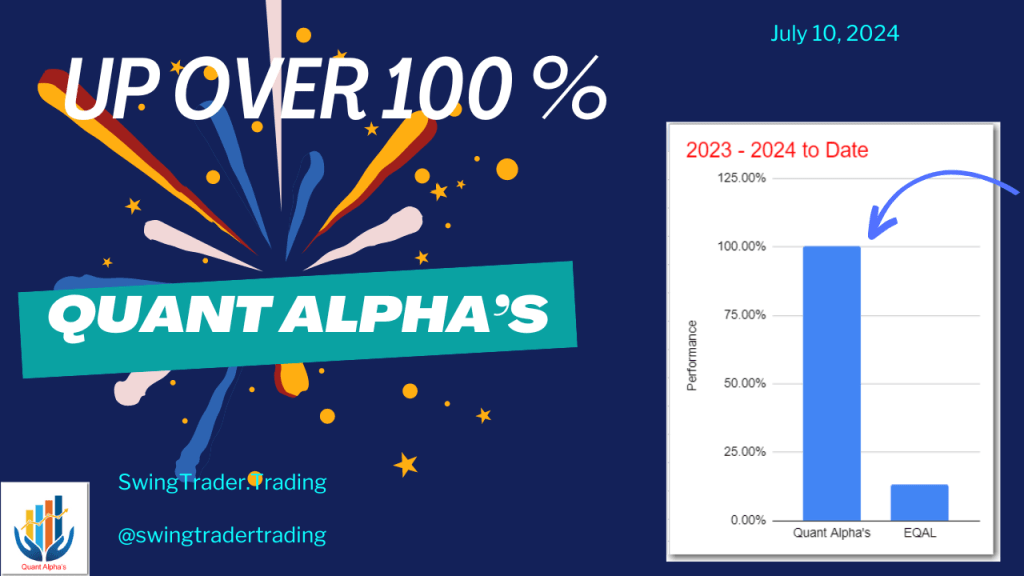

Up 100% – Quant Alpha’s Portfolio Update 07/10/2024

Quant Alpha’s Portfolio update. Outperforming in 2023. – 2024