Tag: anf

-

Up 158% – Quant Alpha’s Portfolio Update 02/20/2025

Since the last update, the Portfolio has outperformed the ETF benchmark EQAL, up over 158% for 2023-2025. It currently holds 27 stocks, with a strong selection criteria avoiding micro-cap, airlines, crypto, and biotech firms. Key performers include POWL and CLS, with future expansion expected to 30-35 stocks.

-

Up 176% – Quant Alpha’s Portfolio Update 02/06/2025

The Portfolio has significantly outperformed the ETF benchmark EQAL, rising over 176% from April 2023 to February 2025, surpassing the benchmark by 151%. Updated biweekly, it consists of 28 stocks, targeting high liquidity and excluding certain sectors. Notable performers include POWL (+359%) and CLS (+469%).

-

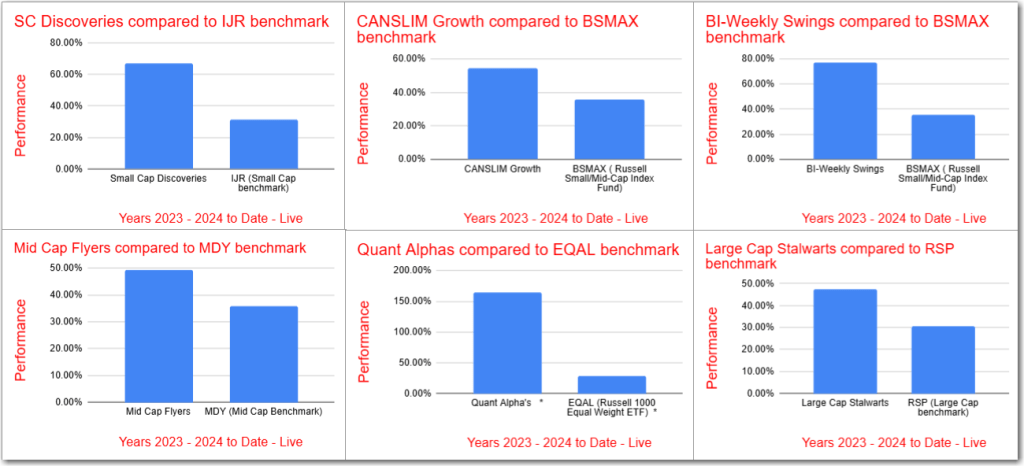

January 2025 – Model Stock Portfolios Outperformance increases

All Model Portfolios significantly outperformed their benchmarks for the 2023-2025 period, with Quant Alpha leading at over 168%, exceeding EQAL by 143%. Active contributors included POWL (+330%), ANF (+137%), and CLS (+427%). The BI-Weekly Swings rose 73%, surpassing BSMAX by 44%, driven by APEI and RAIL. Small Cap Discoveries and CANSLIM Growth were up 72%…

-

Up 178% – Quant Alpha’s Portfolio Update 01/23/2025

The Portfolio has outperformed its ETF benchmark EQAL, achieving a 178% gain for 2023-2025, exceeding the benchmark by 153%. An update included adding FOA and removing APP. Currently, there are 27 stocks, with a goal of 30-35. Notable performers include POWL and APP, reflecting significant returns.

-

Up 156% – Quant Alpha’s Portfolio Update 01/10/2025

The Portfolio has significantly outperformed the ETF benchmark EQAL, achieving over 156% growth for 2023-2024 and surpassing the benchmark by 135%. It now includes 27 stocks. New additions and stringent selection criteria ensure continuous performance improvement, with standout performers like APP gaining 745% since addition.

-

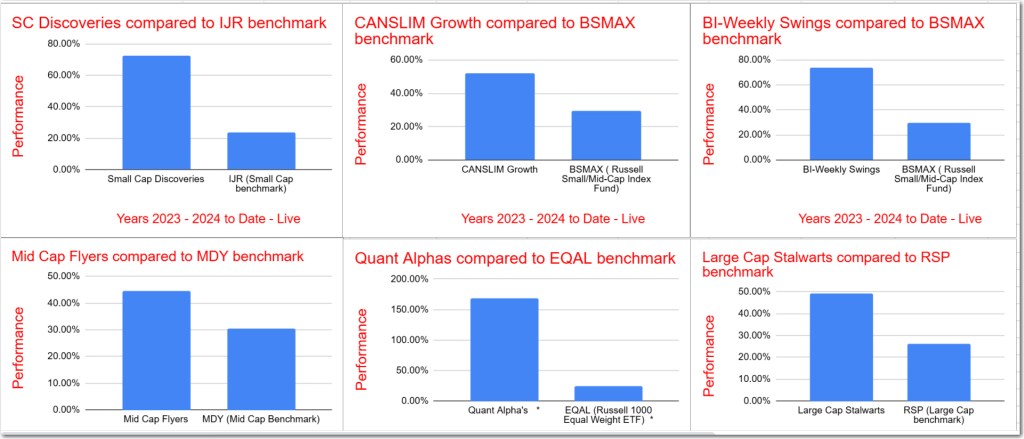

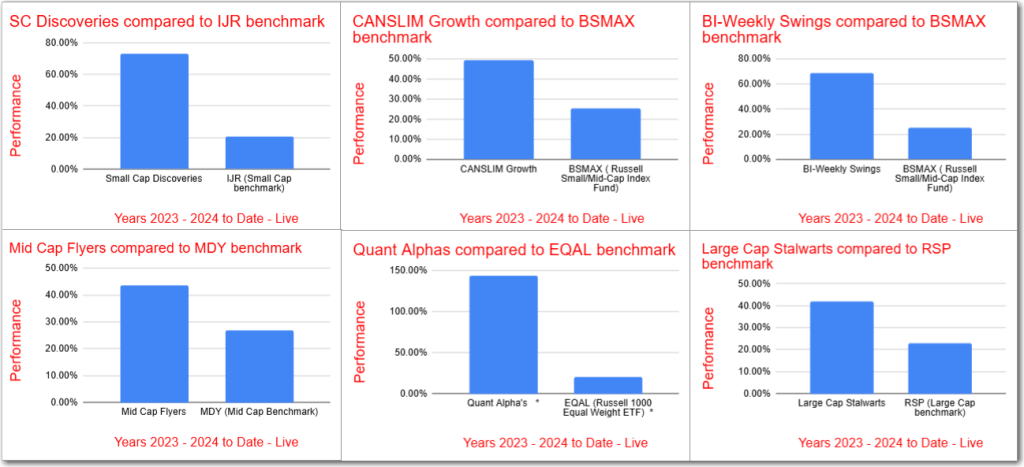

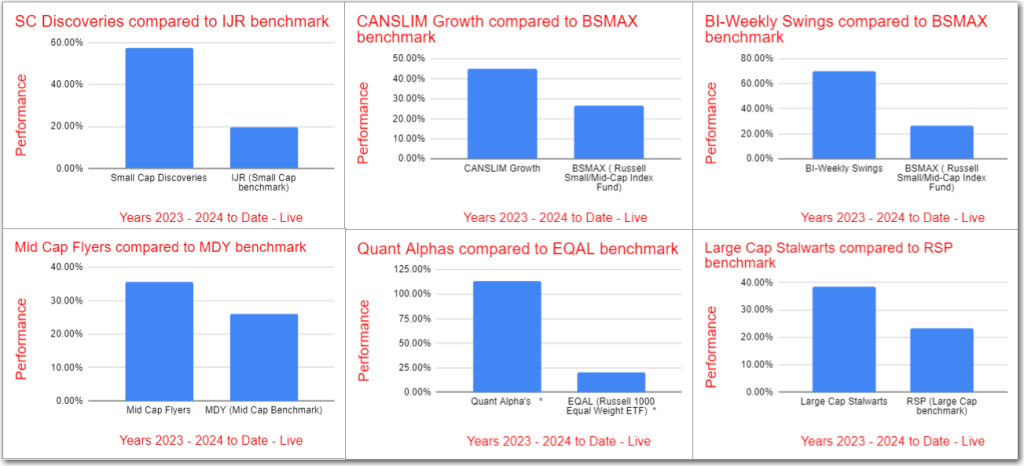

December 2024 – Model Stock Portfolios Outperformance increases

All Model Portfolios outperformed their benchmarks for 2023-2024, led by Quant Alpha’s impressive 144% return. Other portfolios also showed significant gains: BI-Weekly Swings at 68%, Small Cap Discoveries at 73%, and CANSLIM Growth at 49%. Despite a market sell-off, five portfolios improved their relative performances.

-

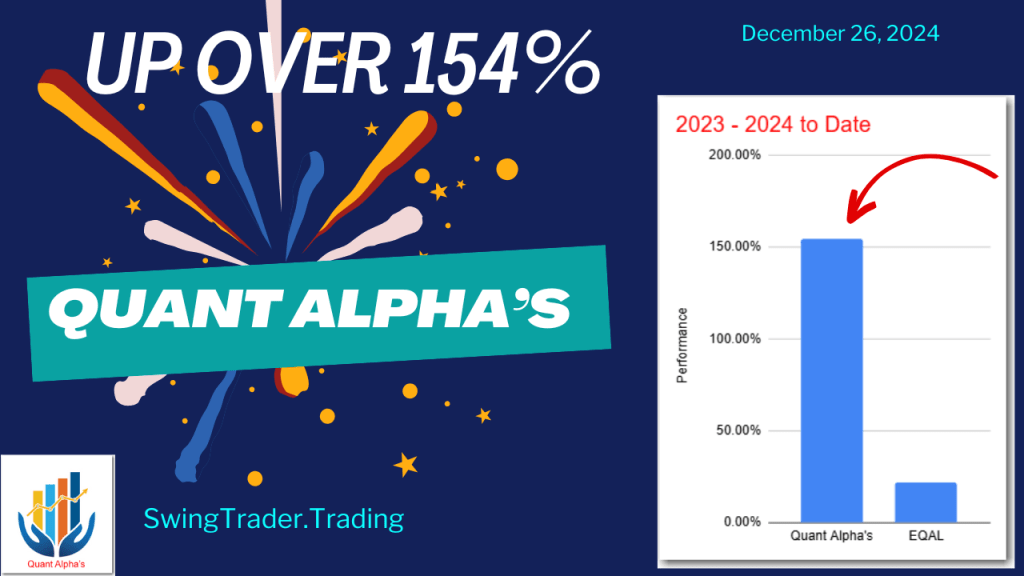

Up 154% – Quant Alpha’s Portfolio Update 12/26/2024

The Portfolio continues to outperform its ETF benchmark, EQAL, with a remarkable 154% increase in 2023-2024, surpassing EQAL by 133%. Updated to include 26 stocks, the Portfolio utilizes Quant scores for stock selection, avoiding certain sectors. Notable performers include AppLovin Corporation, up 790% since addition.

-

Up 152% – Quant Alpha’s Portfolio Update 12/12/2024

The Portfolio has achieved over 152% growth for 2023-2024, significantly outperforming its benchmark EQAL by 127%. It currently includes 25 stocks, with a focus on Quant scores for stock selection. Notable performers include APP with a 737% gain. The strategy emphasizes high liquidity and avoids specific sectors like airlines.

-

November 2024 Summary – Outperformance increases

All Model Portfolios have exceeded their benchmarks for the 2023-2024 period, showing impressive gains. The Quant Alpha’s Portfolio leads with over 165% growth, outperforming its benchmark by 136%. Active stocks like POWL and ANF have significantly contributed to this outperformance. Other portfolios also performed well, with the BI-Weekly Swings up 77%, Small Cap Discoveries up…

-

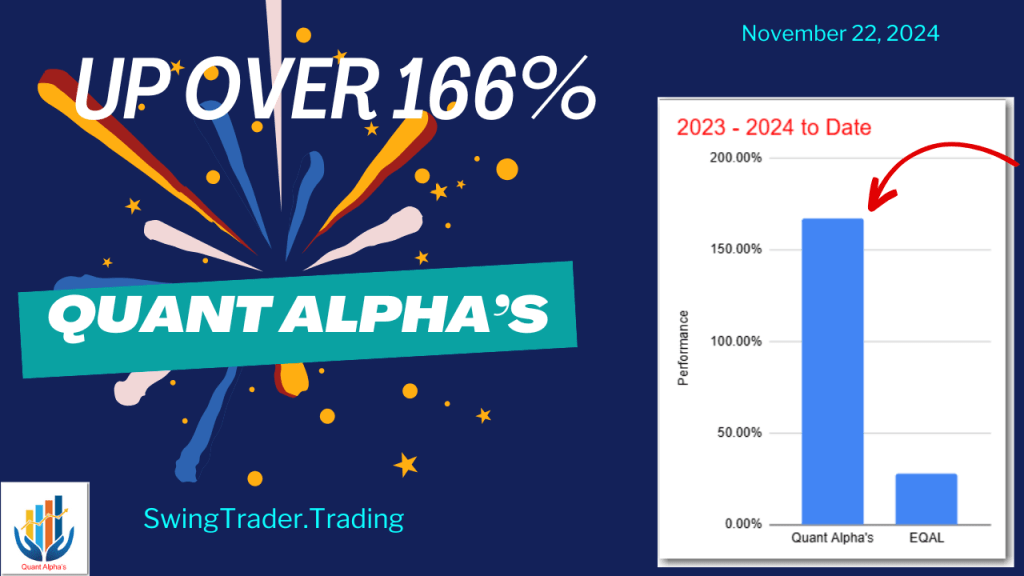

Up 166% – Quant Alpha’s Portfolio Update 11/26/2024

The Portfolio has outperformed its benchmark EQAL with a 166% gain for 2023-2024, surpassing it by 138%. It now includes 24 stocks. The strategy utilizes Quant scores for stock selection, with an expected holding period of 9 months to 2 years.

-

Up 152% – Quant Alpha’s Portfolio Update 11/13/2024

The Portfolio continues to outperform the EQAL benchmark, achieving a 152% increase for 2023-2024, surpassing the benchmark by 127%. Containing 26 stocks, it utilizes Quant scores for selection, avoiding micro-cap and specific sectors. Notable performers include POWL and APP.

-

October 2024 Summary – Outperformance increases

All Model Portfolios are ahead of their respective benchmarks for the 2023-2024 period. The Quant Alpha’s is now up over 113% for 2023-2024 and continues to destroy its benchmark EQAL by 93%. This is a substantial increase in outperformance since last month. Active outperformers POWL, ANF , APP and CLS account for some of this…

-

Remove SMCI – Quant Alpha’s Portfolio Update 10/30/2024

SMCI (Super Micro Computer) released some troubling news on Wednesday. Their auditor resigned. This is very bad sign for a company. It could indicate more undisclosed problems are lurking. Since the Quant ratings are very close to a Sell signal and with this additional negative news, I am removing this stock from the active list.…

-

Up 129% – Quant Alpha’s Portfolio Update 10/29/2024

The Model Portfolio Quant Alpha was updated. The portfolio, using Quant scores for selection, is up 129% since April 2023, outperforming the EQAL benchmark significantly. Performance highlights include stocks like SMCI and POWL, with expected growth to 30-35 holdings.

-

Up 111% – Quant Alpha’s Portfolio Update 10/10/2024

The Model Portfolio Quant Alpha’s was updated on 10/10/2024, adding Carnival Corporation (CCL) and removing Core & Main (CNM), with a total of 25 stocks now included. The portfolio focuses on Quant scores, avoiding subjective criteria and eliminating micro-cap stocks, airlines, crypto, biotech, and mega caps. Performance is strong, with a 111% increase since its…

-

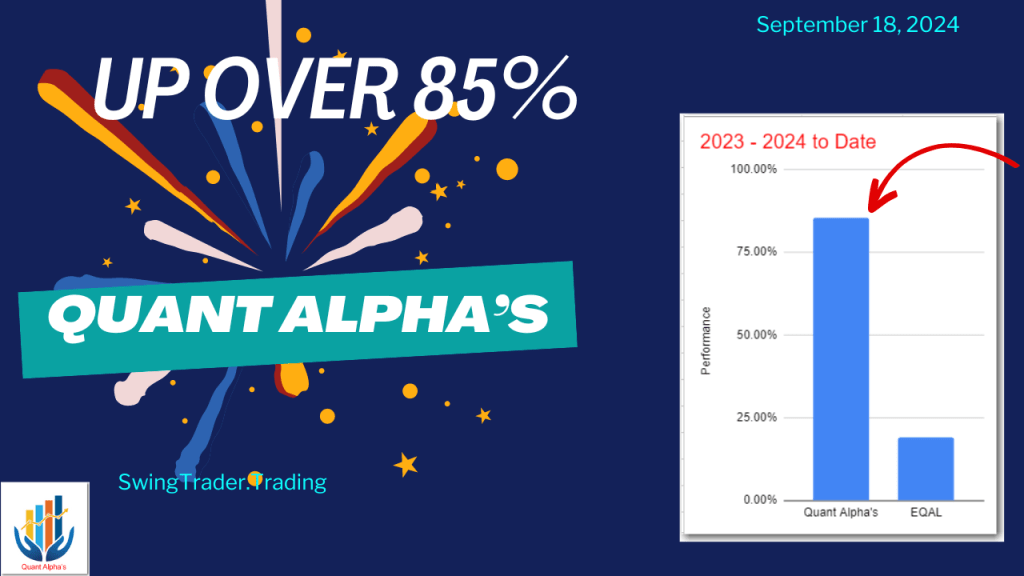

Up 85% – Quant Alpha’s Portfolio Update 09/18/2024

The Model Portfolio Quant Alpha was updated with the addition of Rush Street Interactive and the removals of Pactiv Evergreen and Caterpillar, now totaling 25 stocks. The portfolio, using Quant scores for stock selection, has outperformed its benchmark, EQAL, with an 85% increase for 2023-2024. Notable performers include Super Micro, POWL, and ANF. The strategy…

-

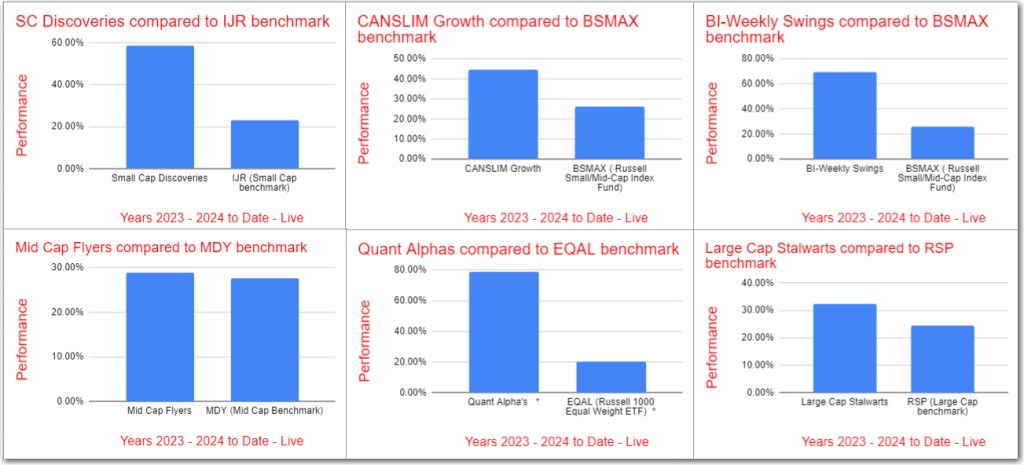

August 2024 Summary – Outperformance continues

In August 2024, stock market indexes had mixed results. All model portfolios exceeded their benchmarks, with Quant Alpha’s leading at 79%, while other portfolios also showed strong performance, beating their respective benchmarks. This information is for informational purposes only and does not constitute financial advice.

-

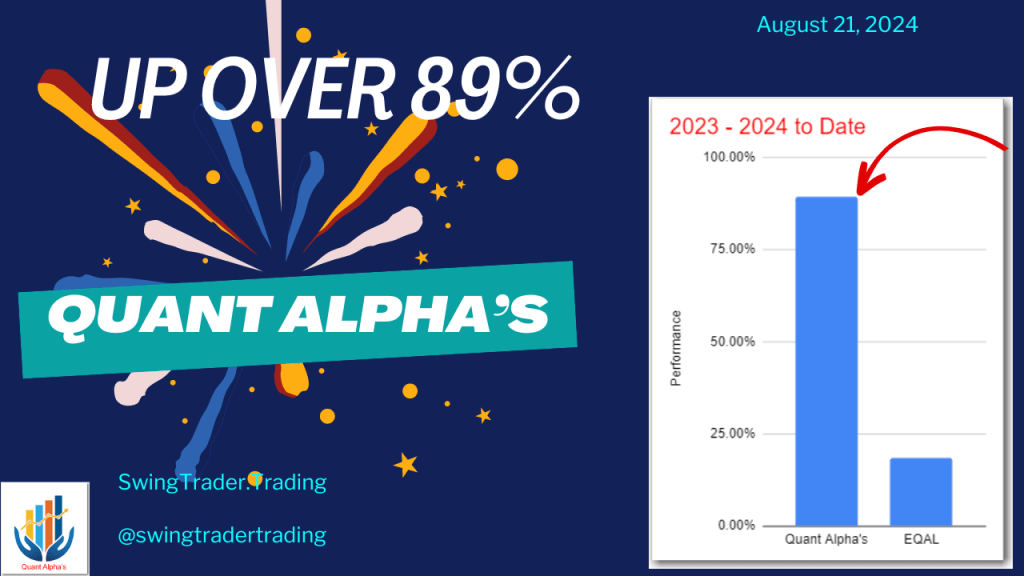

Up 89% – Quant Alpha’s Portfolio Update 08/21/2024

The Model Portfolio Quant Alpha’s was updated this morning with a new stock added and a stock removed. The portfolio now holds 26 stocks, using Quant scores for selection. It has outperformed the EQAL benchmark, achieving an 89% increase and beating the benchmark by 70% for 2023-2024.

-

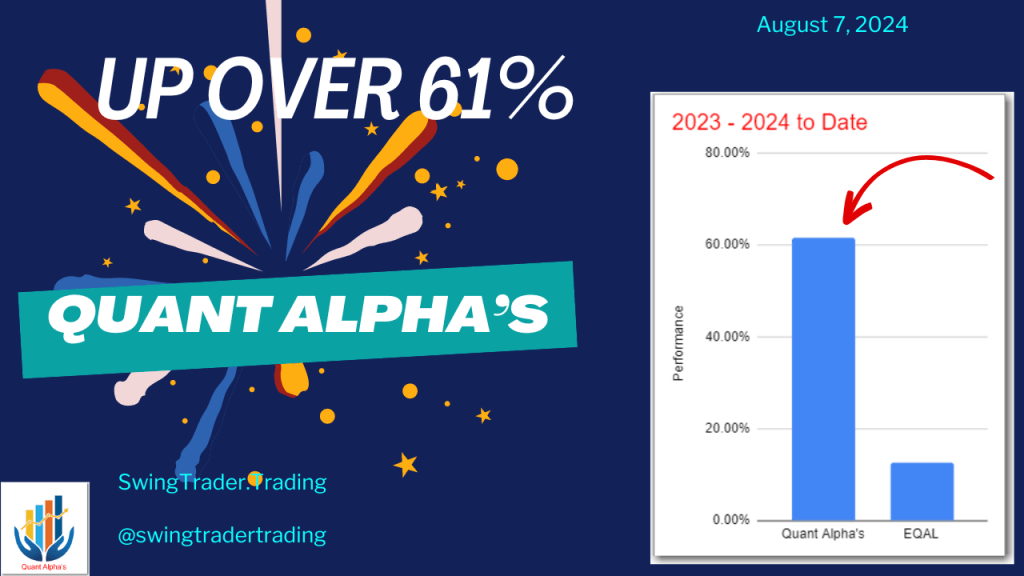

Up 61% – Quant Alpha’s Portfolio Update 08/07/2024

The updated Model Portfolio Quant Alpha’s includes 26 stocks based on Quant scores and specific criteria. It does not include micro-cap stocks, emphasizes high liquidity, and limits stocks to USA/Canada headquarters. The portfolio outperformed the EQAL benchmark by 39%, with standout performers such as SMCI, POWL, and ANF. Notable recent addition: WGS (GeneDx Holdings).

-

July 2024 Summary – Outperformance continues

In the stock market this month, benchmarks showed positive results. The Model Portfolios are ahead of their benchmarks for the 2023-2024 period. Quant Alpha’s is up over 96%, outperforming its benchmark by 77%. BI-Weekly Swings and Small Cap Discoveries also outperformed their benchmarks. .