Tag: app

-

Quant Alpha Weekly and Quant 30 are launched today

My six model portfolios started at the beginning of 2023 have now been closed. The Legacy scorecard can be seen here. I am beginning two new Quant Model portfolios starting today. These new portfolios will start from scratch during a time of all time market highs. The least favorable time to start a new Model…

-

January 2025 – Model Stock Portfolios Outperformance increases

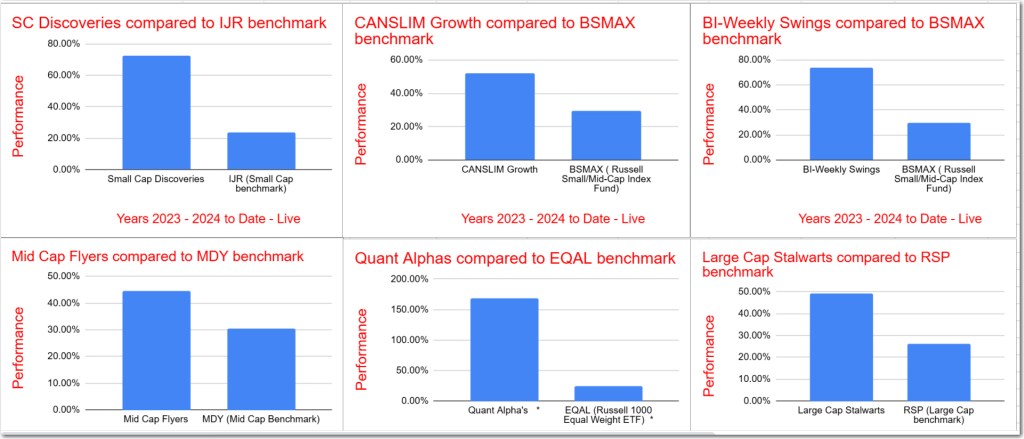

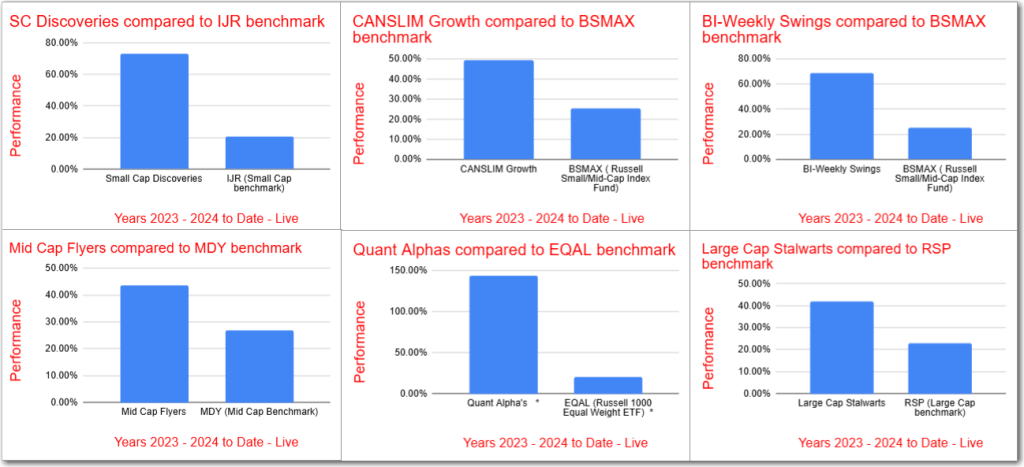

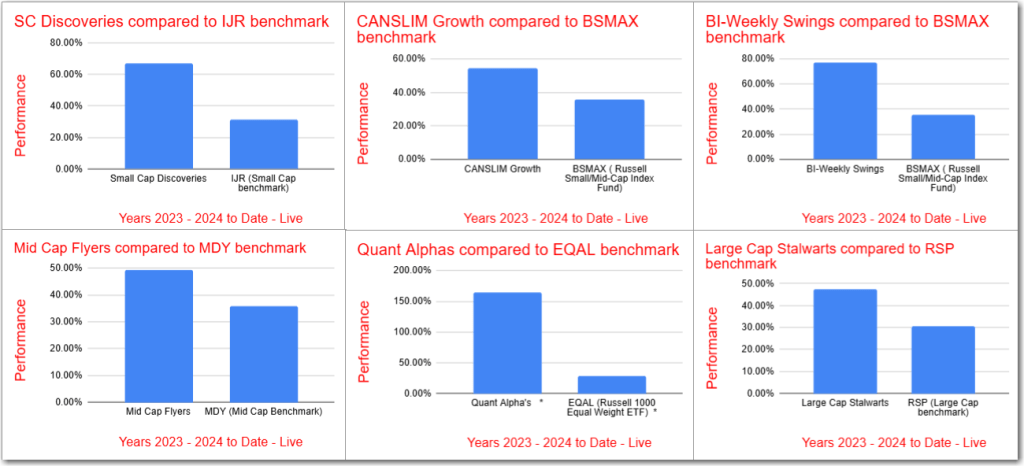

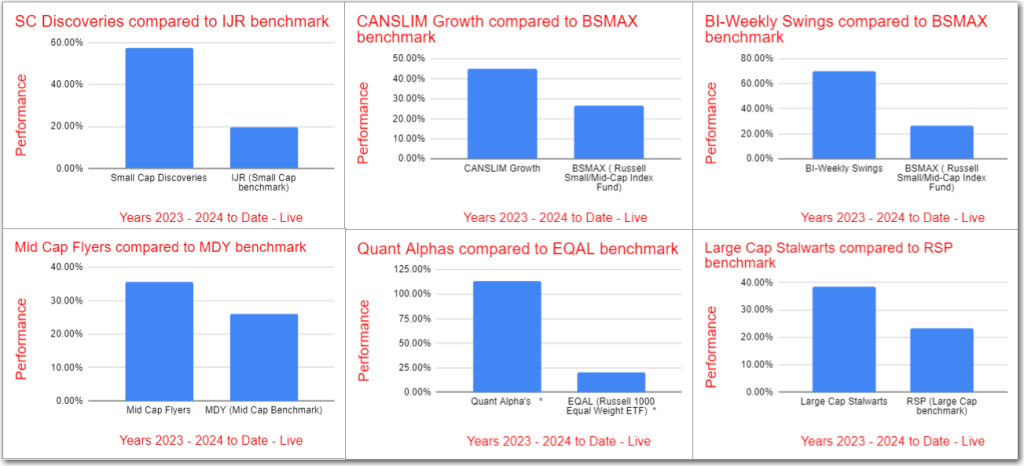

All Model Portfolios significantly outperformed their benchmarks for the 2023-2025 period, with Quant Alpha leading at over 168%, exceeding EQAL by 143%. Active contributors included POWL (+330%), ANF (+137%), and CLS (+427%). The BI-Weekly Swings rose 73%, surpassing BSMAX by 44%, driven by APEI and RAIL. Small Cap Discoveries and CANSLIM Growth were up 72%…

-

Up 178% – Quant Alpha’s Portfolio Update 01/23/2025

The Portfolio has outperformed its ETF benchmark EQAL, achieving a 178% gain for 2023-2025, exceeding the benchmark by 153%. An update included adding FOA and removing APP. Currently, there are 27 stocks, with a goal of 30-35. Notable performers include POWL and APP, reflecting significant returns.

-

Up 156% – Quant Alpha’s Portfolio Update 01/10/2025

The Portfolio has significantly outperformed the ETF benchmark EQAL, achieving over 156% growth for 2023-2024 and surpassing the benchmark by 135%. It now includes 27 stocks. New additions and stringent selection criteria ensure continuous performance improvement, with standout performers like APP gaining 745% since addition.

-

December 2024 – Model Stock Portfolios Outperformance increases

All Model Portfolios outperformed their benchmarks for 2023-2024, led by Quant Alpha’s impressive 144% return. Other portfolios also showed significant gains: BI-Weekly Swings at 68%, Small Cap Discoveries at 73%, and CANSLIM Growth at 49%. Despite a market sell-off, five portfolios improved their relative performances.

-

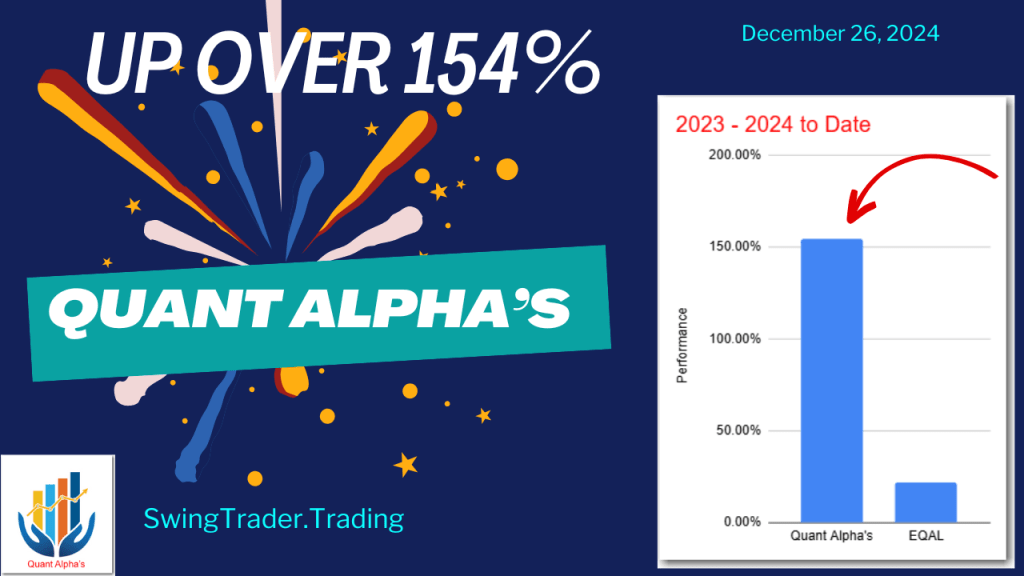

Up 154% – Quant Alpha’s Portfolio Update 12/26/2024

The Portfolio continues to outperform its ETF benchmark, EQAL, with a remarkable 154% increase in 2023-2024, surpassing EQAL by 133%. Updated to include 26 stocks, the Portfolio utilizes Quant scores for stock selection, avoiding certain sectors. Notable performers include AppLovin Corporation, up 790% since addition.

-

Up 152% – Quant Alpha’s Portfolio Update 12/12/2024

The Portfolio has achieved over 152% growth for 2023-2024, significantly outperforming its benchmark EQAL by 127%. It currently includes 25 stocks, with a focus on Quant scores for stock selection. Notable performers include APP with a 737% gain. The strategy emphasizes high liquidity and avoids specific sectors like airlines.

-

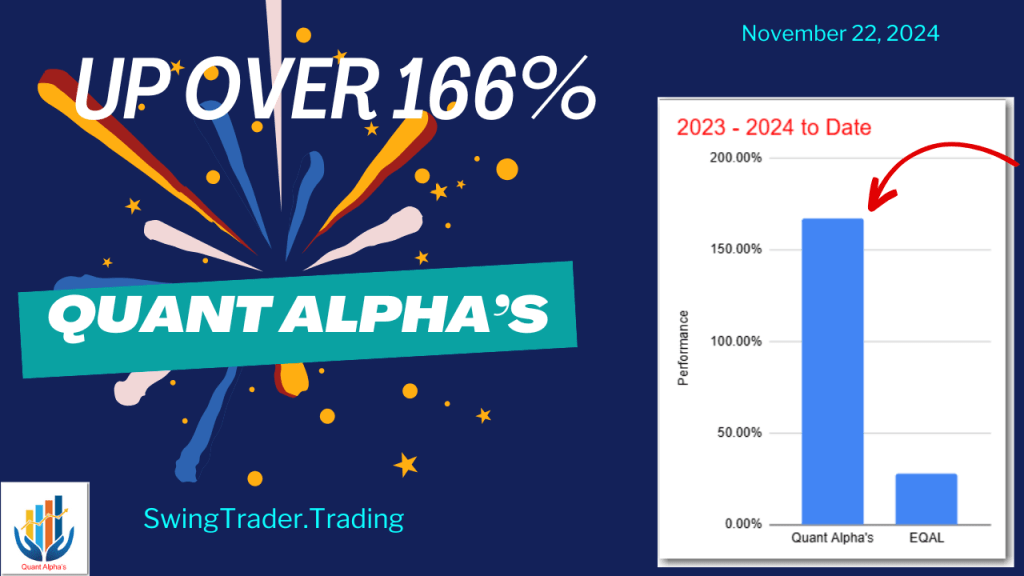

November 2024 Summary – Outperformance increases

All Model Portfolios have exceeded their benchmarks for the 2023-2024 period, showing impressive gains. The Quant Alpha’s Portfolio leads with over 165% growth, outperforming its benchmark by 136%. Active stocks like POWL and ANF have significantly contributed to this outperformance. Other portfolios also performed well, with the BI-Weekly Swings up 77%, Small Cap Discoveries up…

-

Up 166% – Quant Alpha’s Portfolio Update 11/26/2024

The Portfolio has outperformed its benchmark EQAL with a 166% gain for 2023-2024, surpassing it by 138%. It now includes 24 stocks. The strategy utilizes Quant scores for stock selection, with an expected holding period of 9 months to 2 years.

-

Up 152% – Quant Alpha’s Portfolio Update 11/13/2024

The Portfolio continues to outperform the EQAL benchmark, achieving a 152% increase for 2023-2024, surpassing the benchmark by 127%. Containing 26 stocks, it utilizes Quant scores for selection, avoiding micro-cap and specific sectors. Notable performers include POWL and APP.

-

October 2024 Summary – Outperformance increases

All Model Portfolios are ahead of their respective benchmarks for the 2023-2024 period. The Quant Alpha’s is now up over 113% for 2023-2024 and continues to destroy its benchmark EQAL by 93%. This is a substantial increase in outperformance since last month. Active outperformers POWL, ANF , APP and CLS account for some of this…

-

Remove SMCI – Quant Alpha’s Portfolio Update 10/30/2024

SMCI (Super Micro Computer) released some troubling news on Wednesday. Their auditor resigned. This is very bad sign for a company. It could indicate more undisclosed problems are lurking. Since the Quant ratings are very close to a Sell signal and with this additional negative news, I am removing this stock from the active list.…

-

Up 129% – Quant Alpha’s Portfolio Update 10/29/2024

The Model Portfolio Quant Alpha was updated. The portfolio, using Quant scores for selection, is up 129% since April 2023, outperforming the EQAL benchmark significantly. Performance highlights include stocks like SMCI and POWL, with expected growth to 30-35 holdings.

-

Up 111% – Quant Alpha’s Portfolio Update 10/10/2024

The Model Portfolio Quant Alpha’s was updated on 10/10/2024, adding Carnival Corporation (CCL) and removing Core & Main (CNM), with a total of 25 stocks now included. The portfolio focuses on Quant scores, avoiding subjective criteria and eliminating micro-cap stocks, airlines, crypto, biotech, and mega caps. Performance is strong, with a 111% increase since its…

-

Quant Alpha’s Portfolio Update 11/01/2023 – Up over 11% in 2023

Quant Alpha’s Portfolio update. Outperforming in 2023.

-

Quant Alpha’s Portfolio Update 10/18/2023 – Up over 19% in 2023

Quant Alpha’s Portfolio update. Outperforming in 2023.