Tag: BZFD

-

Up 78% – BI-Weekly Swings Update – 12/05/2024

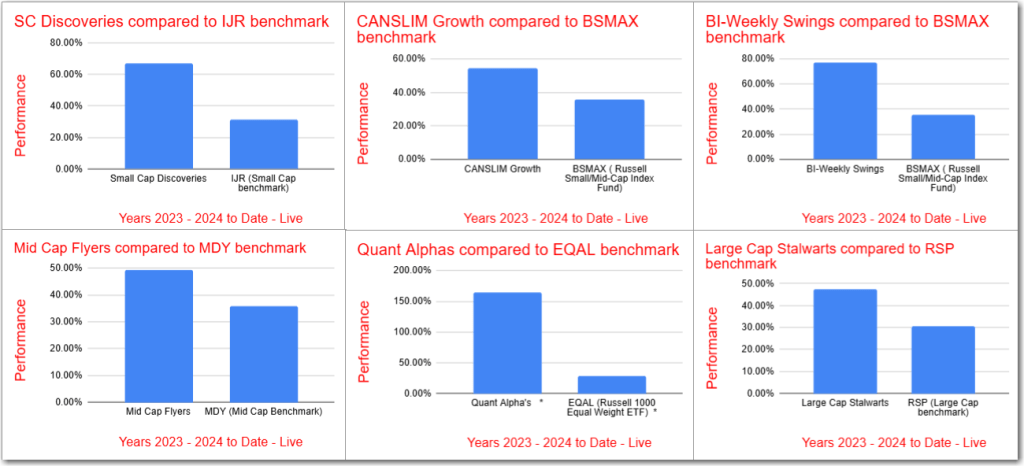

The BI-Weekly Swings Model Portfolio was updated with five new stocks added and five removed, maintaining 21 stocks total. Since its inception in 2023, the portfolio has risen 78%, outperforming the BSMAX benchmark by 42%. Various strategies focus on mid, small, and micro-cap stocks, showing consistent strong performance.

-

November 2024 Summary – Outperformance increases

All Model Portfolios have exceeded their benchmarks for the 2023-2024 period, showing impressive gains. The Quant Alpha’s Portfolio leads with over 165% growth, outperforming its benchmark by 136%. Active stocks like POWL and ANF have significantly contributed to this outperformance. Other portfolios also performed well, with the BI-Weekly Swings up 77%, Small Cap Discoveries up…

-

Up 76% – BI-Weekly Swings Update – 11/07/2024

The Model Portfolio BI-Weekly Swings updated on 11/07/2024, adding and removing six stocks, now comprising 21 in total. It boasts a 76% gain since 2023, outperforming its benchmark BSMAX by 44%. The portfolio employs three strategies focusing on EPS and ROE metrics for stock selection and has historically excelled in backtests.

-

Up 56% – Small Cap Discoveries Portfolio Update – August 2024

The Model Portfolio Small Cap Discoveries was updated with 9 new stocks added and 8 removed. It outperformed its benchmark, IJR, by 30% and is up over 56% for 2023-2024. The portfolio consists of 20 to 30 stocks and uses three strategies to identify positive trends in small and micro cap stocks. The Backtest for…

-

Up 64% – BI-Weekly Swings Update – 08/14/24

The Model Portfolio BI-Weekly Swings, updated with 9 new stocks and 9 removals, has shown 64% growth, outperforming its benchmark BSMAX by 45%. The portfolio consists of 15 to 21 stocks, utilizing three strategies and backtesting well against benchmarks. Notable outperformers include VIRC and HRTG. It is up 64% since 2023.