Tag: CANSLIM Growth

-

April 2025 – Model Stock Portfolios Update – Final Update

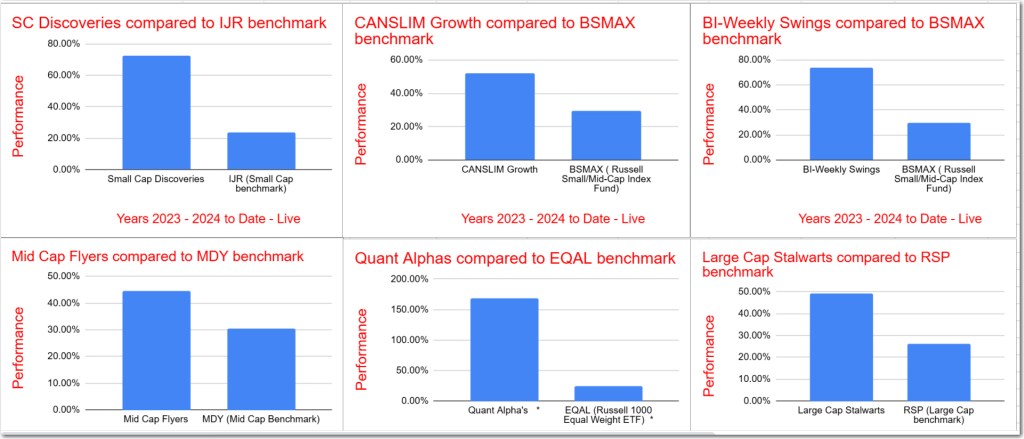

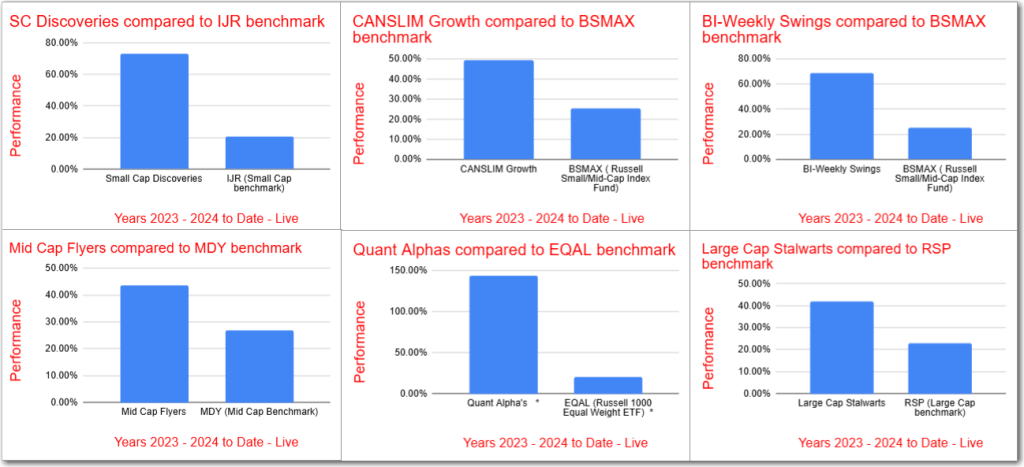

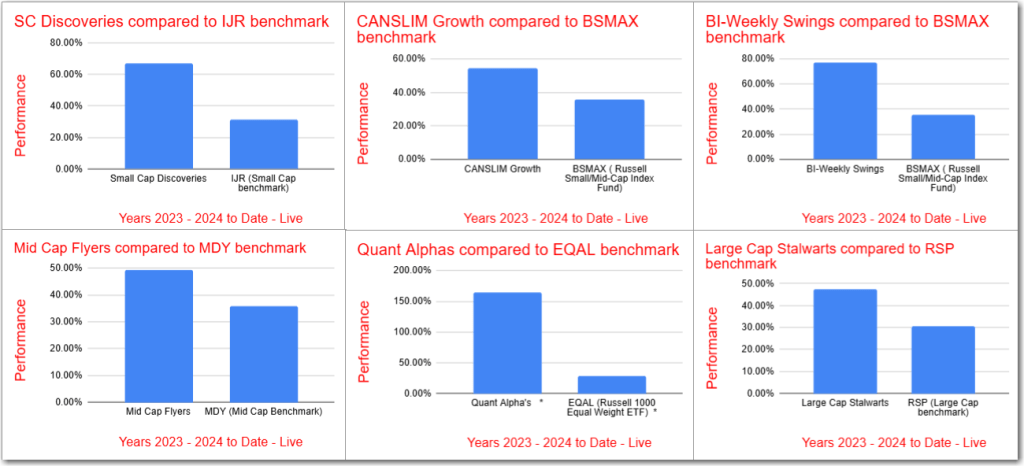

The final update on the Model Portfolios reveals impressive performance through 2023-2025, with all portfolios exceeding their benchmarks. The Quant Alpha’s portfolio leads with over 122% growth, outperforming its benchmark EQAL by 106%. Notable performers include WGS (+301%) and APP (+877%). Other portfolios such as BI-Weekly Swings and Small Cap Discoveries also show strong gains…

-

Up 40% – CANSLIM Growth Portfolio Update – April 2025

The CANSLIM Growth Model Portfolio is up over 40% in 2023-2025 and is 25% ahead of it s benchmark BSMAX. The CANSLIM Growth Model Portfolio was updated this weekend. New Adds of 0 stocks were made and Removals of 0 stocks were made. All prices are as of 04/25/2025. A total of 6 stocks are…

-

March 2025 – Model Stock Portfolios Update – In the Wrap-up Phase

One month remains of a two month long wrap-up of the live update posts for the six Model Portfolios. During the next month, only Removes from the six model portfolios will be posted but no new Adds will be made. At the end of April 2025, the final monthly report will be made and no…

-

Up 41% – CANSLIM Growth Portfolio Update – March 2025

The CANSLIM Growth Model Portfolio is up over 41% in 2023-2025 and is 20% ahead of it s benchmark BSMAX. The CANSLIM Growth Model Portfolio was updated this weekend. New Adds of 0 stocks were made and Removals of 1 stock was made. All prices are as of 03/28/2025. A total of 6 stocks are…

-

Up 43% – CANSLIM Growth Portfolio Update -February 2025

The CANSLIM Growth Model Portfolio is up over 43% in 2023-2025 and is 19% ahead of it s benchmark BSMAX. The CANSLIM Growth Model Portfolio was updated this weekend. New Adds of 0 stocks were made and Removals of 12 stocks were made. All prices are as of 02/28/2025. A total of 7 stocks are…

-

February 2025 – Model Stock Portfolios Update – Entering the Wrap-up Phase

Today marks the beginning of a two month long wrap-up of the live update posts for the six Model Portfolios. During the next two months, only Removes from the six model portfolios will be posted but no new Adds will be made. At the end of April 2025, the final monthly report will be made…

-

January 2025 – Model Stock Portfolios Outperformance increases

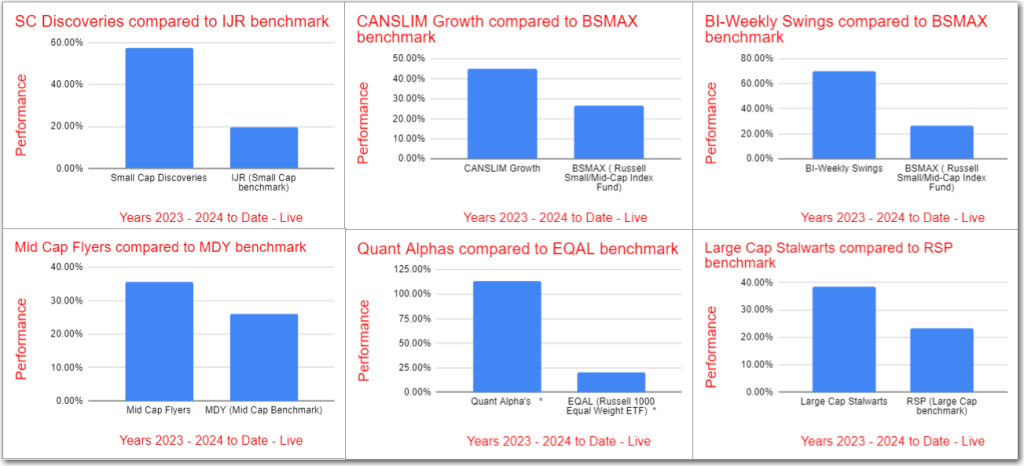

All Model Portfolios significantly outperformed their benchmarks for the 2023-2025 period, with Quant Alpha leading at over 168%, exceeding EQAL by 143%. Active contributors included POWL (+330%), ANF (+137%), and CLS (+427%). The BI-Weekly Swings rose 73%, surpassing BSMAX by 44%, driven by APEI and RAIL. Small Cap Discoveries and CANSLIM Growth were up 72%…

-

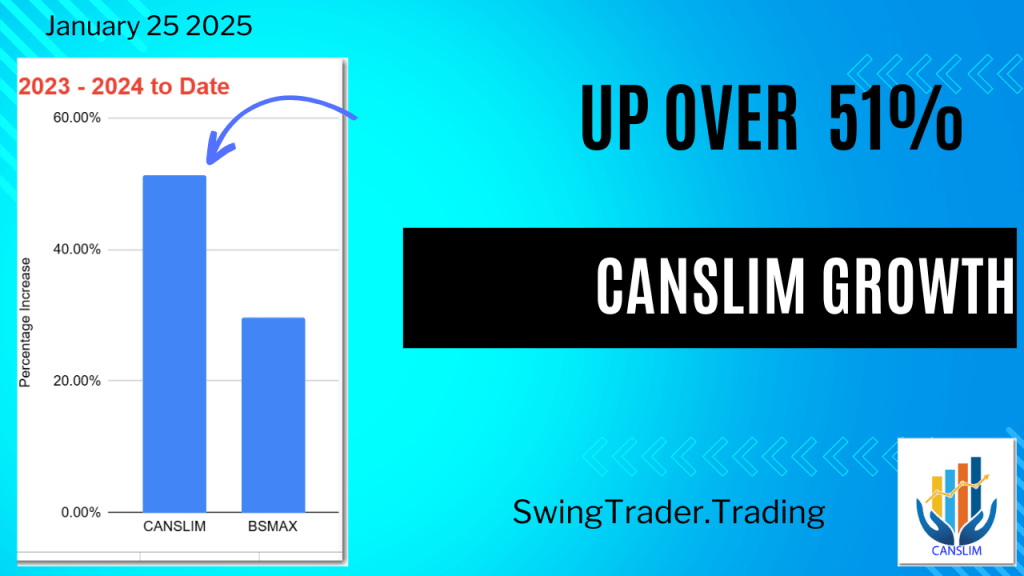

Up 51% – CANSLIM Growth Portfolio Update -January 2025

The CANSLIM Growth Model Portfolio has increased by over 51% in 2023-2024, significantly surpassing its benchmark BSMAX by 21%. The portfolio, consisting of 20 stocks, uses the CANSLIM approach focused on earnings per share, return on equity, and sales growth. Recent changes included adding six stocks and removing five.

-

December 2024 – Model Stock Portfolios Outperformance increases

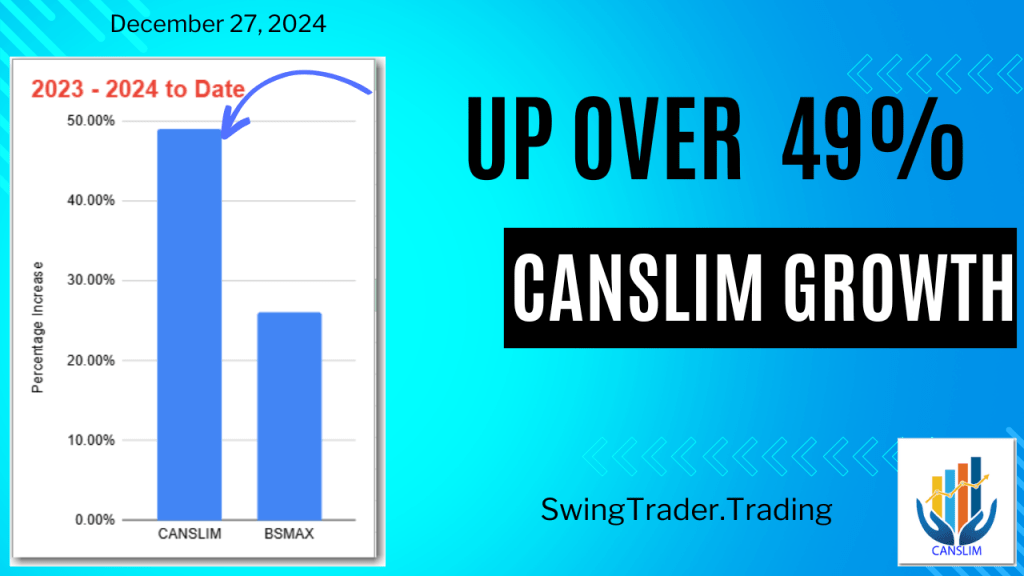

All Model Portfolios outperformed their benchmarks for 2023-2024, led by Quant Alpha’s impressive 144% return. Other portfolios also showed significant gains: BI-Weekly Swings at 68%, Small Cap Discoveries at 73%, and CANSLIM Growth at 49%. Despite a market sell-off, five portfolios improved their relative performances.

-

Up 49% – CANSLIM Growth Portfolio Update December 2024

The CANSLIM Growth Model Portfolio has risen over 49% in 2023-2024, outperforming the BSMAX benchmark by 23%. Recent updates added 2 stocks and removed 3, with 19 stocks now in the portfolio. Backtesting shows consistent outperformance across 18 of 19 years, highlighting the effectiveness of the CANSLIM strategy.

-

November 2024 Summary – Outperformance increases

All Model Portfolios have exceeded their benchmarks for the 2023-2024 period, showing impressive gains. The Quant Alpha’s Portfolio leads with over 165% growth, outperforming its benchmark by 136%. Active stocks like POWL and ANF have significantly contributed to this outperformance. Other portfolios also performed well, with the BI-Weekly Swings up 77%, Small Cap Discoveries up…

-

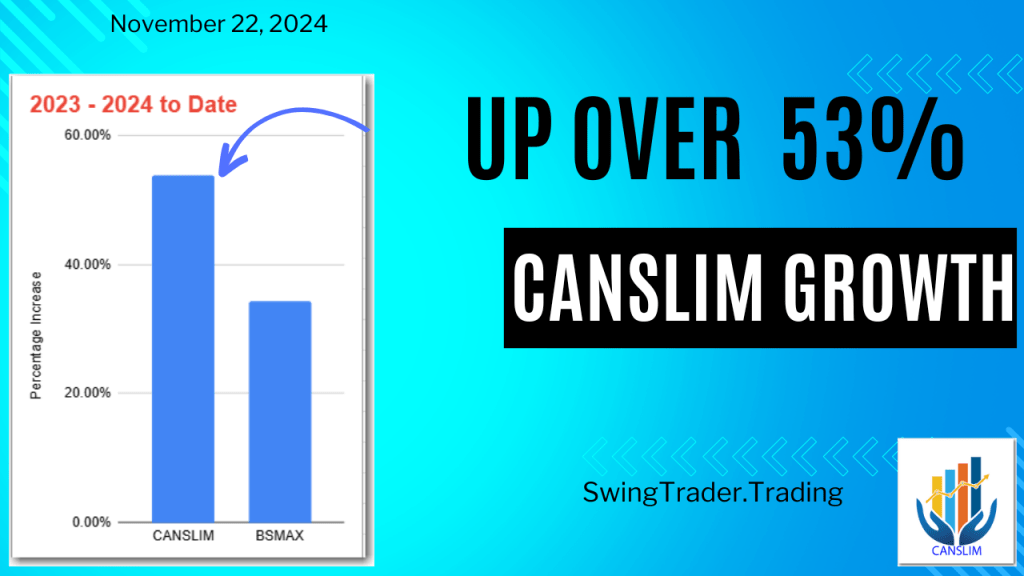

Up 53% – CANSLIM Growth Portfolio Update November 2024

The CANSLIM Growth Model Portfolio was updated this weekend. New Adds of 8 stocks were made and Removals of 5 stocks were made. All prices are as of 11/22/2024. A total of 20 stocks are in the Portfolio. The CANSLIM Growth Model Portfolio is up over 53% in 2023-2024 and is 19% ahead of its…

-

October 2024 Summary – Outperformance increases

All Model Portfolios are ahead of their respective benchmarks for the 2023-2024 period. The Quant Alpha’s is now up over 113% for 2023-2024 and continues to destroy its benchmark EQAL by 93%. This is a substantial increase in outperformance since last month. Active outperformers POWL, ANF , APP and CLS account for some of this…

-

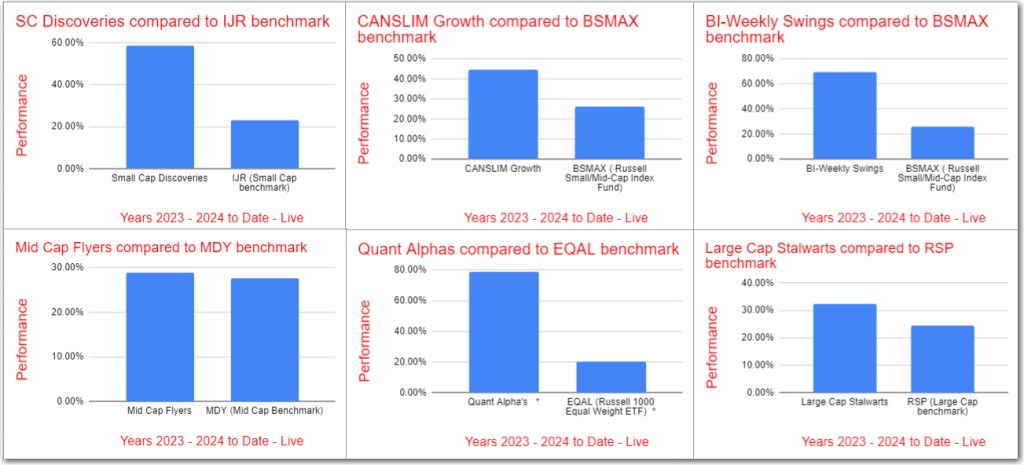

Up 44% – CANSLIM Growth Portfolio Update October 2024

The CANSLIM Growth Model Portfolio was updated with five new additions and five removals, maintaining 17 stocks. It has gained over 44% in 2023-2024, outperforming its benchmark BSMAX by 18%. Using the CANSLIM criteria, the portfolio has consistently outperformed benchmarks in 18 of 19 tested years, showcasing robust performance.

-

Up 41% – CANSLIM Growth Portfolio Update 09/27/2024

The CANSLIM Growth Model Portfolio was updated this weekend. New Adds of 2 stocks were made and Removals of 3 stocks were made. All prices are as of 09/27/2024. A total of 17 stocks are in the Portfolio. The CANSLIM Growth Model Portfolio is up over 41% in 2023-2024 and is 15% ahead of its…

-

Up 60% – Small Cap Discoveries Portfolio Update – September 2024

The Model Portfolio Small Cap Discoveries was updated this weekend. New Adds of 5 stocks were made and Removals of 4 stocks were made. All prices are as of 09/20/2024. A total of 21 stocks are in the Portfolio now. The Portfolio continues to outpace its benchmark, IJR, by a wide margin. The Portfolio is…

-

August 2024 Summary – Outperformance continues

In August 2024, stock market indexes had mixed results. All model portfolios exceeded their benchmarks, with Quant Alpha’s leading at 79%, while other portfolios also showed strong performance, beating their respective benchmarks. This information is for informational purposes only and does not constitute financial advice.

-

Up 44% – CANSLIM Growth Portfolio Update 08/23/2024

The CANSLIM Growth Model Portfolio was updated with 6 new stock additions and 7 removals, totaling 18 stocks. It has outperformed its benchmark by 18% and has recorded significant backtest outperformance. The portfolio follows the CANSLIM approach, focusing on EPS, Return on Equity, and Sales Increase. Notable active transactions and impressive performance details are also…

-

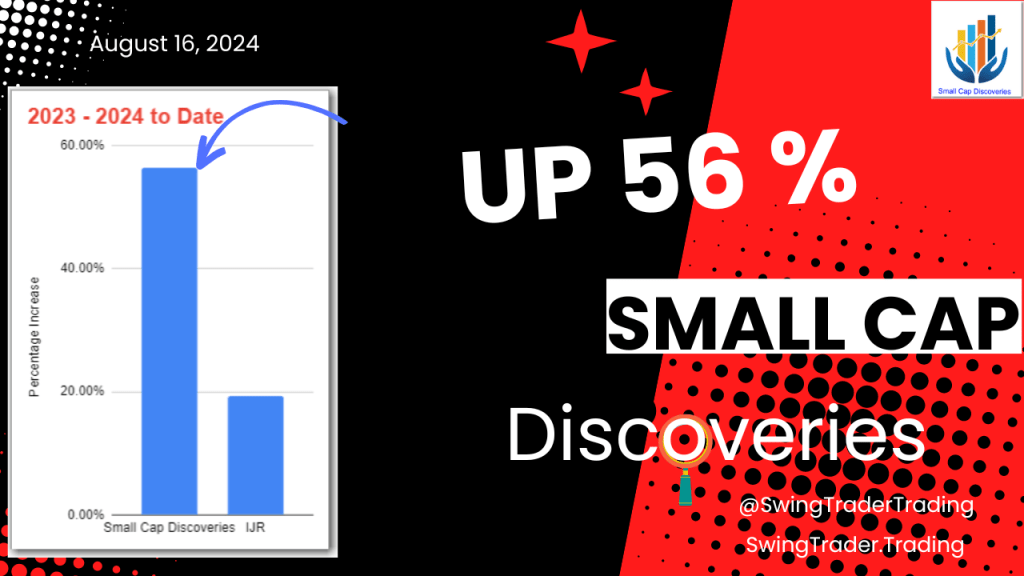

Up 56% – Small Cap Discoveries Portfolio Update – August 2024

The Model Portfolio Small Cap Discoveries was updated with 9 new stocks added and 8 removed. It outperformed its benchmark, IJR, by 30% and is up over 56% for 2023-2024. The portfolio consists of 20 to 30 stocks and uses three strategies to identify positive trends in small and micro cap stocks. The Backtest for…

-

July 2024 Summary – Outperformance continues

In the stock market this month, benchmarks showed positive results. The Model Portfolios are ahead of their benchmarks for the 2023-2024 period. Quant Alpha’s is up over 96%, outperforming its benchmark by 77%. BI-Weekly Swings and Small Cap Discoveries also outperformed their benchmarks. .