Tag: finance

-

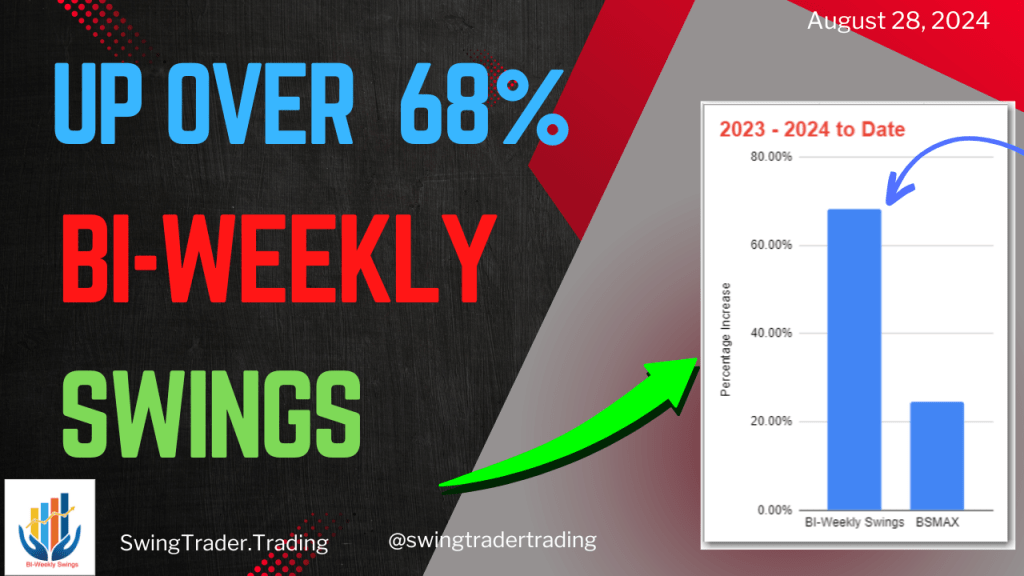

Up 68% – BI-Weekly Swings Update – 08/28/24

The Model Portfolio BI-Weekly Swings, updated with 9 new stocks and 9 removals, has shown 64% growth, outperforming its benchmark BSMAX by 45%. The portfolio consists of 15 to 21 stocks, utilizing three strategies and backtesting well against benchmarks. Notable outperformers include VIRC and HRTG. It is up 64% since 2023.

-

Up 64% – BI-Weekly Swings Update – 08/14/24

The Model Portfolio BI-Weekly Swings, updated with 9 new stocks and 9 removals, has shown 64% growth, outperforming its benchmark BSMAX by 45%. The portfolio consists of 15 to 21 stocks, utilizing three strategies and backtesting well against benchmarks. Notable outperformers include VIRC and HRTG. It is up 64% since 2023.

-

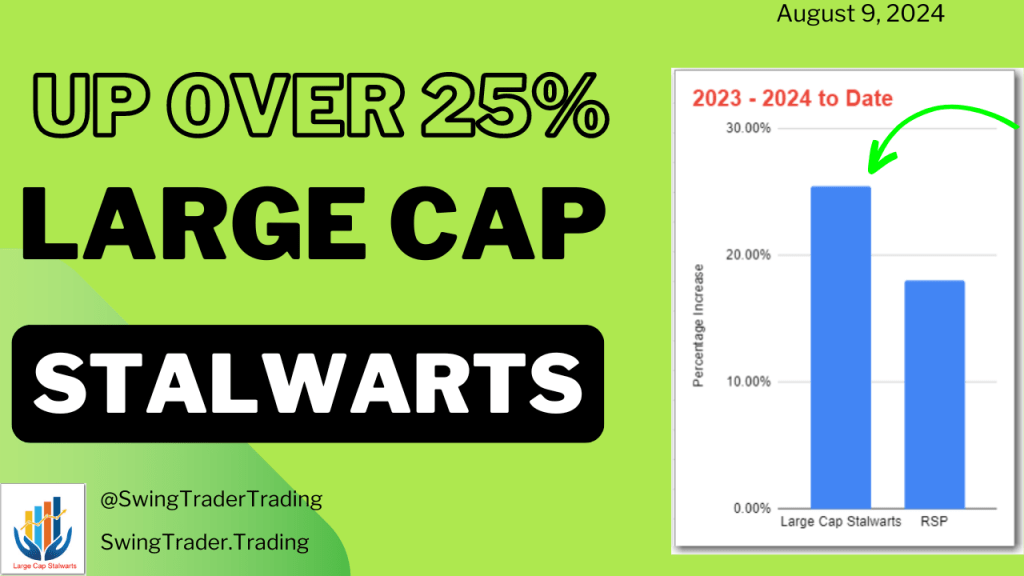

Up 25% – Large Cap Stalwarts Update – August 2024

Model Portfolio Update – Large Cap Stalwarts – Outperformance Continues

-

July 2024 Summary – Outperformance continues

In the stock market this month, benchmarks showed positive results. The Model Portfolios are ahead of their benchmarks for the 2023-2024 period. Quant Alpha’s is up over 96%, outperforming its benchmark by 77%. BI-Weekly Swings and Small Cap Discoveries also outperformed their benchmarks. .

-

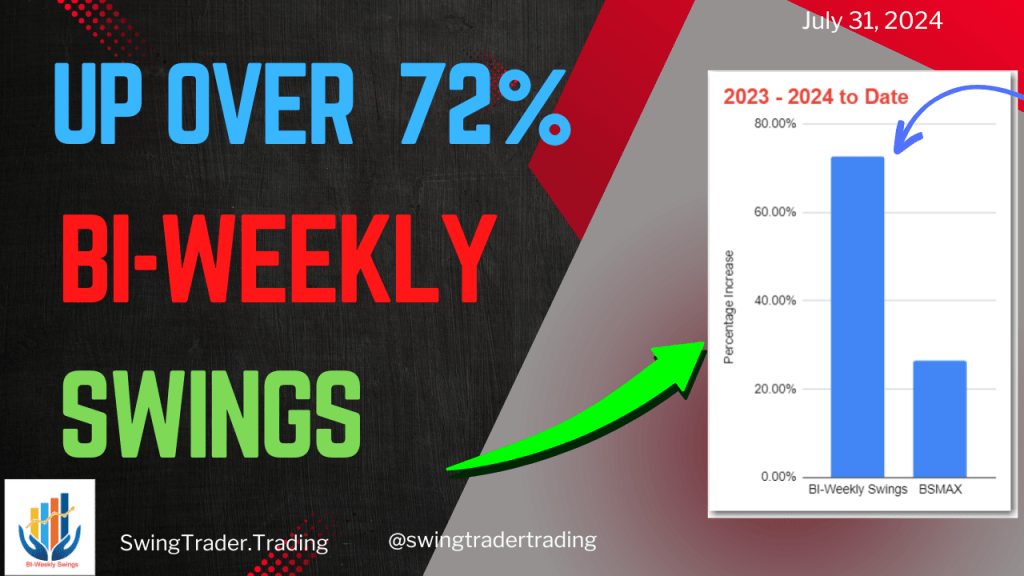

Up 72% – BI-Weekly Swings Update – 07/31/24

The BI-Weekly Swings Portfolio has been updated with 9 new stocks and 9 removals. It consists of 15 to 21 stocks, using three strategies to cover Mid Cap, Small Cap, and Micro Cap stocks. It outperformed its benchmarks in most years and is up 72% since 2023. Notable outperformers include VIRC and APEI.