Tag: FOA

-

January 2025 – Model Stock Portfolios Outperformance increases

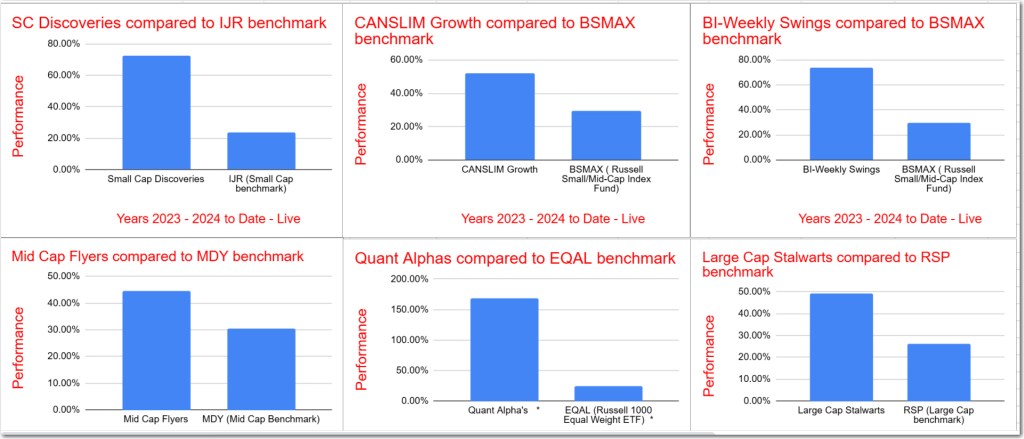

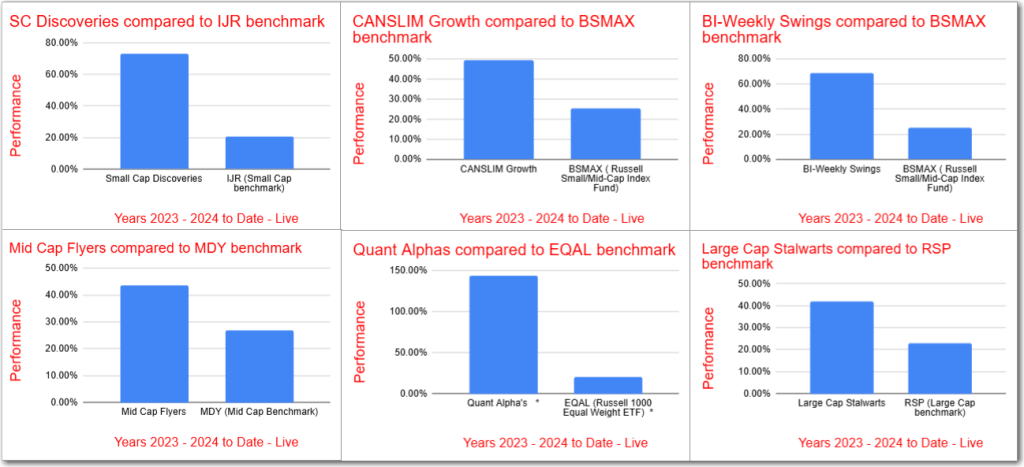

All Model Portfolios significantly outperformed their benchmarks for the 2023-2025 period, with Quant Alpha leading at over 168%, exceeding EQAL by 143%. Active contributors included POWL (+330%), ANF (+137%), and CLS (+427%). The BI-Weekly Swings rose 73%, surpassing BSMAX by 44%, driven by APEI and RAIL. Small Cap Discoveries and CANSLIM Growth were up 72%…

-

December 2024 – Model Stock Portfolios Outperformance increases

All Model Portfolios outperformed their benchmarks for 2023-2024, led by Quant Alpha’s impressive 144% return. Other portfolios also showed significant gains: BI-Weekly Swings at 68%, Small Cap Discoveries at 73%, and CANSLIM Growth at 49%. Despite a market sell-off, five portfolios improved their relative performances.

-

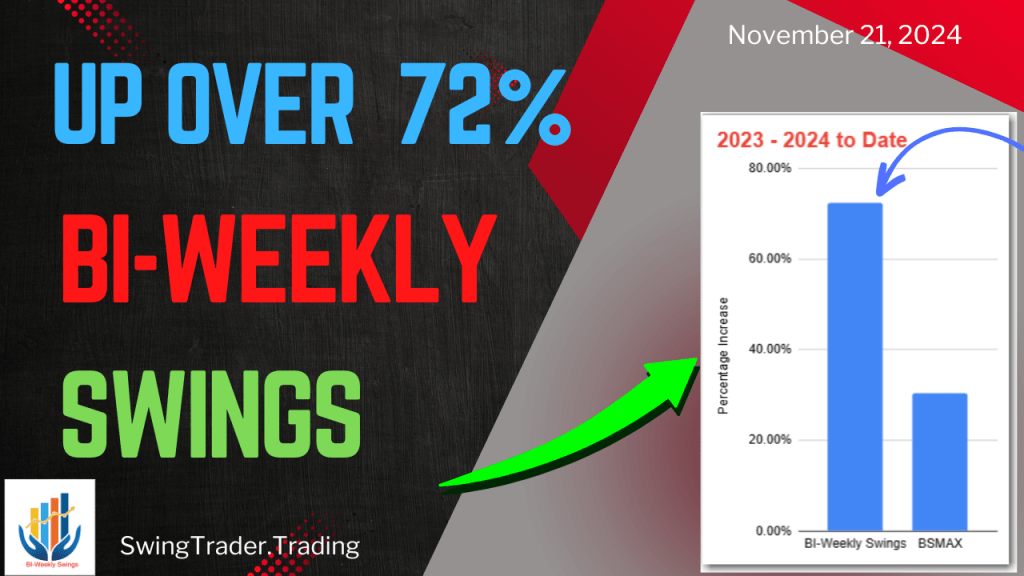

Up 72% – BI-Weekly Swings Update – 11/21/2024

The Model Portfolio BI-Weekly Swings, updated on 11/21/2024, added and removed six stocks, maintaining a total of 21. It has achieved a remarkable 72% increase from 2023-2024, outperforming the BSMAX benchmark by 39%. The portfolio uses a blend of strategies focused on various stock caps and key financial metrics.

-

Up 58% – Small Cap Discoveries Portfolio Update – November 2024

The Model Portfolio Small Cap Discoveries was updated to include three new stocks while removing ten, resulting in a total of 14 stocks. The Portfolio outperformed its benchmark IJR significantly, with a 58% increase for 2023-2024. Notable transactions included HRTG, which was removed after a 121% gain.