Tag: NCLH

-

January 2025 – Model Stock Portfolios Outperformance increases

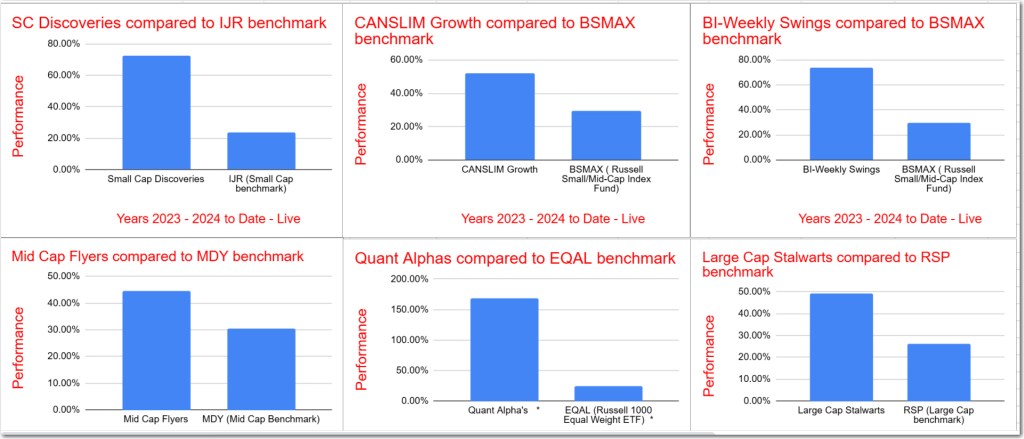

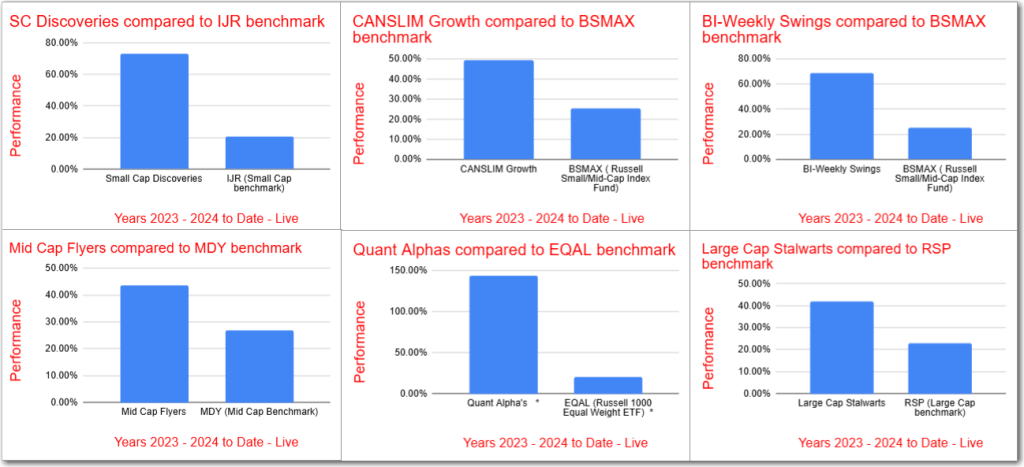

All Model Portfolios significantly outperformed their benchmarks for the 2023-2025 period, with Quant Alpha leading at over 168%, exceeding EQAL by 143%. Active contributors included POWL (+330%), ANF (+137%), and CLS (+427%). The BI-Weekly Swings rose 73%, surpassing BSMAX by 44%, driven by APEI and RAIL. Small Cap Discoveries and CANSLIM Growth were up 72%…

-

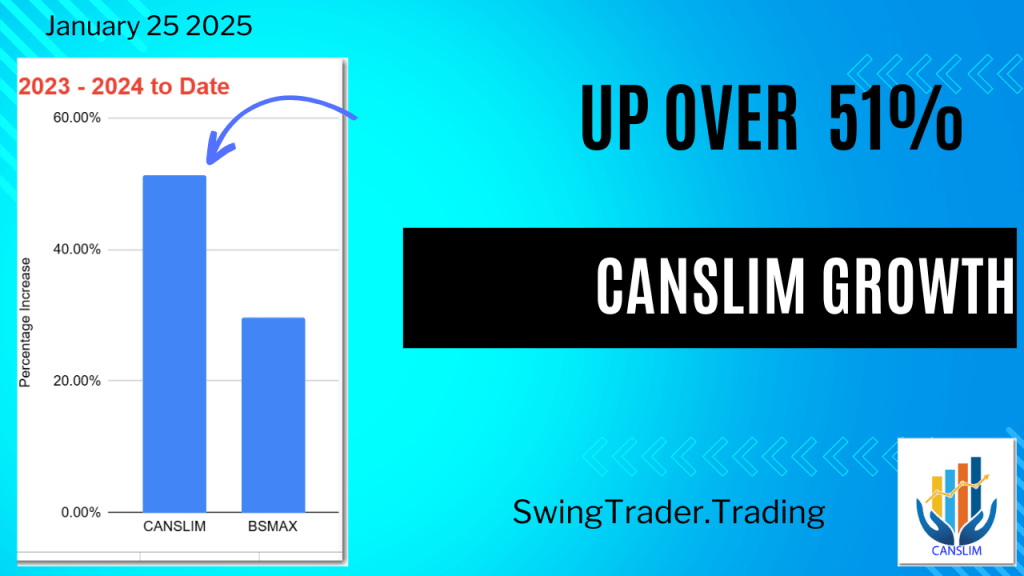

Up 51% – CANSLIM Growth Portfolio Update -January 2025

The CANSLIM Growth Model Portfolio has increased by over 51% in 2023-2024, significantly surpassing its benchmark BSMAX by 21%. The portfolio, consisting of 20 stocks, uses the CANSLIM approach focused on earnings per share, return on equity, and sales growth. Recent changes included adding six stocks and removing five.

-

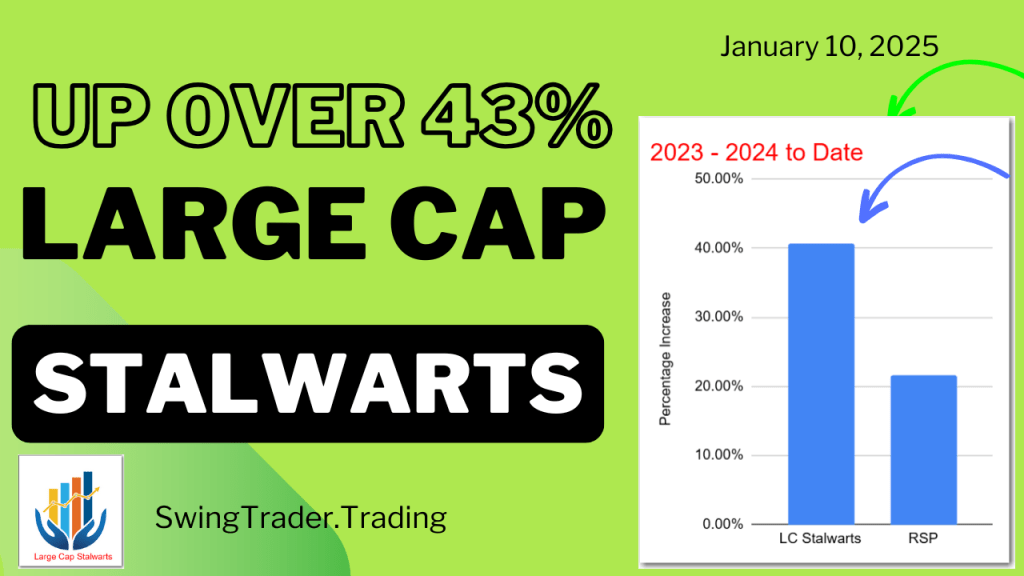

Up 43% – Large Cap Stalwarts Update – January 2025

The Large Cap Stalwarts Model Portfolio has outperformed its RSP benchmark by 22%, achieving a 43% gain since its 2023 launch. Recent updates included the addition of 7 stocks and removal of 8, bringing the total to 18. Historical backtests show consistent outperformance in most years, with significant gains achieved.

-

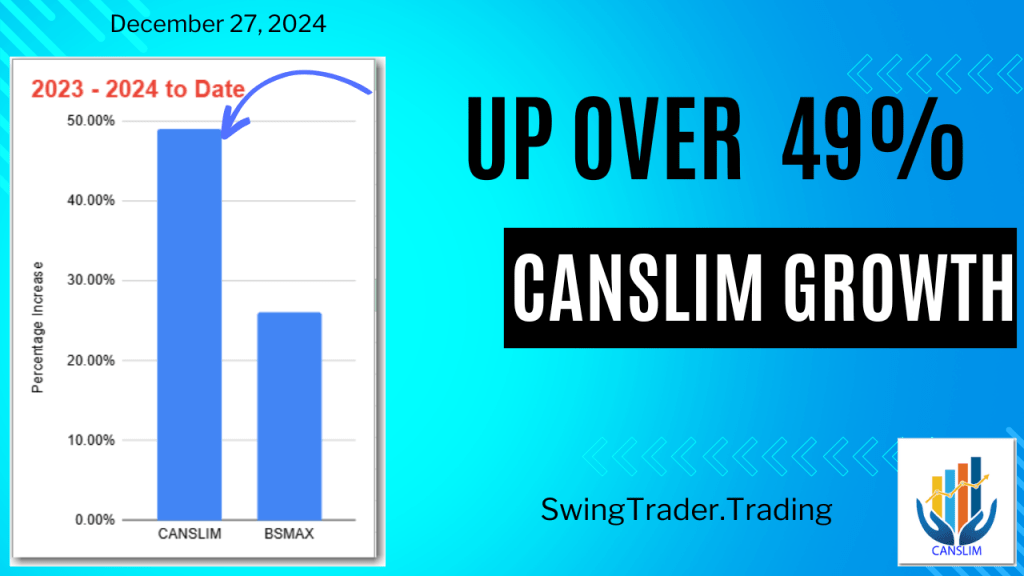

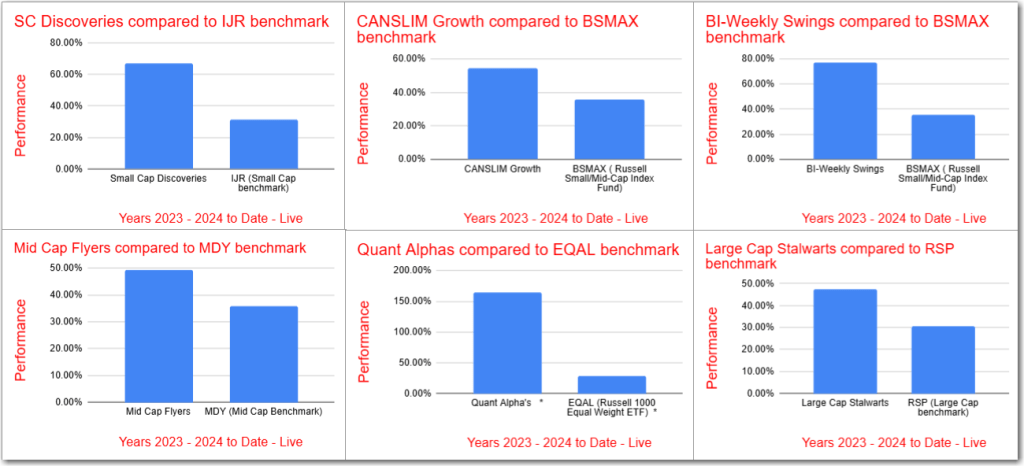

December 2024 – Model Stock Portfolios Outperformance increases

All Model Portfolios outperformed their benchmarks for 2023-2024, led by Quant Alpha’s impressive 144% return. Other portfolios also showed significant gains: BI-Weekly Swings at 68%, Small Cap Discoveries at 73%, and CANSLIM Growth at 49%. Despite a market sell-off, five portfolios improved their relative performances.

-

Up 49% – CANSLIM Growth Portfolio Update December 2024

The CANSLIM Growth Model Portfolio has risen over 49% in 2023-2024, outperforming the BSMAX benchmark by 23%. Recent updates added 2 stocks and removed 3, with 19 stocks now in the portfolio. Backtesting shows consistent outperformance across 18 of 19 years, highlighting the effectiveness of the CANSLIM strategy.

-

Up 46% – Large Cap Stalwarts Update – December 2024

The Model Portfolio Large Cap Stalwarts has outperformed its RSP benchmark by 19%, with a 46% increase since its inception in 2023. Recent updates included the addition of five stocks and removal of six. The portfolio generally outperformed the RSP in 12 out of 19 backtested years, with notable successes.

-

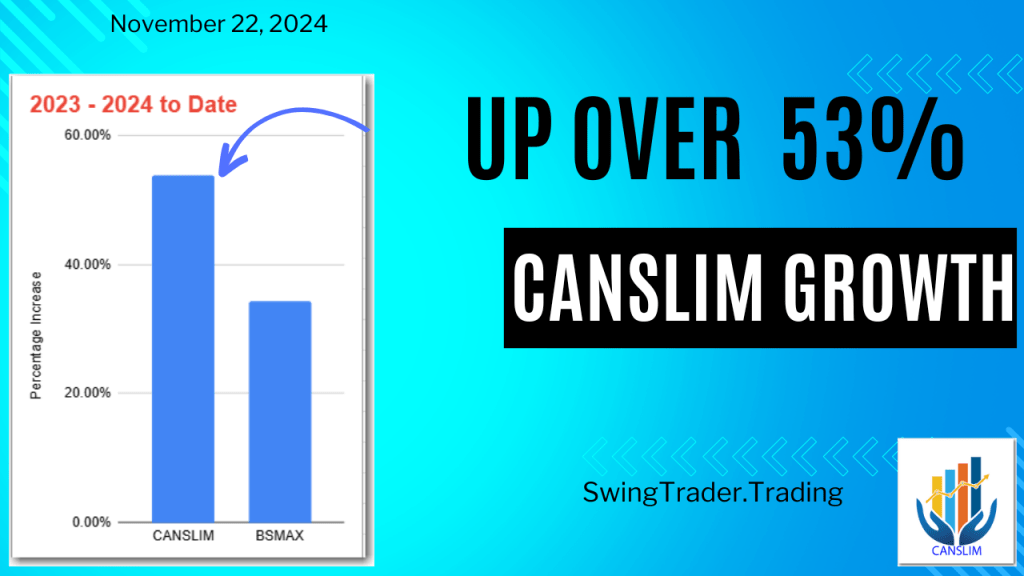

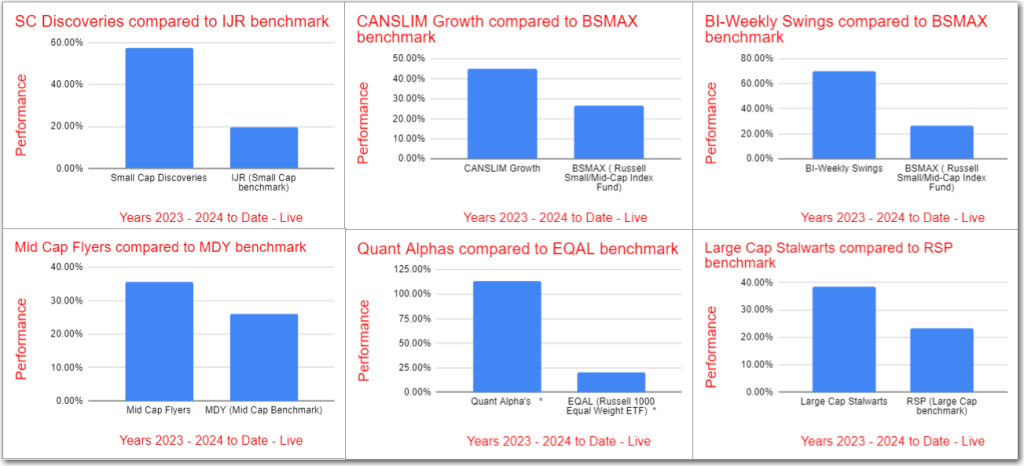

November 2024 Summary – Outperformance increases

All Model Portfolios have exceeded their benchmarks for the 2023-2024 period, showing impressive gains. The Quant Alpha’s Portfolio leads with over 165% growth, outperforming its benchmark by 136%. Active stocks like POWL and ANF have significantly contributed to this outperformance. Other portfolios also performed well, with the BI-Weekly Swings up 77%, Small Cap Discoveries up…

-

Up 53% – CANSLIM Growth Portfolio Update November 2024

The CANSLIM Growth Model Portfolio was updated this weekend. New Adds of 8 stocks were made and Removals of 5 stocks were made. All prices are as of 11/22/2024. A total of 20 stocks are in the Portfolio. The CANSLIM Growth Model Portfolio is up over 53% in 2023-2024 and is 19% ahead of its…

-

October 2024 Summary – Outperformance increases

All Model Portfolios are ahead of their respective benchmarks for the 2023-2024 period. The Quant Alpha’s is now up over 113% for 2023-2024 and continues to destroy its benchmark EQAL by 93%. This is a substantial increase in outperformance since last month. Active outperformers POWL, ANF , APP and CLS account for some of this…

-

Up 44% – CANSLIM Growth Portfolio Update 08/23/2024

The CANSLIM Growth Model Portfolio was updated with 6 new stock additions and 7 removals, totaling 18 stocks. It has outperformed its benchmark by 18% and has recorded significant backtest outperformance. The portfolio follows the CANSLIM approach, focusing on EPS, Return on Equity, and Sales Increase. Notable active transactions and impressive performance details are also…