Tag: nfe

-

Up 72% – BI-Weekly Swings Update – 01/16/2025

The BI-Weekly Swings Portfolio has risen 72% from 2023-2025, outperforming its benchmark BSMAX by 45%. It includes 18 stocks, with recent additions of 4 and removals of 3. The Portfolio implements three strategies focusing on earnings trends and has outperformed historical benchmarks in most tested years, with 2016 as its best year.

-

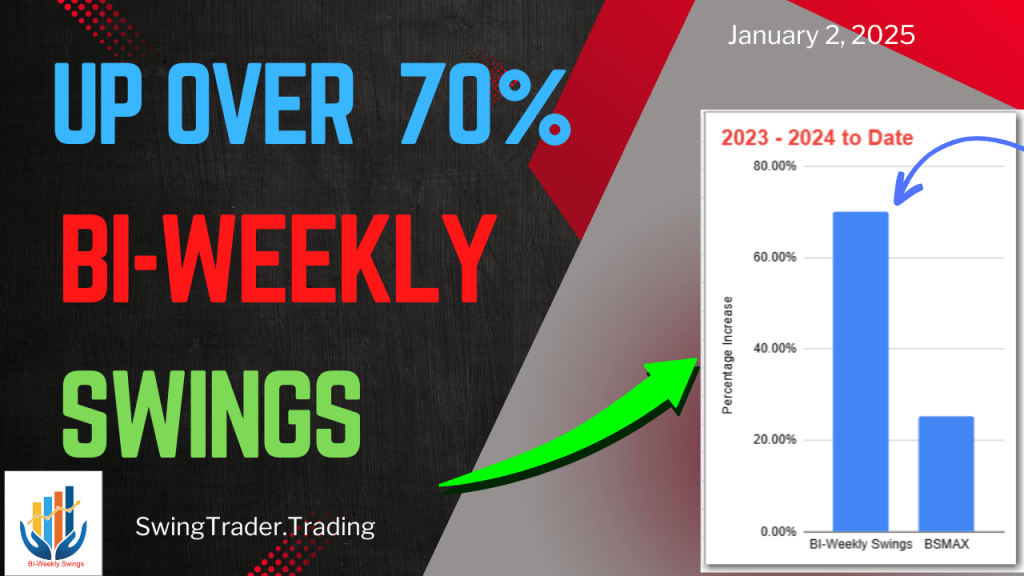

Up 70% – BI-Weekly Swings Update – 01/02/2025

The BI-Weekly Swings Portfolio has achieved a 70% return from 2023-2025, surpassing its benchmark, BSMAX, by 44%. The portfolio consists of 17 stocks, updated bi-weekly, utilizing multiple strategies focusing on EPS, ROE, and relative strength. Backtests show it outperformed benchmarks in 15 of 19 years tested.

-

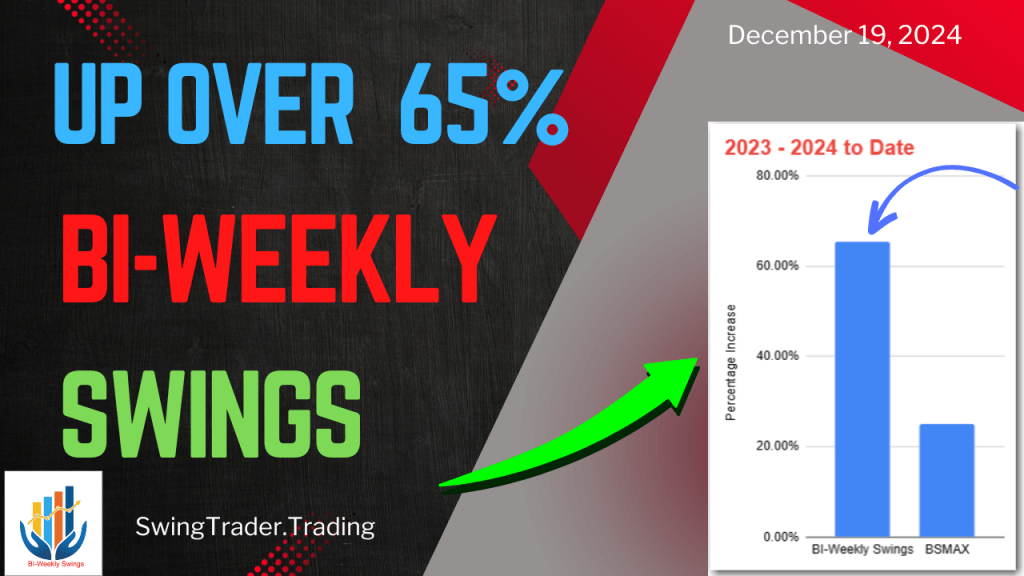

Up 65% – BI-Weekly Swings Update – 12/19/2024

The BI-Weekly Swings Portfolio has achieved a remarkable 65% growth in 2023-2024, surpassing its benchmark BSMAX by 45%. Updated bi-weekly, it now holds 16 stocks, incorporating three distinct strategies focusing on mid, small, and micro-cap stocks. Recent adjustments included adding three stocks and removing eight. Backtesting indicates consistent historical outperformance.

-

Up 51% – CANSLIM Growth Portfolio Update 07/26/2024

The CANSLIM Growth Model Portfolio was updated with 6 new stocks and the removal of 7, resulting in a total of 19 stocks. It has shown impressive performance, surpassing its benchmark by 26% and achieving a 51% increase in 2023-2024. The portfolio follows the CANSLIM approach, focusing on criteria such as EPS, Return on Equity,…

-

Model Portfolio update 05/26/2023 – CANSLIM Growth Monthly update

Model Portfolio update 05/26/2023 – CANSLIM Growth Monthly update.