Tag: smci

-

Up 152% – Quant Alpha’s Portfolio Update 11/13/2024

The Portfolio continues to outperform the EQAL benchmark, achieving a 152% increase for 2023-2024, surpassing the benchmark by 127%. Containing 26 stocks, it utilizes Quant scores for selection, avoiding micro-cap and specific sectors. Notable performers include POWL and APP.

-

Remove SMCI – Quant Alpha’s Portfolio Update 10/30/2024

SMCI (Super Micro Computer) released some troubling news on Wednesday. Their auditor resigned. This is very bad sign for a company. It could indicate more undisclosed problems are lurking. Since the Quant ratings are very close to a Sell signal and with this additional negative news, I am removing this stock from the active list.…

-

Up 129% – Quant Alpha’s Portfolio Update 10/29/2024

The Model Portfolio Quant Alpha was updated. The portfolio, using Quant scores for selection, is up 129% since April 2023, outperforming the EQAL benchmark significantly. Performance highlights include stocks like SMCI and POWL, with expected growth to 30-35 holdings.

-

Up 111% – Quant Alpha’s Portfolio Update 10/10/2024

The Model Portfolio Quant Alpha’s was updated on 10/10/2024, adding Carnival Corporation (CCL) and removing Core & Main (CNM), with a total of 25 stocks now included. The portfolio focuses on Quant scores, avoiding subjective criteria and eliminating micro-cap stocks, airlines, crypto, biotech, and mega caps. Performance is strong, with a 111% increase since its…

-

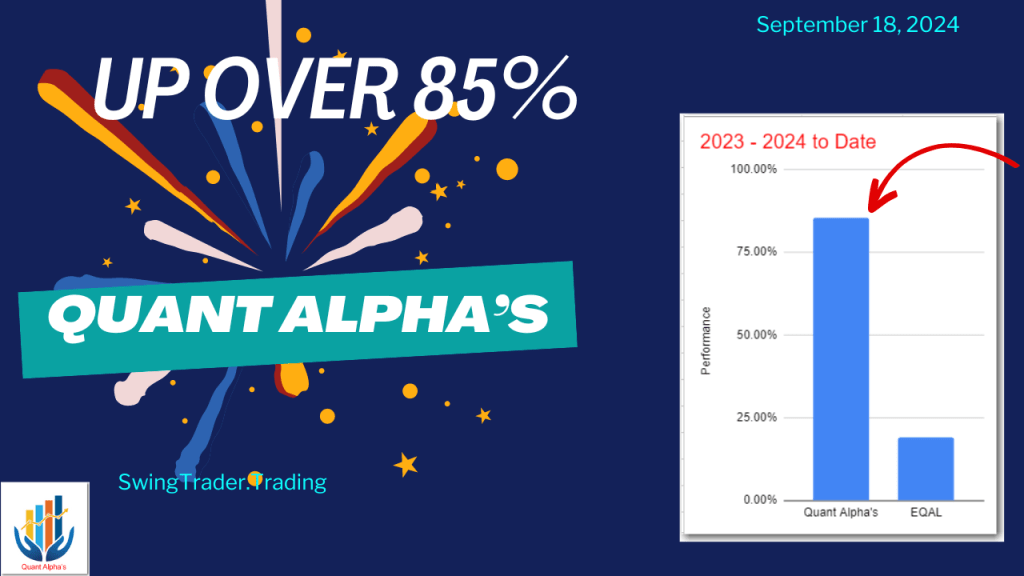

Up 85% – Quant Alpha’s Portfolio Update 09/18/2024

The Model Portfolio Quant Alpha was updated with the addition of Rush Street Interactive and the removals of Pactiv Evergreen and Caterpillar, now totaling 25 stocks. The portfolio, using Quant scores for stock selection, has outperformed its benchmark, EQAL, with an 85% increase for 2023-2024. Notable performers include Super Micro, POWL, and ANF. The strategy…

-

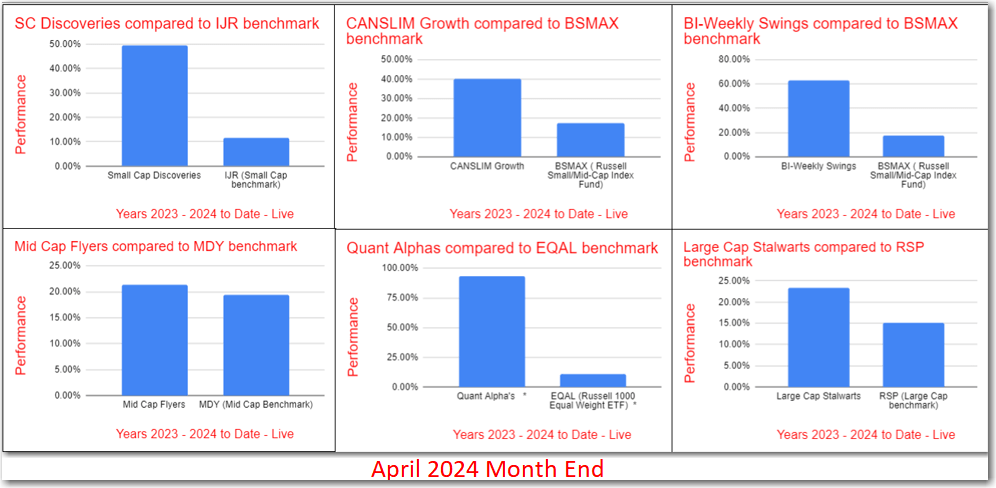

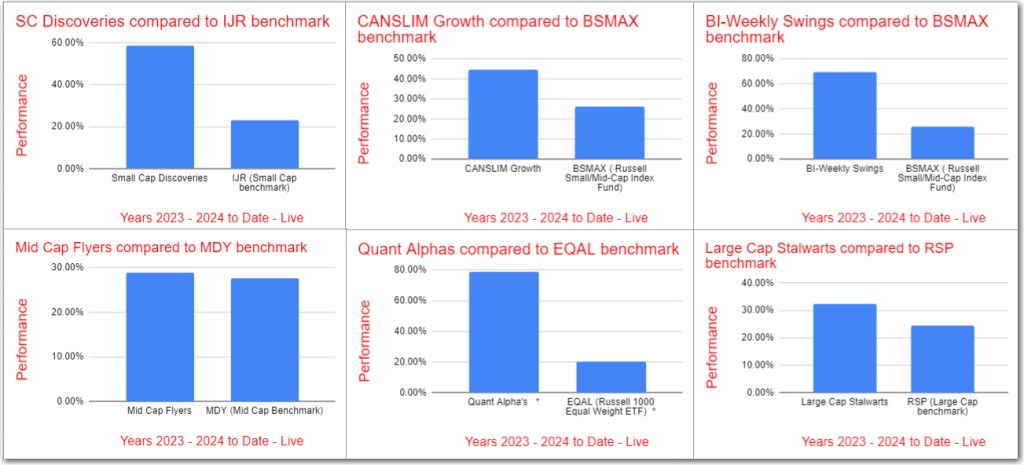

August 2024 Summary – Outperformance continues

In August 2024, stock market indexes had mixed results. All model portfolios exceeded their benchmarks, with Quant Alpha’s leading at 79%, while other portfolios also showed strong performance, beating their respective benchmarks. This information is for informational purposes only and does not constitute financial advice.

-

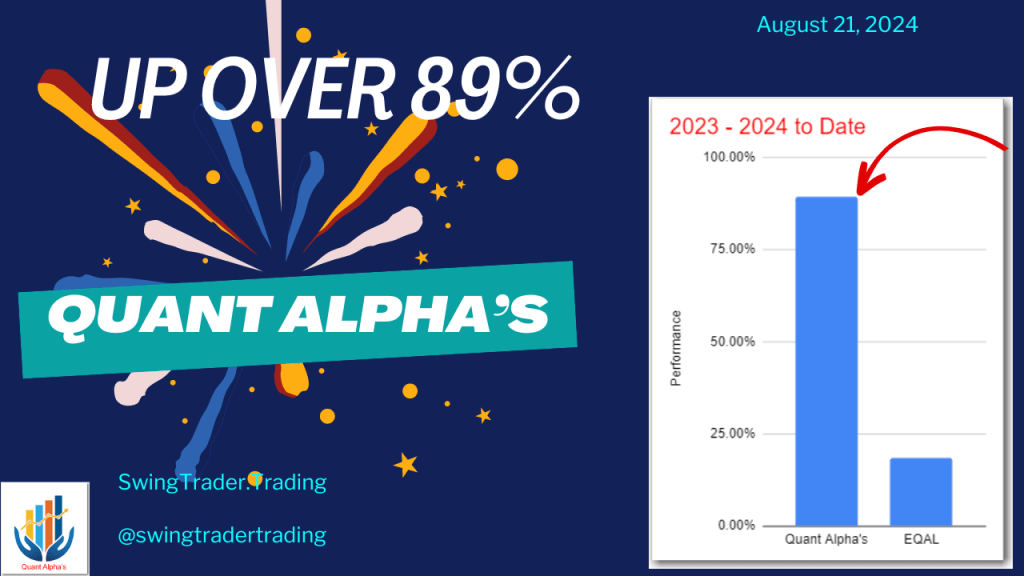

Up 89% – Quant Alpha’s Portfolio Update 08/21/2024

The Model Portfolio Quant Alpha’s was updated this morning with a new stock added and a stock removed. The portfolio now holds 26 stocks, using Quant scores for selection. It has outperformed the EQAL benchmark, achieving an 89% increase and beating the benchmark by 70% for 2023-2024.

-

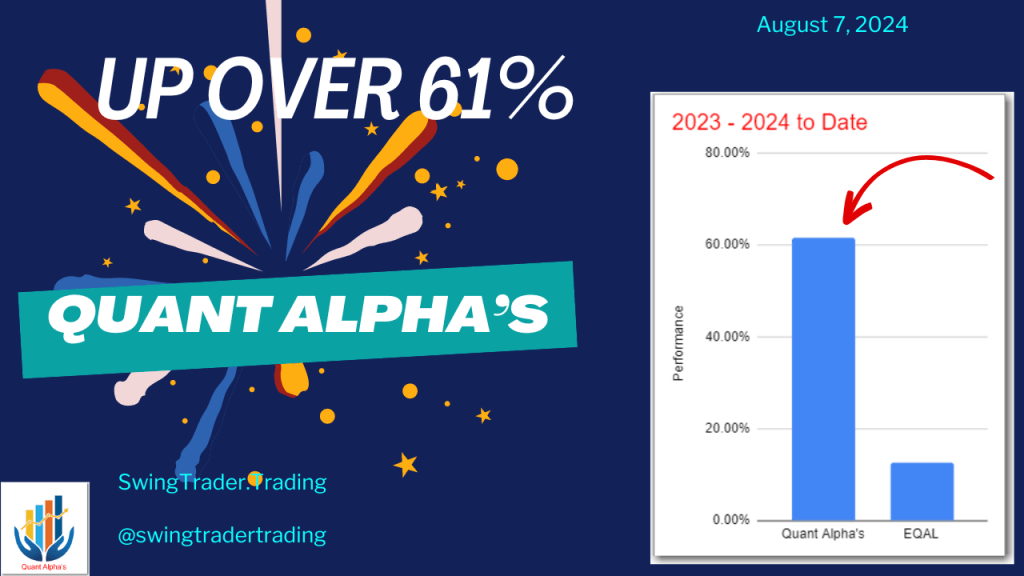

Up 61% – Quant Alpha’s Portfolio Update 08/07/2024

The updated Model Portfolio Quant Alpha’s includes 26 stocks based on Quant scores and specific criteria. It does not include micro-cap stocks, emphasizes high liquidity, and limits stocks to USA/Canada headquarters. The portfolio outperformed the EQAL benchmark by 39%, with standout performers such as SMCI, POWL, and ANF. Notable recent addition: WGS (GeneDx Holdings).

-

July 2024 Summary – Outperformance continues

In the stock market this month, benchmarks showed positive results. The Model Portfolios are ahead of their benchmarks for the 2023-2024 period. Quant Alpha’s is up over 96%, outperforming its benchmark by 77%. BI-Weekly Swings and Small Cap Discoveries also outperformed their benchmarks. .

-

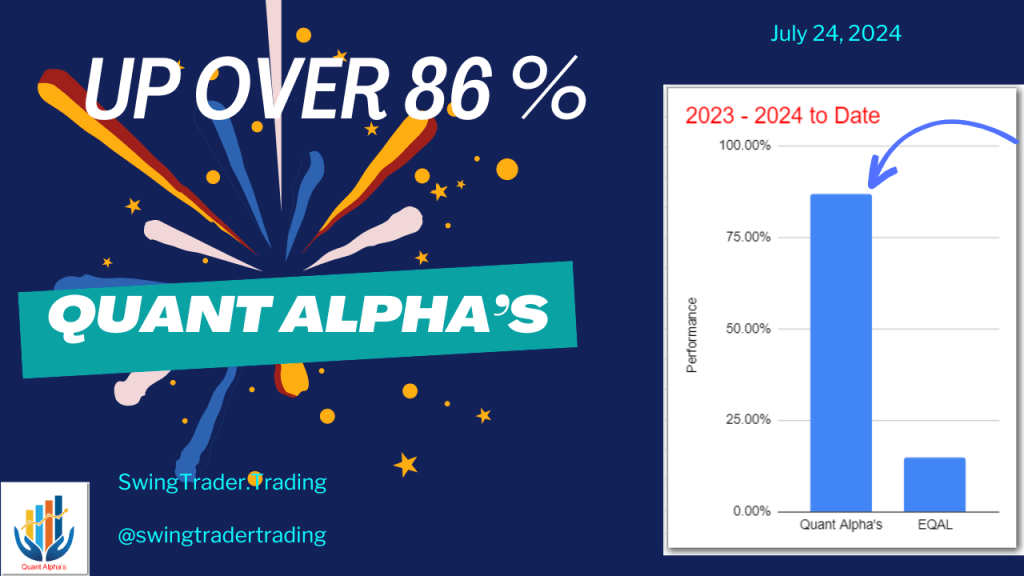

Up 86% – Quant Alpha’s Portfolio Update 07/24/2024

Quant Alpha’s Portfolio update. Outperforming in 2023. – 2024

-

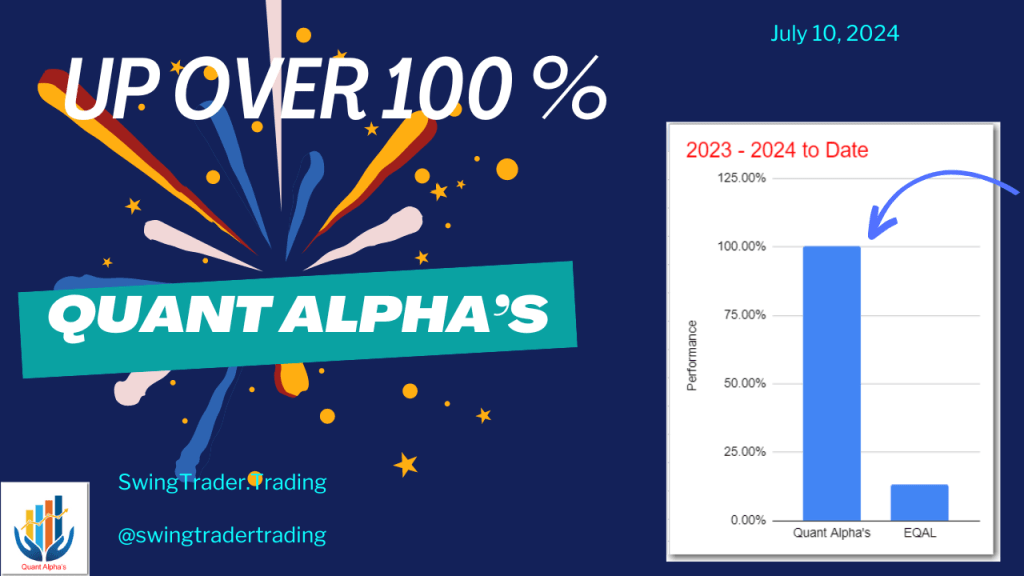

Up 100% – Quant Alpha’s Portfolio Update 07/10/2024

Quant Alpha’s Portfolio update. Outperforming in 2023. – 2024

-

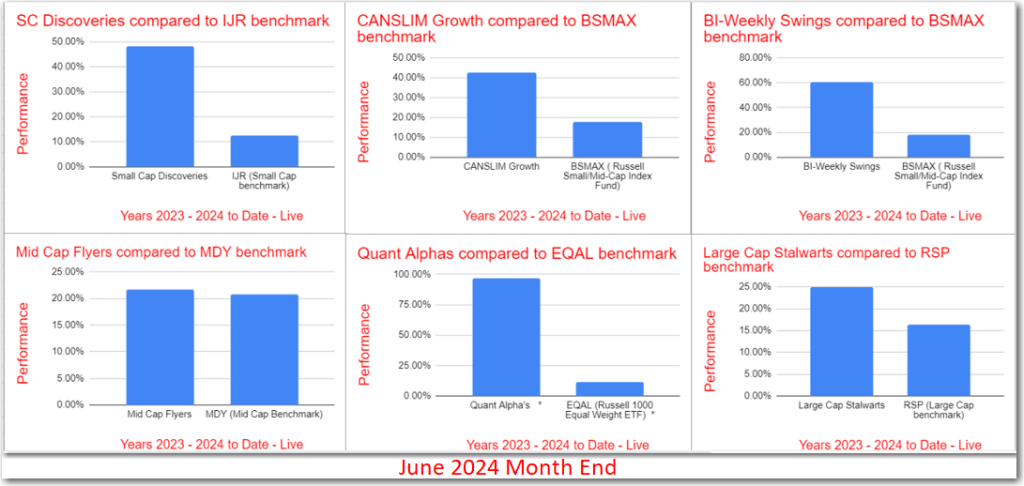

June 2024 Summary – Outperformance is maintained

The Month End summary for SwingTrader.Trading. Outperformance is maintained.

-

Up 96% – Quant Alpha’s Portfolio Update 06/26/2024

Quant Alpha’s Portfolio update. Outperforming in 2023. – 2024

-

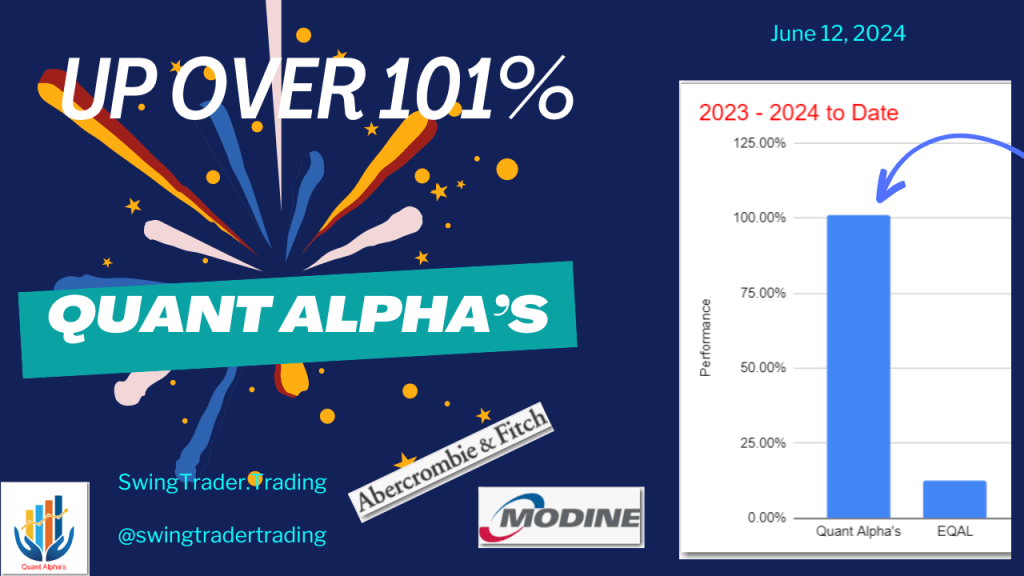

Quant Alpha’s Portfolio Update 06/12/2024 – Up over 101% in 2023-2024

Quant Alpha’s Portfolio update. Outperforming in 2023. – 2024

-

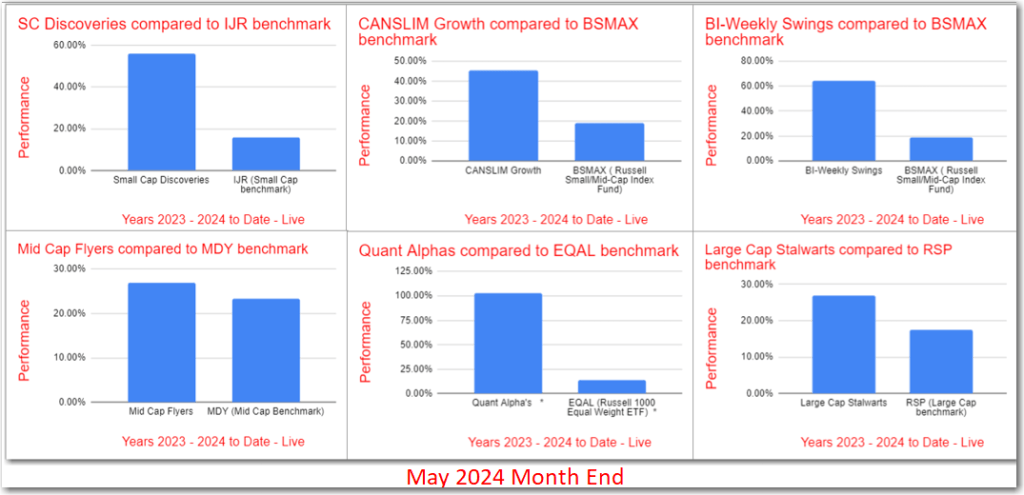

May 2024 Summary – Outperformance increases

The Month End summary for SwingTrader.Trading. Outperformance increases.

-

Quant Alpha’s Portfolio Update 05/15/2024 – Up over 113% in 2023-2024

Quant Alpha’s Portfolio update. Outperforming in 2023. – 2024

-

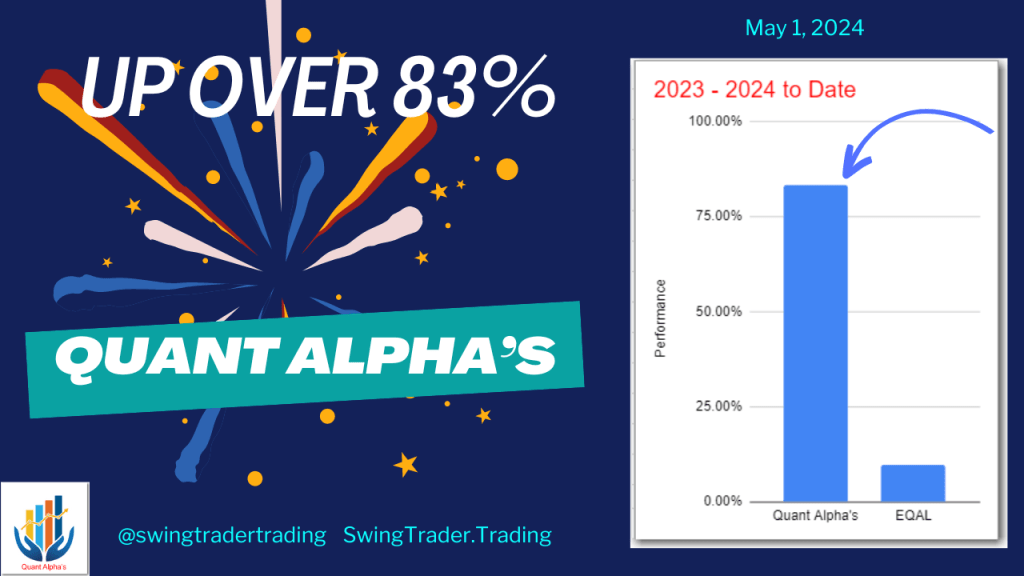

Quant Alpha’s Portfolio Update 05/01/2024 – Up over 83% in 2023-2024

Quant Alpha’s Portfolio update. Outperforming in 2023. – 2024

-

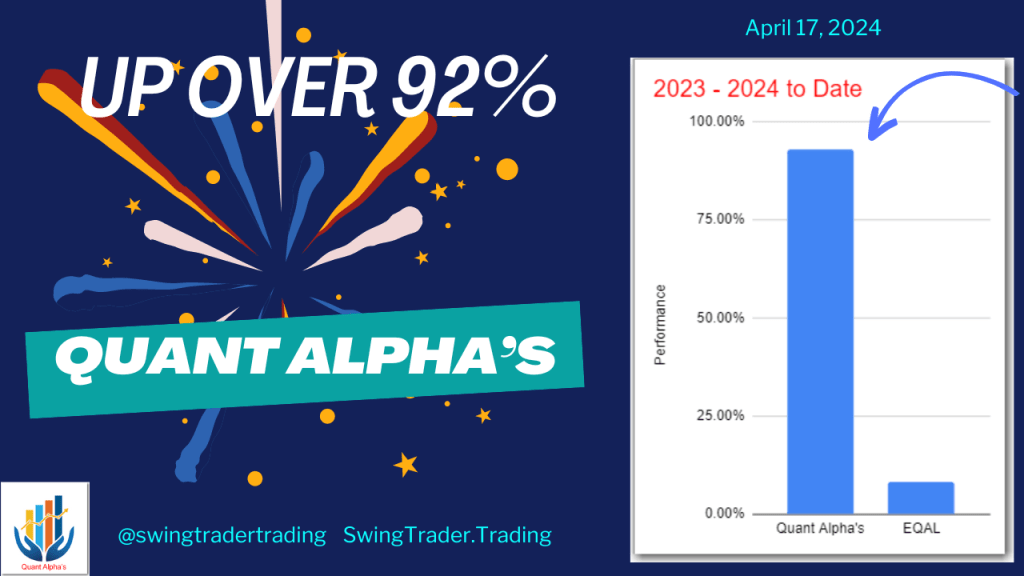

Quant Alpha’s Portfolio Update 04/17/2024 – Up over 92% in 2023-2024

Quant Alpha’s Portfolio update. Outperforming in 2023. – 2024

-

Quant Alpha’s Portfolio Update 04/03/2024 – Up over 112% in 2023-2024

Quant Alpha’s Portfolio update. Outperforming in 2023. – 2024