Tag: stock portfolio

-

Up 41% – CANSLIM Growth Portfolio Update – March 2025

The CANSLIM Growth Model Portfolio is up over 41% in 2023-2025 and is 20% ahead of it s benchmark BSMAX. The CANSLIM Growth Model Portfolio was updated this weekend. New Adds of 0 stocks were made and Removals of 1 stock was made. All prices are as of 03/28/2025. A total of 6 stocks are…

-

Up 67% – BI-Weekly Swings Update – 03/28/2025

The BI-Weekly Swings Portfolio is up 67% 2023-2025 and is 47% ahead of its benchmark BSMAX. The Model Portfolio BI-Weekly Swings was updated this morning. No new Adds were made and Removals of 2 stocks were made. All prices are as of 03/28/2025. A total of 6 stocks are in the Portfolio. Add – New…

-

Up 66% – BI-Weekly Swings Update – 03/14/2025

The BI-Weekly Swings Portfolio is up 66% 2023-2025 and is 48% ahead of its benchmark BSMAX. The Model Portfolio BI-Weekly Swings was updated this morning. No new Adds were made and Removals of 7 stocks were made. All prices are as of 03/14/2025. A total of 8 stocks are in the Portfolio. Add – New…

-

Up 43% – CANSLIM Growth Portfolio Update -February 2025

The CANSLIM Growth Model Portfolio is up over 43% in 2023-2025 and is 19% ahead of it s benchmark BSMAX. The CANSLIM Growth Model Portfolio was updated this weekend. New Adds of 0 stocks were made and Removals of 12 stocks were made. All prices are as of 02/28/2025. A total of 7 stocks are…

-

February 2025 – Model Stock Portfolios Update – Entering the Wrap-up Phase

Today marks the beginning of a two month long wrap-up of the live update posts for the six Model Portfolios. During the next two months, only Removes from the six model portfolios will be posted but no new Adds will be made. At the end of April 2025, the final monthly report will be made…

-

Up 70% – BI-Weekly Swings Update – 02/27/2025

The BI-Weekly Swings Portfolio is up 70% 2023-2025 and is 48% ahead of its benchmark BSMAX. The Model Portfolio BI-Weekly Swings was updated this morning. New Adds of 4 stocks were made and Removals of 4 stocks were made. All prices are as of 02/27/2025. A total of 15 stocks are in the Portfolio. The BI-Weekly…

-

Up 76% – BI-Weekly Swings Update – 02/13/2025

The BI-Weekly Swings Portfolio has grown 76% from 2023 to 2025, outperforming its benchmark BSMAX by 48%. Comprising 15 stocks, it employs three strategies focused on Mid Cap, Small Cap, and Micro Cap investing. Recent updates included adding two stocks and removing four, reflecting its dynamic management approach.

-

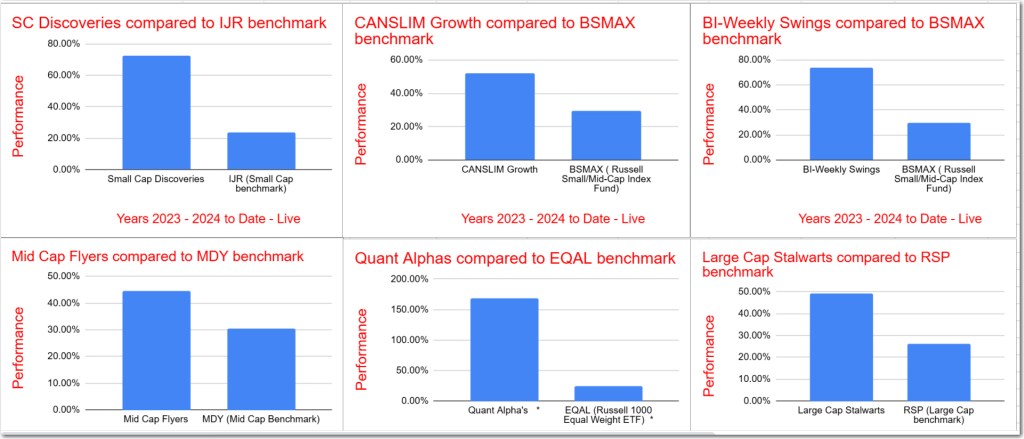

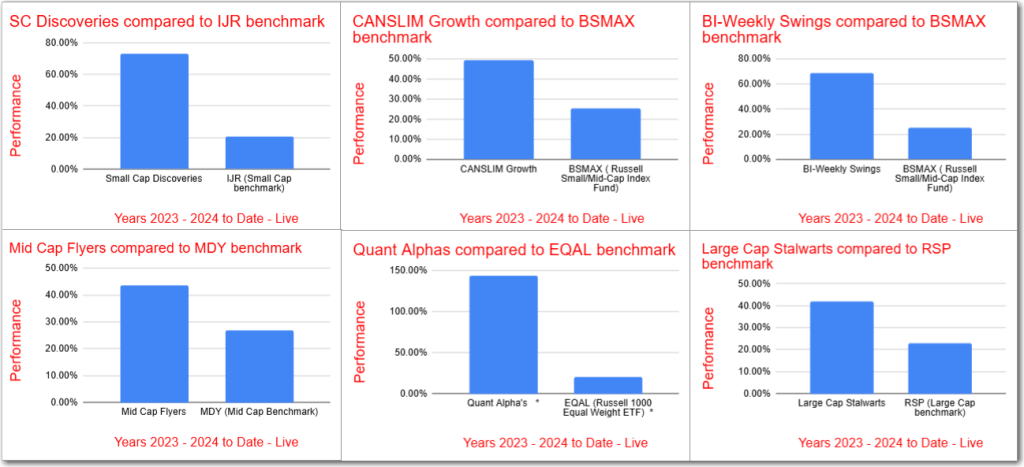

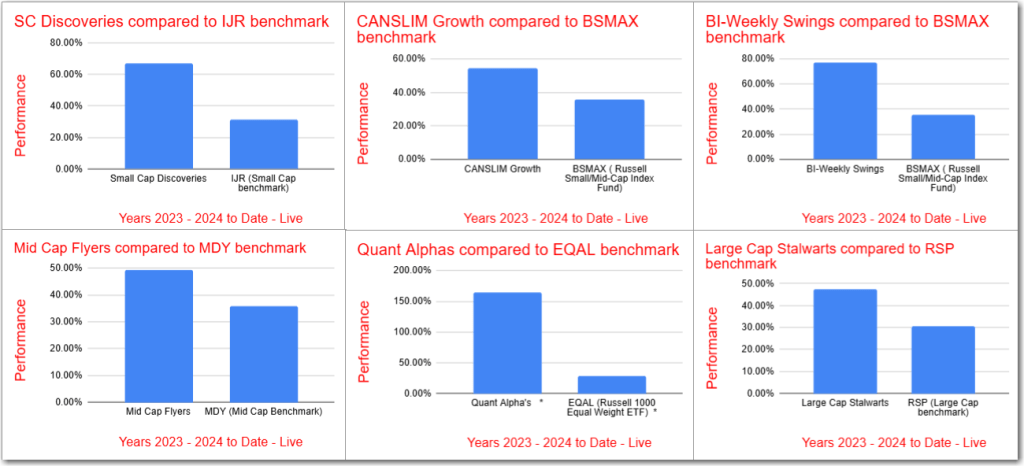

January 2025 – Model Stock Portfolios Outperformance increases

All Model Portfolios significantly outperformed their benchmarks for the 2023-2025 period, with Quant Alpha leading at over 168%, exceeding EQAL by 143%. Active contributors included POWL (+330%), ANF (+137%), and CLS (+427%). The BI-Weekly Swings rose 73%, surpassing BSMAX by 44%, driven by APEI and RAIL. Small Cap Discoveries and CANSLIM Growth were up 72%…

-

Up 74% – BI-Weekly Swings Update – 01/30/2025

The BI-Weekly Swings Portfolio has achieved a 74% gain from 2023 to 2025, outperforming its benchmark BSMAX by 45%. It includes 17 stocks with bi-weekly updates, utilizing strategies centered on earnings metrics. Notably, it outperformed benchmarks in 15 of 19 years tested, with the best year being 2016 at an 86% increase.

-

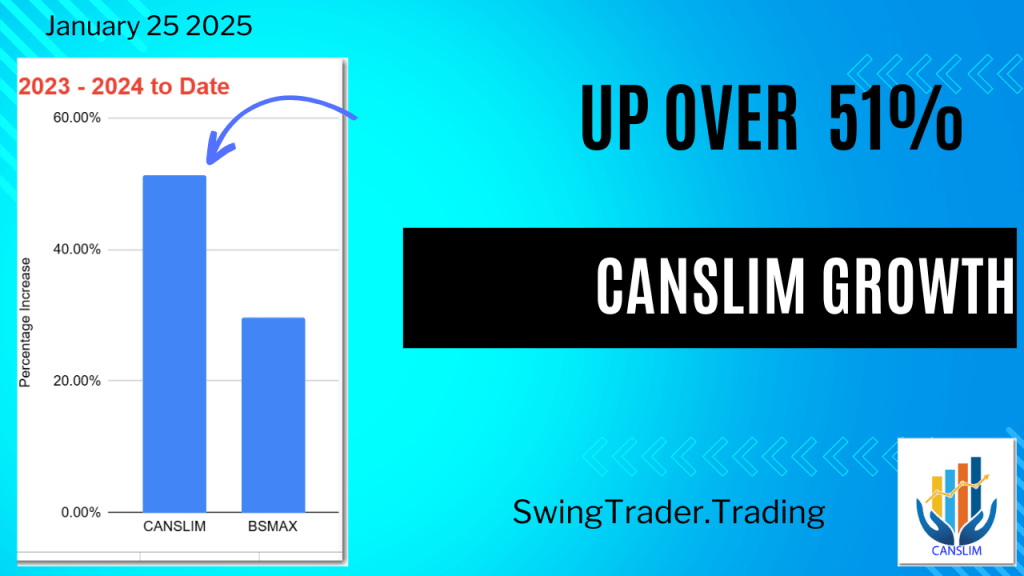

Up 51% – CANSLIM Growth Portfolio Update -January 2025

The CANSLIM Growth Model Portfolio has increased by over 51% in 2023-2024, significantly surpassing its benchmark BSMAX by 21%. The portfolio, consisting of 20 stocks, uses the CANSLIM approach focused on earnings per share, return on equity, and sales growth. Recent changes included adding six stocks and removing five.

-

Up 72% – BI-Weekly Swings Update – 01/16/2025

The BI-Weekly Swings Portfolio has risen 72% from 2023-2025, outperforming its benchmark BSMAX by 45%. It includes 18 stocks, with recent additions of 4 and removals of 3. The Portfolio implements three strategies focusing on earnings trends and has outperformed historical benchmarks in most tested years, with 2016 as its best year.

-

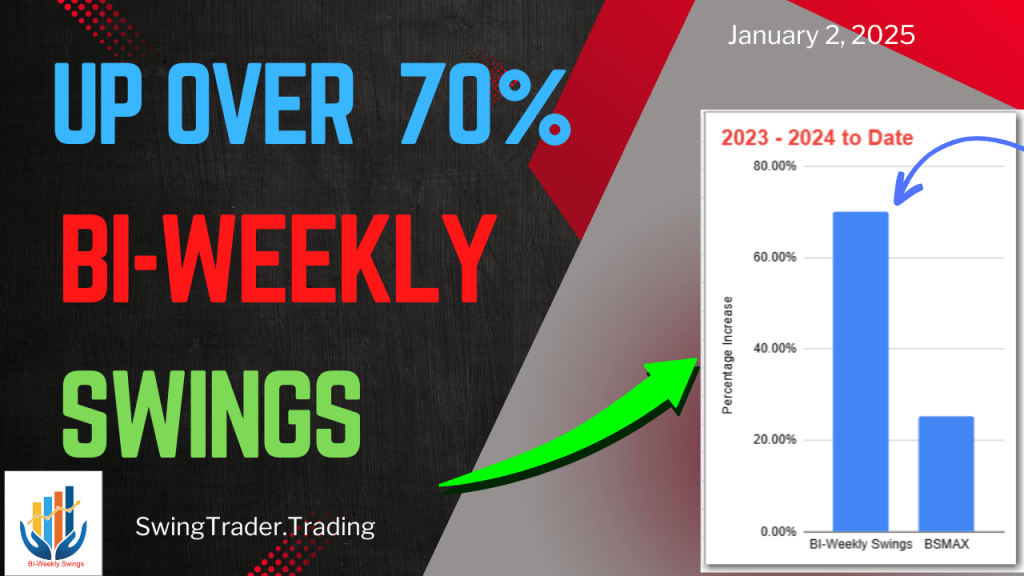

Up 70% – BI-Weekly Swings Update – 01/02/2025

The BI-Weekly Swings Portfolio has achieved a 70% return from 2023-2025, surpassing its benchmark, BSMAX, by 44%. The portfolio consists of 17 stocks, updated bi-weekly, utilizing multiple strategies focusing on EPS, ROE, and relative strength. Backtests show it outperformed benchmarks in 15 of 19 years tested.

-

December 2024 – Model Stock Portfolios Outperformance increases

All Model Portfolios outperformed their benchmarks for 2023-2024, led by Quant Alpha’s impressive 144% return. Other portfolios also showed significant gains: BI-Weekly Swings at 68%, Small Cap Discoveries at 73%, and CANSLIM Growth at 49%. Despite a market sell-off, five portfolios improved their relative performances.

-

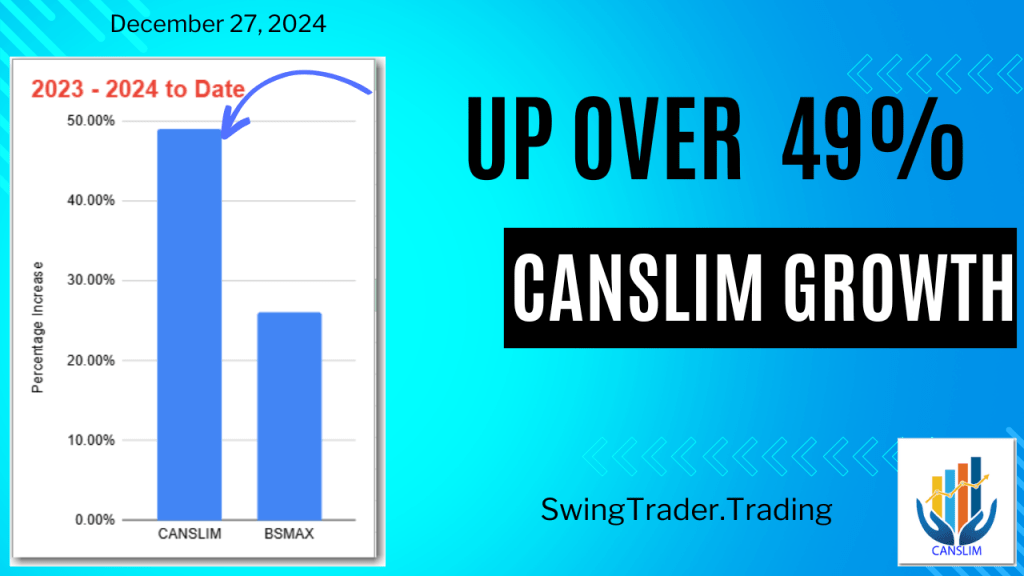

Up 49% – CANSLIM Growth Portfolio Update December 2024

The CANSLIM Growth Model Portfolio has risen over 49% in 2023-2024, outperforming the BSMAX benchmark by 23%. Recent updates added 2 stocks and removed 3, with 19 stocks now in the portfolio. Backtesting shows consistent outperformance across 18 of 19 years, highlighting the effectiveness of the CANSLIM strategy.

-

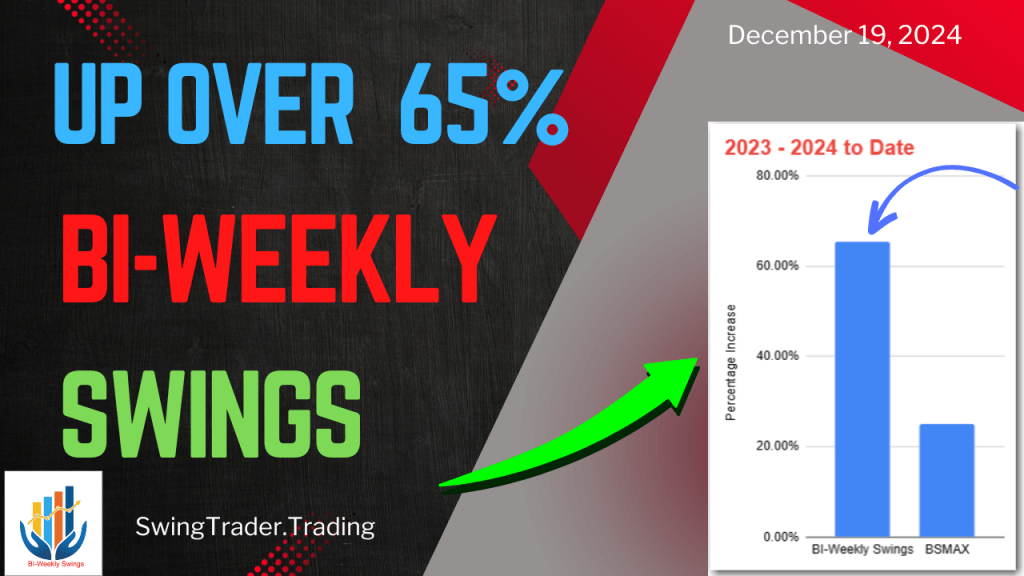

Up 65% – BI-Weekly Swings Update – 12/19/2024

The BI-Weekly Swings Portfolio has achieved a remarkable 65% growth in 2023-2024, surpassing its benchmark BSMAX by 45%. Updated bi-weekly, it now holds 16 stocks, incorporating three distinct strategies focusing on mid, small, and micro-cap stocks. Recent adjustments included adding three stocks and removing eight. Backtesting indicates consistent historical outperformance.

-

Up 78% – BI-Weekly Swings Update – 12/05/2024

The BI-Weekly Swings Model Portfolio was updated with five new stocks added and five removed, maintaining 21 stocks total. Since its inception in 2023, the portfolio has risen 78%, outperforming the BSMAX benchmark by 42%. Various strategies focus on mid, small, and micro-cap stocks, showing consistent strong performance.

-

November 2024 Summary – Outperformance increases

All Model Portfolios have exceeded their benchmarks for the 2023-2024 period, showing impressive gains. The Quant Alpha’s Portfolio leads with over 165% growth, outperforming its benchmark by 136%. Active stocks like POWL and ANF have significantly contributed to this outperformance. Other portfolios also performed well, with the BI-Weekly Swings up 77%, Small Cap Discoveries up…

-

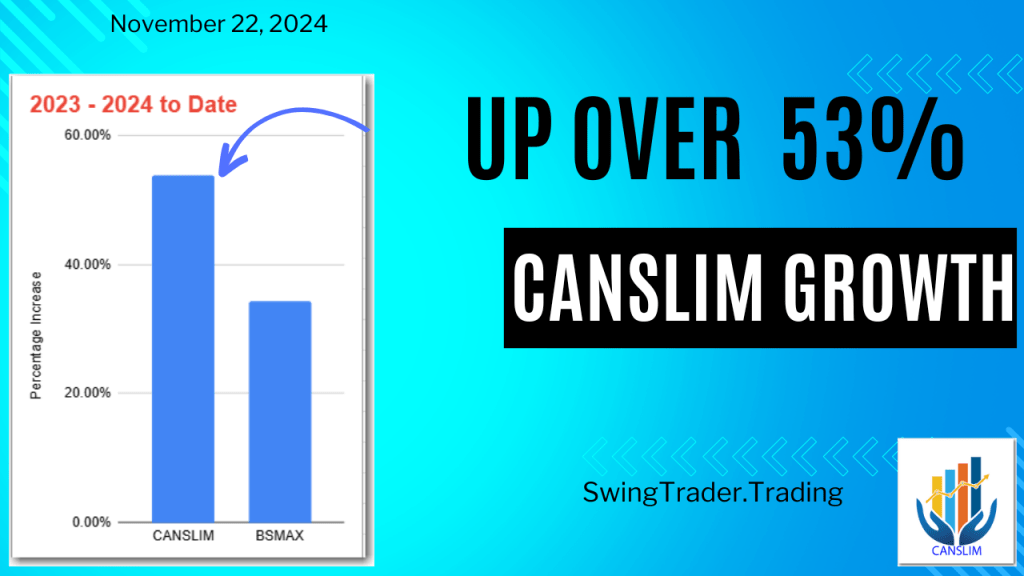

Up 53% – CANSLIM Growth Portfolio Update November 2024

The CANSLIM Growth Model Portfolio was updated this weekend. New Adds of 8 stocks were made and Removals of 5 stocks were made. All prices are as of 11/22/2024. A total of 20 stocks are in the Portfolio. The CANSLIM Growth Model Portfolio is up over 53% in 2023-2024 and is 19% ahead of its…

-

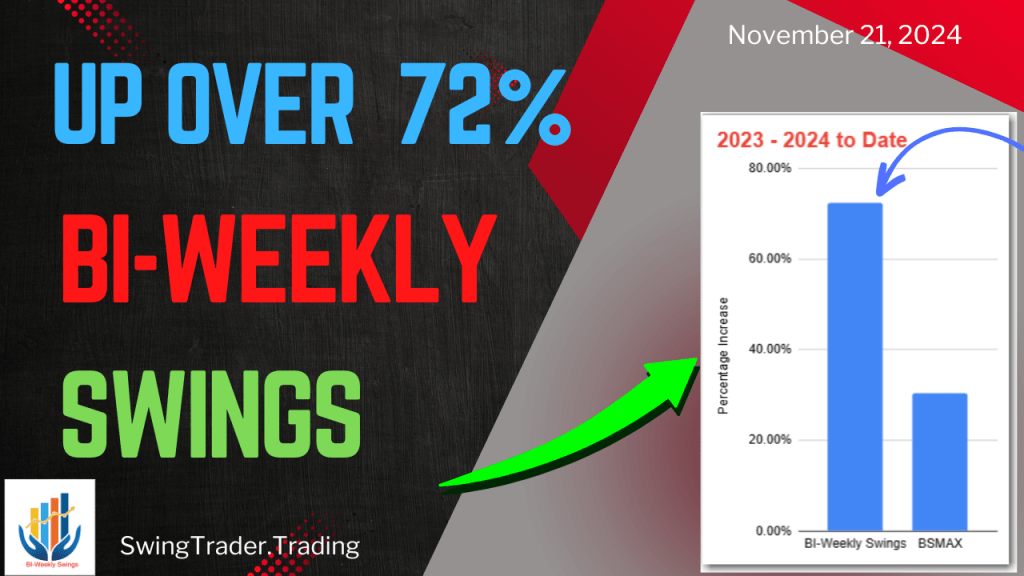

Up 72% – BI-Weekly Swings Update – 11/21/2024

The Model Portfolio BI-Weekly Swings, updated on 11/21/2024, added and removed six stocks, maintaining a total of 21. It has achieved a remarkable 72% increase from 2023-2024, outperforming the BSMAX benchmark by 39%. The portfolio uses a blend of strategies focused on various stock caps and key financial metrics.

-

Up 76% – BI-Weekly Swings Update – 11/07/2024

The Model Portfolio BI-Weekly Swings updated on 11/07/2024, adding and removing six stocks, now comprising 21 in total. It boasts a 76% gain since 2023, outperforming its benchmark BSMAX by 44%. The portfolio employs three strategies focusing on EPS and ROE metrics for stock selection and has historically excelled in backtests.