Tag: stocks

-

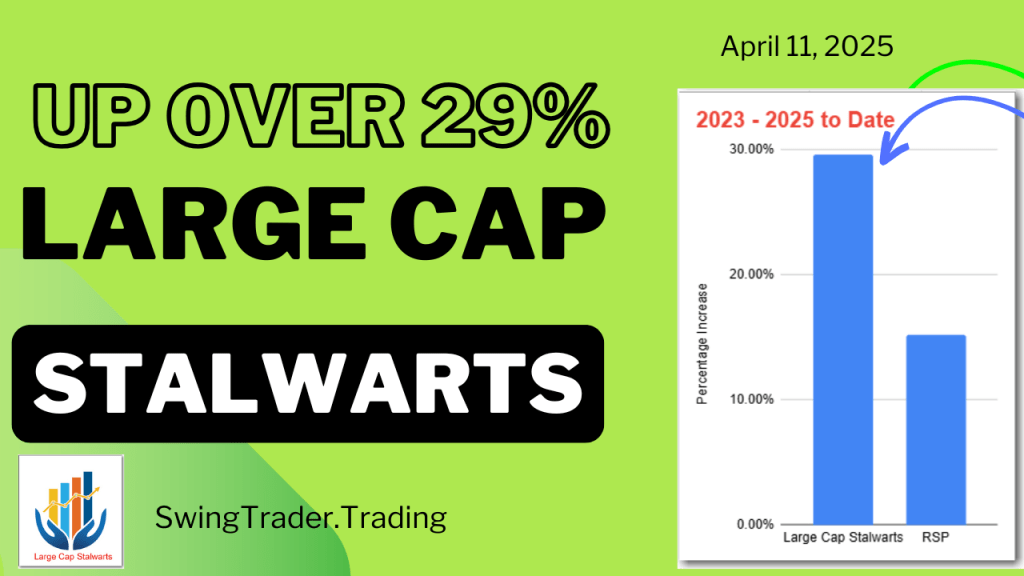

Up 29% – Large Cap Stalwarts Update – April 2025

The Model Portfolio Large Cap Stalwarts continues its outperformance over its benchmark RSP ( S&P 500 Equal Weight ETF). It is now up 29% since it went live in 2023. This is 14% ahead of its benchmark RSP. The Model Portfolio Large Cap Stalwarts was updated this weekend. No new Adds were made and Removals of 12…

-

Up 32% – Large Cap Stalwarts Update – March 2025

The Model Portfolio Large Cap Stalwarts continues its outperformance over its benchmark RSP ( S&P 500 Equal Weight ETF). It is now up 32% since it went live in 2023. This is 11% ahead of its benchmark RSP. The Model Portfolio Large Cap Stalwarts was updated this weekend. No new Adds were made and Removals of 4…

-

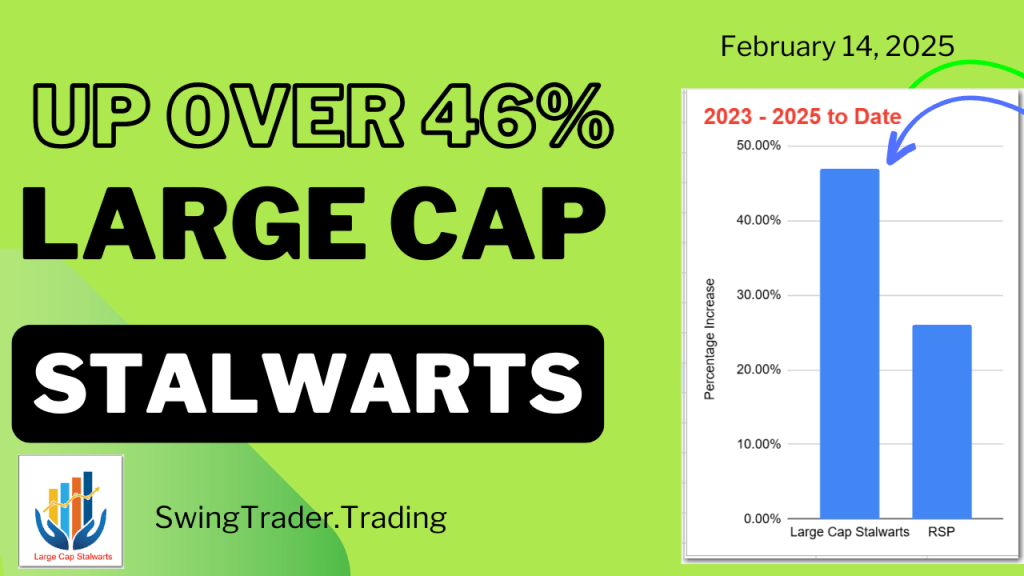

Up 46% – Large Cap Stalwarts Update – February 2025

The Model Portfolio Large Cap Stalwarts has surpassed its benchmark, the RSP, by 20% with a 46% increase since launch in 2023. Recently updated, it now includes 17 stocks after adding 9 and removing 10. Historically, it outperformed the RSP in 12 of the past 19 years tested.

-

Up 76% – BI-Weekly Swings Update – 02/13/2025

The BI-Weekly Swings Portfolio has grown 76% from 2023 to 2025, outperforming its benchmark BSMAX by 48%. Comprising 15 stocks, it employs three strategies focused on Mid Cap, Small Cap, and Micro Cap investing. Recent updates included adding two stocks and removing four, reflecting its dynamic management approach.

-

Up 74% – BI-Weekly Swings Update – 01/30/2025

The BI-Weekly Swings Portfolio has achieved a 74% gain from 2023 to 2025, outperforming its benchmark BSMAX by 45%. It includes 17 stocks with bi-weekly updates, utilizing strategies centered on earnings metrics. Notably, it outperformed benchmarks in 15 of 19 years tested, with the best year being 2016 at an 86% increase.

-

Up 72% – BI-Weekly Swings Update – 01/16/2025

The BI-Weekly Swings Portfolio has risen 72% from 2023-2025, outperforming its benchmark BSMAX by 45%. It includes 18 stocks, with recent additions of 4 and removals of 3. The Portfolio implements three strategies focusing on earnings trends and has outperformed historical benchmarks in most tested years, with 2016 as its best year.

-

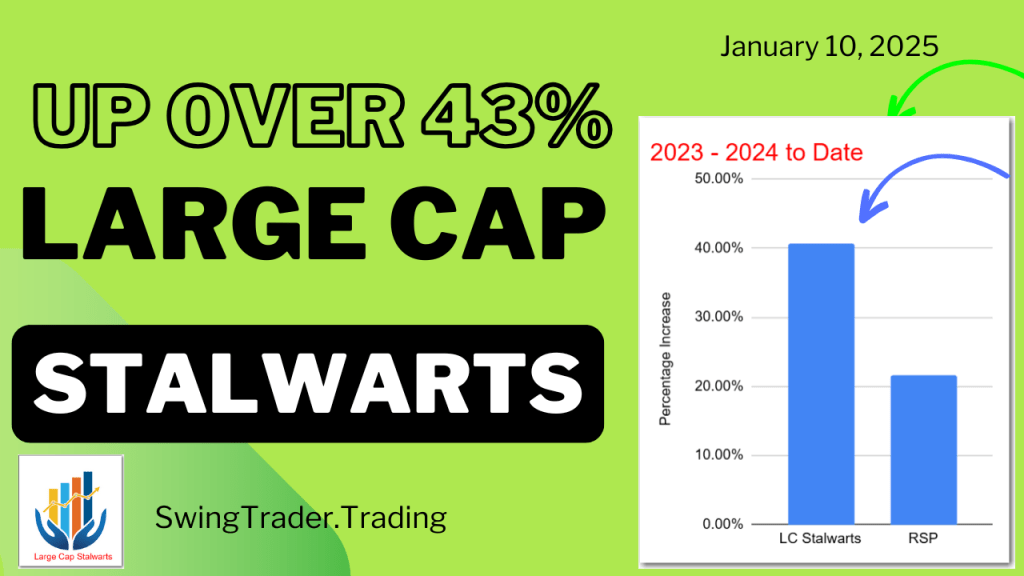

Up 43% – Large Cap Stalwarts Update – January 2025

The Large Cap Stalwarts Model Portfolio has outperformed its RSP benchmark by 22%, achieving a 43% gain since its 2023 launch. Recent updates included the addition of 7 stocks and removal of 8, bringing the total to 18. Historical backtests show consistent outperformance in most years, with significant gains achieved.

-

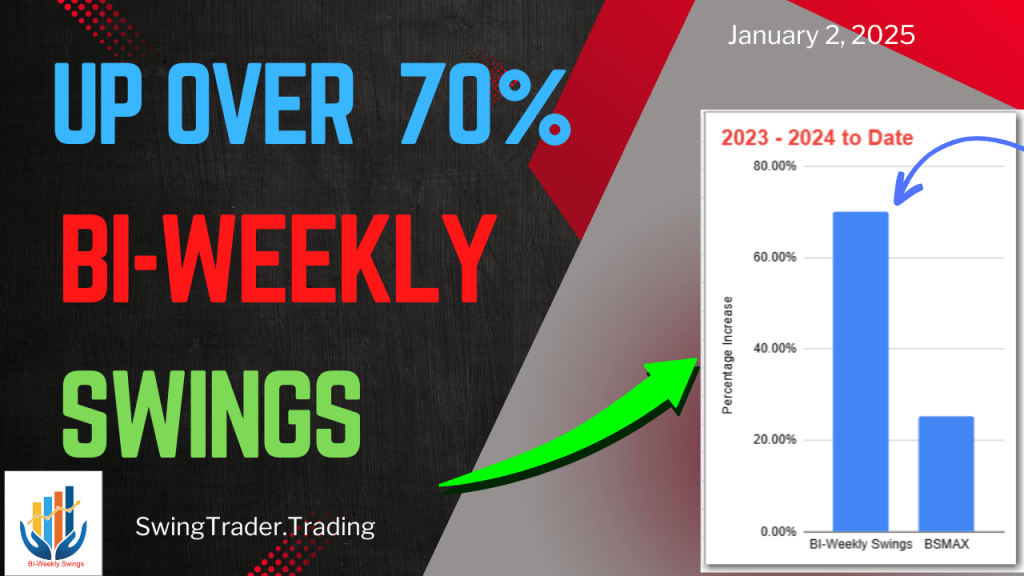

Up 70% – BI-Weekly Swings Update – 01/02/2025

The BI-Weekly Swings Portfolio has achieved a 70% return from 2023-2025, surpassing its benchmark, BSMAX, by 44%. The portfolio consists of 17 stocks, updated bi-weekly, utilizing multiple strategies focusing on EPS, ROE, and relative strength. Backtests show it outperformed benchmarks in 15 of 19 years tested.

-

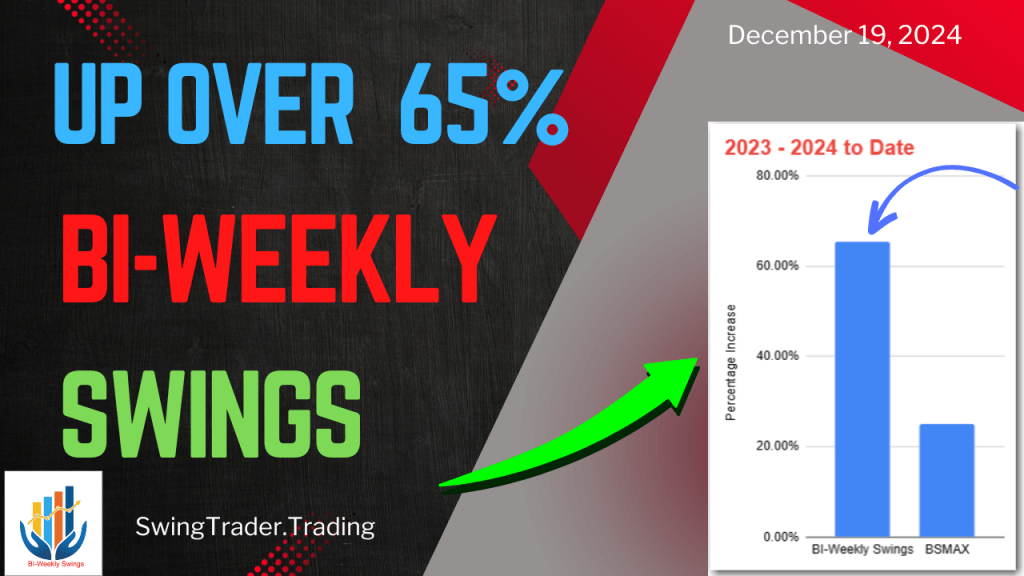

Up 65% – BI-Weekly Swings Update – 12/19/2024

The BI-Weekly Swings Portfolio has achieved a remarkable 65% growth in 2023-2024, surpassing its benchmark BSMAX by 45%. Updated bi-weekly, it now holds 16 stocks, incorporating three distinct strategies focusing on mid, small, and micro-cap stocks. Recent adjustments included adding three stocks and removing eight. Backtesting indicates consistent historical outperformance.

-

Up 46% – Large Cap Stalwarts Update – December 2024

The Model Portfolio Large Cap Stalwarts has outperformed its RSP benchmark by 19%, with a 46% increase since its inception in 2023. Recent updates included the addition of five stocks and removal of six. The portfolio generally outperformed the RSP in 12 out of 19 backtested years, with notable successes.

-

Up 78% – BI-Weekly Swings Update – 12/05/2024

The BI-Weekly Swings Model Portfolio was updated with five new stocks added and five removed, maintaining 21 stocks total. Since its inception in 2023, the portfolio has risen 78%, outperforming the BSMAX benchmark by 42%. Various strategies focus on mid, small, and micro-cap stocks, showing consistent strong performance.

-

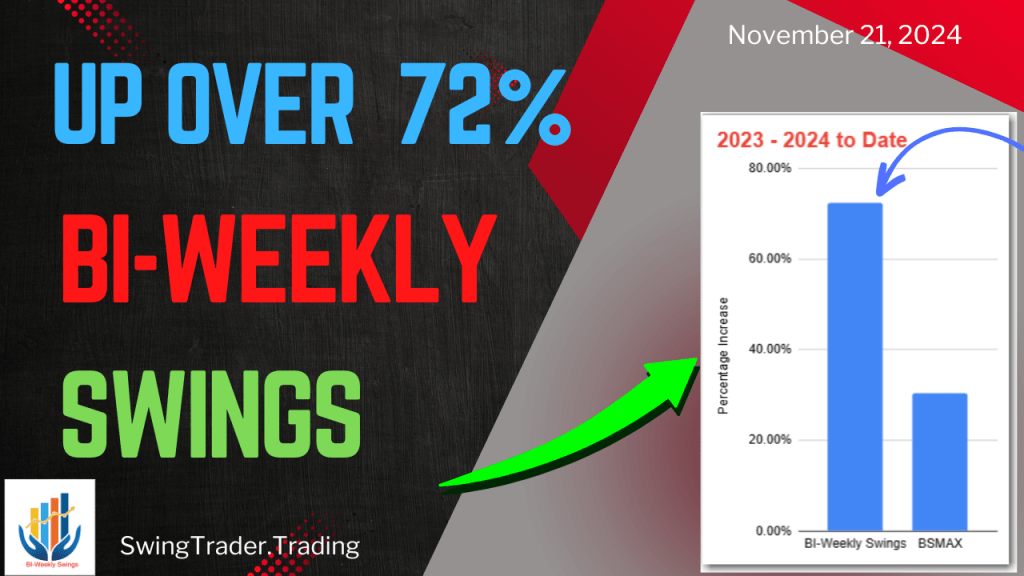

Up 72% – BI-Weekly Swings Update – 11/21/2024

The Model Portfolio BI-Weekly Swings, updated on 11/21/2024, added and removed six stocks, maintaining a total of 21. It has achieved a remarkable 72% increase from 2023-2024, outperforming the BSMAX benchmark by 39%. The portfolio uses a blend of strategies focused on various stock caps and key financial metrics.

-

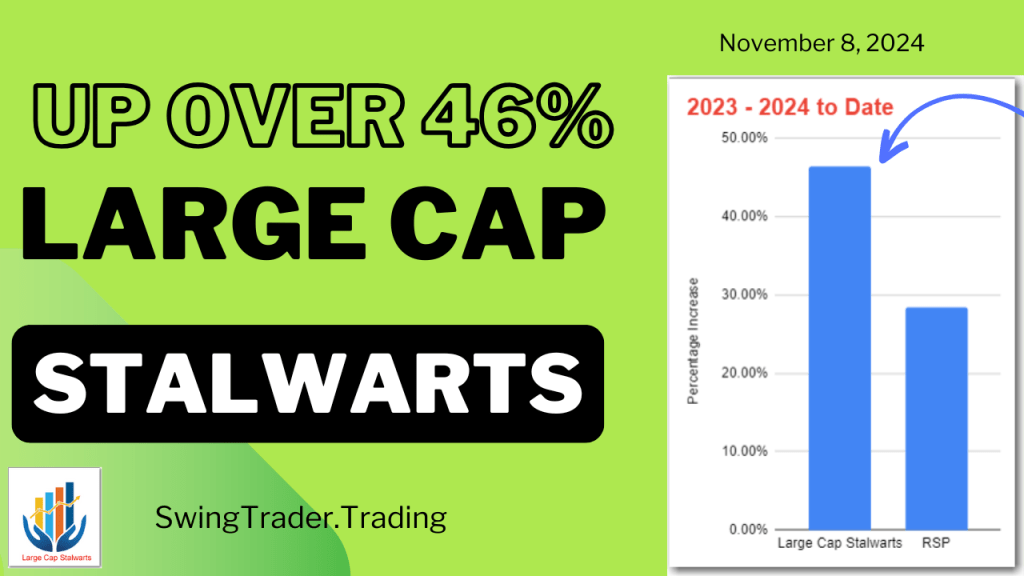

Up 46% – Large Cap Stalwarts Update – November 2024

The Model Portfolio Large Cap Stalwarts was updated this weekend. New Adds of 7 stocks were made and 6 Removals of stocks were made. All prices are as of 11/08/2024. A total of 18 stocks are in the Portfolio now. Add – APH, BLK, GRMN, NTRS, PGR, SYF, ZBRA Remove – CPT, DVA, EXPE, HCA,…

-

Up 76% – BI-Weekly Swings Update – 11/07/2024

The Model Portfolio BI-Weekly Swings updated on 11/07/2024, adding and removing six stocks, now comprising 21 in total. It boasts a 76% gain since 2023, outperforming its benchmark BSMAX by 44%. The portfolio employs three strategies focusing on EPS and ROE metrics for stock selection and has historically excelled in backtests.

-

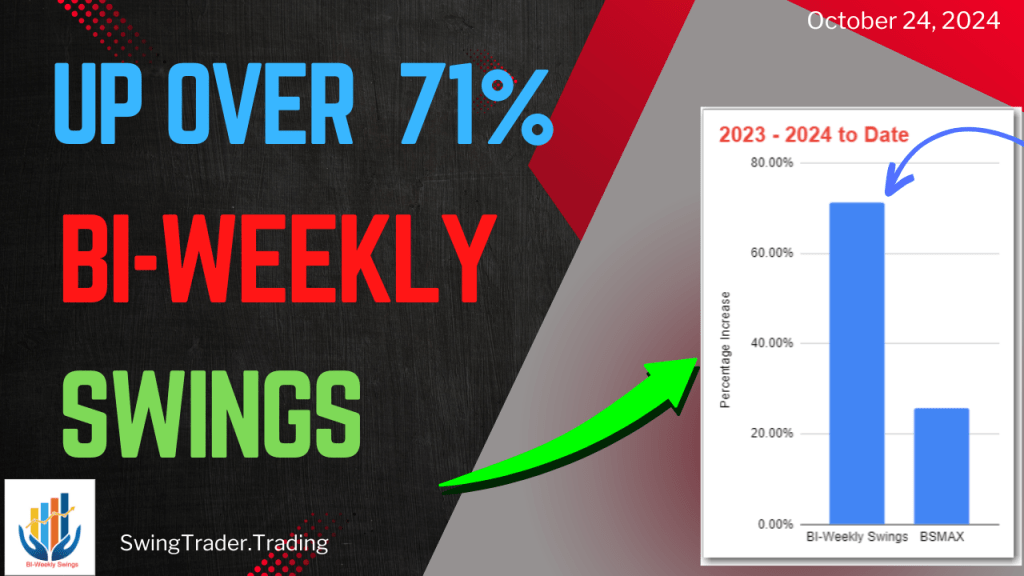

Up 71% – BI-Weekly Swings Update – 10/24/2024

The Model Portfolio BI-Weekly Swings was updated with five new stock additions and five removals, totaling 21 stocks. It has achieved a 71% return for 2023-2024, outperforming the BSMAX benchmark by 45%. Various strategies incorporating EPS and ROE are employed, with notable past performance across multiple years.

-

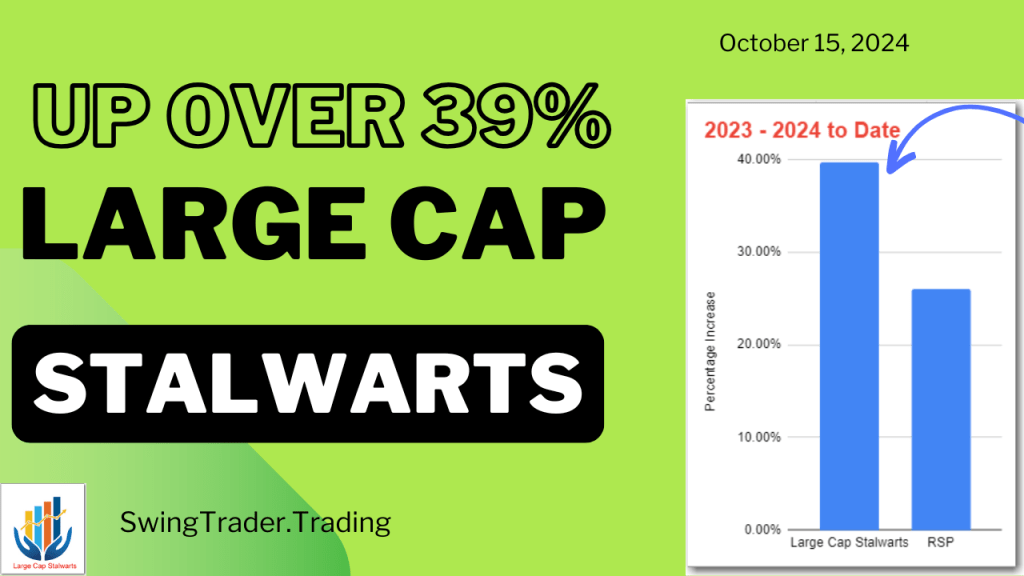

Up 39% – Large Cap Stalwarts Update – October 2024

The Model Portfolio Large Cap Stalwarts received updates this weekend, with six new stocks added (CCL, CF, EXPE, IP, NTAP, PODD) and four removed (CHRW, HWM, STX, UHS), totaling 17 stocks. As of 10/15/2024, the portfolio has risen 39% since its 2023 inception, outperforming the S&P 500 Equal Weight ETF benchmark by 13%. Backtests show…

-

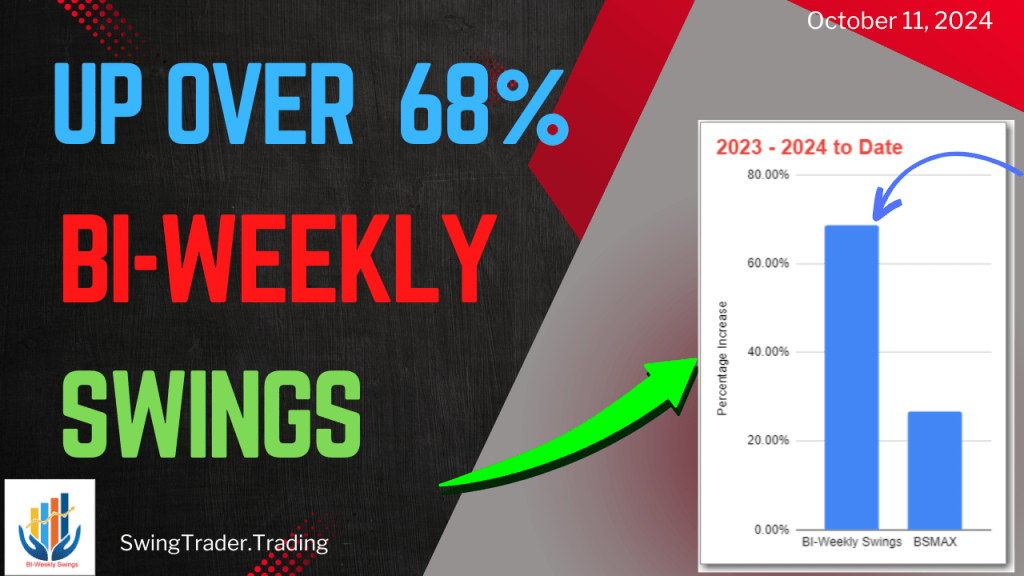

Up 68% – BI-Weekly Swings Update – 10/11/2024

The Model Portfolio BI-Weekly Swings was updated on 10/11/2024, adding and removing five stocks, resulting in a total of 21 stocks. The portfolio has recorded a 68% increase since 2023, outperforming its benchmark BSMAX by 42%. It employs three strategies focusing on Mid Cap, Small Cap, and Micro Cap stocks, utilizing criteria like EPS and…

-

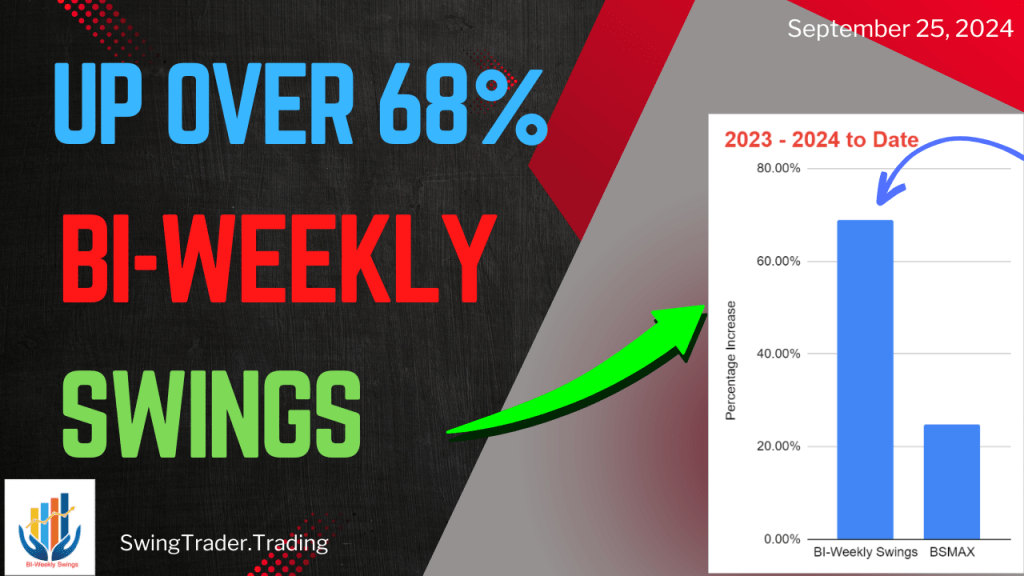

Up 68% – BI-Weekly Swings Update – 09/25/24

The Model Portfolio BI-Weekly Swings was updated this morning. New Adds of 5 stocks were made and Removals of 5 stocks were made. All prices are as of 09/25/2024. A total of 21 stocks are in the Portfolio. The BI-Weekly Swings Portfolio is up 68% 2023-2024 and is 43% ahead of its benchmark BSMAX. The BI-Weekly…

-

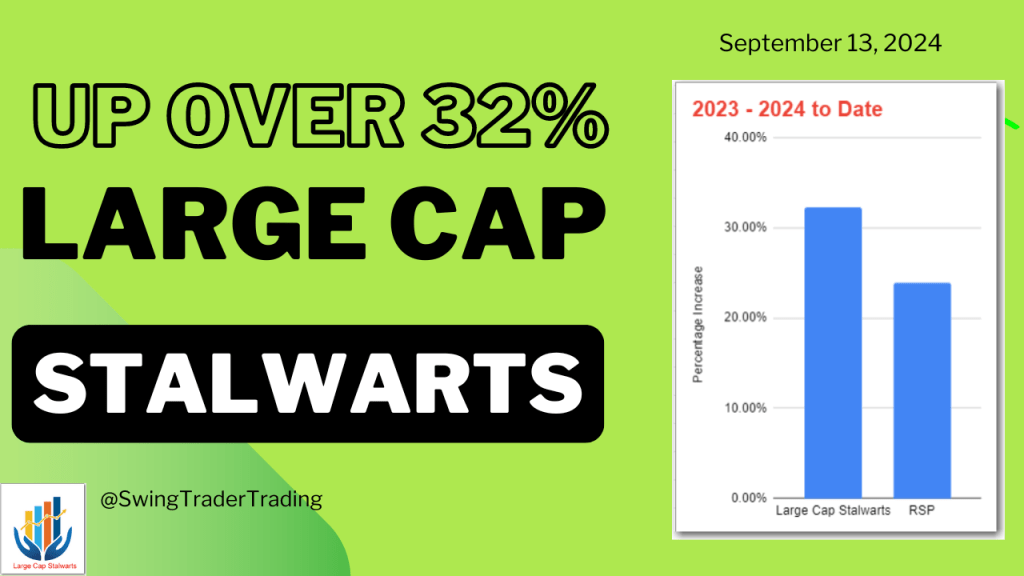

Up 32% – Large Cap Stalwarts Update – September 2024

The Model Portfolio Large Cap Stalwarts updated, adding 6 stocks and removing 5. With a total of 15 stocks and outperformance over the RSP benchmark, it’s up 32% since 2023. The backtest outperformed the benchmark in 12 out of 19 years. For more details, refer to the live scorecard and consult financial professionals before making…

-

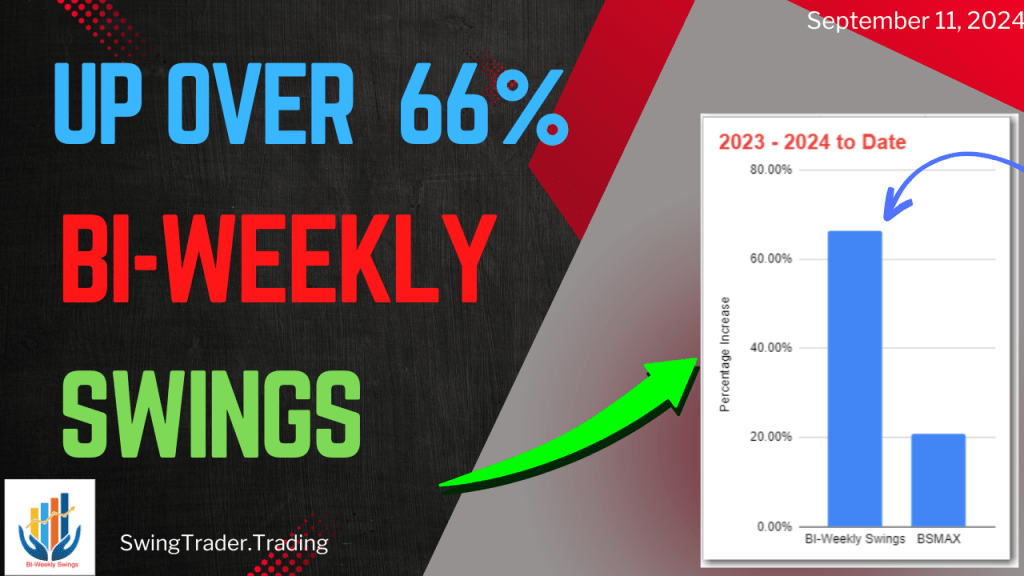

Up 66% – BI-Weekly Swings Update – 09/11/24

The BI-Weekly Swings Portfolio was updated with 8 new stocks and 8 removals, bringing the total to 21 stocks. It has outperformed its benchmark BSMAX by 45%, totaling a 66% increase from 2023-2024. The portfolio is comprised of 3 strategies and has shown consistent outperformance in backtests, notably in 2016.