Tag: swing trading

-

Up 42% – Mid Cap Flyers Portfolio Changes – February 2025

The Mid Cap Flyers Model Portfolio has risen 42%, exceeding its benchmark, MDY, by 13%. Recently, 10 stocks were added and removed, now totaling 20. The portfolio primarily targets mid-cap stocks with market capitalizations between $1 billion and $12 billion. Backtests show strong historical performance, outperforming in 15 of 19 years.

-

Up 176% – Quant Alpha’s Portfolio Update 02/06/2025

The Portfolio has significantly outperformed the ETF benchmark EQAL, rising over 176% from April 2023 to February 2025, surpassing the benchmark by 151%. Updated biweekly, it consists of 28 stocks, targeting high liquidity and excluding certain sectors. Notable performers include POWL (+359%) and CLS (+469%).

-

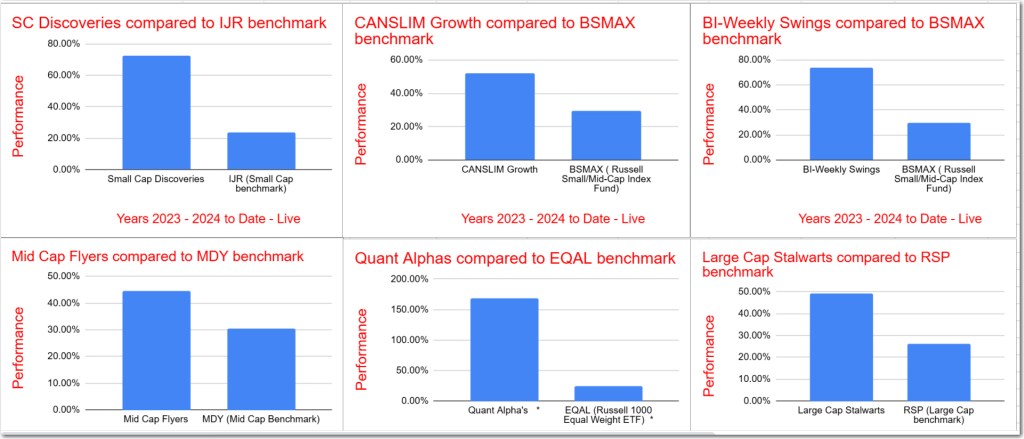

January 2025 – Model Stock Portfolios Outperformance increases

All Model Portfolios significantly outperformed their benchmarks for the 2023-2025 period, with Quant Alpha leading at over 168%, exceeding EQAL by 143%. Active contributors included POWL (+330%), ANF (+137%), and CLS (+427%). The BI-Weekly Swings rose 73%, surpassing BSMAX by 44%, driven by APEI and RAIL. Small Cap Discoveries and CANSLIM Growth were up 72%…

-

Up 74% – BI-Weekly Swings Update – 01/30/2025

The BI-Weekly Swings Portfolio has achieved a 74% gain from 2023 to 2025, outperforming its benchmark BSMAX by 45%. It includes 17 stocks with bi-weekly updates, utilizing strategies centered on earnings metrics. Notably, it outperformed benchmarks in 15 of 19 years tested, with the best year being 2016 at an 86% increase.

-

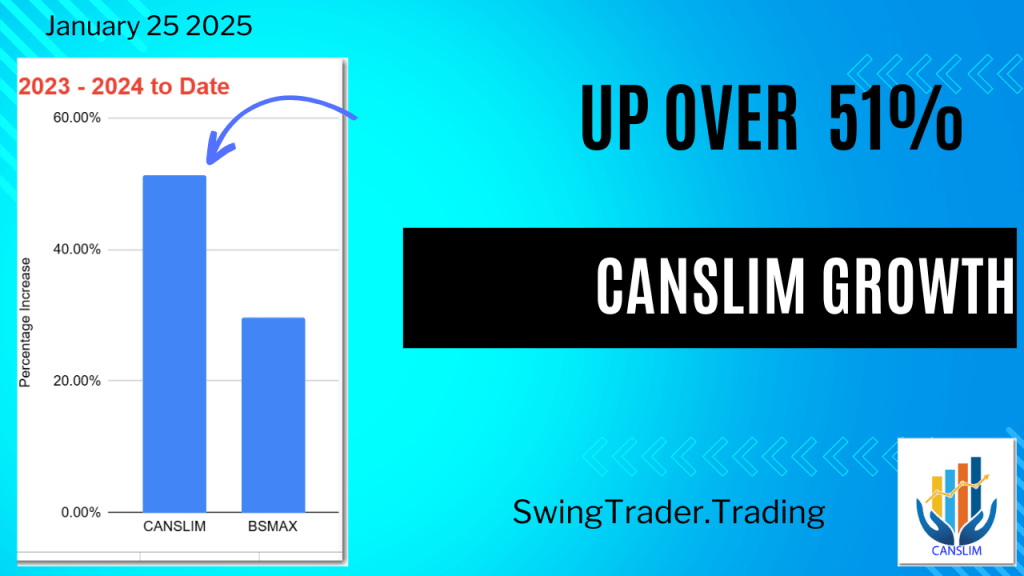

Up 51% – CANSLIM Growth Portfolio Update -January 2025

The CANSLIM Growth Model Portfolio has increased by over 51% in 2023-2024, significantly surpassing its benchmark BSMAX by 21%. The portfolio, consisting of 20 stocks, uses the CANSLIM approach focused on earnings per share, return on equity, and sales growth. Recent changes included adding six stocks and removing five.

-

Up 178% – Quant Alpha’s Portfolio Update 01/23/2025

The Portfolio has outperformed its ETF benchmark EQAL, achieving a 178% gain for 2023-2025, exceeding the benchmark by 153%. An update included adding FOA and removing APP. Currently, there are 27 stocks, with a goal of 30-35. Notable performers include POWL and APP, reflecting significant returns.

-

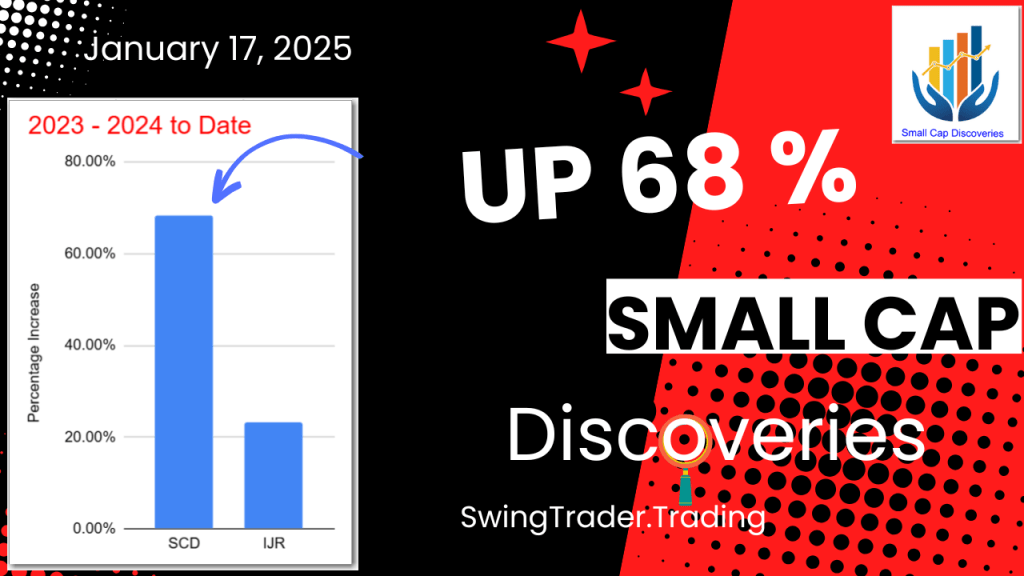

Up 68% – Small Cap Discoveries Portfolio Update – January 2025

The Small Cap Discoveries Portfolio has significantly outperformed its benchmark, IJR, with a 68% increase for 2023-2024, surpassing the benchmark by 45%. The portfolio comprises 14 stocks, incorporating various strategies to identify positive trends. Recent updates include adding one stock and removing three, with notable past performance in 2009.

-

Up 72% – BI-Weekly Swings Update – 01/16/2025

The BI-Weekly Swings Portfolio has risen 72% from 2023-2025, outperforming its benchmark BSMAX by 45%. It includes 18 stocks, with recent additions of 4 and removals of 3. The Portfolio implements three strategies focusing on earnings trends and has outperformed historical benchmarks in most tested years, with 2016 as its best year.

-

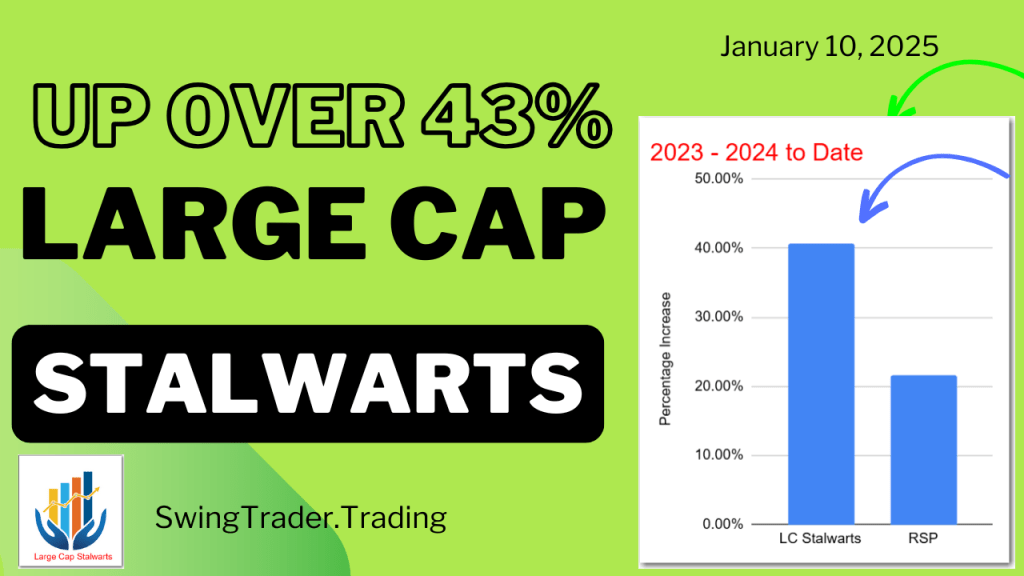

Up 43% – Large Cap Stalwarts Update – January 2025

The Large Cap Stalwarts Model Portfolio has outperformed its RSP benchmark by 22%, achieving a 43% gain since its 2023 launch. Recent updates included the addition of 7 stocks and removal of 8, bringing the total to 18. Historical backtests show consistent outperformance in most years, with significant gains achieved.

-

Up 156% – Quant Alpha’s Portfolio Update 01/10/2025

The Portfolio has significantly outperformed the ETF benchmark EQAL, achieving over 156% growth for 2023-2024 and surpassing the benchmark by 135%. It now includes 27 stocks. New additions and stringent selection criteria ensure continuous performance improvement, with standout performers like APP gaining 745% since addition.

-

Up 44% – Mid Cap Flyers Portfolio Changes – January 2025

The Mid Cap Flyers Model Portfolio has risen 44%, exceeding its benchmark by 16%. Recent updates included adding and removing nine stocks, bringing the total to 20. Historically, it outperformed the MDY benchmark in 15 of 19 tested years. Key performance metrics indicate strong trends in earnings.

-

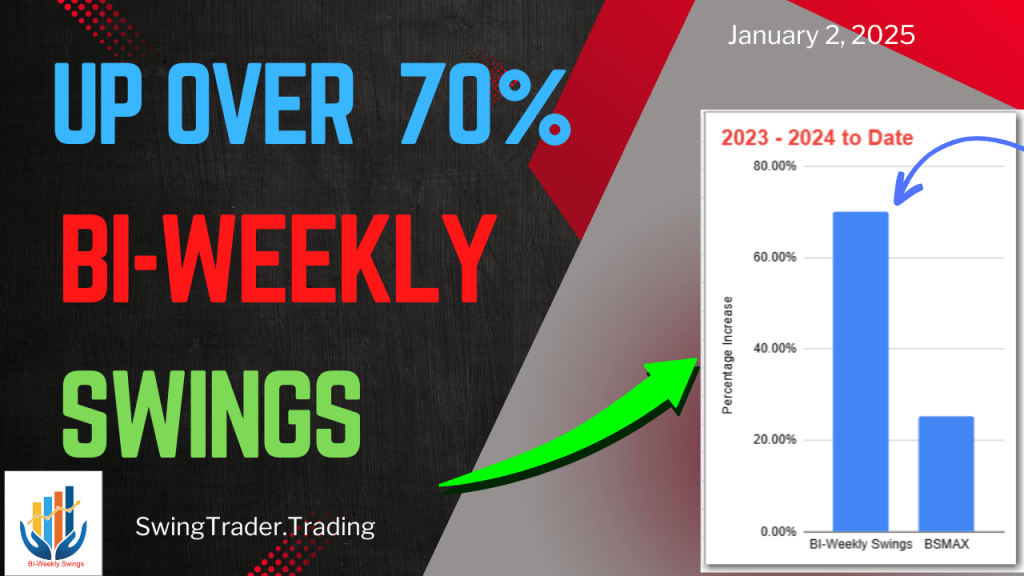

Up 70% – BI-Weekly Swings Update – 01/02/2025

The BI-Weekly Swings Portfolio has achieved a 70% return from 2023-2025, surpassing its benchmark, BSMAX, by 44%. The portfolio consists of 17 stocks, updated bi-weekly, utilizing multiple strategies focusing on EPS, ROE, and relative strength. Backtests show it outperformed benchmarks in 15 of 19 years tested.

-

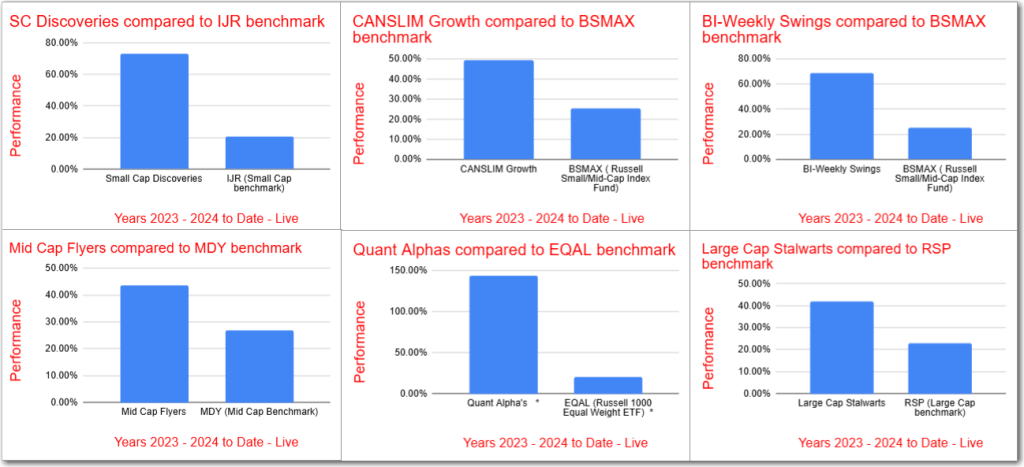

December 2024 – Model Stock Portfolios Outperformance increases

All Model Portfolios outperformed their benchmarks for 2023-2024, led by Quant Alpha’s impressive 144% return. Other portfolios also showed significant gains: BI-Weekly Swings at 68%, Small Cap Discoveries at 73%, and CANSLIM Growth at 49%. Despite a market sell-off, five portfolios improved their relative performances.

-

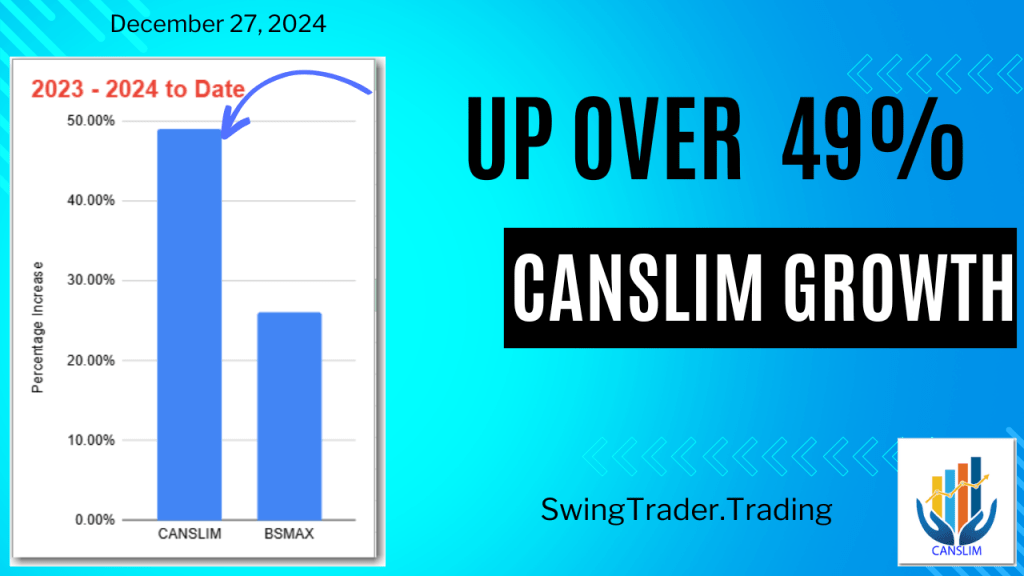

Up 49% – CANSLIM Growth Portfolio Update December 2024

The CANSLIM Growth Model Portfolio has risen over 49% in 2023-2024, outperforming the BSMAX benchmark by 23%. Recent updates added 2 stocks and removed 3, with 19 stocks now in the portfolio. Backtesting shows consistent outperformance across 18 of 19 years, highlighting the effectiveness of the CANSLIM strategy.

-

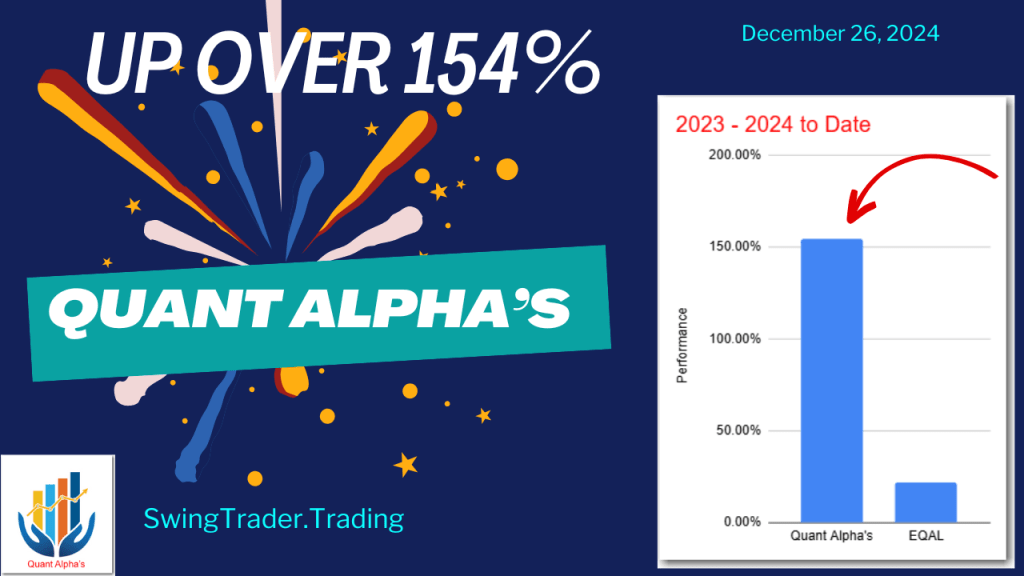

Up 154% – Quant Alpha’s Portfolio Update 12/26/2024

The Portfolio continues to outperform its ETF benchmark, EQAL, with a remarkable 154% increase in 2023-2024, surpassing EQAL by 133%. Updated to include 26 stocks, the Portfolio utilizes Quant scores for stock selection, avoiding certain sectors. Notable performers include AppLovin Corporation, up 790% since addition.

-

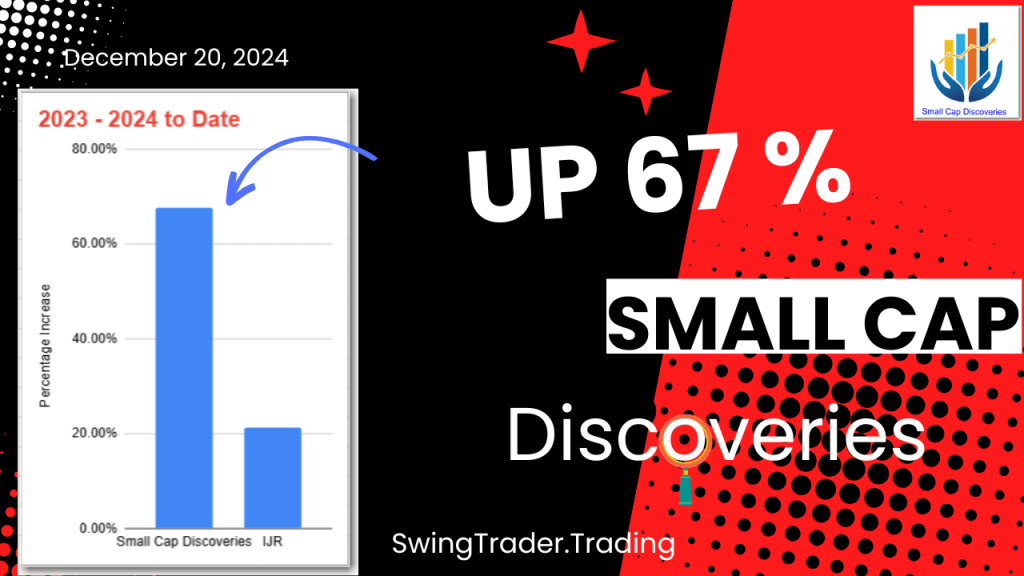

Up 67% – Small Cap Discoveries Portfolio Update – December 2024

The Small Cap Discoveries Portfolio has significantly outperformed its benchmark, the IJR, with a 67% increase since early 2023, 45% ahead of the benchmark. Recent updates included the addition of seven stocks and the removal of five, bringing the total to 16 stocks. Backtesting shows consistent outperformance across most years.

-

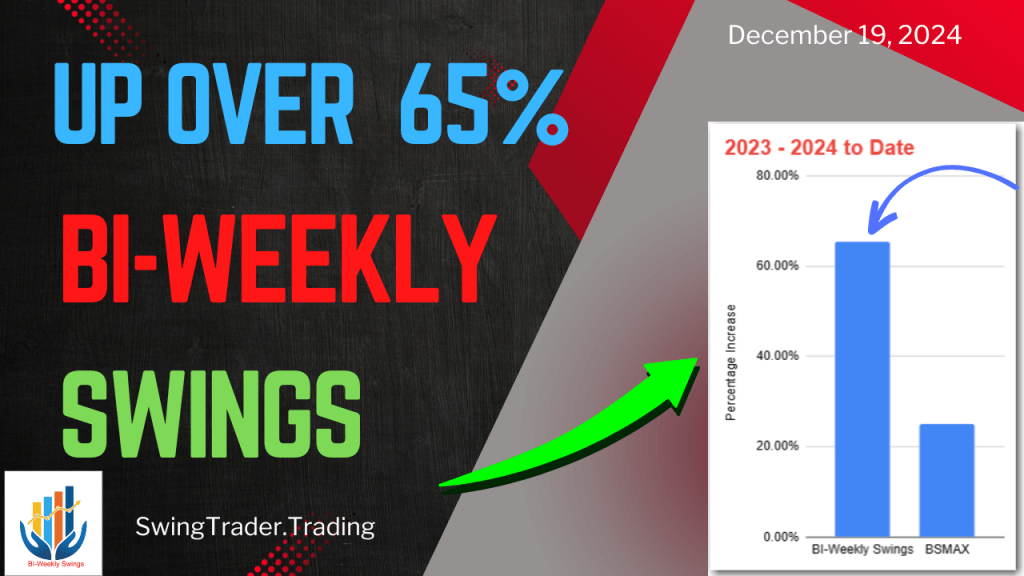

Up 65% – BI-Weekly Swings Update – 12/19/2024

The BI-Weekly Swings Portfolio has achieved a remarkable 65% growth in 2023-2024, surpassing its benchmark BSMAX by 45%. Updated bi-weekly, it now holds 16 stocks, incorporating three distinct strategies focusing on mid, small, and micro-cap stocks. Recent adjustments included adding three stocks and removing eight. Backtesting indicates consistent historical outperformance.

-

Up 46% – Large Cap Stalwarts Update – December 2024

The Model Portfolio Large Cap Stalwarts has outperformed its RSP benchmark by 19%, with a 46% increase since its inception in 2023. Recent updates included the addition of five stocks and removal of six. The portfolio generally outperformed the RSP in 12 out of 19 backtested years, with notable successes.

-

Up 152% – Quant Alpha’s Portfolio Update 12/12/2024

The Portfolio has achieved over 152% growth for 2023-2024, significantly outperforming its benchmark EQAL by 127%. It currently includes 25 stocks, with a focus on Quant scores for stock selection. Notable performers include APP with a 737% gain. The strategy emphasizes high liquidity and avoids specific sectors like airlines.

-

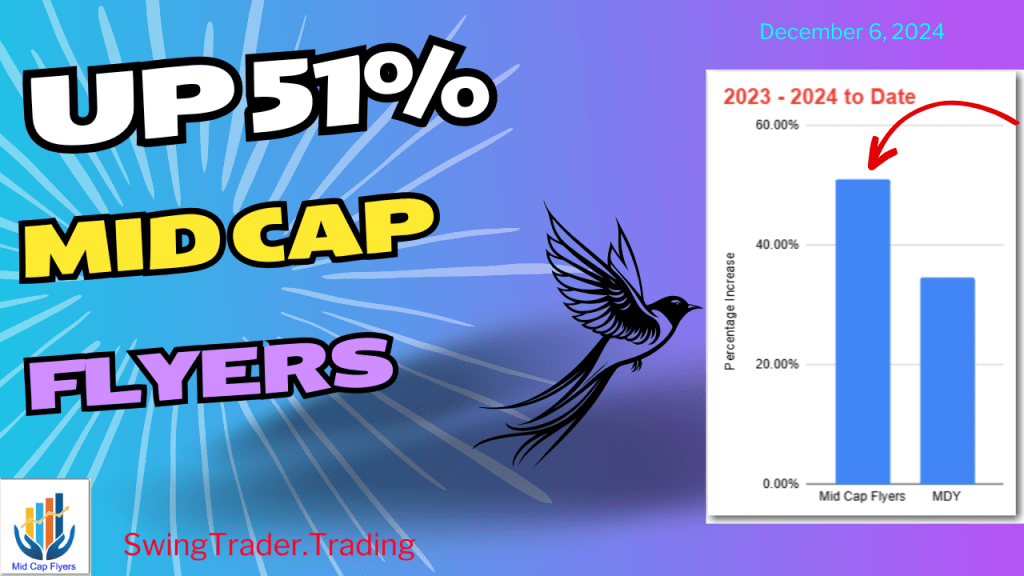

Up 51% – Mid Cap Flyers Portfolio Changes – December 2024

The Mid Cap Flyers Model Portfolio saw a 51% increase and is 16% ahead of its benchmark since the November update. With a recent adjustment of 9 stocks added and removed, it now holds 20 stocks based on mid-cap criteria and EPS trends. Historical performance indicates consistent outperformance against benchmarks.