Tag: swing trading

-

Up 78% – BI-Weekly Swings Update – 12/05/2024

The BI-Weekly Swings Model Portfolio was updated with five new stocks added and five removed, maintaining 21 stocks total. Since its inception in 2023, the portfolio has risen 78%, outperforming the BSMAX benchmark by 42%. Various strategies focus on mid, small, and micro-cap stocks, showing consistent strong performance.

-

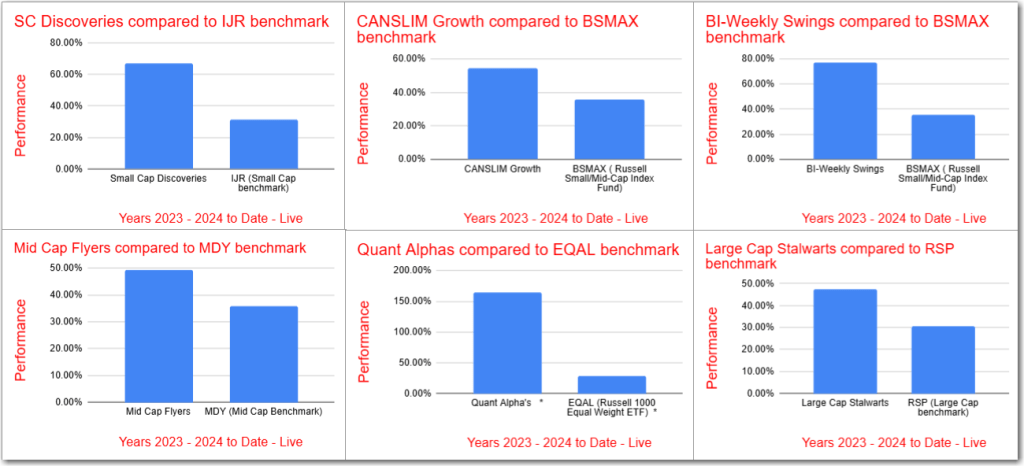

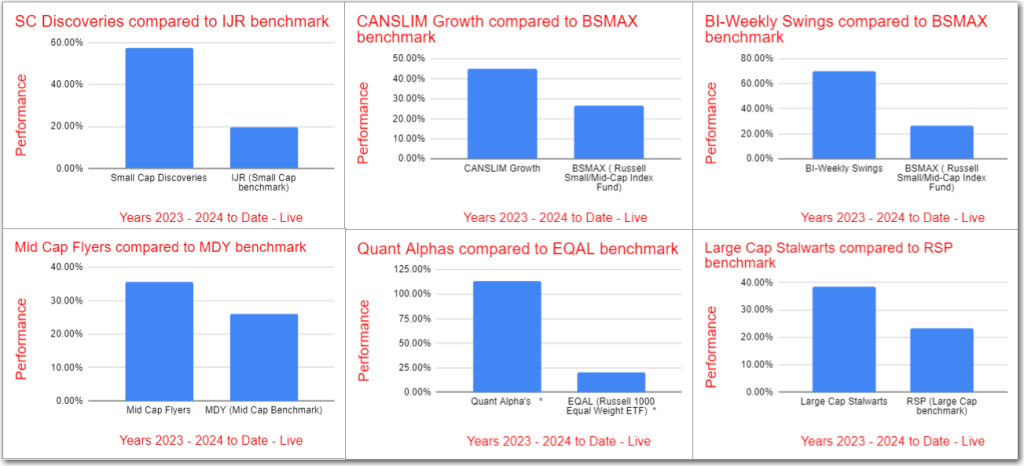

November 2024 Summary – Outperformance increases

All Model Portfolios have exceeded their benchmarks for the 2023-2024 period, showing impressive gains. The Quant Alpha’s Portfolio leads with over 165% growth, outperforming its benchmark by 136%. Active stocks like POWL and ANF have significantly contributed to this outperformance. Other portfolios also performed well, with the BI-Weekly Swings up 77%, Small Cap Discoveries up…

-

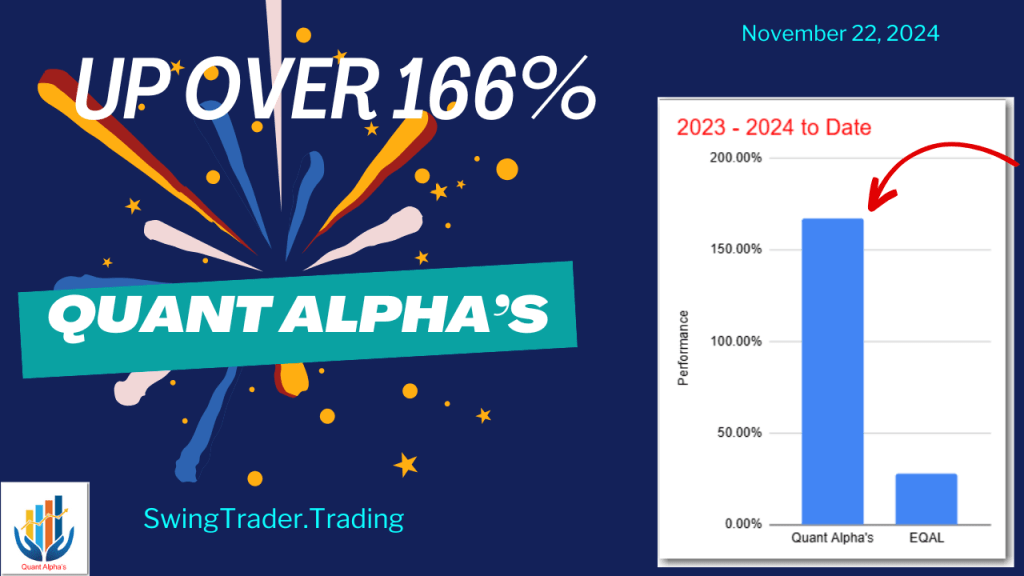

Up 166% – Quant Alpha’s Portfolio Update 11/26/2024

The Portfolio has outperformed its benchmark EQAL with a 166% gain for 2023-2024, surpassing it by 138%. It now includes 24 stocks. The strategy utilizes Quant scores for stock selection, with an expected holding period of 9 months to 2 years.

-

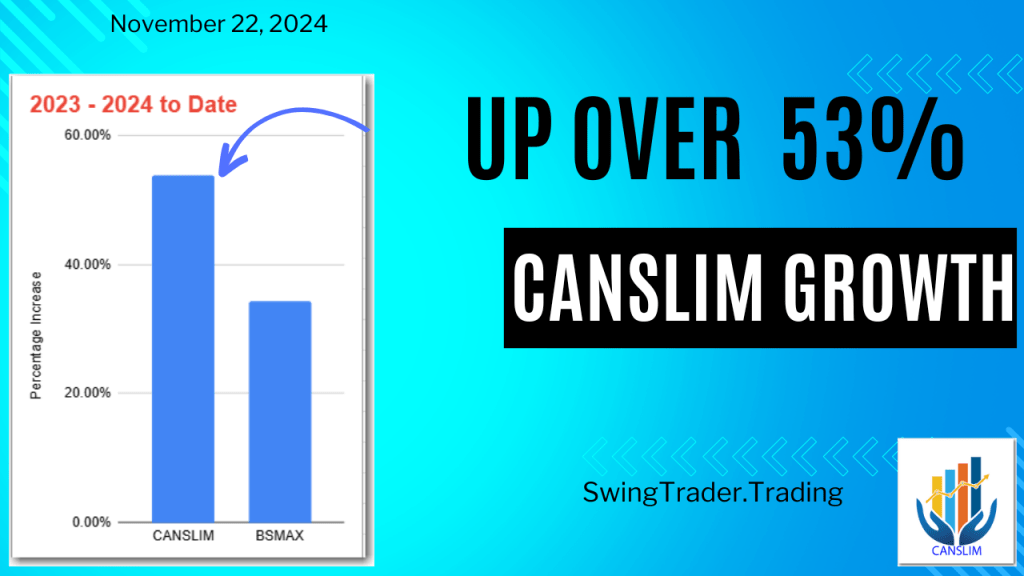

Up 53% – CANSLIM Growth Portfolio Update November 2024

The CANSLIM Growth Model Portfolio was updated this weekend. New Adds of 8 stocks were made and Removals of 5 stocks were made. All prices are as of 11/22/2024. A total of 20 stocks are in the Portfolio. The CANSLIM Growth Model Portfolio is up over 53% in 2023-2024 and is 19% ahead of its…

-

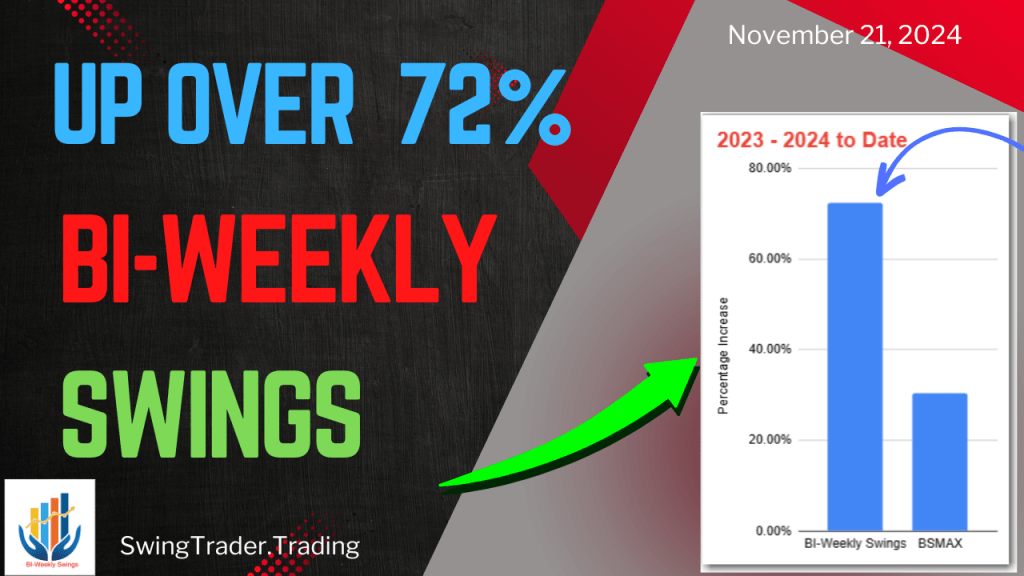

Up 72% – BI-Weekly Swings Update – 11/21/2024

The Model Portfolio BI-Weekly Swings, updated on 11/21/2024, added and removed six stocks, maintaining a total of 21. It has achieved a remarkable 72% increase from 2023-2024, outperforming the BSMAX benchmark by 39%. The portfolio uses a blend of strategies focused on various stock caps and key financial metrics.

-

Up 58% – Small Cap Discoveries Portfolio Update – November 2024

The Model Portfolio Small Cap Discoveries was updated to include three new stocks while removing ten, resulting in a total of 14 stocks. The Portfolio outperformed its benchmark IJR significantly, with a 58% increase for 2023-2024. Notable transactions included HRTG, which was removed after a 121% gain.

-

Up 152% – Quant Alpha’s Portfolio Update 11/13/2024

The Portfolio continues to outperform the EQAL benchmark, achieving a 152% increase for 2023-2024, surpassing the benchmark by 127%. Containing 26 stocks, it utilizes Quant scores for selection, avoiding micro-cap and specific sectors. Notable performers include POWL and APP.

-

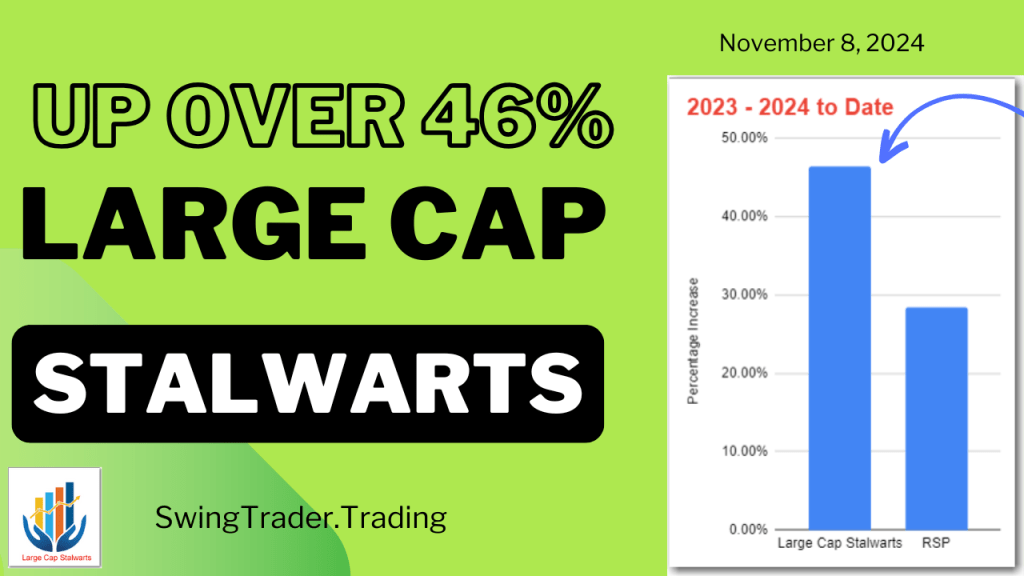

Up 46% – Large Cap Stalwarts Update – November 2024

The Model Portfolio Large Cap Stalwarts was updated this weekend. New Adds of 7 stocks were made and 6 Removals of stocks were made. All prices are as of 11/08/2024. A total of 18 stocks are in the Portfolio now. Add – APH, BLK, GRMN, NTRS, PGR, SYF, ZBRA Remove – CPT, DVA, EXPE, HCA,…

-

Up 76% – BI-Weekly Swings Update – 11/07/2024

The Model Portfolio BI-Weekly Swings updated on 11/07/2024, adding and removing six stocks, now comprising 21 in total. It boasts a 76% gain since 2023, outperforming its benchmark BSMAX by 44%. The portfolio employs three strategies focusing on EPS and ROE metrics for stock selection and has historically excelled in backtests.

-

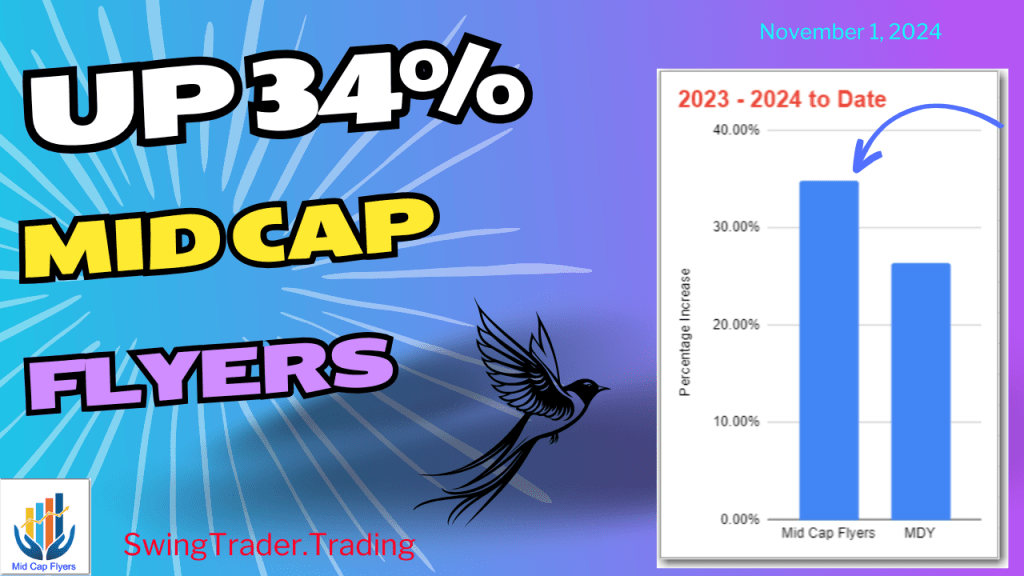

Up 34% – Mid Cap Flyers Portfolio Changes – November 2024

The Model Portfolio Mid Cap Flyers was updated today. New Adds of 6 stocks were made and Removals of 7 stocks were made. All prices are as of 11/01/2024. A total of 20 stocks are in the Portfolio now. The Mid Cap Flyers Model Portfolio is now up 34%. It is 8% above its benchmark…

-

October 2024 Summary – Outperformance increases

All Model Portfolios are ahead of their respective benchmarks for the 2023-2024 period. The Quant Alpha’s is now up over 113% for 2023-2024 and continues to destroy its benchmark EQAL by 93%. This is a substantial increase in outperformance since last month. Active outperformers POWL, ANF , APP and CLS account for some of this…

-

Remove SMCI – Quant Alpha’s Portfolio Update 10/30/2024

SMCI (Super Micro Computer) released some troubling news on Wednesday. Their auditor resigned. This is very bad sign for a company. It could indicate more undisclosed problems are lurking. Since the Quant ratings are very close to a Sell signal and with this additional negative news, I am removing this stock from the active list.…

-

Up 129% – Quant Alpha’s Portfolio Update 10/29/2024

The Model Portfolio Quant Alpha was updated. The portfolio, using Quant scores for selection, is up 129% since April 2023, outperforming the EQAL benchmark significantly. Performance highlights include stocks like SMCI and POWL, with expected growth to 30-35 holdings.

-

Up 44% – CANSLIM Growth Portfolio Update October 2024

The CANSLIM Growth Model Portfolio was updated with five new additions and five removals, maintaining 17 stocks. It has gained over 44% in 2023-2024, outperforming its benchmark BSMAX by 18%. Using the CANSLIM criteria, the portfolio has consistently outperformed benchmarks in 18 of 19 tested years, showcasing robust performance.

-

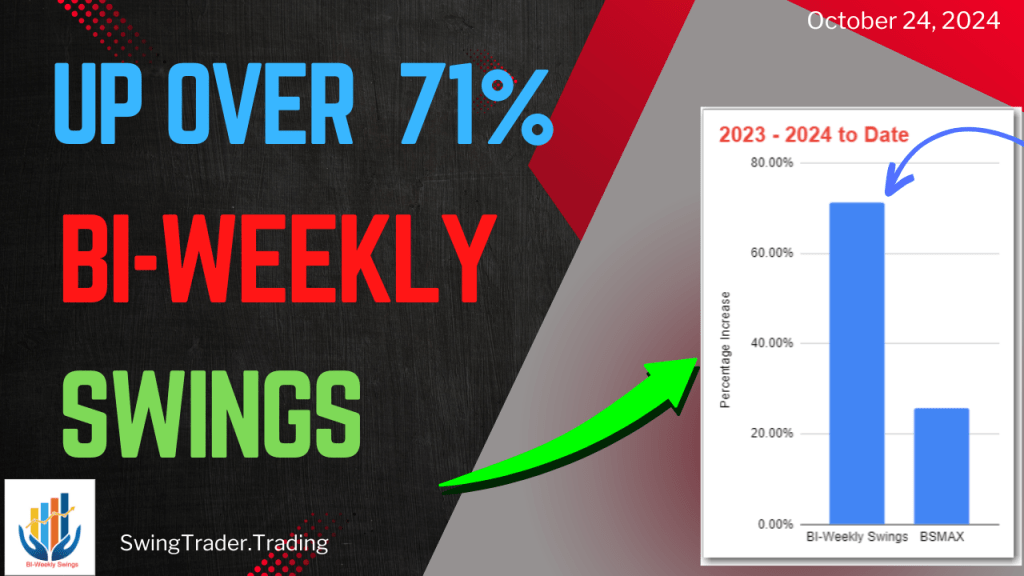

Up 71% – BI-Weekly Swings Update – 10/24/2024

The Model Portfolio BI-Weekly Swings was updated with five new stock additions and five removals, totaling 21 stocks. It has achieved a 71% return for 2023-2024, outperforming the BSMAX benchmark by 45%. Various strategies incorporating EPS and ROE are employed, with notable past performance across multiple years.

-

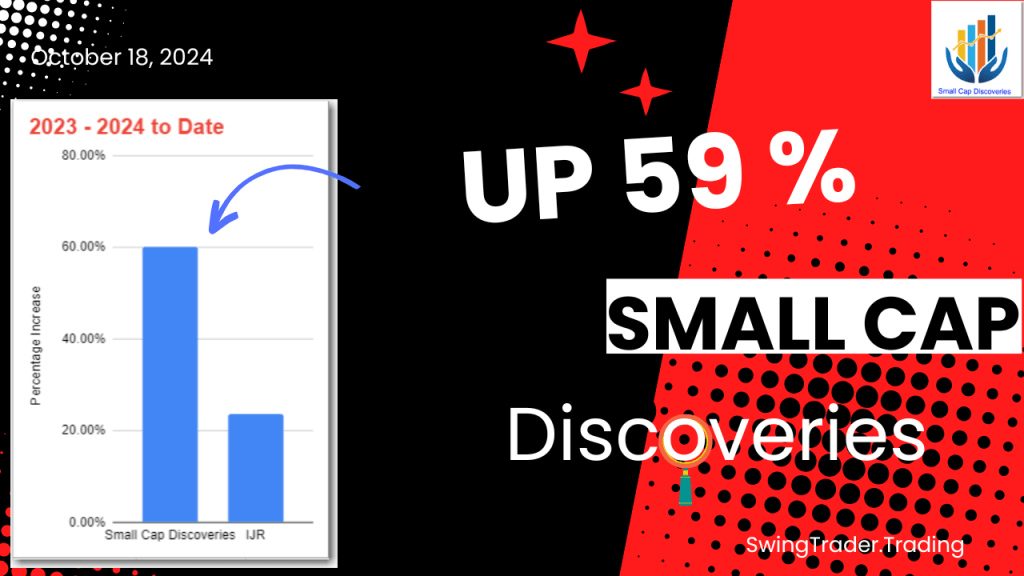

Up 59% – Small Cap Discoveries Portfolio Update – October 2024

The Small Cap Discoveries Model Portfolio was updated with three new stock additions and removals, totaling 21 stocks. The portfolio has significantly outperformed the IJR benchmark with a 59% gain for 2023-2024. Notable stocks include HRTG and HBB, which rose 90% and 82%, respectively.

-

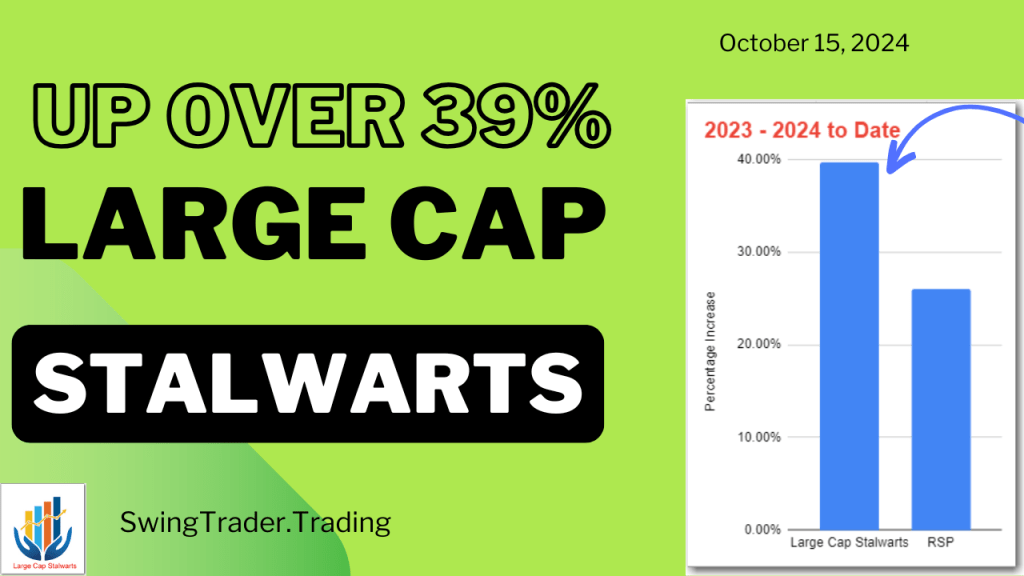

Up 39% – Large Cap Stalwarts Update – October 2024

The Model Portfolio Large Cap Stalwarts received updates this weekend, with six new stocks added (CCL, CF, EXPE, IP, NTAP, PODD) and four removed (CHRW, HWM, STX, UHS), totaling 17 stocks. As of 10/15/2024, the portfolio has risen 39% since its 2023 inception, outperforming the S&P 500 Equal Weight ETF benchmark by 13%. Backtests show…

-

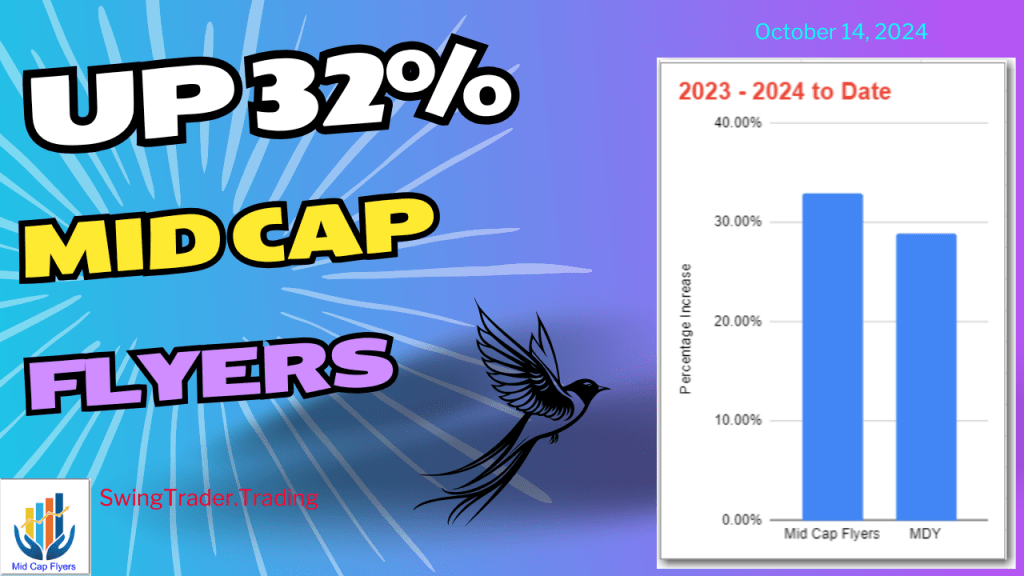

Up 32% – Mid Cap Flyers Portfolio Changes – October 2024

The Mid Cap Flyers Model Portfolio has undergone updates, with 12 new stocks added and 11 removed, totaling 21 stocks as of 10/14/2024. The portfolio shows a 32% increase since its inception in early 2023. It includes stocks from the Mid Cap universe, which have market capitalizations between $1 billion and $12 billion, focusing on…

-

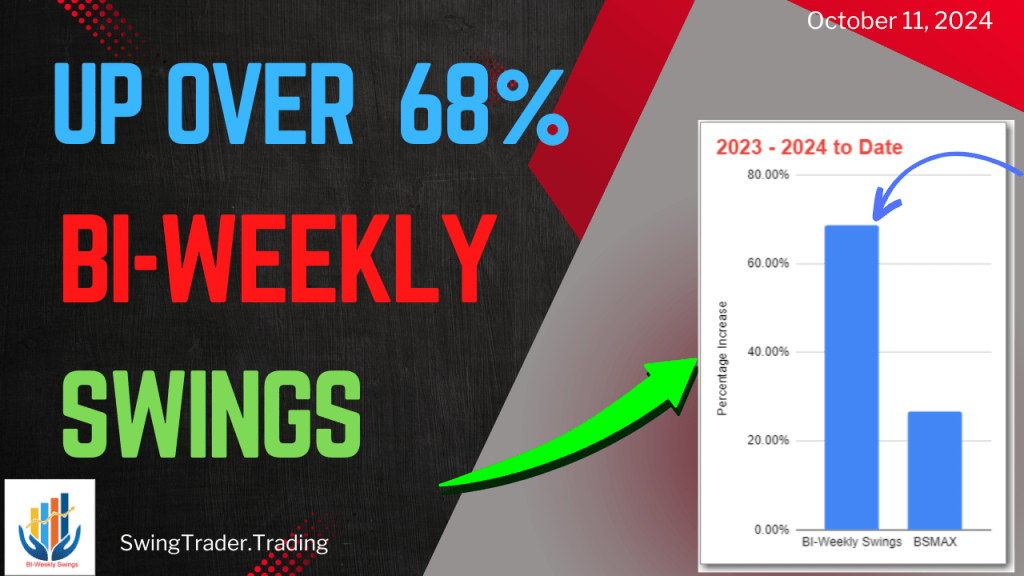

Up 68% – BI-Weekly Swings Update – 10/11/2024

The Model Portfolio BI-Weekly Swings was updated on 10/11/2024, adding and removing five stocks, resulting in a total of 21 stocks. The portfolio has recorded a 68% increase since 2023, outperforming its benchmark BSMAX by 42%. It employs three strategies focusing on Mid Cap, Small Cap, and Micro Cap stocks, utilizing criteria like EPS and…

-

Up 111% – Quant Alpha’s Portfolio Update 10/10/2024

The Model Portfolio Quant Alpha’s was updated on 10/10/2024, adding Carnival Corporation (CCL) and removing Core & Main (CNM), with a total of 25 stocks now included. The portfolio focuses on Quant scores, avoiding subjective criteria and eliminating micro-cap stocks, airlines, crypto, biotech, and mega caps. Performance is strong, with a 111% increase since its…