Tag: TZOO

-

January 2025 – Model Stock Portfolios Outperformance increases

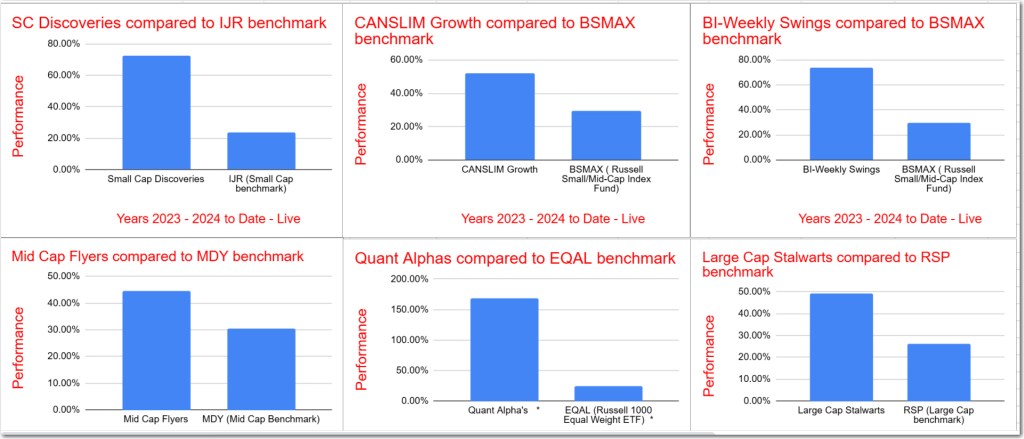

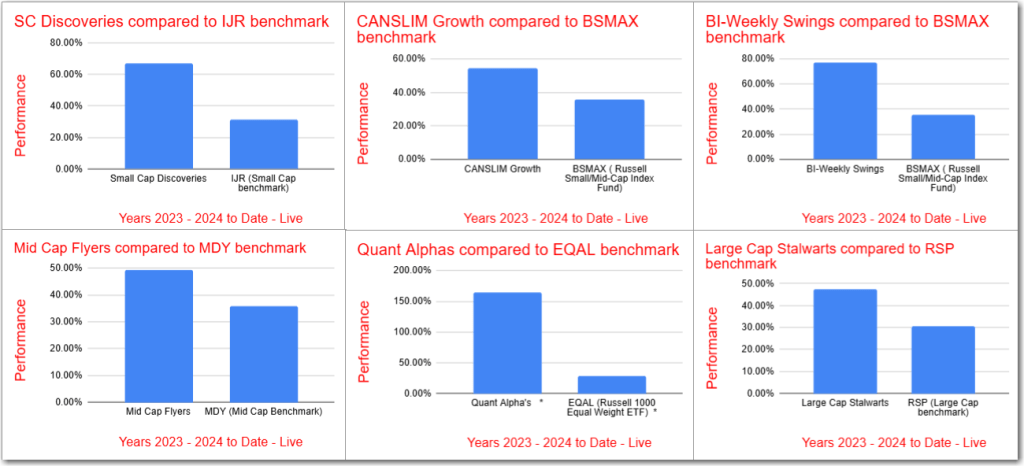

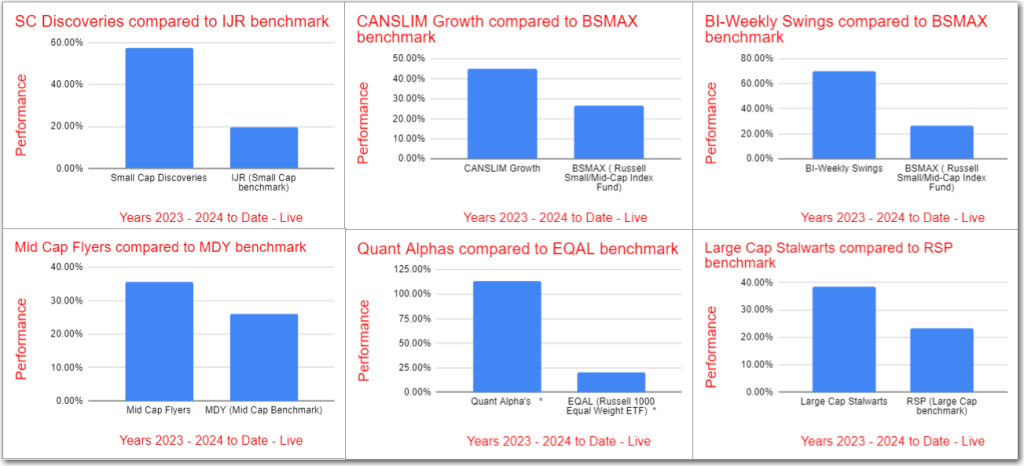

All Model Portfolios significantly outperformed their benchmarks for the 2023-2025 period, with Quant Alpha leading at over 168%, exceeding EQAL by 143%. Active contributors included POWL (+330%), ANF (+137%), and CLS (+427%). The BI-Weekly Swings rose 73%, surpassing BSMAX by 44%, driven by APEI and RAIL. Small Cap Discoveries and CANSLIM Growth were up 72%…

-

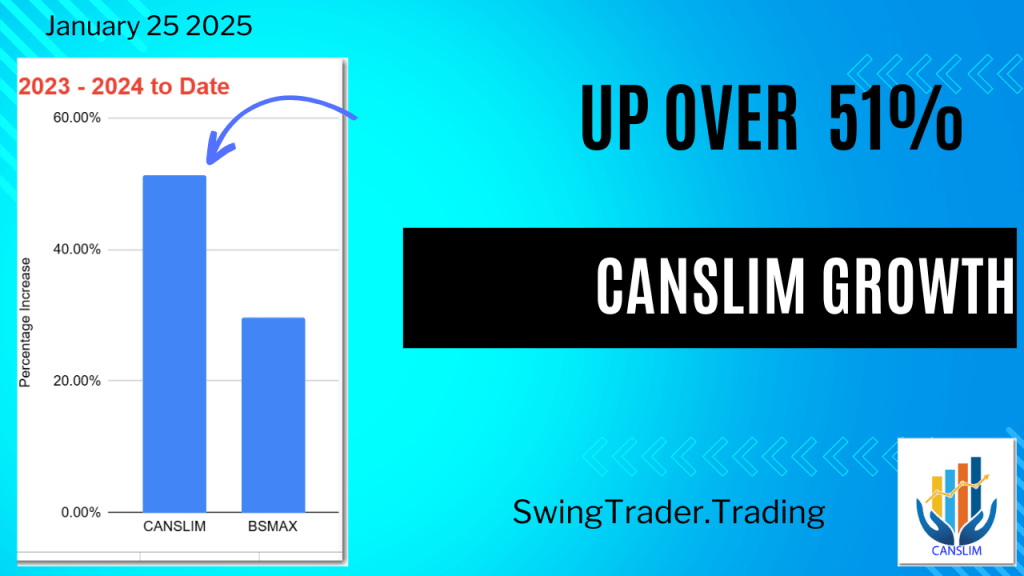

Up 51% – CANSLIM Growth Portfolio Update -January 2025

The CANSLIM Growth Model Portfolio has increased by over 51% in 2023-2024, significantly surpassing its benchmark BSMAX by 21%. The portfolio, consisting of 20 stocks, uses the CANSLIM approach focused on earnings per share, return on equity, and sales growth. Recent changes included adding six stocks and removing five.

-

December 2024 – Model Stock Portfolios Outperformance increases

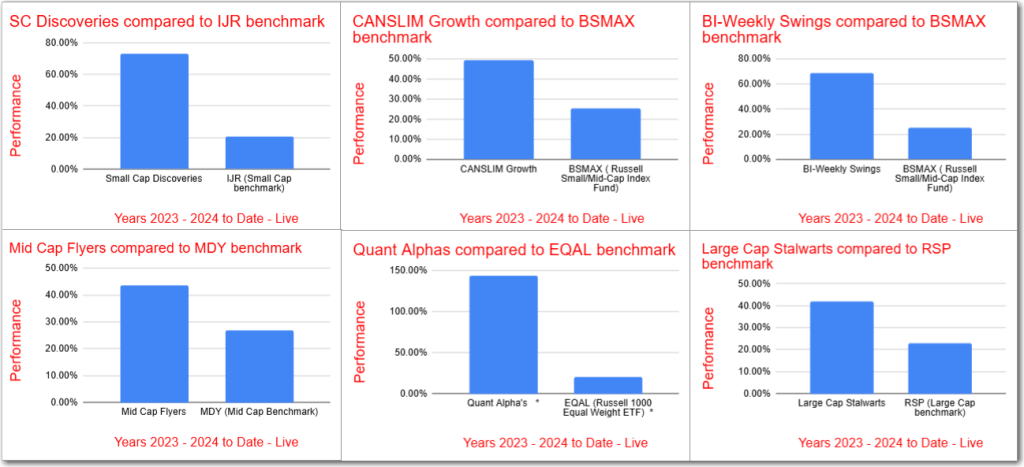

All Model Portfolios outperformed their benchmarks for 2023-2024, led by Quant Alpha’s impressive 144% return. Other portfolios also showed significant gains: BI-Weekly Swings at 68%, Small Cap Discoveries at 73%, and CANSLIM Growth at 49%. Despite a market sell-off, five portfolios improved their relative performances.

-

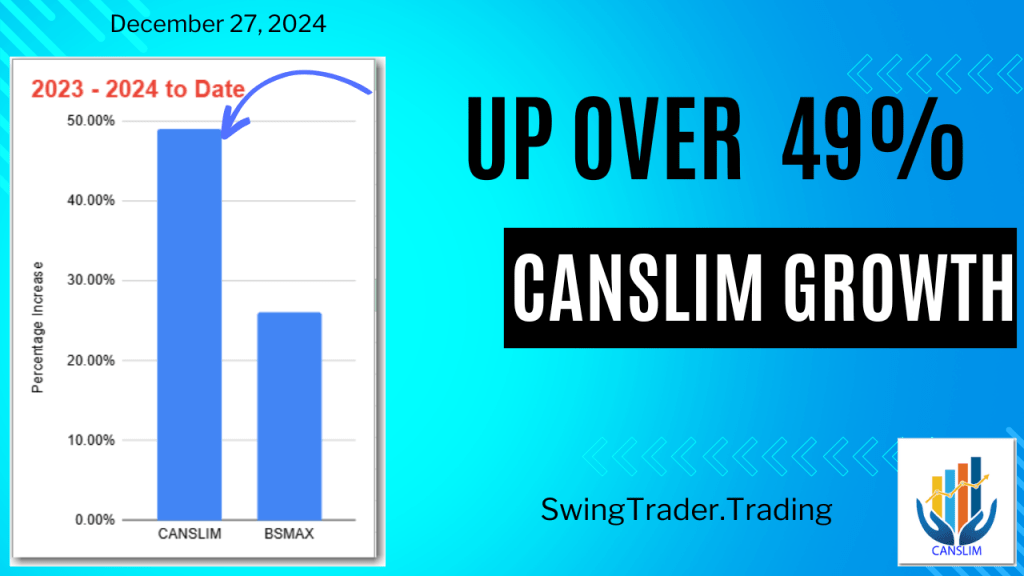

Up 49% – CANSLIM Growth Portfolio Update December 2024

The CANSLIM Growth Model Portfolio has risen over 49% in 2023-2024, outperforming the BSMAX benchmark by 23%. Recent updates added 2 stocks and removed 3, with 19 stocks now in the portfolio. Backtesting shows consistent outperformance across 18 of 19 years, highlighting the effectiveness of the CANSLIM strategy.

-

November 2024 Summary – Outperformance increases

All Model Portfolios have exceeded their benchmarks for the 2023-2024 period, showing impressive gains. The Quant Alpha’s Portfolio leads with over 165% growth, outperforming its benchmark by 136%. Active stocks like POWL and ANF have significantly contributed to this outperformance. Other portfolios also performed well, with the BI-Weekly Swings up 77%, Small Cap Discoveries up…

-

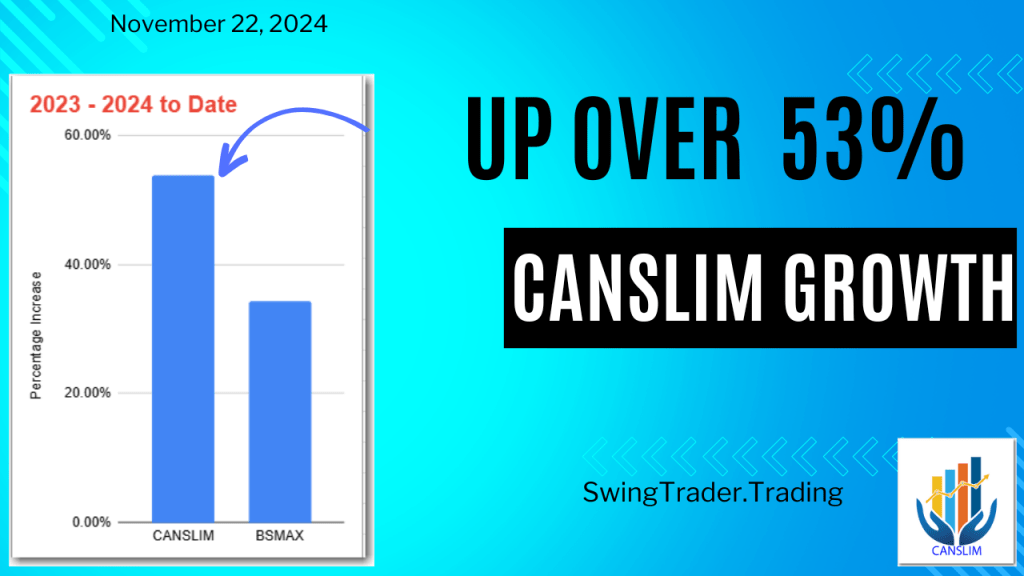

Up 53% – CANSLIM Growth Portfolio Update November 2024

The CANSLIM Growth Model Portfolio was updated this weekend. New Adds of 8 stocks were made and Removals of 5 stocks were made. All prices are as of 11/22/2024. A total of 20 stocks are in the Portfolio. The CANSLIM Growth Model Portfolio is up over 53% in 2023-2024 and is 19% ahead of its…

-

October 2024 Summary – Outperformance increases

All Model Portfolios are ahead of their respective benchmarks for the 2023-2024 period. The Quant Alpha’s is now up over 113% for 2023-2024 and continues to destroy its benchmark EQAL by 93%. This is a substantial increase in outperformance since last month. Active outperformers POWL, ANF , APP and CLS account for some of this…

-

Up 44% – CANSLIM Growth Portfolio Update 08/23/2024

The CANSLIM Growth Model Portfolio was updated with 6 new stock additions and 7 removals, totaling 18 stocks. It has outperformed its benchmark by 18% and has recorded significant backtest outperformance. The portfolio follows the CANSLIM approach, focusing on EPS, Return on Equity, and Sales Increase. Notable active transactions and impressive performance details are also…

-

Up 64% – BI-Weekly Swings Update – 08/14/24

The Model Portfolio BI-Weekly Swings, updated with 9 new stocks and 9 removals, has shown 64% growth, outperforming its benchmark BSMAX by 45%. The portfolio consists of 15 to 21 stocks, utilizing three strategies and backtesting well against benchmarks. Notable outperformers include VIRC and HRTG. It is up 64% since 2023.