Tag: vff

-

Quant Weekly: Celestica Turns 11-Bagger, Portfolios Keep Outpacing the Market – Update 10/24/2025

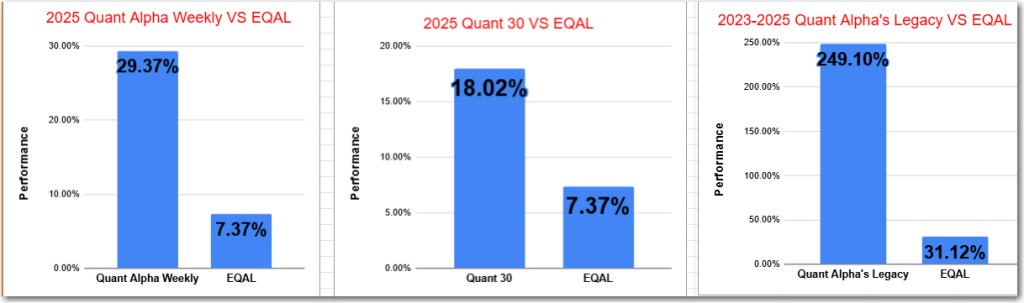

Quant Weekly – Up over 29% in 3 1/2 months Quant 30 – Up over 18% in 3 1/2 months Legacy – continues to be up over 230%, Celestica becomes a 11 bagger. Summary “What are ten baggers and how to spot them”

-

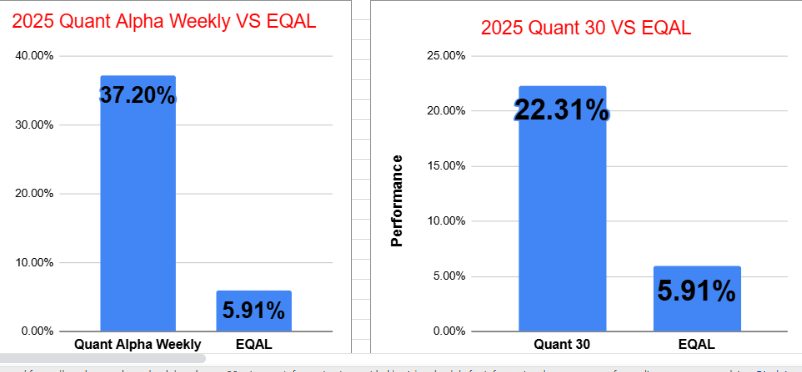

Quant Weekly +37% | The Hidden Dangers Behind Leveraged ETFs’ Big Swings – Update 10/17/2025

Quant Weekly – Up over 35% in 3 1/2 months Quant 30 – Up over 20% in 3 1/2 months Legacy – continues to be up over 220% summary “Why Leveraged ETF’s are considered too risky for most investors”

-

Quant Weekly Up 28%—Gold Surge Fuels Miner Rally as Celestica Hits 10-Bagger Status – Update 10/10/2025

Quant Weekly – Up over 28% in 3 months Quant 30 – Up over 19% in 3 months Legacy – continues to be up over 220%, Celestica has now become a 10 bagger. Summary on the outlook for minerals stocks.

-

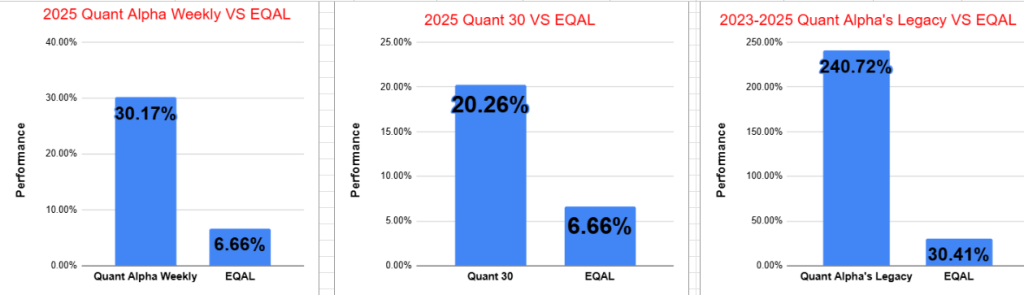

Quant Portfolios Surge: Weekly +30%, Quant 30 +20%, Legacy Up +220% Amid Shutdown Talk – Update 10/03/2025

In the past three months, Quant Weekly and Quant 30 have risen over 30% and 20%, respectively, while the Legacy portfolio has surged over 220%. US government shutdowns typically cause minor stock market declines, but rebounds follow, while sectors like defense and healthcare face risks. Portfolios continue to outperform benchmarks significantly.

-

Quant Weekly up 30%, Quant 30 up 18% – Update 09/26/2025

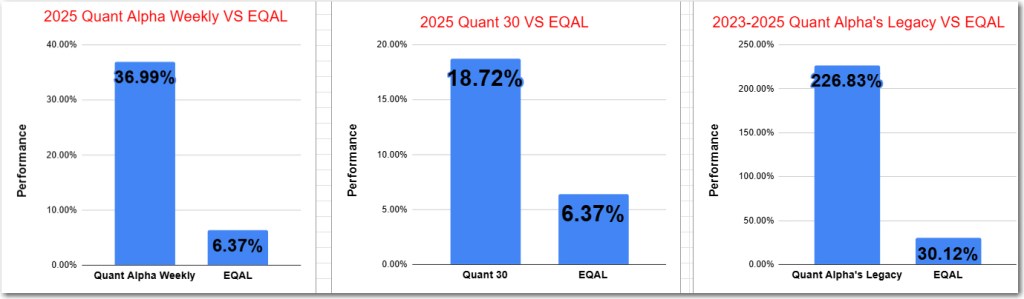

Quantitative portfolios show strong performance, with Quant Weekly up over 30%, Quant 30 up 18%, and the Legacy portfolio exceeding 200%. Key lessons from “Rich Dad Poor Dad” emphasize financial education, the importance of assets over liabilities, and a mindset shift from earning a paycheck to generating wealth through investments and entrepreneurship.

-

Quant Portfolios Surge—Weekly +30%, Quant 30 +18%, Legacy Tops 200% -Update 09/19/2025

Quant portfolios show significant growth, with Quant Alpha Weekly up over 30% and Quant 30 up over 18% in 2.5 months. The Legacy portfolio exceeds 200% gains since 2023. Key factors influencing stock reactions to Fed rate cuts include lower borrowing costs, investor confidence, but risks from recession and regulatory changes for specific companies like…