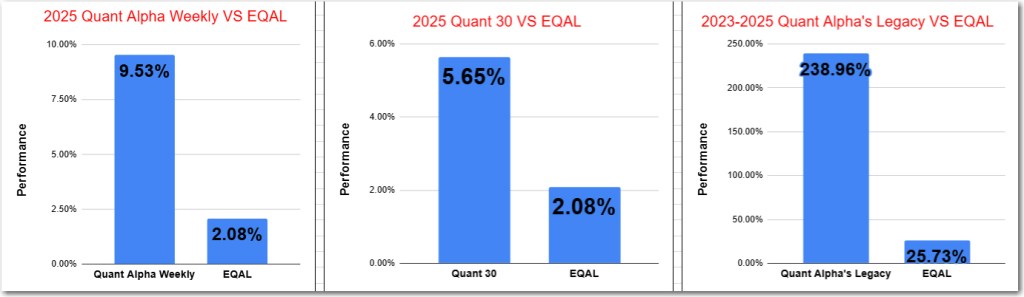

- Quant 30 – UP over 5% since June

- Quant Weekly – Up over 9% since June

- Legacy – Up over 230% since April 2023

- Education – How smart position sizing boosts your stock market results.

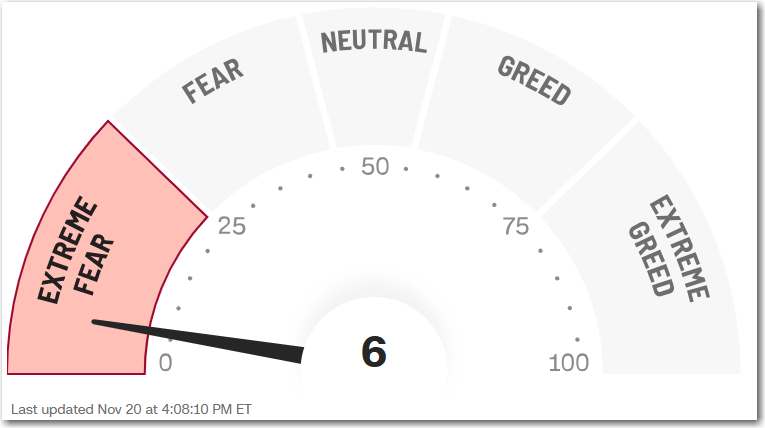

The last two weeks have seen a rather extreme example of what happens when investors move in a panicked way to sell their winners. Extreme Fear grips the markets right now. This happens from time to time. There does not seem any reason for it. In the past, these types of mass stampedes for the exit have been excellent buying opportunities.

This is the last blog post update to be made on Friday morning. Following the Thanksgiving Holiday, I will resume blog post updates every Monday morning. The first one will be on December 1, 2025. This change will allow me more time to put together the free and paid posts. In addition, by posting on Monday morning, the Quantitative research platform will have the weekend to process all the new information coming in at the end of the week. Improved results might just result from this change.

Note: This site now offers both a free and a paid subscription. Paid subscribers receive weekly Portfolio updates as soon as they’re released. Free subscribers still get full content, but Portfolio updates will be posted with at least a two-week delay. Want timely access to the new Adds/Removes? Click here.

Model Portfolio Quant Alpha Weekly

The newly Added stock, if any, is being released to the Paid Subscribers today. Shown below is the stock Added two weeks ago. This Portfolio continues to beat its benchmark by a wide margin, 9% to 2%.

One Add to the Weekly portfolio this update and one Remove.

NGD (New Gold) has accepted a buyout offer from Coeur Mining (CDE). NGD was up 27% since added on 8/21/25. It will now be Removed.

Add (11/07/25): PARR (Par Pacific Holdings)

Remove (11/07/25): NGD (New Gold)

What does Par Pacific Holdings (PARR) do?

- Houston-based energy player running refineries, retail fuel stations, and logistics networks across the U.S.

- Refines gasoline, diesel, and asphalt in Hawaii, Washington, Wyoming, and Montana.

- Operates Hele, 76, and Nomnom gas stations and convenience stores across Hawaii, Washington, and Idaho.

- Controls pipelines, storage, marine, and rail assets moving fuel across the West Coast and Pacific.

- A full-stack energy operator — refining to retail — built for scale and steady cash flow.

Positives for Par Pacific Holdings

- Renewables push: PARR’s moving fast on its Hawaii SAF project through a JV, giving it a strong early lead in renewable fuels backed by serious infrastructure and logistics.

- Wide-reaching ops: Three segments—Refining, Retail, Logistics—plus four refineries, strong in-house retail brands, and a big multi-modal logistics network from Hawaii to the Rockies.

- Clean execution: Wyoming restart wrapped ahead of schedule; Montana and Hawaii expansions are staying on track.

- Solid financial base: Strong liquidity and smart interest-rate hedging support growth and shareholder returns without stressing the balance sheet.

- Prime territory: Their logistics footprint gives them a real edge serving underserved markets across Hawaii and the western U.S.

Concerns for Par Pacific Holdings

- Refining swings: Q1 showed how crude-price whiplash can squeeze margins and drag EBITDA—refining stays a volatile business.

- Project delays: Hawaii renewables build could slip and slow 2025 output, though execution risk looks manageable for now.

- Heavy competition: PARR’s up against big integrated players and major retail brands with way deeper pockets.

- Union constraints: With 23% of staff unionized, labor costs and flexibility can get tighter when conditions shift.

Outperformers: CLS (Celestica) is up over 40%, COMM (CommScope) is up over +110%

Click here for the Quant Alpha Weekly details

Model Portfolio Quant 30

This week’s new update, if any, is being released to the paid subscribers. Shown below is the update made two weeks ago. This Portfolio continues to beat its benchmark by a wide margin, 5% to 2%.

NGD (New Gold) has accepted a buyout offer from Coeur Mining (CDE). NGD was up 38% since added on 7/03/25.

Add (11/7/25): LITE (Lumentum Holdings), IMPP (Imperial Petroleum), PARR (Par Pacific Holdings)

Remove (11/7/25): CECO (CECO Environmental), LPL (LG Display), NGD (New Gold)

Outperformers: MU (Micron Technology), GFI (Gold Fields) and CLS (Celestica) are up over 40%.

Click here for the Quant 30 details

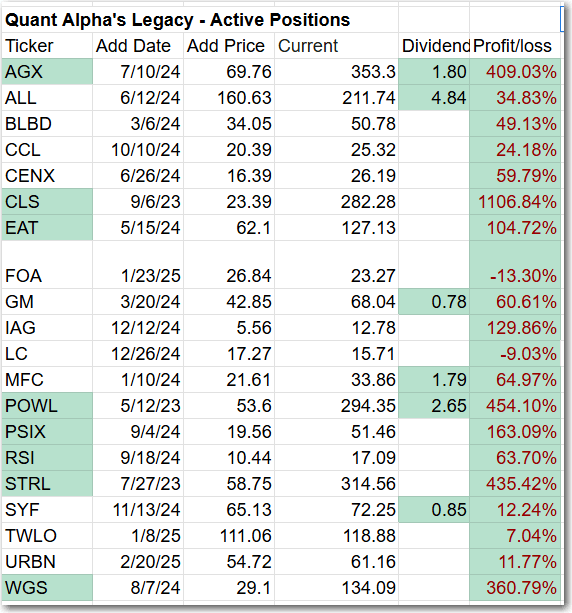

Model Portfolio Quant Alpha’s – Legacy

The portfolio now has around 20 stocks in it. It is up over +230% since it began in 2023. Celestica continues its 11 bagger performance.

QTWO (Q2 Holdings) has received a hard Sell from the Quantitative research platform.

Remove (11/7/25): QTWO (Q2 Holdings)

Outperformers: AGX (Argan) and WGS (GeneDx Holdings) are up over 300%, STRL (Sterling Infrastructure) and POWL (Powell Industries) are up over +400% and CLS (Celestica) is up over 1100%

Click here for the Quant Alpha’s – Legacy details

Performance to 11-20-2025

| Portfolio start date 6/27/25 | |

| Quant Alpha Weekly | 9.53% |

| EQAL (Russell 1000 Equal Weight ETF) | 2.08% |

| Portfolio start date 6/27/25 | |

| Quant 30 | 5.65% |

| EQAL (Russell 1000 Equal Weight ETF) | 2.08% |

| Portfolio start date 4/14/23 | |

| Quant Alpha’s – Legacy | 238.96% |

| EQAL (Russell 1000 Equal Weight ETF) | 25.73% |

Click here for the Live Quant scorecard

The Quant Alpha Weekly Portfolio remains ahead of its benchmark. Up over 9% since it began on June 27. 2025.

The Quant 30 Portfolio managed to close ahead of the benchmark once again. It is up 5% since it began on June 27. 2025.

The Quant Alpha’s – Legacy Portfolio maintained its over 230% return since April 2023, in a classic Position Trading Portfolio implementation.

How smart position sizing boosts your stock market results

It’s one of the most underrated moves in stock market investing.

Limits catastrophic losses: Smart sizing keeps you from betting the farm on one trade. One bad move won’t take you out of the game.

Maximizes compounding power: Winners stay big, losers stay small—creating the kind of asymmetric payoff that builds real long-term wealth.

Reduces emotional decision-making: With the right size on, you’re not sweating every tick. No panic-selling, no revenge-trading.

Enables diversification: Good sizing lets you spread risk across positions without getting overexposed to any one sector or theme.

Adapts to market conditions: Scale up when the odds are in your favor, scale down when volatility spikes or uncertainty rises.

Protects against overtrading: Discipline keeps you selective—you’re not chasing every shiny ticker when your sizing rules keep you grounded.

Bottom line: position sizing isn’t sexy, but it’s the difference between surviving and thriving in this market. The pros size positions methodically — amateurs bet big and hope.

Website Investment Educational Blog Posts –

All content on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalized advice before you make any trading or investing decisions. This post was written with the assistance of artificial intelligence. The original ideas and final review are human-generated. Disclaimer

Copyright 2023-2025 SwingTrader.Trading. All Rights Reserved.

You must be logged in to post a comment.