- Quant 30 – UP over 17% since June

- Quant Weekly – Up over 31% since June

- Legacy – Up over 250% since April 2023

- Education – After a correction of 10% in the US stock market what is the history of performance after 6 months?

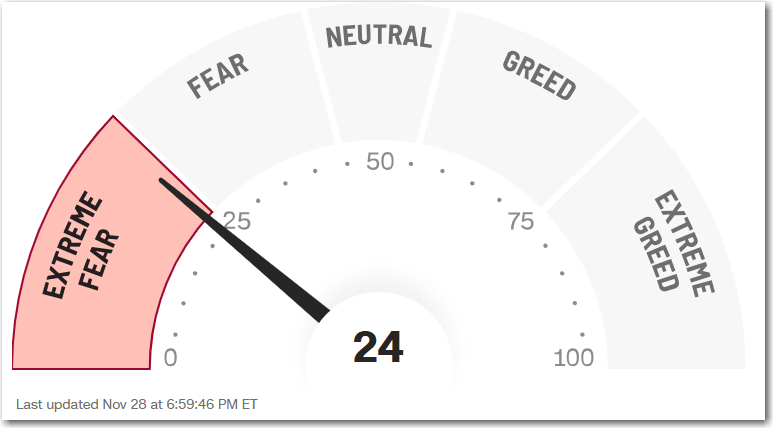

Extreme Fear in the US stock market eased last week and we saw the three Quant model portfolios rally up strongly. Quant Alpha Weekly rose from +9% to +31%. Quant 30 rose from +7% to +17%. Quant Alpha’s Legacy rose from +238% to +275%.

Note: This site now offers both a free and a paid subscription. Paid subscribers receive weekly Portfolio updates as soon as they’re released. Free subscribers still get full content, but Portfolio updates will be posted with at least a two-week delay. Want timely access to the new Adds/Removes? Click here.

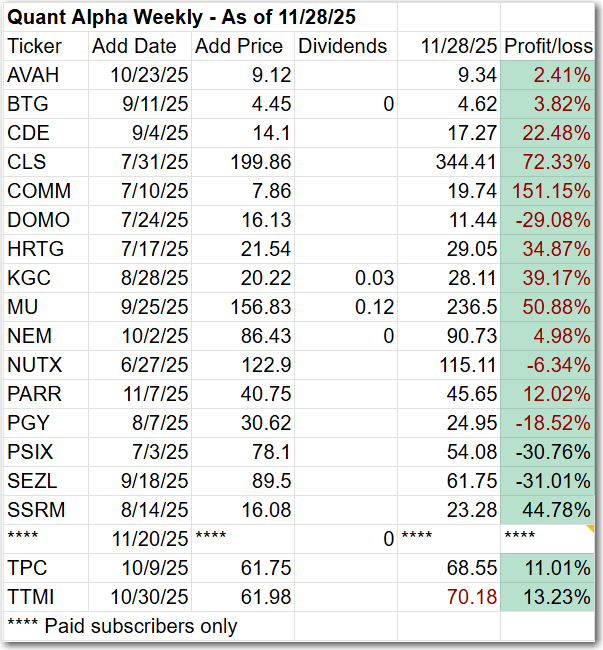

Model Portfolio Quant Alpha Weekly

The newly Added stock, if any, is being released to the Paid Subscribers today. Shown below is the stock Added two weeks ago. This Portfolio continues to beat its benchmark by a wide margin, 31% to 7%.

No changes to the Weekly portfolio for this update.

Add (11/14/25) : None

Outperformers: CLS (Celestica) is up over 70%, COMM (CommScope) is up over +150%

Click here for the Quant Alpha Weekly details

Model Portfolio Quant 30

This week’s new update, if any, is being released to the paid subscribers. Shown below is the update made two weeks ago. This Portfolio continues to beat its benchmark by a wide margin, 17% to 7%.

Two new Adds and two Removals for this update.

Add (11/14/25) : UNFI (United Natural Foods) , TSM (Taiwan Semiconductor)

Remove (11/14/25) : PRCH (Porch Group) , SEZL (Sezzle)

Outperformers: MU (Micron Technology), GFI (Gold Fields) and CLS (Celestica) are up over 70%.

Click here for the Quant 30 details

Model Portfolio Quant Alpha’s – Legacy

The portfolio now has around 20 stocks in it. It is up over +250% since it began in 2023. Celestica achieves a 13 bagger performance.

Remove (11/14/25): None

Outperformers: AGX (Argan), WGS (GeneDx Holdings), STRL (Sterling Infrastructure) and POWL (Powell Industries) are up over +400% and CLS (Celestica) is up over 1300%

Click here for the Quant Alpha’s – Legacy details

Performance to 11-28-2025

| Portfolio start date 6/27/25 | |

| Quant Alpha Weekly | 31.45% |

| EQAL (Russell 1000 Equal Weight ETF) | 7.92% |

| Portfolio start date 6/27/25 | |

| Quant 30 | 17.98% |

| EQAL (Russell 1000 Equal Weight ETF) | 7.92% |

| Portfolio start date 4/14/23 | |

| Quant Alpha’s – Legacy | 275.38% |

| EQAL (Russell 1000 Equal Weight ETF) | 31.68% |

Click here for the Live Quant scorecard

The Quant Alpha Weekly Portfolio remains ahead of its benchmark. Up over 31% since it began on June 27, 2025.

The Quant 30 Portfolio managed to close ahead of the benchmark once again. It is up 17% since it began on June 27, 2025.

The Quant Alpha’s – Legacy Portfolio maintained its over 250% return since April 2023, in a classic Position Trading Portfolio implementation.

After a correction of 10% in the US stock market what is the history of performance after 6 months?

- Markets usually bounce back: After a 10% correction, the S&P 500 is historically up about 8–10% six months later.

- Most outcomes are positive: Roughly 70–75% of six-month periods show gains after a correction — odds are in your favor.

- Snapbacks can be sharp: Plenty of rebounds hit double-digit returns as panic sellers disappear and buyers step in.

- Deeper dips = bigger recoveries: Corrections closer to 15–20% historically lead to even stronger six-month rebounds.

- Only real trouble? Recessions: If the correction is tied to a full-blown recessionary bear market, the six-month recovery slows — but still isn’t reliably negative.

Bottom line — a 10% correction isn’t the end of the world. Historically, it’s usually the setup for the comeback.

Website Investment Educational Blog Posts –

All content on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalized advice before you make any trading or investing decisions. This post was written with the assistance of artificial intelligence. The original ideas and final review are human-generated. Disclaimer

Copyright 2023-2025 SwingTrader.Trading. All Rights Reserved.

You must be logged in to post a comment.