- Quant 30 – Up over 30% since June

- Quant Weekly – Up over 14% since June

- Legacy – Up over 250% since April 2023

- Education – Main points of the book “The bed of Procrustes by Nassim Taleb”.

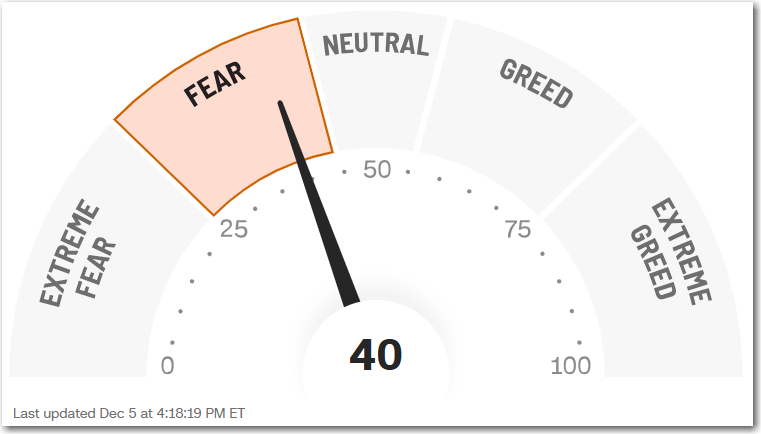

The S&P 500 index rallied back above its all-time high this week. Easing investor concerns created by the recent emotional sell off in stocks over the last month. Hopefully, none of my subscribers succumbed to panic selling during this time. The Quant Portfolios continue to hold their own. The CNN Fear and Greed index has now climbed back to the 40 level. Still in the Fear category but close to getting back to neutral.

Note: This site now offers both a free and a paid subscription. Paid subscribers receive weekly Portfolio updates as soon as they’re released. Free subscribers still get full content, but Portfolio updates will be posted with at least a two-week delay. Want timely access to the new Adds/Removes? Click here.

Model Portfolio Quant Alpha Weekly

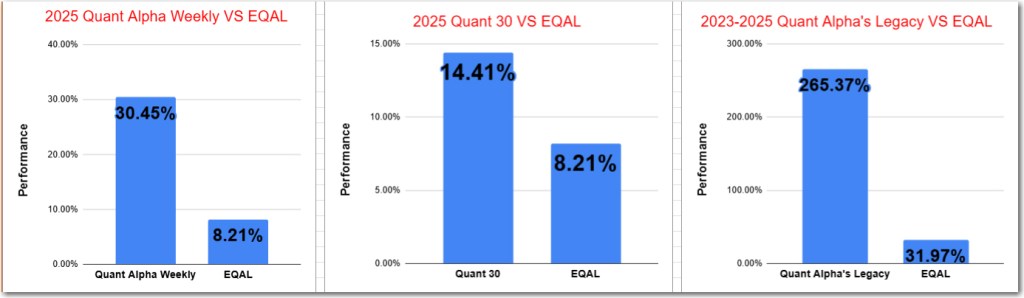

The newly Added stock, if any, is being released to the Paid Subscribers today. Shown below is the stock Added two weeks ago. This Portfolio continues to beat its benchmark by a wide margin, 30% to 8%.

One new Add to the Weekly portfolio for this update.

Add (11/21/25) : THG (Hanover Insurance Group)

Outperformers: CLS (Celestica) is up over 60%, COMM (CommScope) is up over +140%

Click here for the Quant Alpha Weekly details

What does Hanover Insurance do?

The Hanover Insurance Group is a U.S. property and casualty insurer offering commercial, specialty, and personal coverage. Its products range from commercial auto and workers’ comp to professional liability, marine, surety, home, auto, and personal umbrella policies. The company sells through independent agents and brokers. Founded in 1852 and renamed in 2005, Hanover is headquartered in Worcester, Massachusetts.

Positives for Hanover Insurance:

- Diversified and steady: THG’s investment mix is solid, cash flow keeps climbing, and they keep raising dividends without stretching the balance sheet.

- Valuation edge: Trading at a 15% P/E discount to the competition—analysts say you’re getting quality without paying high prices.

- Strong Q1 pop: Operating income per share jumped 26%, showing the company can deliver real earnings growth even in a choppy market.

Concerns for Hanover Insurance:

- Margin lag: EBITDA and net income margins trail the big players in the P&C space—THG isn’t the most efficient shop on the block.

- Cat-loss risk: Storms, fires, disasters—one bad event and earnings can take a hit, even with reinsurance in place.

- Rate-cut pressure: If the Fed trims rates, THG’s fixed-income-heavy portfolio could see lower yields, trimming investment income.

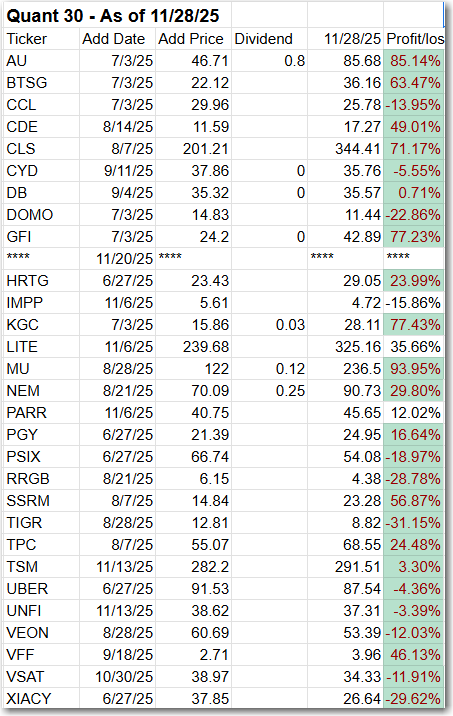

Model Portfolio Quant 30

This week’s new update, if any, is being released to the paid subscribers. Shown below is the update made two weeks ago. This Portfolio continues to beat its benchmark by a wide margin, 14% to 8%.

One new Add and one Removal for this update.

Add (11/21/25) : GH (Guardant Health)

Remove (11/21/25) : BTM (Bitcoin Depot)

Outperformers: MU (Micron Technology) up over 90%, GFI (Gold Fields) up over 70% and CLS (Celestica) are up over 70%.

Click here for the Quant 30 details

Model Portfolio Quant Alpha’s – Legacy

The portfolio now has around 20 stocks in it. It is up over +250% since it began in 2023. Celestica achieves a 12 bagger performance.

Remove (11/21/25): None

Outperformers: AGX (Argan) up over 300%, WGS (GeneDx Holdings) up over 400%, STRL (Sterling Infrastructure) up over 400%, POWL (Powell Industries) up over 500% and CLS (Celestica) is up over 1200%

Click here for the Quant Alpha’s – Legacy details

Performance to 12-05-2025

| Portfolio start date 6/27/25 | |

| Quant Alpha Weekly | 30.45% |

| EQAL (Russell 1000 Equal Weight ETF) | 8.21% |

| Portfolio start date 6/27/25 | |

| Quant 30 | 14.41% |

| EQAL (Russell 1000 Equal Weight ETF) | 8.21% |

| Portfolio start date 4/14/23 | |

| Quant Alpha’s – Legacy | 265.37% |

| EQAL (Russell 1000 Equal Weight ETF) | 31.97% |

Click here for the Live Quant scorecard

The Quant Alpha Weekly Portfolio remains ahead of its benchmark. Up over 30% since it began on June 27, 2025.

The Quant 30 Portfolio managed to close ahead of the benchmark once again. It is up 14% since it began on June 27, 2025.

The Quant Alpha’s – Legacy Portfolio maintained its over 250% return since April 2023, in a classic Position Trading Portfolio implementation.

Main points of the book “The bed of Procrustes by Nassim Taleb”.

- We force reality into neat boxes: People love clean narratives, even when life is messy. That’s the Procrustes trap.

- What we measure isn’t always what matters: Stats, models, fancy charts — they miss half the picture.

- Modern life loves illusion over truth: We prefer the comfortable lie to the uncomfortable fact.

- Knowledge gets confused with wisdom: Degrees and titles don’t mean someone actually understands anything.

- Randomness scares people: So they pretend it doesn’t exist — and then get blindsided when it hits.

- Simplicity beats sophistication: Most problems get worse when experts overthink them.

- Comfort can make you fragile: The more cushioned your life, the less you can handle a real hit.

- The loudest people usually know the least: Real thinkers don’t need to scream — they let the results talk.

- Virtue signaling replaces virtue: Folks act “good” so they look good, not because they are.

- Freedom means walking your own path: Don’t shrink your ideas to fit the world — make the world adjust to you.

Website Investment Educational Blog Posts –

All content on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalized advice before you make any trading or investing decisions. This post was written with the assistance of artificial intelligence. The original ideas and final review are human-generated. Disclaimer

Copyright 2023-2025 SwingTrader.Trading. All Rights Reserved.

You must be logged in to post a comment.