- Quant 30 – Up over 16% since June

- Quant Weekly – Up over 31% since June

- Legacy – Up over 250% since April 2023

- Education – When do small-cap stocks tend to outperform large-cap stocks?

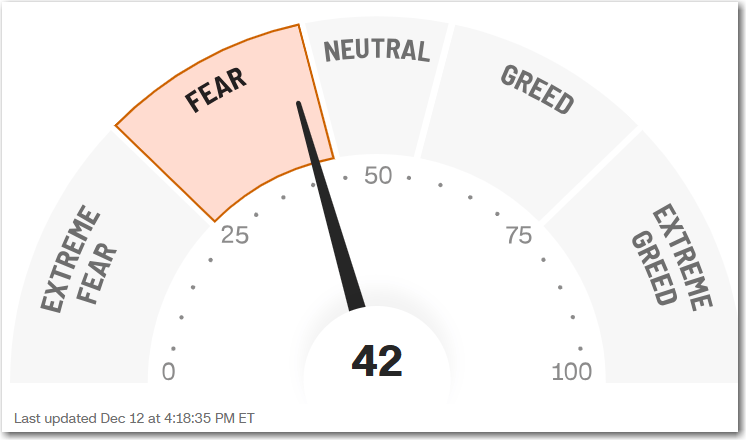

The S&P 500 made another new all-time high this week. The Dow index and Russell 2000 indexes also made new highs. Despite the encouraging signs of the main stock indexes making new highs, the CNN Fear and Greed Index remains at the Fear category. The Quant Weekly and 30 Portfolios both increased slightly since last week.

Note: This site now offers both a free and a paid subscription. Paid subscribers receive weekly Portfolio updates as soon as they’re released. Free subscribers still get full content, but Portfolio updates will be posted with at least a two-week delay. Want timely access to the new Adds/Removes? Click here.

Model Portfolio Quant Alpha Weekly

The newly Added stock, if any, is being released to the Paid Subscribers today. Shown below is the stock Added two weeks ago. This Portfolio continues to beat its benchmark by a wide margin, 31% to 8%.

One Removal made to the Weekly portfolio for this update.

Add (11/28/25) : None

Remove (11/28/25) : DOMO

Outperformers: CLS (Celestica) is up over 50%, MU (Micron Technology) is up over 50% and COMM (CommScope) is up over +140%

Click here for the Quant Alpha Weekly details

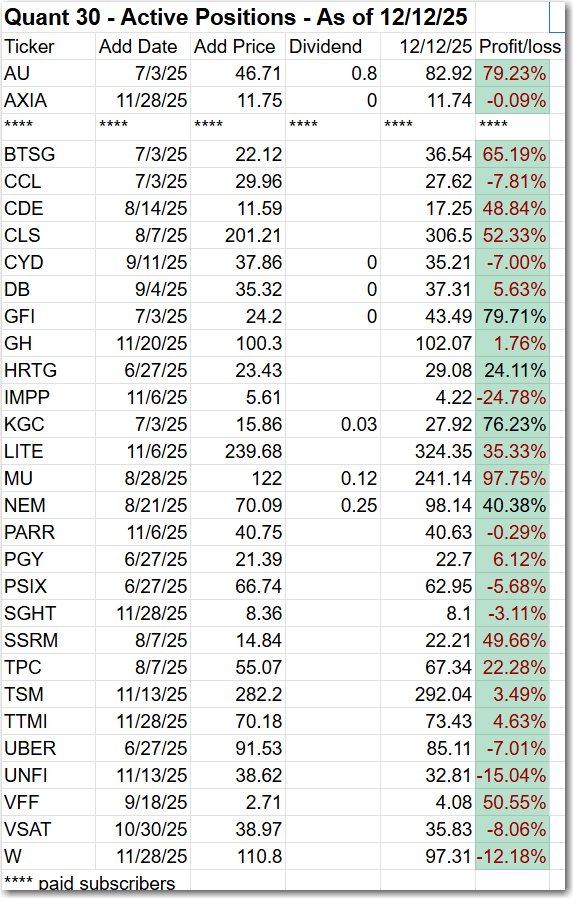

Model Portfolio Quant 30

This week’s new update, if any, is being released to the paid subscribers. Shown below is the update made two weeks ago. This Portfolio continues to beat its benchmark by a wide margin, 16% to 8%.

Four new Adds and Four Removals for this update.

Add (11/28/25) : W (Wayfair), TTMI (TTM Technologies) , AXIA (Centrais Elétricas Brasileiras) , SGHT (Sight Sciences)

Remove (11/28/25) : DOM0, RRGB (Red Robin Gourmet Burgers), VEON, TIGR (UP Fintech Holding)

Outperformers: MU (Micron Technology) up over 90%, GFI (Gold Fields) up over 70% and AU ( AngloGold Ashanti) up over 70%.

Click here for the Quant 30 details

Model Portfolio Quant Alpha’s – Legacy

The portfolio now has around 20 stocks in it. It is up over +250% since it began in 2023. Celestica achieves a 12 bagger performance.

Remove (11/28/25): None

Outperformers: AGX (Argan) up over 300%, WGS (GeneDx Holdings) up over 400%, STRL (Sterling Infrastructure) up over 400%, POWL (Powell Industries) up over 500% and CLS (Celestica) is up over 1200%

Click here for the Quant Alpha’s – Legacy details

Performance to 12-12-2025

| Portfolio start date 6/27/25 | |

| Quant Alpha Weekly | 31.21% |

| EQAL (Russell 1000 Equal Weight ETF) | 8.82% |

| Portfolio start date 6/27/25 | |

| Quant 30 | 16.48% |

| EQAL (Russell 1000 Equal Weight ETF) | 8.82% |

| Portfolio start date 4/14/23 | |

| Quant Alpha’s – Legacy | 264.11% |

| EQAL (Russell 1000 Equal Weight ETF) | 32.59% |

Click here for the Live Quant scorecard

The Quant Alpha Weekly Portfolio remains ahead of its benchmark. Up over 31% since it began on June 27, 2025.

The Quant 30 Portfolio managed to close ahead of the benchmark once again. It is up 16% since it began on June 27, 2025.

The Quant Alpha’s – Legacy Portfolio maintained its over 250% return since April 2023, in a classic Position Trading Portfolio implementation.

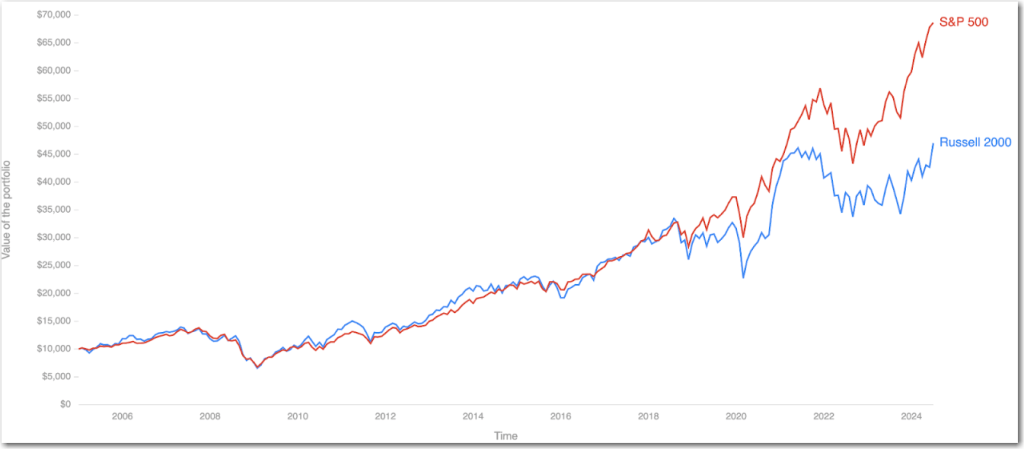

When do small-cap stocks tend to outperform large-cap stocks?

When small caps tend to lead (and why)

- Right after a recession / during early recovery

Small-cap stocks historically shine in the 12 months after an economic trough. That’s when risk appetite rebounds and smaller firms — nimble, domestic, often undervalued — benefit first. - When borrowing costs ease / interest rates fall

Small companies often carry more floating-rate debt, so when rates drop they get a profitability boost. Lower rates = cheaper capital = small caps benefit. - When liquidity returns and credit risk appears manageable

As economic conditions stabilize and default risk recedes, small-cap “size-premium” tends to reassert itself. - During broad “risk-on” or economic growth phases

When confidence is high and investors hunt returns beyond the giants, small-caps often outperform — they tend to “punch above their weight” during expansions. - In short: small-caps historically do best in recovery and early expansion phases, especially as monetary conditions improve and economic growth picks up.

When large caps often outperform small caps

- During recessions or economic slowdowns — small firms are more vulnerable to credit stress, lower demand, weak margins.

- When interest rates are high and liquidity is tight — big companies with stronger balance sheets weather the storm better than smaller, leveraged firms.

- Late in the economic cycle or just before peaks — investors often rotate back into large caps as a defensive move when uncertainty rises.

Where we seem to be now (as of late 2025)

- There’s growing chatter that small caps are on the cusp of a comeback: some analysts point to renewed investor interest in small-cap stocks, especially in an environment where rate cuts may be coming.

- That said — we’re still in a fragile cycle: high interest rates, uncertain economic growth, and mixed global conditions make it a complicated backdrop. As a result, small caps remain volatile and sensitive to macro shifts.

- So: conditions fit the “potential early-expansion / risk-on” box where small caps historically perform well — if stability returns. Think of it as small-caps waiting for the green light.

Bottom Line

If the economy’s kicking off a rebound — interest rates ease, liquidity flows, and confidence comes back — small-cap stocks have traditionally been the first out of the gate.

Right now? We’re around that bend — not a slam-dunk, but small caps may be getting ready if macro winds shift in their favor.

Website Investment Educational Blog Posts –

All content on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalized advice before you make any trading or investing decisions. This post was written with the assistance of artificial intelligence. The original ideas and final review are human-generated. Disclaimer

Copyright 2023-2025 SwingTrader.Trading. All Rights Reserved.

You must be logged in to post a comment.