Tag: cls

-

Quant Stock Portfolios – Weekly update 08/22/2025

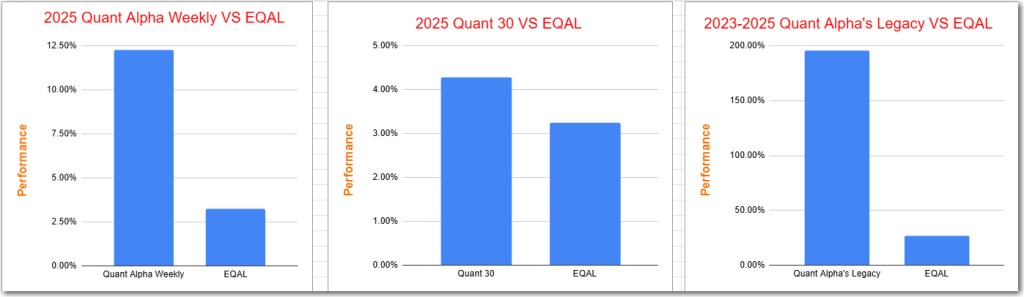

The website has rebranded from SwingTrader.Trading to PositionTrader.Blog to align with the management of Quant Model Portfolios. The Quant Alpha Weekly and Quant 30 portfolios have introduced new stocks, while the Legacy portfolio is up over 180%. Performance updates show steady growth against benchmarks.

-

Quant Stock Portfolios – Weekly update 08/15/2025

The Quant Alpha Weekly and Quant 30 portfolios both reported strong performance, significantly outpacing benchmarks. This week, Quant Alpha added SSRM, while Quant 30 included BTM, CDE, and LASR. Legacy portfolios have achieved over 190% return since 2023, with numerous outperformers showing substantial gains.

-

CommScope up over 90% – Quant Weekly update 08/08/2025

CommScope’s stock surged over 90% due to a partial buyout offer from Amphenol, significantly boosting the Quant Alpha Weekly Portfolio. The Quant 30 Portfolio witnessed five additions and removals, achieving its first benchmark lead. The Legacy Portfolio maintains a remarkable 190% return since its inception in 2023.

-

Quant Stock Portfolios – Weekly update 08/01/2025

The Legacy Portfolio has surged over 190% since its inception in 2023, while the Quant 30 has seen recent additions and removals. Challenges arise during market highs, emphasizing the importance of confidence in strategies. Momentum stocks often rebound quickly, highlighting the risk of premature exits from investments.

-

Introducing the “Quant Alpha’s – Legacy” Portfolio – Weekly update 07/25/2025

The Quant Alpha’s – Legacy Model Portfolio has been launched, retaining 24 stocks from its predecessor. This “Buy and Hold Until” strategy ensures minimal turnover, with only one stock removed due to a Sell signal. Performance remains strong, achieving a +170% return while the benchmark rose +27%. The Quant 30 portfolio shows no recent changes.

-

Up 158% – Quant Alpha’s Portfolio Update 02/20/2025

Since the last update, the Portfolio has outperformed the ETF benchmark EQAL, up over 158% for 2023-2025. It currently holds 27 stocks, with a strong selection criteria avoiding micro-cap, airlines, crypto, and biotech firms. Key performers include POWL and CLS, with future expansion expected to 30-35 stocks.

-

Up 176% – Quant Alpha’s Portfolio Update 02/06/2025

The Portfolio has significantly outperformed the ETF benchmark EQAL, rising over 176% from April 2023 to February 2025, surpassing the benchmark by 151%. Updated biweekly, it consists of 28 stocks, targeting high liquidity and excluding certain sectors. Notable performers include POWL (+359%) and CLS (+469%).

-

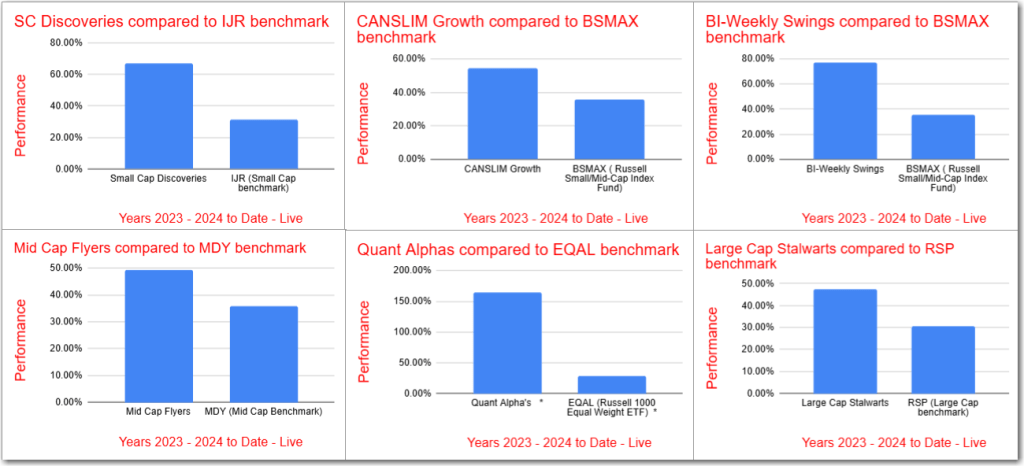

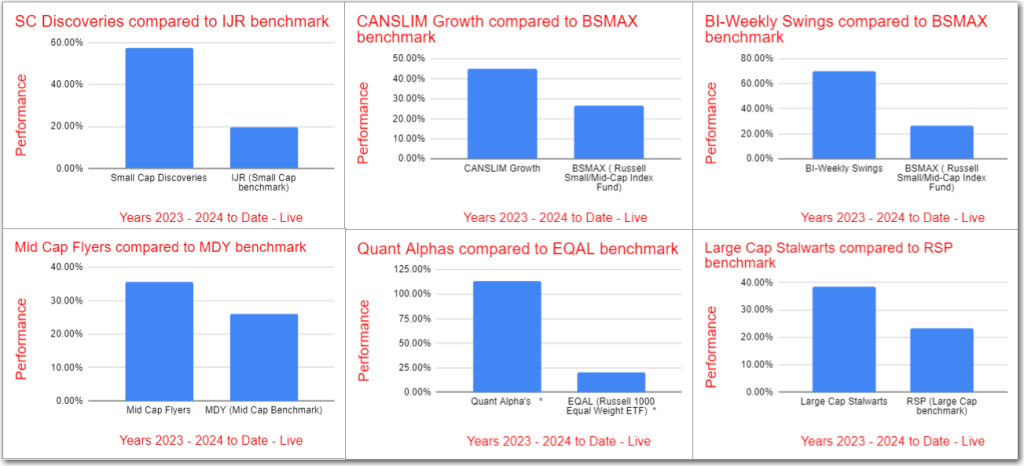

January 2025 – Model Stock Portfolios Outperformance increases

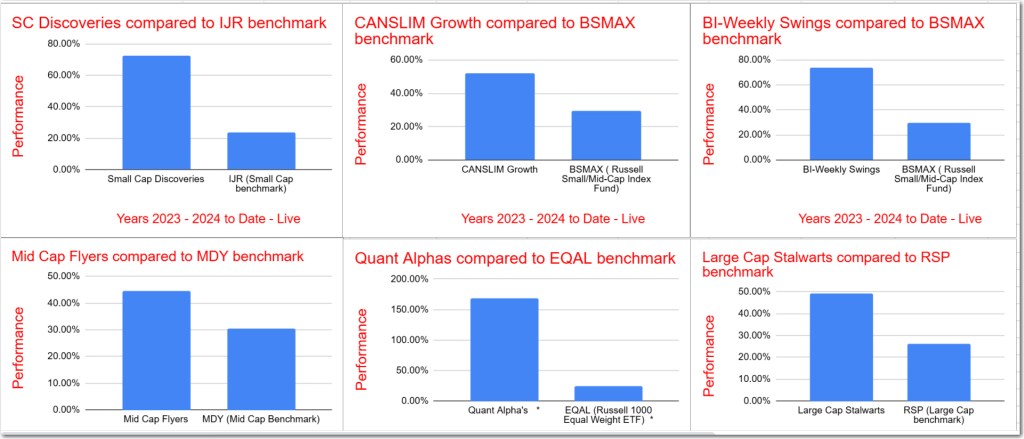

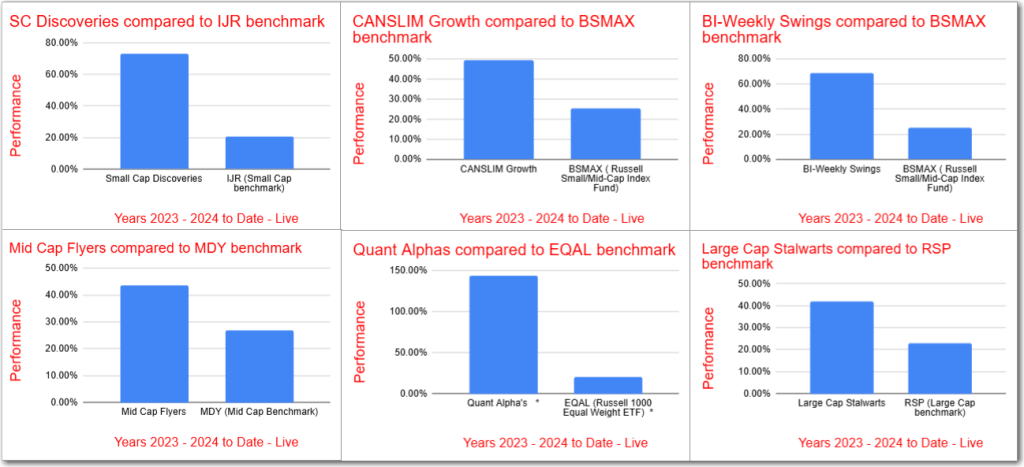

All Model Portfolios significantly outperformed their benchmarks for the 2023-2025 period, with Quant Alpha leading at over 168%, exceeding EQAL by 143%. Active contributors included POWL (+330%), ANF (+137%), and CLS (+427%). The BI-Weekly Swings rose 73%, surpassing BSMAX by 44%, driven by APEI and RAIL. Small Cap Discoveries and CANSLIM Growth were up 72%…

-

Up 178% – Quant Alpha’s Portfolio Update 01/23/2025

The Portfolio has outperformed its ETF benchmark EQAL, achieving a 178% gain for 2023-2025, exceeding the benchmark by 153%. An update included adding FOA and removing APP. Currently, there are 27 stocks, with a goal of 30-35. Notable performers include POWL and APP, reflecting significant returns.

-

Up 156% – Quant Alpha’s Portfolio Update 01/10/2025

The Portfolio has significantly outperformed the ETF benchmark EQAL, achieving over 156% growth for 2023-2024 and surpassing the benchmark by 135%. It now includes 27 stocks. New additions and stringent selection criteria ensure continuous performance improvement, with standout performers like APP gaining 745% since addition.

-

December 2024 – Model Stock Portfolios Outperformance increases

All Model Portfolios outperformed their benchmarks for 2023-2024, led by Quant Alpha’s impressive 144% return. Other portfolios also showed significant gains: BI-Weekly Swings at 68%, Small Cap Discoveries at 73%, and CANSLIM Growth at 49%. Despite a market sell-off, five portfolios improved their relative performances.

-

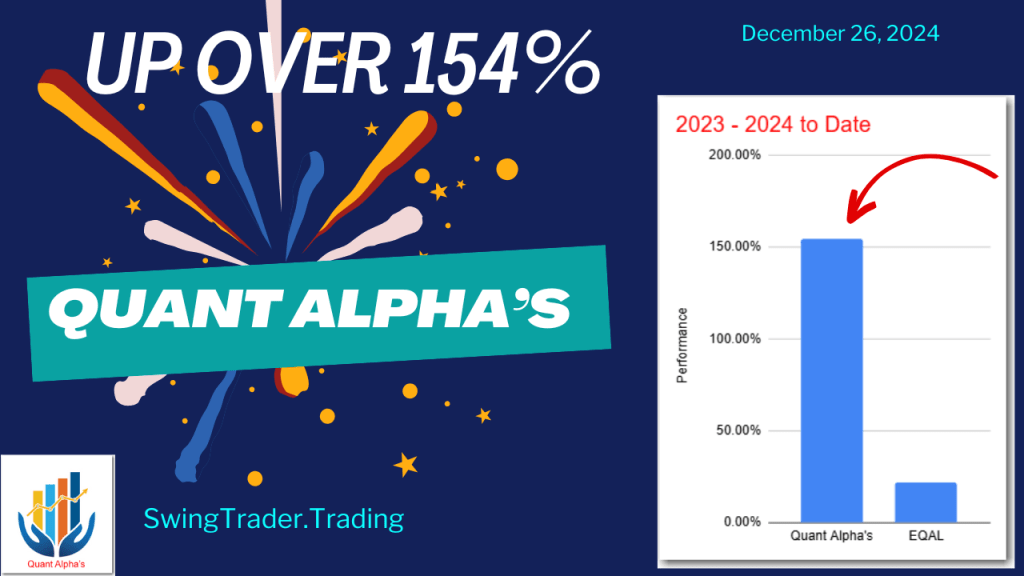

Up 154% – Quant Alpha’s Portfolio Update 12/26/2024

The Portfolio continues to outperform its ETF benchmark, EQAL, with a remarkable 154% increase in 2023-2024, surpassing EQAL by 133%. Updated to include 26 stocks, the Portfolio utilizes Quant scores for stock selection, avoiding certain sectors. Notable performers include AppLovin Corporation, up 790% since addition.

-

Up 152% – Quant Alpha’s Portfolio Update 12/12/2024

The Portfolio has achieved over 152% growth for 2023-2024, significantly outperforming its benchmark EQAL by 127%. It currently includes 25 stocks, with a focus on Quant scores for stock selection. Notable performers include APP with a 737% gain. The strategy emphasizes high liquidity and avoids specific sectors like airlines.

-

November 2024 Summary – Outperformance increases

All Model Portfolios have exceeded their benchmarks for the 2023-2024 period, showing impressive gains. The Quant Alpha’s Portfolio leads with over 165% growth, outperforming its benchmark by 136%. Active stocks like POWL and ANF have significantly contributed to this outperformance. Other portfolios also performed well, with the BI-Weekly Swings up 77%, Small Cap Discoveries up…

-

October 2024 Summary – Outperformance increases

All Model Portfolios are ahead of their respective benchmarks for the 2023-2024 period. The Quant Alpha’s is now up over 113% for 2023-2024 and continues to destroy its benchmark EQAL by 93%. This is a substantial increase in outperformance since last month. Active outperformers POWL, ANF , APP and CLS account for some of this…

-

CANSLIM Growth Portfolio Update 02/23/2024 – Up over 35% in 2023 – 2024

CanSlim Growth Monthly Update – Outperformance Continues into 2024

-

Month End Summary – January 2024- Outperformance powers higher

The Month End summary for SwingTrader.Trading. Outperformance powers higher.

-

CANSLIM Growth Portfolio Update 01/26/2024 – Up over 34% in 2023 – 2024

CanSlim Growth Monthly Update – Outperformance Continues into 2024

-

CANSLIM Growth Portfolio Update 12/29/2023 – Up over 34% in 2023

CanSlim Growth Monthly Update – Outperformance Continues

-

2023 Year End Summary – Outperformance Across the Board

The Month End summary for SwingTrader.Trading. Outperformance Increases.