Tag: powl

-

Quant Weekly: Celestica Turns 11-Bagger, Portfolios Keep Outpacing the Market – Update 10/24/2025

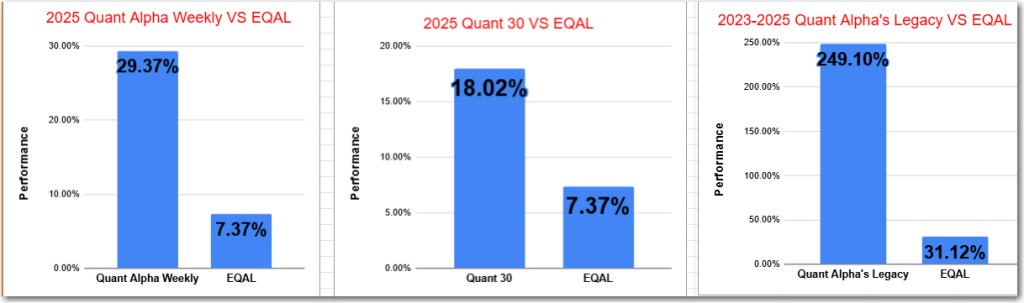

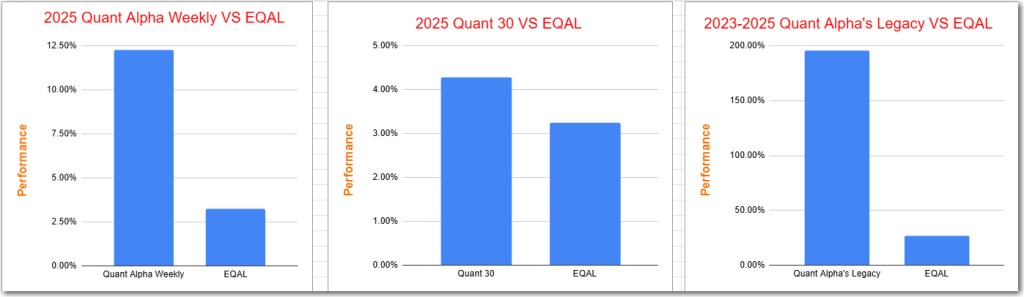

Quant Weekly – Up over 29% in 3 1/2 months Quant 30 – Up over 18% in 3 1/2 months Legacy – continues to be up over 230%, Celestica becomes a 11 bagger. Summary “What are ten baggers and how to spot them”

-

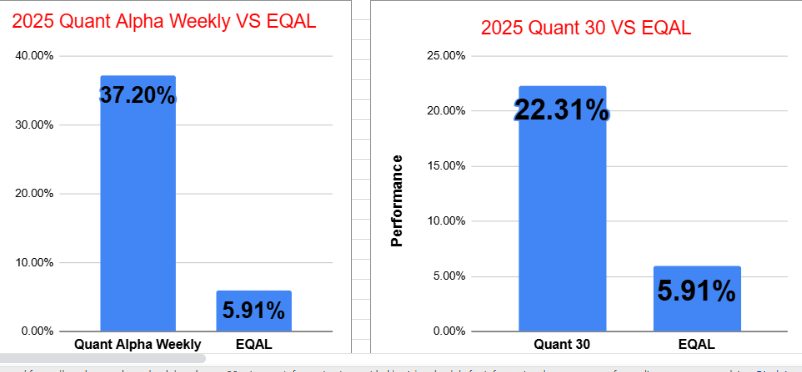

Quant Weekly +37% | The Hidden Dangers Behind Leveraged ETFs’ Big Swings – Update 10/17/2025

Quant Weekly – Up over 35% in 3 1/2 months Quant 30 – Up over 20% in 3 1/2 months Legacy – continues to be up over 220% summary “Why Leveraged ETF’s are considered too risky for most investors”

-

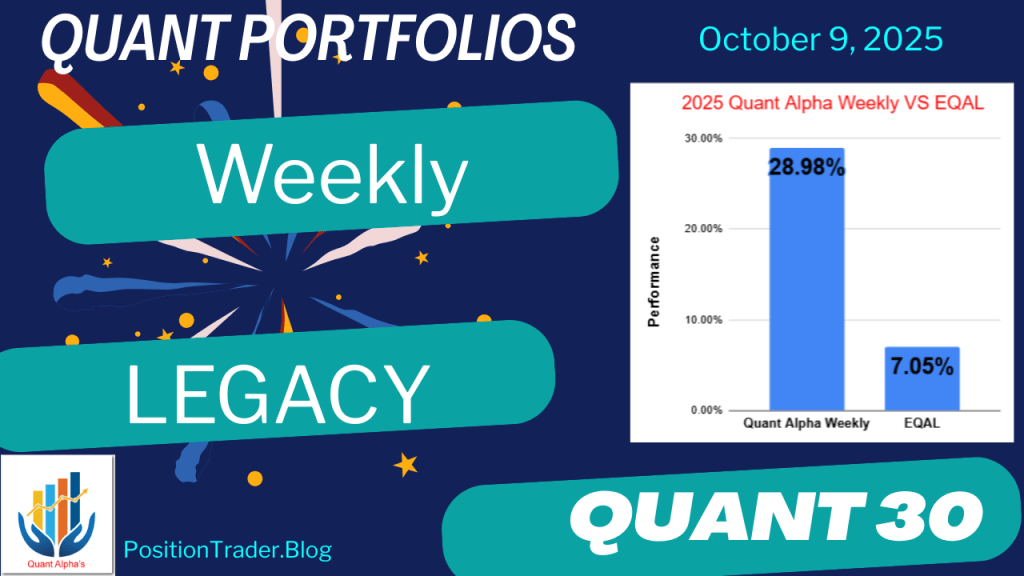

Quant Weekly Up 28%—Gold Surge Fuels Miner Rally as Celestica Hits 10-Bagger Status – Update 10/10/2025

Quant Weekly – Up over 28% in 3 months Quant 30 – Up over 19% in 3 months Legacy – continues to be up over 220%, Celestica has now become a 10 bagger. Summary on the outlook for minerals stocks.

-

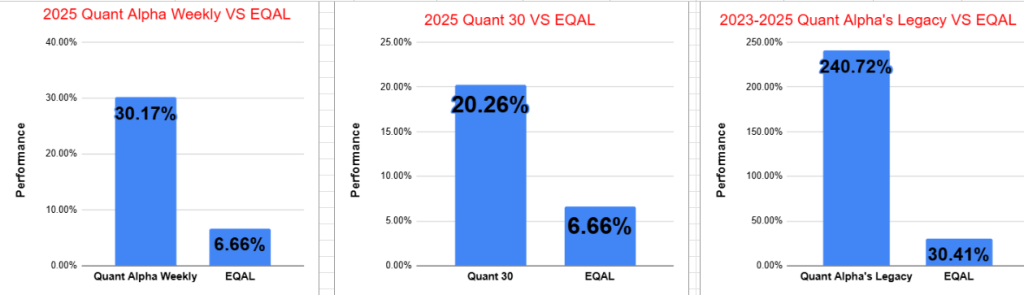

Quant Portfolios Surge: Weekly +30%, Quant 30 +20%, Legacy Up +220% Amid Shutdown Talk – Update 10/03/2025

In the past three months, Quant Weekly and Quant 30 have risen over 30% and 20%, respectively, while the Legacy portfolio has surged over 220%. US government shutdowns typically cause minor stock market declines, but rebounds follow, while sectors like defense and healthcare face risks. Portfolios continue to outperform benchmarks significantly.

-

Quant Weekly up 30%, Quant 30 up 18% – Update 09/26/2025

Quantitative portfolios show strong performance, with Quant Weekly up over 30%, Quant 30 up 18%, and the Legacy portfolio exceeding 200%. Key lessons from “Rich Dad Poor Dad” emphasize financial education, the importance of assets over liabilities, and a mindset shift from earning a paycheck to generating wealth through investments and entrepreneurship.

-

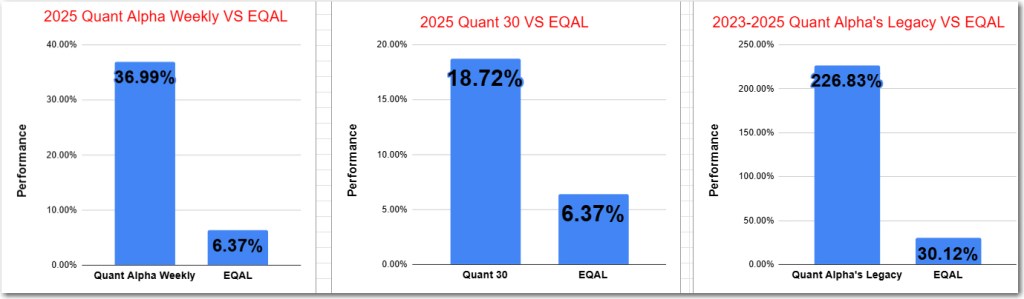

Quant Portfolios Surge—Weekly +30%, Quant 30 +18%, Legacy Tops 200% -Update 09/19/2025

Quant portfolios show significant growth, with Quant Alpha Weekly up over 30% and Quant 30 up over 18% in 2.5 months. The Legacy portfolio exceeds 200% gains since 2023. Key factors influencing stock reactions to Fed rate cuts include lower borrowing costs, investor confidence, but risks from recession and regulatory changes for specific companies like…

-

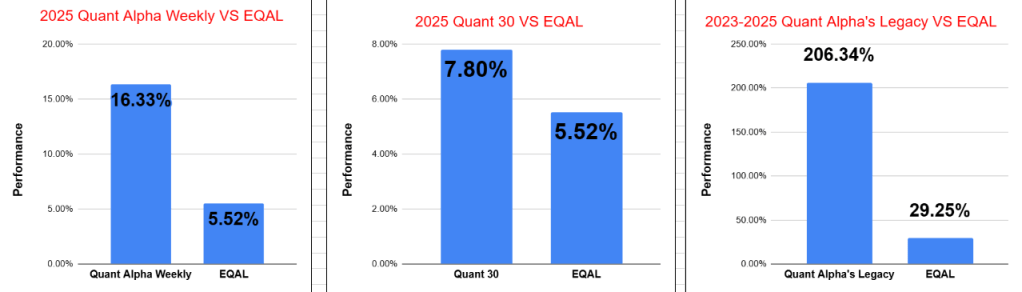

Quant Weekly & Legacy: Beating Benchmarks with +30% and +200% Returns – Update 09/12/2025

Quant Weekly reports significant portfolio performance, with Quant Alpha Weekly up 30% and Legacy over 200%. Key updates include … . Performance shows strong returns relative to benchmarks.

-

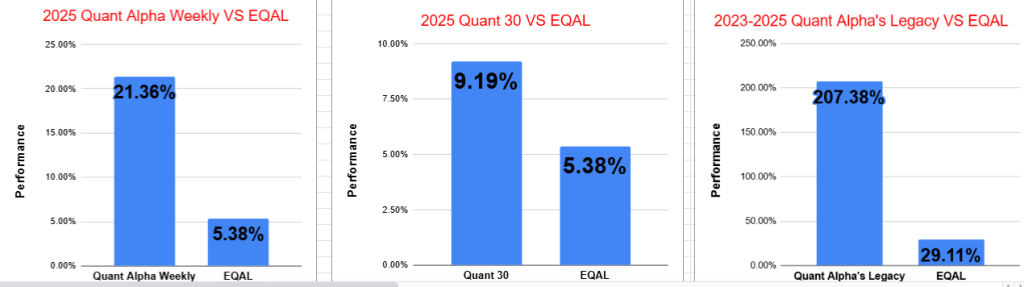

Quant Stock Portfolio Quant Alpha Weekly Up 20% | Legacy Portfolio Soars 200%+s – Update 09/05/2025

Quant Weekly has risen over 20% in two months, with Quant 30 and Legacy Portfolio outperforming benchmarks by significant margins. The summary of “The Emotional Traps That Destroy Traders” emphasizes that traders’ emotions, not the market, are their greatest danger, requiring mastery through discipline and predefined rules for successful trading.

-

Quant Weekly: New Adds, Big Rotations in Quant 30, and Legacy Portfolio Surges Past +200% – Update 08/29/2025

The update discusses the Quant Weekly portfolio, including new additions and removals, with the Legacy portfolio up over 200%. It summarizes key lessons from “The Richest Man in Babylon,” emphasizing savings, living within means, wise investment, and wealth protection. Specific stock performances and concerns about Kinross Gold and OppFi are highlighted.

-

Quant Stock Portfolios – Weekly update 08/22/2025

The website has rebranded from SwingTrader.Trading to PositionTrader.Blog to align with the management of Quant Model Portfolios. The Quant Alpha Weekly and Quant 30 portfolios have introduced new stocks, while the Legacy portfolio is up over 180%. Performance updates show steady growth against benchmarks.

-

Quant Stock Portfolios – Weekly update 08/15/2025

The Quant Alpha Weekly and Quant 30 portfolios both reported strong performance, significantly outpacing benchmarks. This week, Quant Alpha added SSRM, while Quant 30 included BTM, CDE, and LASR. Legacy portfolios have achieved over 190% return since 2023, with numerous outperformers showing substantial gains.

-

CommScope up over 90% – Quant Weekly update 08/08/2025

CommScope’s stock surged over 90% due to a partial buyout offer from Amphenol, significantly boosting the Quant Alpha Weekly Portfolio. The Quant 30 Portfolio witnessed five additions and removals, achieving its first benchmark lead. The Legacy Portfolio maintains a remarkable 190% return since its inception in 2023.

-

Quant Stock Portfolios – Weekly update 08/01/2025

The Legacy Portfolio has surged over 190% since its inception in 2023, while the Quant 30 has seen recent additions and removals. Challenges arise during market highs, emphasizing the importance of confidence in strategies. Momentum stocks often rebound quickly, highlighting the risk of premature exits from investments.

-

Introducing the “Quant Alpha’s – Legacy” Portfolio – Weekly update 07/25/2025

The Quant Alpha’s – Legacy Model Portfolio has been launched, retaining 24 stocks from its predecessor. This “Buy and Hold Until” strategy ensures minimal turnover, with only one stock removed due to a Sell signal. Performance remains strong, achieving a +170% return while the benchmark rose +27%. The Quant 30 portfolio shows no recent changes.

-

Up 158% – Quant Alpha’s Portfolio Update 02/20/2025

Since the last update, the Portfolio has outperformed the ETF benchmark EQAL, up over 158% for 2023-2025. It currently holds 27 stocks, with a strong selection criteria avoiding micro-cap, airlines, crypto, and biotech firms. Key performers include POWL and CLS, with future expansion expected to 30-35 stocks.

-

Up 176% – Quant Alpha’s Portfolio Update 02/06/2025

The Portfolio has significantly outperformed the ETF benchmark EQAL, rising over 176% from April 2023 to February 2025, surpassing the benchmark by 151%. Updated biweekly, it consists of 28 stocks, targeting high liquidity and excluding certain sectors. Notable performers include POWL (+359%) and CLS (+469%).

-

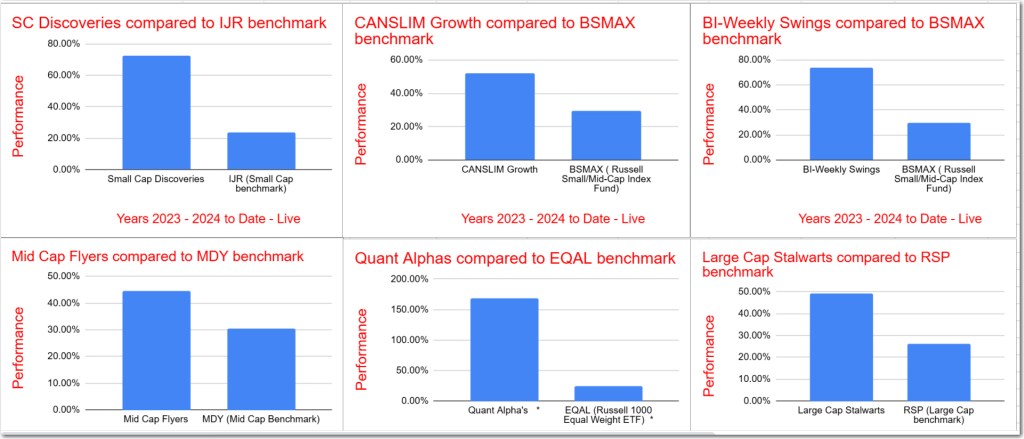

January 2025 – Model Stock Portfolios Outperformance increases

All Model Portfolios significantly outperformed their benchmarks for the 2023-2025 period, with Quant Alpha leading at over 168%, exceeding EQAL by 143%. Active contributors included POWL (+330%), ANF (+137%), and CLS (+427%). The BI-Weekly Swings rose 73%, surpassing BSMAX by 44%, driven by APEI and RAIL. Small Cap Discoveries and CANSLIM Growth were up 72%…

-

Up 178% – Quant Alpha’s Portfolio Update 01/23/2025

The Portfolio has outperformed its ETF benchmark EQAL, achieving a 178% gain for 2023-2025, exceeding the benchmark by 153%. An update included adding FOA and removing APP. Currently, there are 27 stocks, with a goal of 30-35. Notable performers include POWL and APP, reflecting significant returns.

-

Up 156% – Quant Alpha’s Portfolio Update 01/10/2025

The Portfolio has significantly outperformed the ETF benchmark EQAL, achieving over 156% growth for 2023-2024 and surpassing the benchmark by 135%. It now includes 27 stocks. New additions and stringent selection criteria ensure continuous performance improvement, with standout performers like APP gaining 745% since addition.