Tag: stock-market

-

Quant Weekly up 30%, Quant 30 up 18% – Update 09/26/2025

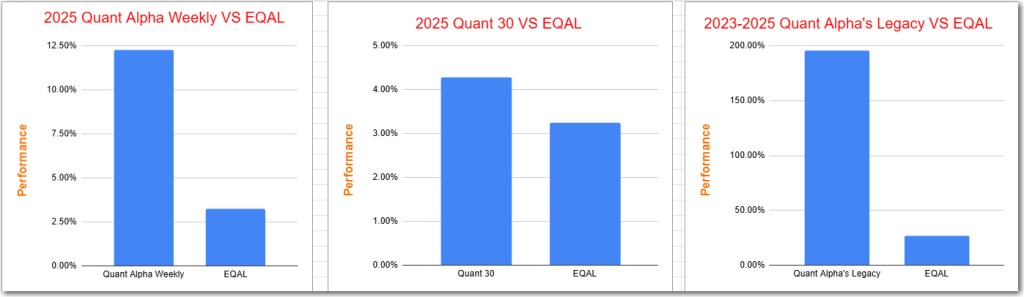

Quantitative portfolios show strong performance, with Quant Weekly up over 30%, Quant 30 up 18%, and the Legacy portfolio exceeding 200%. Key lessons from “Rich Dad Poor Dad” emphasize financial education, the importance of assets over liabilities, and a mindset shift from earning a paycheck to generating wealth through investments and entrepreneurship.

-

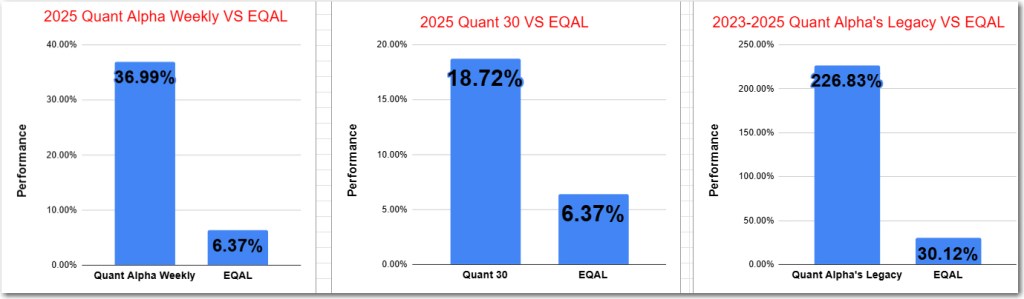

Quant Portfolios Surge—Weekly +30%, Quant 30 +18%, Legacy Tops 200% -Update 09/19/2025

Quant portfolios show significant growth, with Quant Alpha Weekly up over 30% and Quant 30 up over 18% in 2.5 months. The Legacy portfolio exceeds 200% gains since 2023. Key factors influencing stock reactions to Fed rate cuts include lower borrowing costs, investor confidence, but risks from recession and regulatory changes for specific companies like…

-

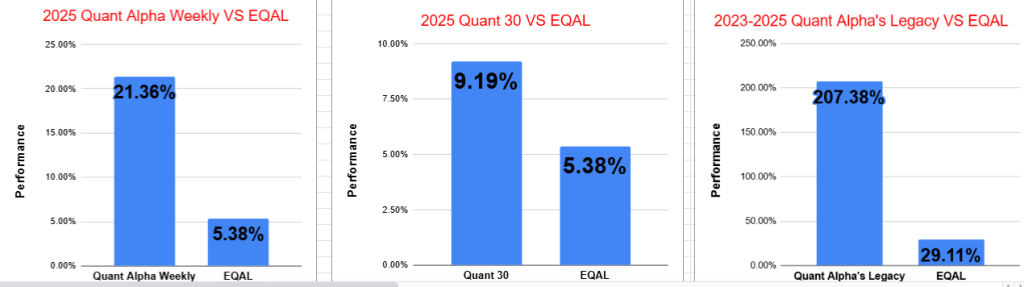

Quant Weekly & Legacy: Beating Benchmarks with +30% and +200% Returns – Update 09/12/2025

Quant Weekly reports significant portfolio performance, with Quant Alpha Weekly up 30% and Legacy over 200%. Key updates include … . Performance shows strong returns relative to benchmarks.

-

Quant Stock Portfolio Quant Alpha Weekly Up 20% | Legacy Portfolio Soars 200%+s – Update 09/05/2025

Quant Weekly has risen over 20% in two months, with Quant 30 and Legacy Portfolio outperforming benchmarks by significant margins. The summary of “The Emotional Traps That Destroy Traders” emphasizes that traders’ emotions, not the market, are their greatest danger, requiring mastery through discipline and predefined rules for successful trading.

-

Quant Weekly: New Adds, Big Rotations in Quant 30, and Legacy Portfolio Surges Past +200% – Update 08/29/2025

The update discusses the Quant Weekly portfolio, including new additions and removals, with the Legacy portfolio up over 200%. It summarizes key lessons from “The Richest Man in Babylon,” emphasizing savings, living within means, wise investment, and wealth protection. Specific stock performances and concerns about Kinross Gold and OppFi are highlighted.

-

Quant Stock Portfolios – Weekly update 08/22/2025

The website has rebranded from SwingTrader.Trading to PositionTrader.Blog to align with the management of Quant Model Portfolios. The Quant Alpha Weekly and Quant 30 portfolios have introduced new stocks, while the Legacy portfolio is up over 180%. Performance updates show steady growth against benchmarks.

-

Quant Stock Portfolios – Weekly update 08/15/2025

The Quant Alpha Weekly and Quant 30 portfolios both reported strong performance, significantly outpacing benchmarks. This week, Quant Alpha added SSRM, while Quant 30 included BTM, CDE, and LASR. Legacy portfolios have achieved over 190% return since 2023, with numerous outperformers showing substantial gains.

-

CommScope up over 90% – Quant Weekly update 08/08/2025

CommScope’s stock surged over 90% due to a partial buyout offer from Amphenol, significantly boosting the Quant Alpha Weekly Portfolio. The Quant 30 Portfolio witnessed five additions and removals, achieving its first benchmark lead. The Legacy Portfolio maintains a remarkable 190% return since its inception in 2023.

-

Quant Stock Portfolios – Weekly update 08/01/2025

The Legacy Portfolio has surged over 190% since its inception in 2023, while the Quant 30 has seen recent additions and removals. Challenges arise during market highs, emphasizing the importance of confidence in strategies. Momentum stocks often rebound quickly, highlighting the risk of premature exits from investments.

-

Introducing the “Quant Alpha’s – Legacy” Portfolio – Weekly update 07/25/2025

The Quant Alpha’s – Legacy Model Portfolio has been launched, retaining 24 stocks from its predecessor. This “Buy and Hold Until” strategy ensures minimal turnover, with only one stock removed due to a Sell signal. Performance remains strong, achieving a +170% return while the benchmark rose +27%. The Quant 30 portfolio shows no recent changes.

-

Quant Alpha Weekly and Quant 30 Weekly update – 07/18/2025

The Quant 30 Portfolio employs a Penalty Box strategy for managing stocks that fall below high rank criteria. Stocks must remain in the Penalty Box for two consecutive weeks before removal, allowing potential recovery. Currently, there are no removals, with one stock in the Penalty Box and the portfolio achieving profitability for the first time.

-

Quant Alpha Weekly and Quant 30 Weekly update – 07/11/2025

The weekly update is below for the two Quant Model Portfolios. The target update date for the Portfolios is the last business day of the week. If I am not able to update on that day because of the lack of access to the internet, then Monday morning will be used. Quant Alpha Weekly Newly…

-

Quant Alpha Weekly and Quant 30 Weekly update – 07/07/2025

The weekly update is below for the two Quant Model Portfolios. Quant Alpha Weekly Newly added stock below. Two stocks are now in the Porfolio. PSIX Click here for the Quant Alpha Weekly details Click here for the Quant Alpha Weekly Portfolio criteria Quant 30 Here are the 2nd batch of 15 adds to the…

-

Quant Alpha Weekly and Quant 30 are launched today

My six model portfolios started at the beginning of 2023 have now been closed. The Legacy scorecard can be seen here. I am beginning two new Quant Model portfolios starting today. These new portfolios will start from scratch during a time of all time market highs. The least favorable time to start a new Model…

-

April 2025 – Model Stock Portfolios Update – Final Update

The final update on the Model Portfolios reveals impressive performance through 2023-2025, with all portfolios exceeding their benchmarks. The Quant Alpha’s portfolio leads with over 122% growth, outperforming its benchmark EQAL by 106%. Notable performers include WGS (+301%) and APP (+877%). Other portfolios such as BI-Weekly Swings and Small Cap Discoveries also show strong gains…

-

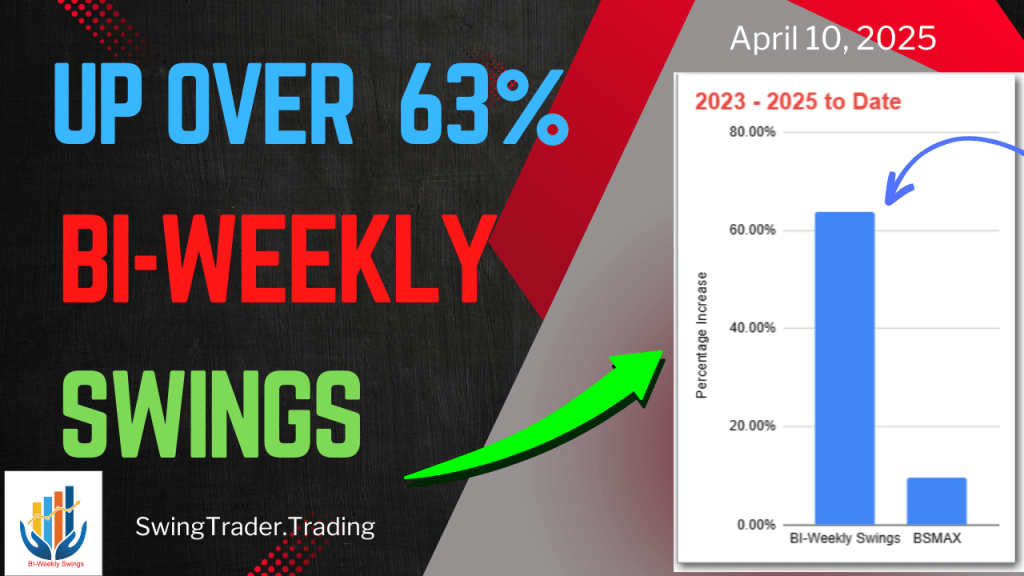

Up 63% – BI-Weekly Swings Update – 04/23/2025

The BI-Weekly Swings Portfolio is up 63% 2023-2025 and is 52% ahead of its benchmark BSMAX. The Model Portfolio BI-Weekly Swings was updated this morning. No new Adds were made and a Removal of 1 stock was made. All prices are as of 04/23/2025. A total of 1 stock is in the Portfolio. Add –…

-

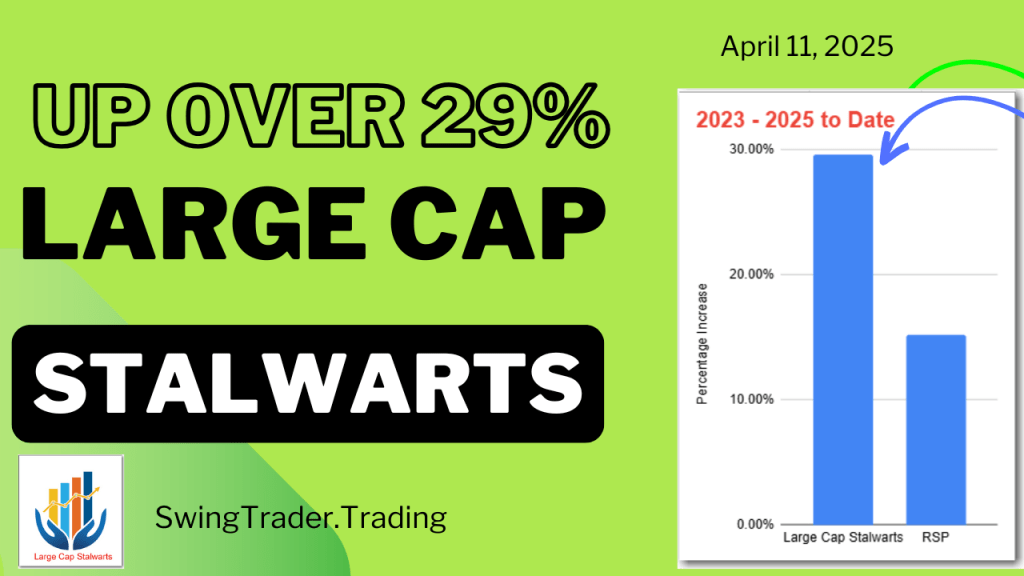

Up 29% – Large Cap Stalwarts Update – April 2025

The Model Portfolio Large Cap Stalwarts continues its outperformance over its benchmark RSP ( S&P 500 Equal Weight ETF). It is now up 29% since it went live in 2023. This is 14% ahead of its benchmark RSP. The Model Portfolio Large Cap Stalwarts was updated this weekend. No new Adds were made and Removals of 12…

-

Up 63% – BI-Weekly Swings Update – 04/10/2025

The BI-Weekly Swings Portfolio is up 63% 2023-2025 and is 53% ahead of its benchmark BSMAX. The Model Portfolio BI-Weekly Swings was updated this morning. No new Adds were made and Removals of 4 stocks were made. All prices are as of 04/10/2025. A total of 2 stocks are in the Portfolio. Add – New…

-

March 2025 – Model Stock Portfolios Update – In the Wrap-up Phase

One month remains of a two month long wrap-up of the live update posts for the six Model Portfolios. During the next month, only Removes from the six model portfolios will be posted but no new Adds will be made. At the end of April 2025, the final monthly report will be made and no…