Tag: hrtg

-

Paid Subscriber – PositionTrader.Blog – Update 12/08/2025

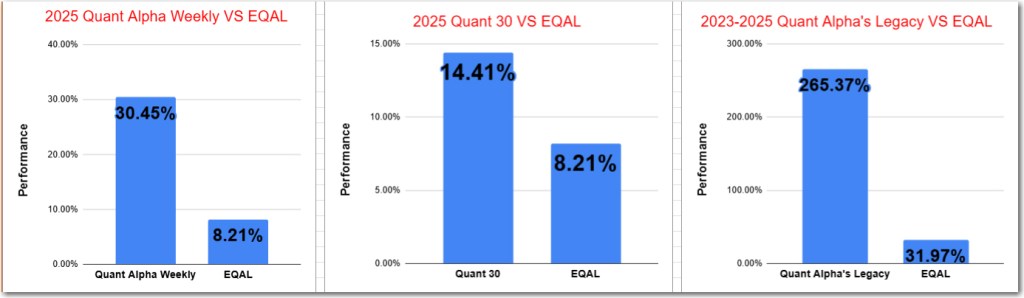

Quant 30 – Up over 30% since June 2025 Quant Weekly – Up over 14% since June 2025 Legacy – Up over 250% since April 2023 Changes made to the Quant Portfolios

-

S&P 500 back to all-time high — Quant Ports up +30%, +14%, +265% – Quant Update 12/08/25

The S&P 500 index rallied back above its all-time high this week. Easing investor concerns created by the recent emotional sell off in stocks over the last month. Hopefully, none of my subscribers succumbed to panic selling during this time. The Quant Portfolios continue to hold their own. The CNN Fear and Greed index has…

-

Paid Subscriber – PositionTrader.Blog – Update 12/01/2025

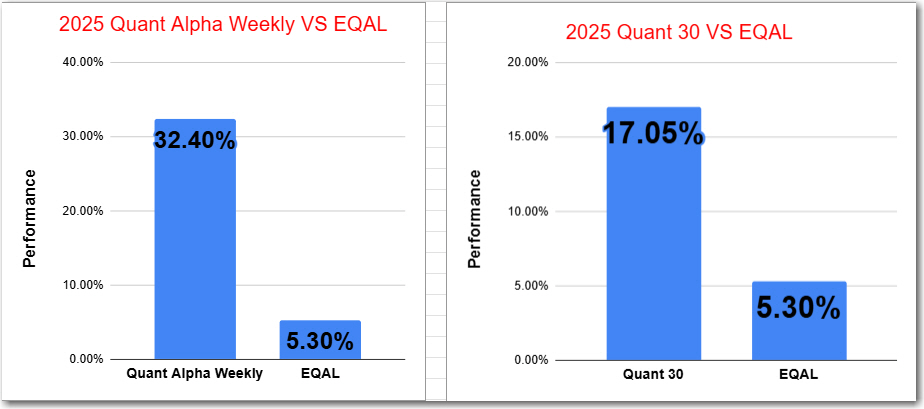

Quant 30 – Up over 17% since June 2025 Quant Weekly – Up over 31% since June 2025 Legacy – Up over 250% since April 2023 Changes made to the Quant Portfolios

-

Extreme Fear eases – Momentum stocks roar back — Update 12/01/25

Quant 30 – UP over 17% since June Quant Weekly – Up over 31% since June Legacy – Up over 250% since April 2023 Education – After a correction of 10% in the US stock market what is the history of performance after 6 months?

-

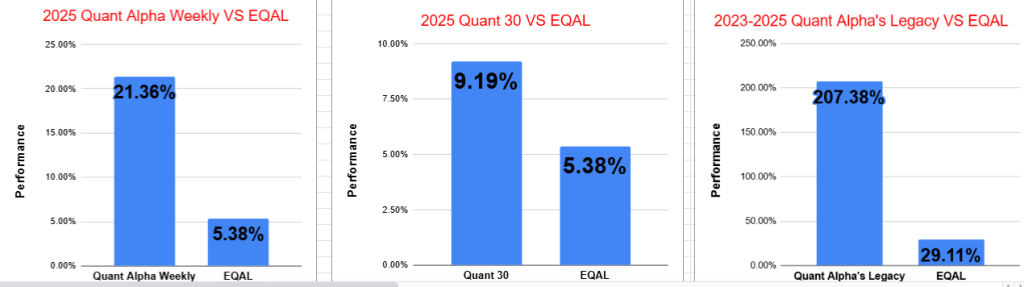

Paid Subscriber – PositionTrader.Blog – Update 11/21/2025

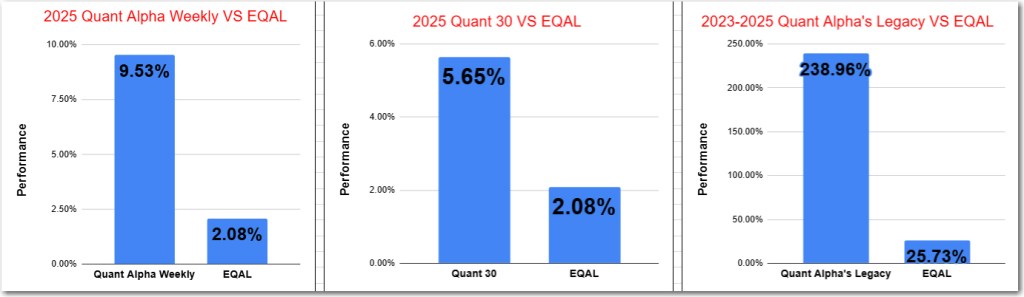

Quant 30 – Up over 5% since June 2025 Quant Weekly – Up over 9% since June 2025 Legacy – Up over 230% since April 2023 Changes made to the Quant Portfolios

-

Extreme Fear Grips Markets – Momentum stocks tumble — Quant Update 11/21/25

Quant 30 – UP over 5% since June Quant Weekly – Up over 9% since June Legacy – Up over 230 since April 2023 Education – How smart position sizing boosts your stock market results.

-

Paid Subscriber – PositionTrader.Blog – Update 11/14/2025

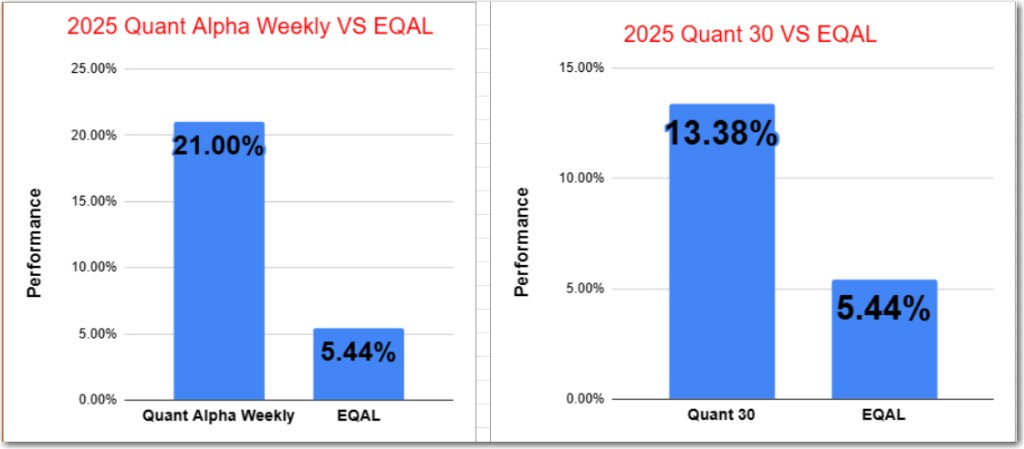

Quant 30 – UP over 13% since June 2025 Quant Weekly – Up over 21% since June 2025 Legacy – Up over 240% since April 2023 Changes made to the Quant Portfolios

-

Fear grips Markets: Quant Portfolios holding at +21%, +13%, and +250% — Update 11/14/25

Quant 30 – UP over 13% since June Quant Weekly – Up over 21% since June Legacy – Up over 240% since April 2023 Summary of “Who Wins if the Supreme Court Kills the IEEPA Tariffs”

-

Momentum Moves Markets: Quant Portfolios Surge 24%, 13%, and 250% — Here’s Why It Works – Update 11/07/2025

Quant 30 – UP over 13% since June Quant Weekly – Up over 24% since June Legacy – Up over 250% since April 2023 Summary of “Why Momentum is one of the most important factors”

-

Paid Subscriber – PositionTrader.Blog – Update 11/7/2025

Quant 30 – UP over 13% since June Quant Weekly – Up over 24% since June Legacy – Up over 250% since April 2023

-

Quiet Money, Big Gains: Quant Portfolios Crush It — +30%, +17%, +240% – Update 10/31/2025

Quant Weekly – Up over 30% Quant 30 – Up over 17% Legacy – Up over 240% Short summary of the book The Millionaire Next Door.

-

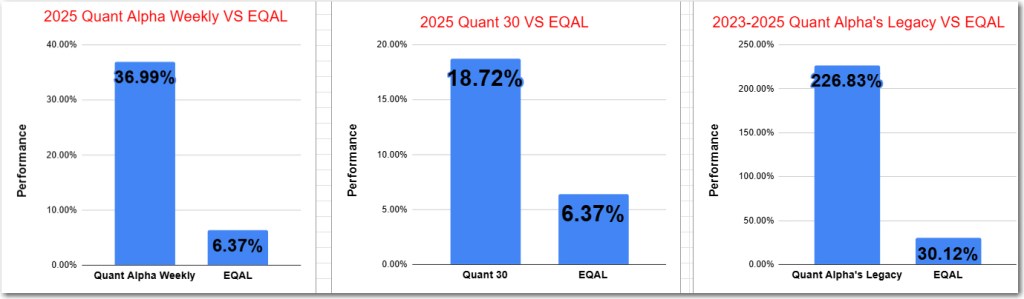

Quant Weekly: Celestica Turns 11-Bagger, Portfolios Keep Outpacing the Market – Update 10/24/2025

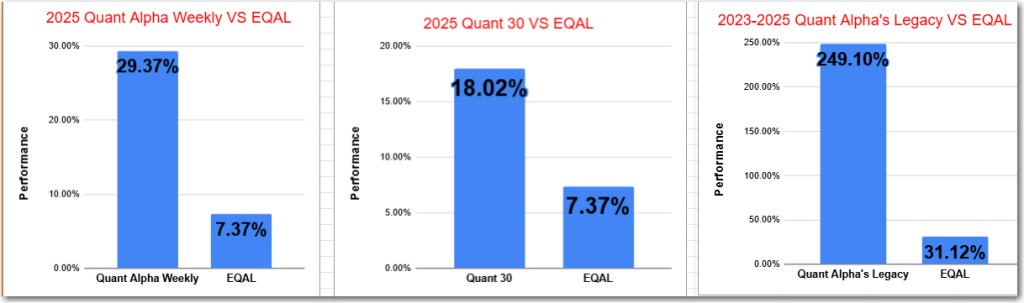

Quant Weekly – Up over 29% in 3 1/2 months Quant 30 – Up over 18% in 3 1/2 months Legacy – continues to be up over 230%, Celestica becomes a 11 bagger. Summary “What are ten baggers and how to spot them”

-

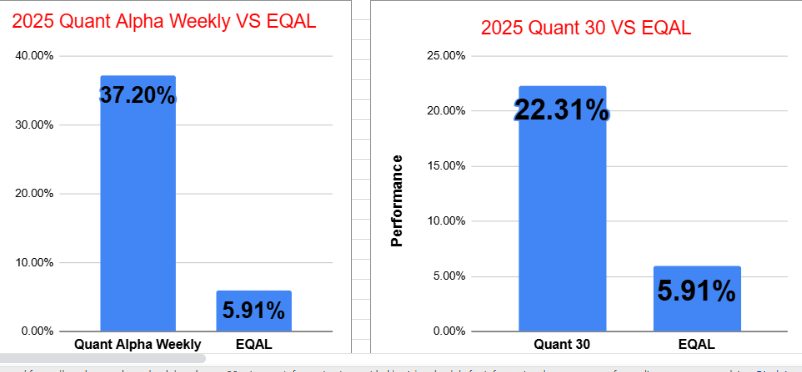

Quant Weekly +37% | The Hidden Dangers Behind Leveraged ETFs’ Big Swings – Update 10/17/2025

Quant Weekly – Up over 35% in 3 1/2 months Quant 30 – Up over 20% in 3 1/2 months Legacy – continues to be up over 220% summary “Why Leveraged ETF’s are considered too risky for most investors”

-

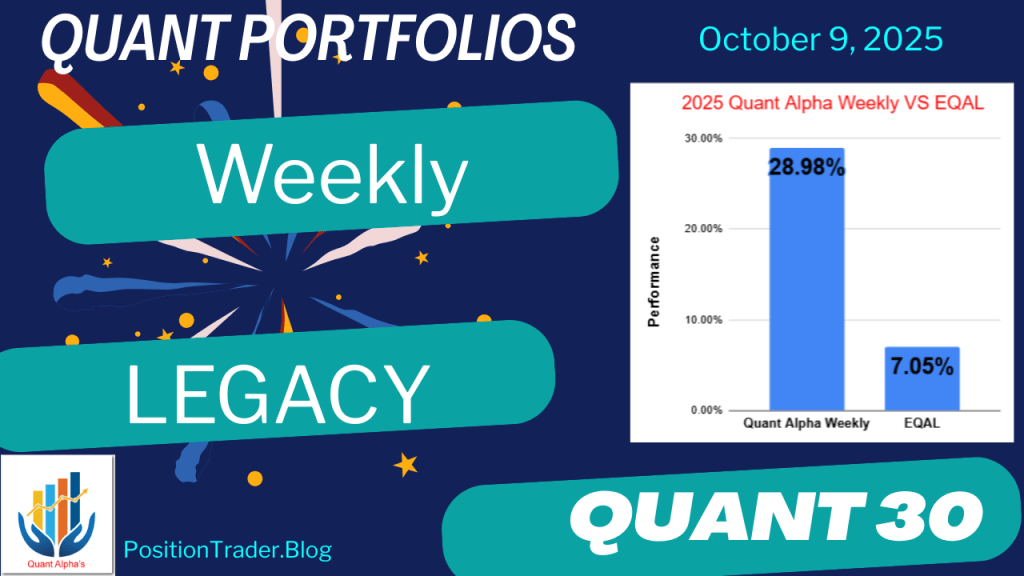

Quant Weekly Up 28%—Gold Surge Fuels Miner Rally as Celestica Hits 10-Bagger Status – Update 10/10/2025

Quant Weekly – Up over 28% in 3 months Quant 30 – Up over 19% in 3 months Legacy – continues to be up over 220%, Celestica has now become a 10 bagger. Summary on the outlook for minerals stocks.

-

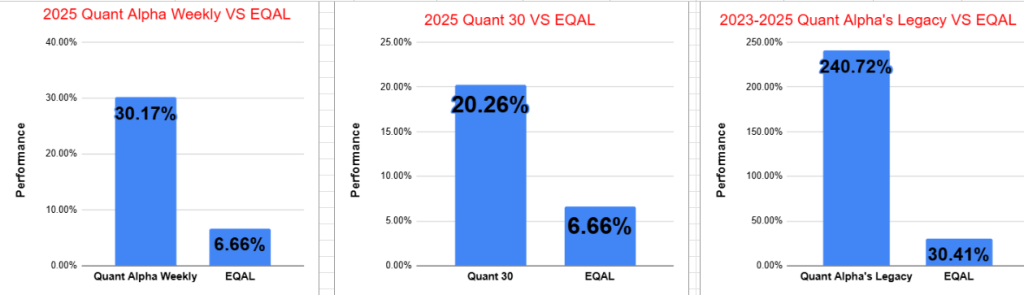

Quant Portfolios Surge: Weekly +30%, Quant 30 +20%, Legacy Up +220% Amid Shutdown Talk – Update 10/03/2025

In the past three months, Quant Weekly and Quant 30 have risen over 30% and 20%, respectively, while the Legacy portfolio has surged over 220%. US government shutdowns typically cause minor stock market declines, but rebounds follow, while sectors like defense and healthcare face risks. Portfolios continue to outperform benchmarks significantly.

-

Quant Weekly up 30%, Quant 30 up 18% – Update 09/26/2025

Quantitative portfolios show strong performance, with Quant Weekly up over 30%, Quant 30 up 18%, and the Legacy portfolio exceeding 200%. Key lessons from “Rich Dad Poor Dad” emphasize financial education, the importance of assets over liabilities, and a mindset shift from earning a paycheck to generating wealth through investments and entrepreneurship.

-

Quant Portfolios Surge—Weekly +30%, Quant 30 +18%, Legacy Tops 200% -Update 09/19/2025

Quant portfolios show significant growth, with Quant Alpha Weekly up over 30% and Quant 30 up over 18% in 2.5 months. The Legacy portfolio exceeds 200% gains since 2023. Key factors influencing stock reactions to Fed rate cuts include lower borrowing costs, investor confidence, but risks from recession and regulatory changes for specific companies like…

-

Quant Weekly & Legacy: Beating Benchmarks with +30% and +200% Returns – Update 09/12/2025

Quant Weekly reports significant portfolio performance, with Quant Alpha Weekly up 30% and Legacy over 200%. Key updates include … . Performance shows strong returns relative to benchmarks.

-

Quant Stock Portfolio Quant Alpha Weekly Up 20% | Legacy Portfolio Soars 200%+s – Update 09/05/2025

Quant Weekly has risen over 20% in two months, with Quant 30 and Legacy Portfolio outperforming benchmarks by significant margins. The summary of “The Emotional Traps That Destroy Traders” emphasizes that traders’ emotions, not the market, are their greatest danger, requiring mastery through discipline and predefined rules for successful trading.